Mid Day Market Update 18 Sept 2025 – Nifty, Bank Nifty Struggle Near Highs | Sector & Global Cues

By CapitalKeeper | Mid Day | Indian Equities | Market Moves That Matter

Indian stock market mid-day update 18 Sept 2025: Nifty at 25,366, Bank Nifty 55,605, Sensex 82,827. Sector-wise trends show strength in IT & Auto, weakness in banks & metals. Global cues mixed ahead of Fed outlook.

🌐 Mid Day Market Update – 18th September 2025: Indices Struggle Near Highs as Bulls Pause

📌 Overview

The Indian stock market on 18th September 2025 began the session with positive momentum, but as the day progressed, selling pressure at higher levels capped the gains. While the broader trend remains constructive, profit booking near resistance levels is keeping the markets range-bound.

At mid-day, here’s where the markets stand:

- Nifty 50: Opened at 25,441.10, now trading at 25,366.00, intraday high 25,449.00

- Bank Nifty: Opened at 55,797.10, now trading at 55,605.00, intraday high 55,835.25

- Sensex: Opened at 83,108.92, now at 82,827.00, intraday high 83,141.21

- Fin Nifty: Opened at 26,685.99, now trading at 26,630.00, intraday high 26,724.00

The data reflects a flat-to-negative tone, suggesting that bulls are facing hurdles near record highs.

📊 Technical Analysis

🔹 Nifty 50

Nifty tested 25,449 but failed to sustain. The index is consolidating just below its resistance at 25,480–25,500 zone.

- Immediate support: 25,300–25,250

- Immediate resistance: 25,480–25,550

- Indicators: RSI is hovering around neutral territory, suggesting consolidation. MACD remains positive but momentum is flattening.

A sustained close above 25,500 could trigger a fresh rally, while failure may keep Nifty in a sideways range.

🔹 Bank Nifty

Bank Nifty opened strong but slipped from its intraday high of 55,835, now near 55,600.

- Support zone: 55,400–55,250

- Resistance zone: 55,850–56,000

- Trend: Private banks show resilience, while PSU banks are slightly weak.

A move above 56,000 will attract momentum buying; below 55,250, selling pressure could increase.

🔹 Sensex

Sensex also followed a similar path—open high near 83,141 but now hovering around 82,827.

- Support levels: 82,500–82,200

- Resistance: 83,200–83,400

- Technical view: Consolidation continues near record highs; heavyweights like Reliance, Infosys, and HDFC Bank are in focus.

🔹 Fin Nifty

Fin Nifty is relatively stable but could not hold above 26,700.

- Support: 26,500–26,400

- Resistance: 26,750–26,900

- Outlook: NBFCs and insurance stocks are supporting, while profit booking in major private banks is capping upside.

🔍 Sector-Wise Performance

✅ Gainers

- IT Sector: Riding on positive global tech earnings, IT majors like Infosys and TCS are holding firm. Weakness in the rupee is adding support.

- Auto Sector: Two-wheelers and passenger vehicle stocks remain resilient ahead of festive demand expectations.

❌ Losers

- Banking & Financials: Slight profit booking in private banks like HDFC Bank, ICICI Bank weighing on Bank Nifty.

- Metals: Weakness in international commodity prices, especially steel and aluminum, is dragging the sector.

⚖️ Mixed

- FMCG: Stable demand keeps the sector defensive; HUL and Nestlé are holding ground.

- Energy: Reliance Industries is showing mild weakness, but ONGC is holding positive after crude oil stabilization.

🌍 Global Market Cues

- US Markets: Wall Street closed mixed yesterday ahead of Federal Reserve policy meeting minutes, with Dow slightly negative while Nasdaq held gains on tech optimism.

- Asian Markets: Japan’s Nikkei traded lower, while Hang Seng was under pressure due to China’s property sector worries.

- Crude Oil: Prices remain stable around $81 per barrel, easing concerns of inflationary spikes.

- Dollar Index & Rupee: Dollar remains firm, while INR is trading near 83.25 per USD, mildly supportive for IT exports.

📰 Key News Flow

- Fed Cues: Investors await clarity on US interest rate trajectory.

- India Macro Data: WPI inflation came slightly lower than expectations, giving RBI more comfort.

- Corporate Buzz: Auto companies report strong festive pre-bookings; IT sector sees robust deal wins.

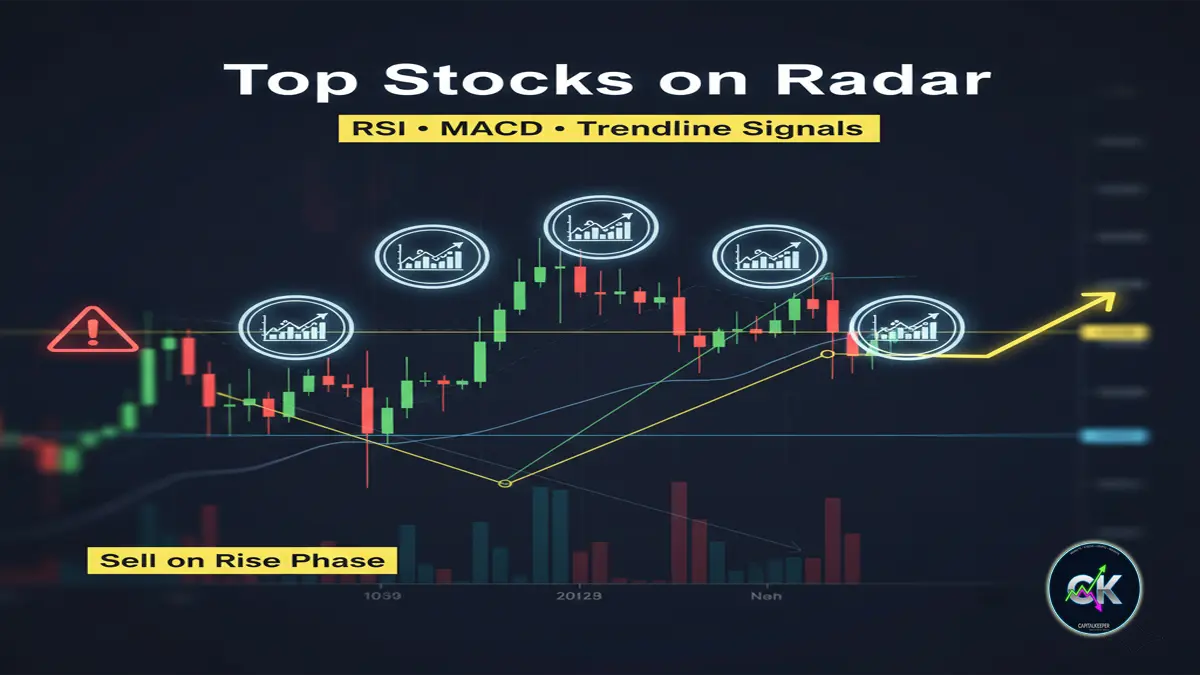

📌 Mid-Day Trading View

The markets are consolidating near highs, with sector rotation in play. Traders should remain cautious near resistance zones and adopt a buy-on-dips, sell-on-rise approach.

🔑 Key Levels to Watch

- Nifty:

- Buy above 25,500 → Targets: 25,600 / 25,750 | SL 25,350

- Sell below 25,300 → Targets: 25,150 / 25,000 | SL 25,450

- Bank Nifty:

- Buy above 56,000 → Targets: 56,250 / 56,400 | SL 55,750

- Sell below 55,250 → Targets: 55,000 / 54,800 | SL 55,500

🏁 Conclusion

The 18th September 2025 mid-day update reflects a pause in momentum at higher levels. While global cues remain mixed, Indian markets continue to consolidate near lifetime highs. Traders should focus on sector-specific plays in IT, auto, and FMCG, while being cautious in banks and metals.

The trend remains structurally bullish, but the short-term tone is sideways as markets await fresh triggers.

📌 For more real-time updates, trade setups, and investment insights — follow us on [Telegram] and [WhatsApp Channel] subscribe to our newsletter!

📌 Disclaimer

The content provided on CapitalKeeper.in is for informational and educational purposes only and does not constitute investment, trading, or financial advice. While we strive to present accurate and up-to-date market data and analysis, we make no warranties or representations regarding the completeness, reliability, or accuracy of the information.

Stock market investments are subject to market risks, and readers/investors are advised to conduct their own due diligence or consult a SEBI-registered financial advisor before making any investment decisions. CapitalKeeper and its authors are not liable for any loss or damage, direct or indirect, arising from the use of this information.

All views and opinions expressed are personal and do not reflect the official policy or position of any agency or organization. Past performance is not indicative of future results.

By using this website, you agree to the terms of this disclaimer.

Ranjit Sahoo

Founder & Chief Editor – CapitalKeeper.in

Ranjit Sahoo is the visionary behind CapitalKeeper.in, a leading platform for real-time market insights, technical analysis, and investment strategies. With a strong focus on Nifty, Bank Nifty, sector trends, and commodities, she delivers in-depth research that helps traders and investors make informed decisions.

Passionate about financial literacy, Ranjit blends technical precision with market storytelling, ensuring even complex concepts are accessible to readers of all levels. Her work covers pre-market analysis, intraday strategies, thematic investing, and long-term portfolio trends.

When he’s not decoding charts, Ranjit enjoys exploring coastal getaways and keeping an eye on emerging business themes.

📌 Follow Ranjit on:

LinkedIn | Twitter/X | Instagram | ✉️ contact@capitalkeeper.in

Leave a Reply