Nifty, Bank Nifty & Fin Nifty Outlook for 24 November 2025 — Will the Market Recover After Mid-Session?

Updated: 24 November 2025

Category: Nifty & Bank Nifty | Market Analysis

By CapitalKeeper Research Desk

Get a detailed 1000+ words analysis for Nifty, Bank Nifty & Fin Nifty for 17 November 2025. Key support & resistance, short-covering zones, intraday strategy, and straddle tips for high-probability trades.

Opening Narrative — A Market Waiting for Confirmation

The new trading week began with hesitation across Indian equities, led by cautious institutional flows, elevated volatility, and a narrow opening range. Monday’s price action felt divided—weak sentiment during the first half, followed by expectations of a rebound once intraday liquidity settled. Based on current derivatives positioning, price structure, and volatility cues, the market appears more corrective than bearish.

Today’s Trend Mix suggests a recovery after the first four hours of trade, implying that early dips may attract buyers—especially near well-defined support clusters.

With quarterly earnings nearly concluded, domestic flows remain strong, but FIIs continue to rotate exposure, reflecting global uncertainty. That leaves short-term traders relying heavily on intraday momentum indicators, liquidity flows, and sector rotation rather than directional conviction.

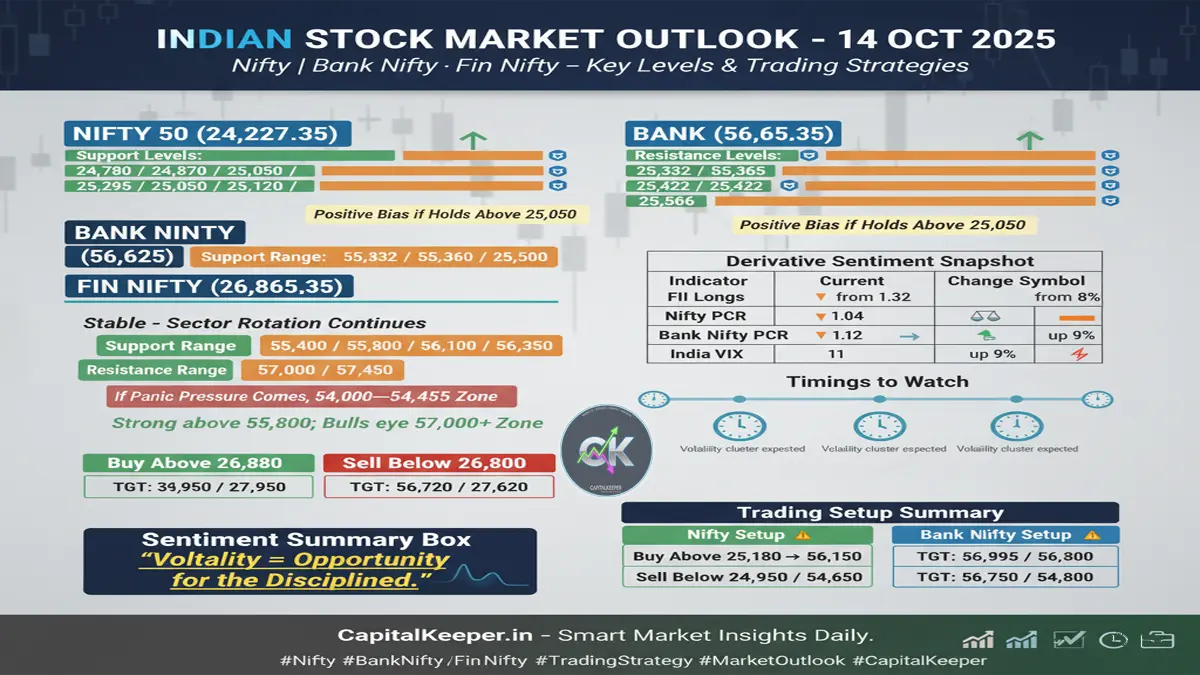

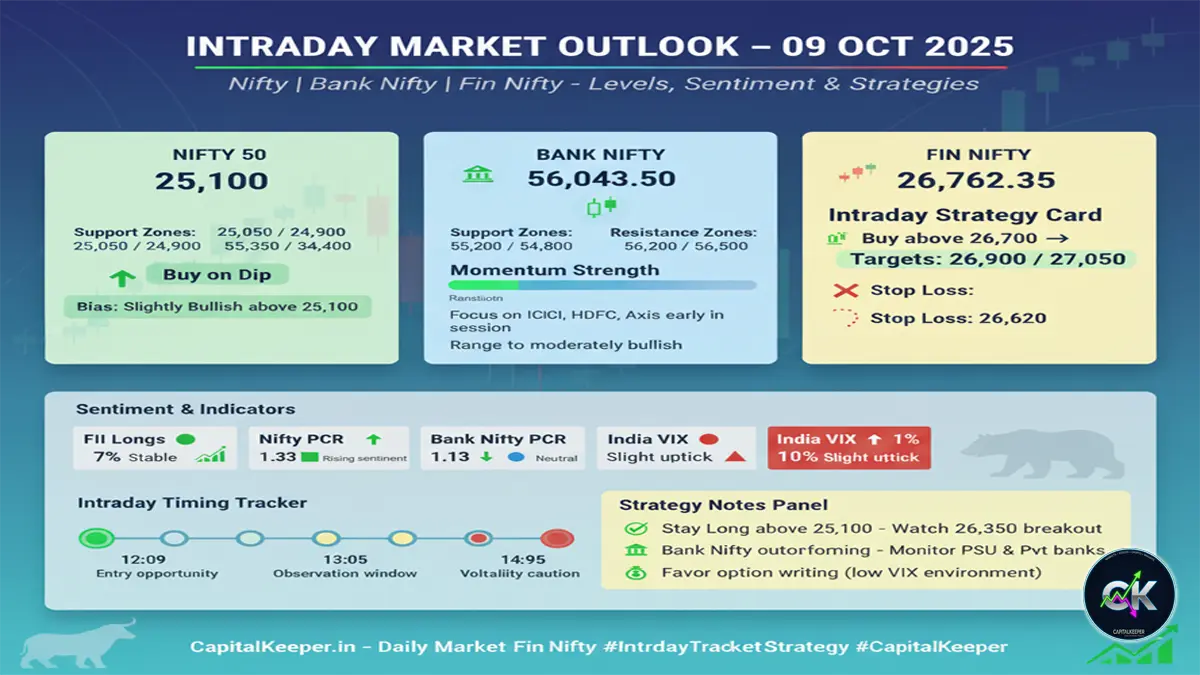

Key Market Sentiment Indicators — 24 November 2025

- FII Index Long Positions: 13% — improving but still cautious

- Nifty PCR: 1.51 — bullish leaning, potential long buildup

- Bank Nifty PCR: 1.24 — moderately positive

- India VIX: 12.14 — up 2%, signaling event-driven volatility

- Market Bias: Positive if supports hold & volatility stabilizes

A rising VIX alongside a high PCR generally signals a volatile upward bias. However, the sustainability of the move depends on institutional participation during the second half of the session.

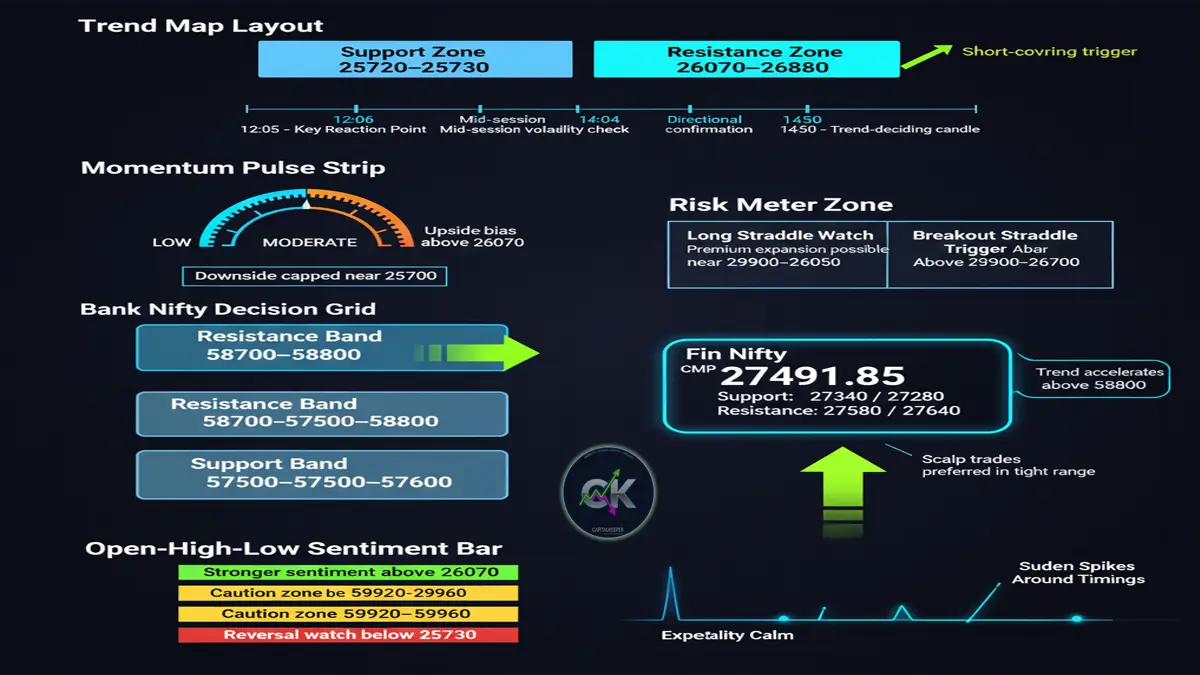

Crucial Intraday Timings to Monitor

- 12:06 — Mixed reaction zone

- 13:20 — Directional attempt likely

- 14:00 — High-impact timing, trend confirmation

Historically, institutional orders, rebalancing activity, and short covering tend to intensify around these windows—making them crucial for intraday traders.

Nifty 50 Outlook — CMP 26,068.15

Support Zones

- 25,800

- 25,920

- 26,030

- 26,070

Resistance Zones

- 26,190

- 26,220

- 26,250

- 26,295

- 26,340

- 26,394

RSI, MACD & Volume Interpretation

- RSI: Holding above 55 — mild bullish momentum, dips may attract buyers

- MACD: Positive crossover — signals continuation if price sustains above 26,200

- Volume: Lower at open, expected to rise post-midday — aligns with Trend Mix recovery expectation

The 26,070–26,030 demand zone remains the most crucial intraday support. Sustaining above it keeps trend buyers active. A breakout above 26,250 may trigger short covering toward 26,340–26,394, especially if financials participate.

If price slips below 25,920, expect a sentiment shift and faster unwinding.

Intraday Strategy

- Buy on dips near 26,030–26,070

SL: 25,950 | T1: 26,190 | T2: 26,250 | T3: 26,340

Avoid aggressive shorting unless Nifty closes below 25,800 with volume confirmation.

Bank Nifty Outlook — CMP 58,867.70

Support Levels

- 58,650

- 58,800

- 58,940

Resistance Levels

- 59,250

- 59,355

- 59,550

Bank Nifty remains inside a broad consolidation channel, but PCR and open interest suggest quiet accumulation rather than distribution.

RSI, MACD & Volume View

- RSI: Near 52 — neutral but improving

- MACD: Flat — awaiting breakout confirmation

- Volume: Segment-wise rotation—PSU banks outperforming, private banks sluggish

The biggest technical trigger lies at 59,250—crossing and sustaining above it could unleash momentum toward 59,550, given the short buildup trapped near higher strikes.

Intraday Strategy

- Buy near 58,800–58,940

SL: 58,650 | T1: 59,250 | T2: 59,355 | T3: 59,550

Downside risk remains limited unless macro risk or negative global cues hit financials.

Fin Nifty Outlook — CMP 27,566.15

Fin Nifty continues to respect its rising channel structure, supported by asset-management, NBFCs, insurance, and fintech strength.

What the Indicators Suggest

- RSI: Around 57 — trending but not overbought

- MACD: Bullish continuation setup

- Volume: Consistent and institutional—supports upward bias

A breakout above 27,650 may drive a move toward 27,800, while profit booking may emerge near 27,900.

Intraday Strategy

- Buy near 27,480–27,520

SL: 27,410 | T1: 27,650 | T2: 27,720 | T3: 27,800

Ideal approach—scalp long setups until resistance breaks convincingly.

Support & Resistance Table — 24 November 2025

| Index | Supports | Resistances |

|---|---|---|

| Nifty 50 | 25,800 / 25,920 / 26,030 | 26,190 / 26,250 / 26,394 |

| Bank Nifty | 58,650 / 58,800 / 58,940 | 59,250 / 59,355 / 59,550 |

| Fin Nifty | 27,480 / 27,520 / 27,410 | 27,650 / 27,720 / 27,800 |

Market Outlook — Should Traders Stay Cautious or Optimistic?

The underlying market tone remains constructive as long as institutional selling remains limited. FIIs increasing long exposure from single digits to 13% is not aggressive—but it’s directional.

High PCR values show option writers preparing for higher levels, while rising VIX warns of sudden volatility pockets.

So, today’s market favors:

✅ Dip buying

✅ Smaller position sizing

✅ Waiting for confirmation near resistance

✅ Avoiding emotional trade entries during volatile windows

Who Should Avoid Trading Today?

- Traders expecting one-directional trending market

- Highly leveraged intraday positions

- Option buyers entering before confirmation candles

Internal Link Suggestions for CapitalKeeper.in

- Read next: “How to Use PCR, VIX & OI to Predict Market Breakouts”

- Also read: “Sector Rotation Strategy for Swing Traders”

- Education: “Beginner’s Guide to RSI & MACD Trading Signals”

FAQs — 24 November 2025

Q1. Is today a buy-on-dip market?

Yes—if Nifty holds above 26,030 and Bank Nifty above 58,800.

Q2. Should traders expect a second-half trend?

Data and timing cycles suggest recovery after the first four hours.

Q3. Is volatility expected to rise further?

Yes—India VIX at 12.14 indicates potential intraday spikes.

Q4. What invalidates the bullish outlook?

A close below Nifty 25,800 or Bank Nifty 58,650.

Q5. Are positional trades recommended?

Only after Nifty sustains above 26,250 with strong volumes.

Final Takeaway

Today’s session favors tactical long setups rather than blind momentum chasing. Markets may appear indecisive early, but price structure, institutional positioning, and technical indicators hint at a recovery post-midday—making disciplined execution more important than prediction.

If supports hold and volatility eases, fresh highs cannot be ruled out this week.

📌 For more real-time updates, trade setups, and investment insights — follow us on [Telegram] and [WhatsApp Channel] subscribe to our newsletter!

📌 Disclaimer

The content provided on CapitalKeeper.in is for informational and educational purposes only and does not constitute investment, trading, or financial advice. While we strive to present accurate and up-to-date market data and analysis, we make no warranties or representations regarding the completeness, reliability, or accuracy of the information.

Stock market investments are subject to market risks, and readers/investors are advised to conduct their own due diligence or consult a SEBI-registered financial advisor before making any investment decisions. CapitalKeeper and its authors are not liable for any loss or damage, direct or indirect, arising from the use of this information.

All views and opinions expressed are personal and do not reflect the official policy or position of any agency or organization. Past performance is not indicative of future results.

By using this website, you agree to the terms of this disclaimer.

Ranjit Sahoo

Founder & Chief Editor – CapitalKeeper.in

Ranjit Sahoo is the visionary behind CapitalKeeper.in, a leading platform for real-time market insights, technical analysis, and investment strategies. With a strong focus on Nifty, Bank Nifty, sector trends, and commodities, she delivers in-depth research that helps traders and investors make informed decisions.

Passionate about financial literacy, Ranjit blends technical precision with market storytelling, ensuring even complex concepts are accessible to readers of all levels. Her work covers pre-market analysis, intraday strategies, thematic investing, and long-term portfolio trends.

When he’s not decoding charts, Ranjit enjoys exploring coastal getaways and keeping an eye on emerging business themes.

📌 Follow Ranjit on:

LinkedIn | Twitter/X | Instagram | ✉️ contact@capitalkeeper.in

Leave a Reply