Nifty & Bank Nifty Analysis Today (29th Sept 2025): Key Support, Resistance & Intraday Strategies

By CapitalKeeper | Nifty & Bank Nifty | Indian Equities | Market Moves That Matter

29th September 2025 stock market analysis: Nifty, Bank Nifty & Fin Nifty key support and resistance, intraday strategies, FII data, PCR ratio, India VIX, and IT sector outlook. Stay updated with tactical insights for today’s trading session.

📈 Nifty & Bank Nifty Analysis Today: Key Levels & Strategies for 29th September 2025

📰 Market Overview – 29th September 2025

The Indian stock market is entering a critical phase of volatility as we step into the last trading week of September. With expiry-driven moves behind us, traders are now gearing up for October positioning, where sector rotation and FII behavior will decide short-term direction.

On Friday, 26th September 2025, Nifty closed at 24,654.70, reflecting weakness at lower levels but also defending crucial support zones. Meanwhile, Bank Nifty ended at 54,389.35, showing underperformance compared to Nifty, and Fin Nifty settled at 26,073, which continues to remain volatile.

Today’s price action is set against the backdrop of:

- FII long positions dropping to 13% from 16%, signaling cautious foreign participation.

- Nifty PCR falling sharply to 0.63 (from 0.68), indicating increasing bearish option writing.

- Bank Nifty PCR softening to 0.71 (from 0.82), showing weaker sentiment in the banking index.

- India VIX jumping 6% to 11.40, reflecting heightened volatility expectations.

All of this points to a mixed trend, where intraday strategies should be tightly risk-managed.

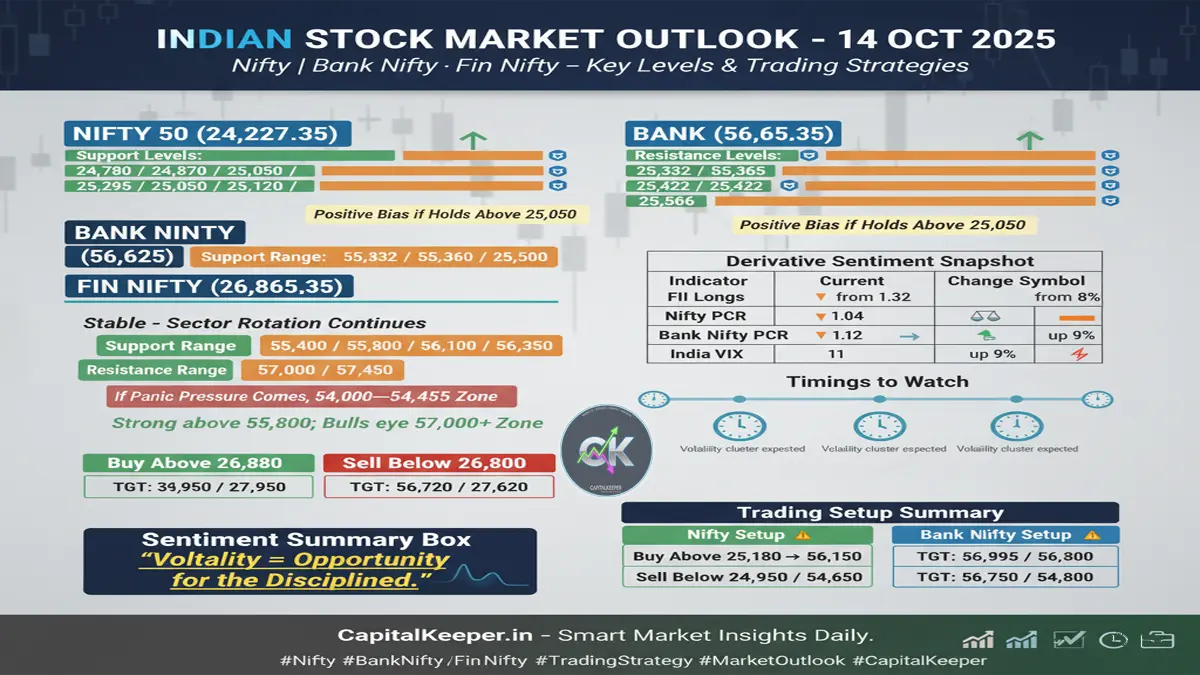

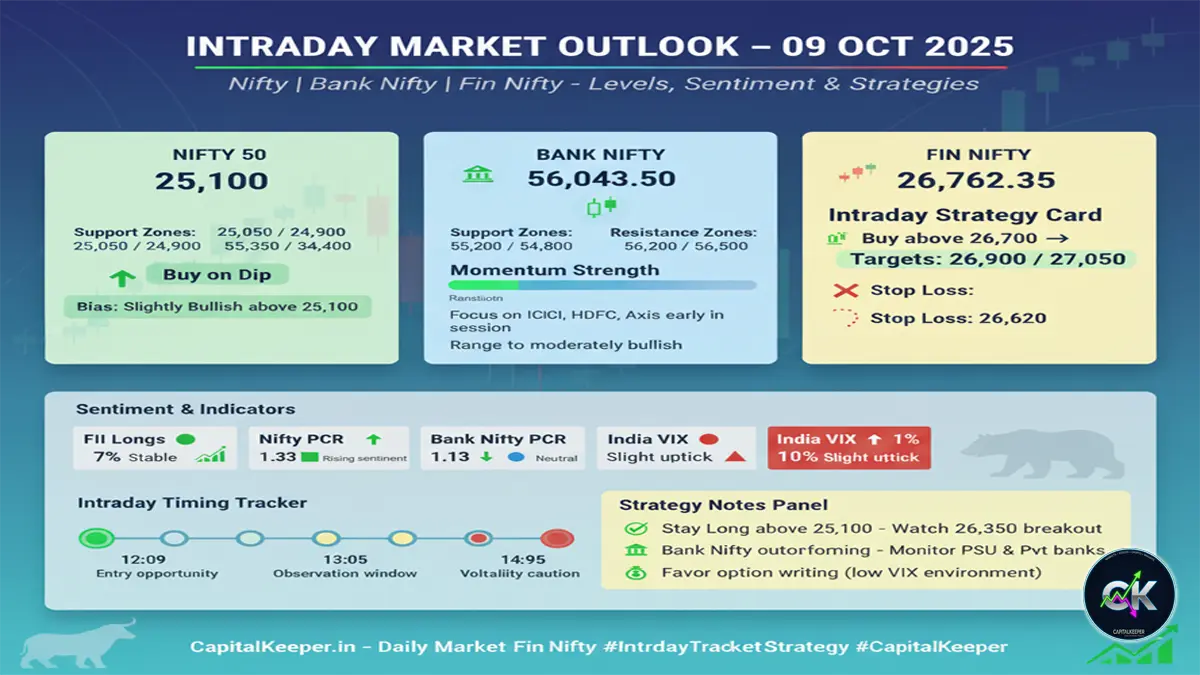

🔑 Nifty 50 Technical Analysis

- Previous Close: 24,654.70

- Immediate Resistance Levels: 24,780 / 24,876 / 24,945 / 25,030

- Support Levels: 24,040 / 24,150 / 24,265 / 24,369

✅ Bullish Scenario:

If Nifty sustains above 25,120, strong momentum can build up. Traders should look for targets towards 25,250–25,400 levels over the next few sessions, especially if global cues support.

❌ Bearish Scenario:

Failure to hold 24,650–24,600 zones can drag Nifty back to 24,265 and 24,150 levels. A break below 24,040 could open the gates to 23,800–23,900.

📊 Market Sentiment:

The fall in PCR (0.63) suggests heavy call writing at upper levels, limiting the upside unless there’s a strong short covering rally.

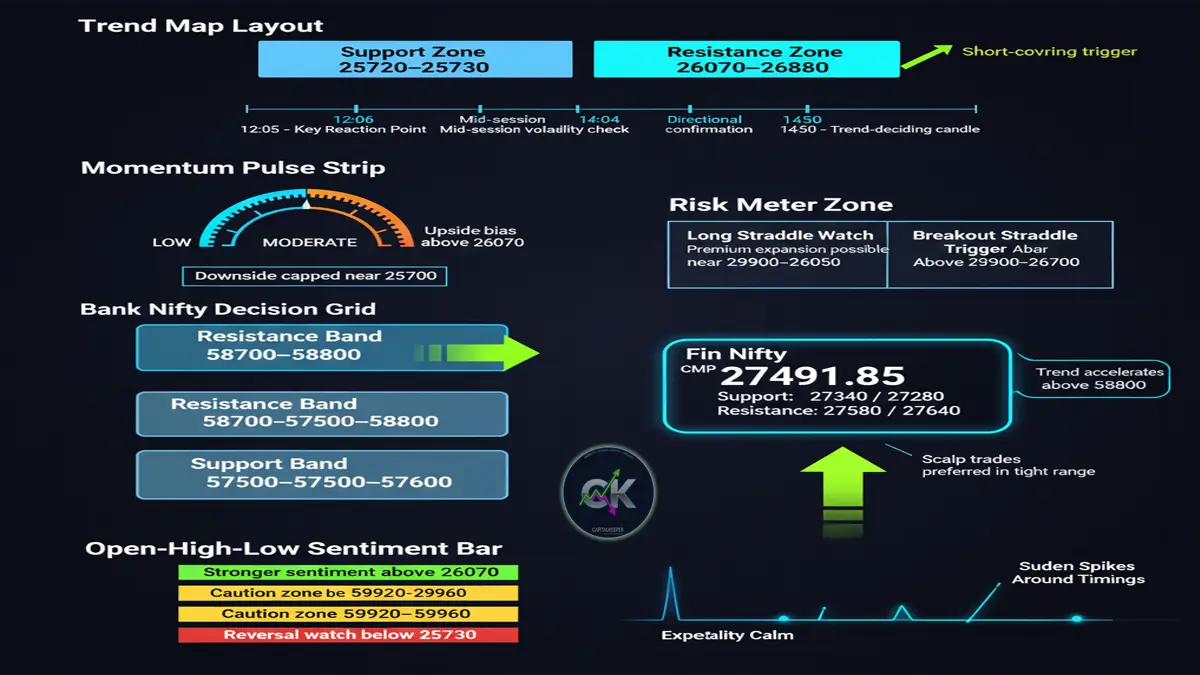

🏦 Bank Nifty Technical Analysis

- Previous Close: 54,389.35

- Immediate Support Levels: 53,565 / 53,700 / 53,850 / 54,000 / 54,100

- Resistance Levels: 54,600 / 54,750 / 54,855 / 55,000 / 55,140 / 55,245

✅ Bullish Case:

Bank Nifty needs to sustain above 54,600–54,750 zone for any momentum. If achieved, the rally may extend to 55,245–55,770 levels.

❌ Bearish Case:

Failure to defend 54,000–54,100 could drag Bank Nifty to 53,700–53,565 zones. Below this, deeper correction may trigger panic selling.

Sector Highlight:

- PSU Banks: Consolidating, awaiting breakout above 7,650 zone (Nifty PSU Banks).

- Private Banks: Still showing weak momentum, keeping Bank Nifty capped.

💹 Fin Nifty Analysis (Now: 26,073)

Fin Nifty continues to show choppiness in intraday charts.

Intraday Strategy Zones:

- Support: 25,950 / 25,880

- Resistance: 26,180 / 26,250 / 26,350

Strategy:

- Go long on dips near 25,950 with stop-loss at 25,850, targeting 26,200–26,350.

- Avoid longs if the index sustains below 25,880, as that could trigger a slide toward 25,600–25,450.

📅 Important Timings to Watch

- 11:13 AM – Opening volatility subsides, key intraday moves often emerge.

- 12:11 PM – Possible reversal point; watch for option writers’ positioning.

- 1:11 PM – Midday breakout/breakdown zone.

- 2:03 PM – Afternoon volatility; high probability of momentum trades.

- 2:52 PM – Caution hour; possible profit booking or panic moves.

👉 Note: The first hour’s high and low (till 10:30 AM) will be crucial reference levels for intraday trend direction.

🌐 Derivatives & FII Data Impact

- FII Long Positions: Dropped to 13% from 16%, showing lack of conviction.

- Nifty PCR (Put-Call Ratio): 0.63 → indicates stronger resistance at higher levels.

- Bank Nifty PCR: 0.71 → signals more downside risk for banking index.

- India VIX at 11.40 (+6%) – The rise in volatility index confirms traders should keep tight stop-losses.

This mix suggests that markets may test lower supports first before attempting an afternoon recovery, in line with the stated “Positive Bias in Second Half.”

📊 IT Stocks Outlook

The note on IT stocks suggests a short-term rebound is expected, but it is advised to exit positions on bounce back.

- Global tech weakness and rupee volatility could cap upside.

- Fresh long positions should be avoided until Nifty IT index closes firmly above 36,000 levels.

🎯 Intraday Strategies for 29th September 2025

🔹 Nifty:

- Buy near 24,600–24,650 with stop-loss 24,540, target 24,876 / 24,945.

- Avoid longs if below 24,600, as downside risk increases.

🔹 Bank Nifty:

- Buy only above 54,600–54,750 for targets 55,000–55,245.

- Sell on rise below 54,100, with downside targets 53,850 / 53,700.

🔹 Fin Nifty:

- Intraday buy zone: 25,950–26,000, SL 25,850, target 26,200–26,350.

- Cautious stance below 25,880.

📌 Key Takeaways

- First Hour levels till 10:30 AM crucial for intraday trend confirmation.

- Nifty above 25,120 = strength, below 24,600 = weakness.

- Bank Nifty remains capped unless it clears 54,750+.

- Fin Nifty offering range-bound opportunities with strict stop-losses.

- IT sector bounce likely, but treat as exit opportunity rather than fresh entry.

- Rising VIX (+6%) warns of choppy moves – expect traps both sides.

✅ Conclusion

The Indian stock market on 29th September 2025 is shaping up for a volatile session with mixed bias. While the first half may see pressure, the second half holds potential for recovery, provided Nifty sustains above 25,120 and Bank Nifty above 54,600.

For traders, the mantra today is simple:

- Buy in dips, but keep stop-losses tight.

- Avoid panic at lower levels.

- Use timing-based strategies aligned with option data.

If executed carefully, today’s session could offer lucrative intraday opportunities in Nifty, Bank Nifty, and Fin Nifty.

📌 For more real-time updates, trade setups, and investment insights — follow us on [Telegram] and [WhatsApp Channel] subscribe to our newsletter!

📌 Disclaimer

The content provided on CapitalKeeper.in is for informational and educational purposes only and does not constitute investment, trading, or financial advice. While we strive to present accurate and up-to-date market data and analysis, we make no warranties or representations regarding the completeness, reliability, or accuracy of the information.

Stock market investments are subject to market risks, and readers/investors are advised to conduct their own due diligence or consult a SEBI-registered financial advisor before making any investment decisions. CapitalKeeper and its authors are not liable for any loss or damage, direct or indirect, arising from the use of this information.

All views and opinions expressed are personal and do not reflect the official policy or position of any agency or organization. Past performance is not indicative of future results.

By using this website, you agree to the terms of this disclaimer.

Ranjit Sahoo

Founder & Chief Editor – CapitalKeeper.in

Ranjit Sahoo is the visionary behind CapitalKeeper.in, a leading platform for real-time market insights, technical analysis, and investment strategies. With a strong focus on Nifty, Bank Nifty, sector trends, and commodities, she delivers in-depth research that helps traders and investors make informed decisions.

Passionate about financial literacy, Ranjit blends technical precision with market storytelling, ensuring even complex concepts are accessible to readers of all levels. Her work covers pre-market analysis, intraday strategies, thematic investing, and long-term portfolio trends.

When he’s not decoding charts, Ranjit enjoys exploring coastal getaways and keeping an eye on emerging business themes.

📌 Follow Ranjit on:

LinkedIn | Twitter/X | Instagram | ✉️ contact@capitalkeeper.in

Leave a Reply