Nifty, Bank Nifty & Fin Nifty Technical Analysis

By CapitalKeeper | Nifty & Bank Nifty | Indian Equities | Market Moves That Matter

05th June 2025 – Trend MiX & Market Study View

Volatility Softens | Dips Still Buyable | Key Levels Ahead

Welcome to today’s edition of Trend MiX, where we decode FII activity, PCR trends, sector rotation, and price action to give you a clear edge in navigating the Indian equity markets.

🔍 STUDY VIEW FOR TODAY

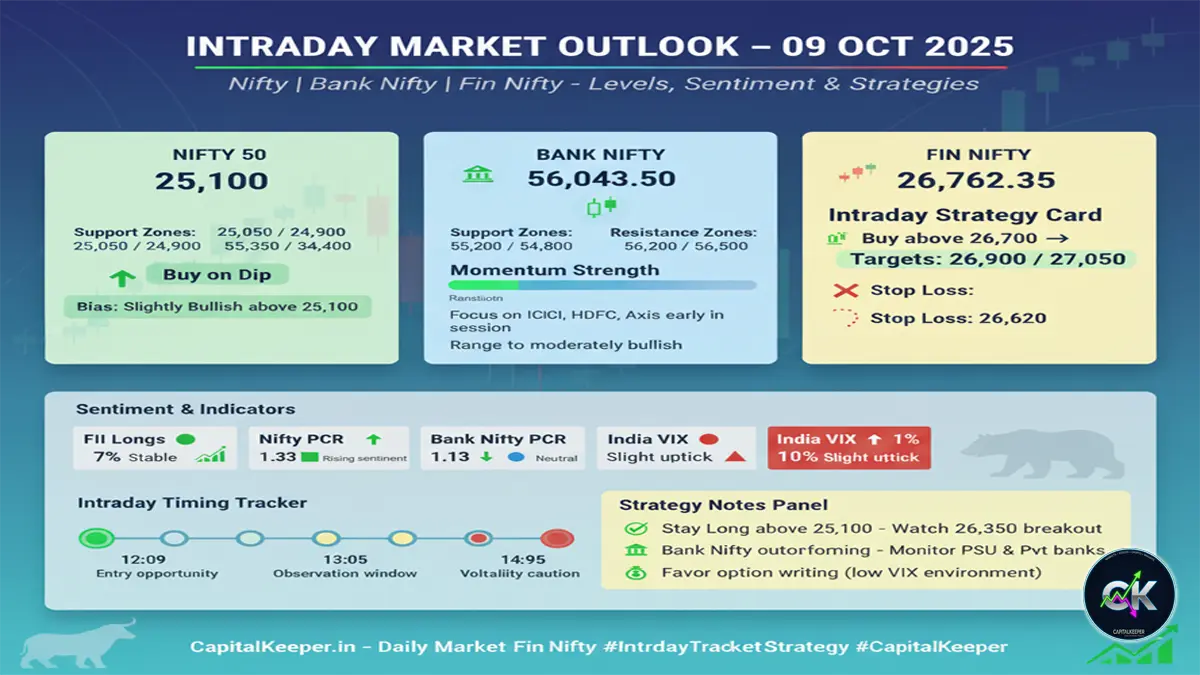

- FII Index Longs: 🟢 Up at 17% (from 16.73%)

Indicates minor long build-up, showing early confidence ahead of key levels. - Nifty PCR: ⬆️ Rose to 0.73 (from 0.65)

- Bank Nifty PCR: ⬇️ Dropped to 0.82 (from 0.87)

Slightly mixed sentiment, but still holding neutral territory. - India VIX: 📉 15.74, down by 5%

Reduced fear — ideal for trending moves if breakout follows.

✅ No major crash signals yet

🔄 Continue Buy-on-Dips strategy as long as spot holds above 24,400+

⚠️ No fresh longs below 24,250–24,400, risk of a dip towards 24,000 / 23,850

📈 Cautiously optimistic above 24,684, stronger signals only if close sustains above 24,720

📈 Sectoral Strength Snapshot

🔥 Strong & Bullish Sectors

- PSU Banks & Private Banks

- Midcaps 100 (Stock-specific)

- Smallcaps 100 (Stock-specific)

- Railway Stocks

- Auto

- Energy & Power

⚠️ Cautious Sectors

- PSEs (Public Sector Enterprises)

- Defense Stocks

- FMCG (Only stock-specific entries advised)

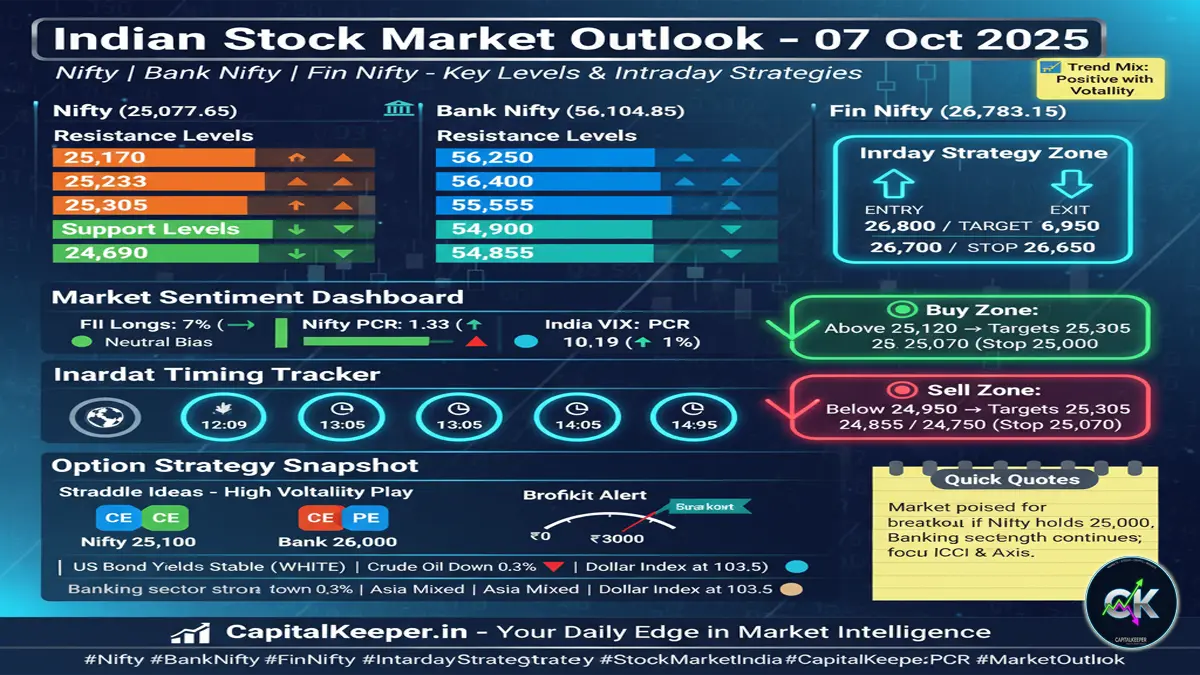

🔧 Key Technical Levels

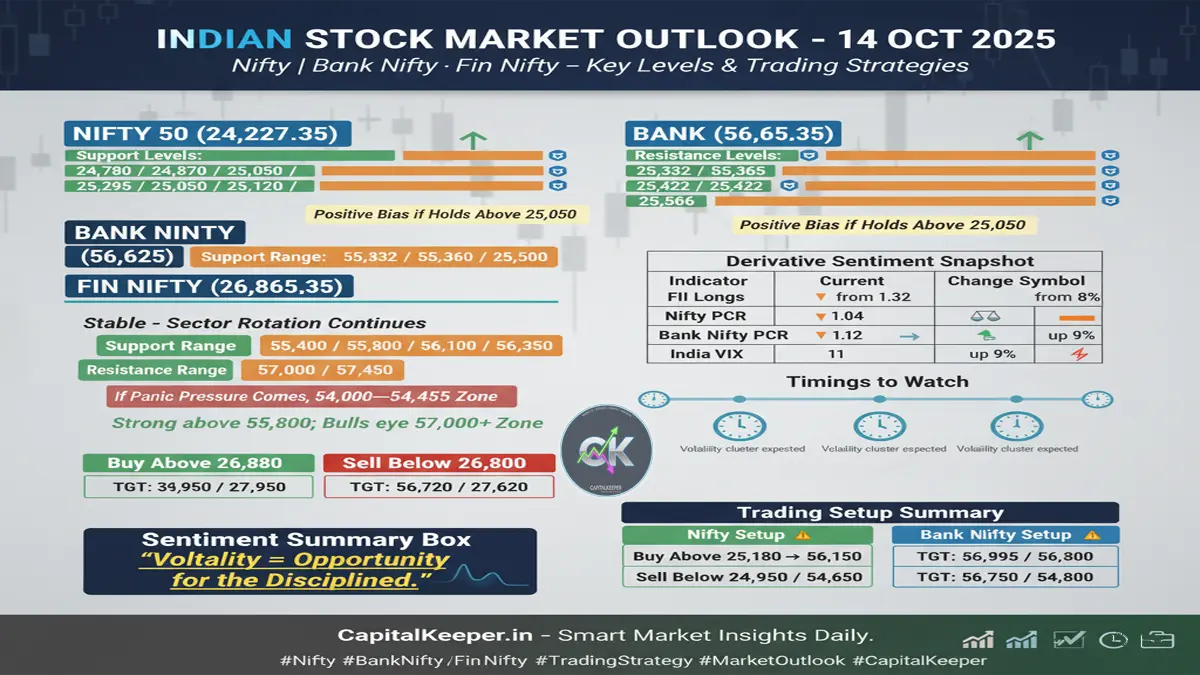

📊 NIFTY (Spot: 24,620.20)

- Resistance Levels

24,720 / 24,780 / 24,855 / 24,930

25,030 / 25,070 / 25,152 / 25,210

➕ Above 25,210: Watch for 25,300 / 25,395+ - Support Levels

24,400 / 24,510 / 24,555

🎯 OPTION TRADE IDEA

🟩 Buy Nifty 24,750 CE @ ₹25

- Targets: ₹70 / ₹90 / ₹120

- Stop Loss: ₹0

(Only with risk capital — high risk/high reward setup)

📊 BANKNIFTY (Spot: 55,676.85)

- Resistance Levels

55,950 / 56,100 / 56,300 / 56,400 / 56,700 - Support Levels

54,000 / 54,255 / 54,450 / 54,510 / 54,600

54,855 / 55,005 / 55,200 / 55,350 / 55,500

🕒 Important Intraday Timings to Watch

Key time zones where sharp price movements or trend reversals could occur:

- ⏰ 12:18 PM

- ⏰ 01:08 PM

- ⏰ 02:07 PM

🧠 CapitalKeeper’s Takeaway

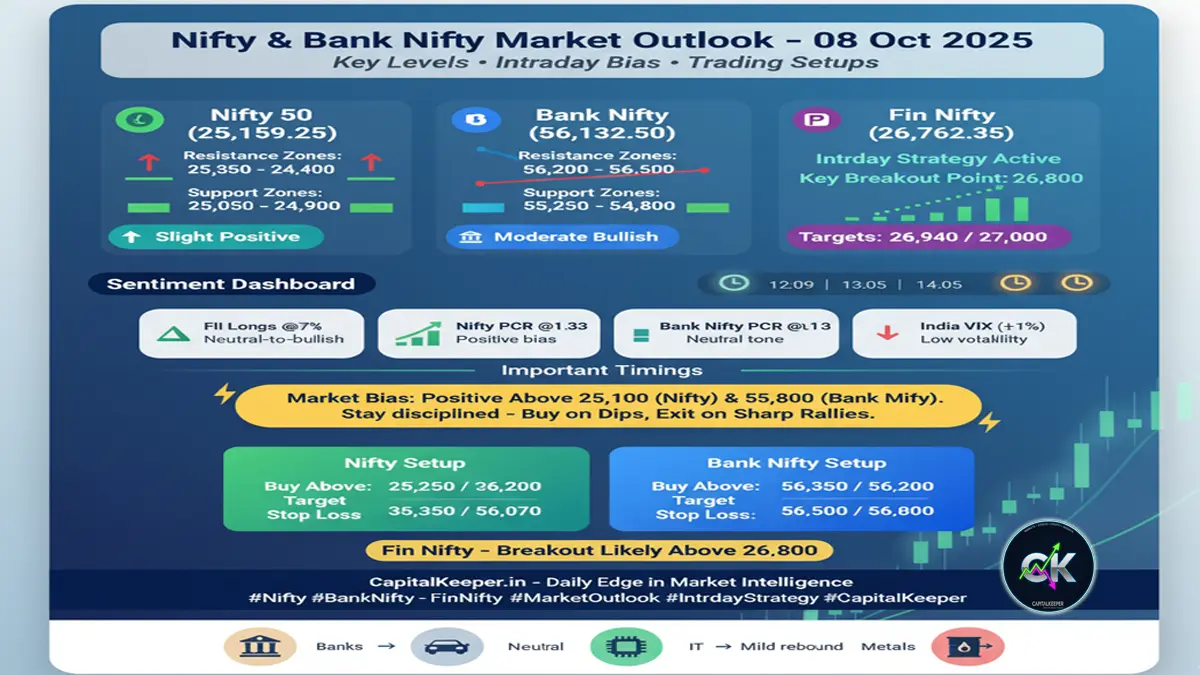

- Market is not in crash mode, but needs strength confirmation above 24,720+.

- Stock-specific action continues in banks, autos, and railways.

- Option buyers can track today’s low-risk, high-reward 24,750 CE trade idea.

- Continue trading with discipline — keep SL tight and avoid overleveraging during sideways consolidation.

📢 Stay updated with intraday calls, index updates, and breakout alerts — only at CapitalKeeper.in

📲 Follow us on Telegram, Instagram & Twitter for charts and real-time levels!

📢 Final Note

The market may witness intraday volatility due to SENSEX weekly expiry. Despite a dip in FII long positions and PCR values, the Buy-on-Dips strategy remains valid only above 24400 (Nifty). Traders should monitor support-resistance zones closely and manage risk near volatile trigger points like 24684 (Nifty).

Stay tuned for intraday trade updates and sector rotation cues throughout the day.

🖊 Written by CapitalKeeper.in – Your Daily Dose of Smart Market Insight

🧠 CapitalKeeper’s Takeaway

- Watch out for price action around 24,800 – it’s the key wall to climb.

- A clean breakout with volume above this congestion zone may fuel momentum towards 25,113+, completing the Wolfe Wave target.

- Maintain a disciplined stop-loss strategy around major intraday supports and don’t chase breakouts blindly in this volatility.

- Stock-specific trades in Auto, Railways, and Banks are likely to offer short-term momentum.

📢 Stay tuned to CapitalKeeper.in for more real-time updates and actionable insights throughout the trading day.

Conclusion:

The Indian equity markets are currently navigating through mixed signals, with Nifty 50 showing signs of consolidation, Bank Nifty exhibiting neutral momentum, and Fin Nifty displaying cautious optimism. Traders and investors should monitor key support and resistance levels, along with global economic developments, to make informed decisions.

📌 For more real-time updates, trade setups, and investment insights — follow us on [Telegram] and subscribe to our newsletter!

📌 Disclaimer

The content provided on CapitalKeeper.in is for informational and educational purposes only and does not constitute investment, trading, or financial advice. While we strive to present accurate and up-to-date market data and analysis, we make no warranties or representations regarding the completeness, reliability, or accuracy of the information.

Stock market investments are subject to market risks, and readers/investors are advised to conduct their own due diligence or consult a SEBI-registered financial advisor before making any investment decisions. CapitalKeeper and its authors are not liable for any loss or damage, direct or indirect, arising from the use of this information.

All views and opinions expressed are personal and do not reflect the official policy or position of any agency or organization. Past performance is not indicative of future results.

By using this website, you agree to the terms of this disclaimer.

Leave a Reply