NIFTY Mid-Day Update – MID-DAY MARKET CHECK

📈 Market Mood: Cautiously Awaiting Breakout

It’s mid-day, and the market is playing the waiting game! Traders are closely watching for a clear breakout during this MID-DAY MARKET CHECK, as both NIFTY and BANK NIFTY hover around key levels, keeping everyone on their toes. As we proceed with our MID-DAY MARKET CHECK, the anticipation builds for potential movement.

🔄 NIFTY: High or Low Break – The Decisive Move!

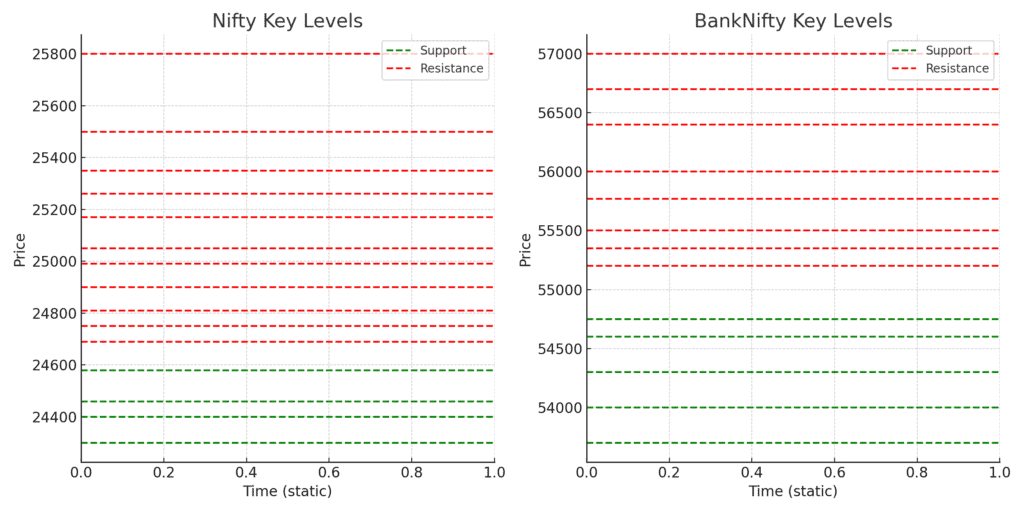

NIFTY has been flirting with both day high and day low, but so far, neither has been decisively breached. This sideways movement indicates that traders are waiting for a signal—either a breakout above the high or a breakdown below the low.

During our MID-DAY MARKET CHECK, it’s important to keep an eye on the evolving trends and signals that may influence future trading decisions.

💡 CapitalKeeper Insight:

- Until either the day high or low is broken, expect choppy and range-bound movements.

- Momentum and Direction: Only a decisive move beyond these levels will set the tone for the rest of the trading session.

- Strategy: Keep your positions light and wait for confirmation before jumping in.

💥 BANK NIFTY: Bracing for Impact at 57,263.80

The real action today might come from BANK NIFTY, which is approaching the critical level of 57,263.80. Traders are bracing for a potential storm if this spot level breaks.

- Why It Matters: Breaking this level could trigger a highly volatile situation, especially for the bears, as selling pressure may intensify.

- What to Do:

- If 57,263.80 Holds: Stay cautious and observe market sentiment.

- If Broken: Be prepared for a sharp move, as panic selling could take hold.

- Shorting Below: If BANK NIFTY slips below this mark, bears might take control, leading to significant downside pressure.

As we analyze the situation, a thorough MID-DAY MARKET CHECK will help traders prepare for any potential shifts.

In today’s MID-DAY MARKET CHECK, understanding the implications of these movements can provide valuable insights.

A reliable financial news website

This MID-DAY MARKET CHECK serves as a reminder to remain vigilant and adjust strategies accordingly.

Remember, every MID-DAY MARKET CHECK brings new opportunities; staying informed is crucial.

⚠️ CapitalKeeper’s Mid-Day Tips:

- Watch Closely: Today’s trading will hinge on whether NIFTY breaks out of the range and BANK NIFTY breaches the critical support.

- Avoid Premature Trades: Jumping in before the levels are decisively broken can be risky.

- Volatility Alert: Prepare for fast, unpredictable moves if BANK NIFTY’s support gives way.

Sector Spotlight

Defence & Pharma

The defence sector has experienced a strong rally, but investors should tread carefully now. Valuations have become excessive, with some public sector companies trading at unjustifiable price-to-earnings ratios exceeding 100. Meanwhile, the pharma and FMCG sectors, which were subdued last week, might continue to show underwhelming performance in the near term.

Vodafone Idea & Telecom

Vodafone Idea has appealed for a waiver of its large financial obligations, citing public interest. However, Sandip sees this as a low-probability event since the Supreme Court will likely focus on legal principles rather than business hardships. Investors should not base their decisions on this news. If relief is eventually granted, the situation can be reassessed then.

Exchange & Broking Stocks

Stocks like BSE and CDSL have surged recently, with BSE hitting all-time highs and CDSL jumping 8% on Friday. Broking stocks such as Angel One have also held firm. The surge is driven by positive sentiment and rising turnover expectations in a bullish market. However, valuations are stretched, and these companies are highly market-sensitive. Investors should wait for better entry points during corrections.

As we proceed with today’s MID-DAY MARKET CHECK, it’s vital to stay alert and responsive to market changes.

This sector analysis will play a key role in our ongoing MID-DAY MARKET CHECK.

Stay sharp and keep your risk management tight!

CapitalKeeper.in – Your Real-Time Trading Companion 📊

📢 Disclaimer:

The information provided in this blog is for informational and educational purposes only. CapitalKeeper.in does not offer financial, investment, or trading advice. The analysis and opinions expressed are based on data available at the time of writing and are subject to change without notice.

Investors and traders are advised to conduct their own research and seek professional guidance before making any financial decisions. Capital markets are subject to risks, including loss of principal. Neither CapitalKeeper.in nor the author shall be liable for any direct or indirect losses incurred as a result of using this information.

Trade wisely. Stay informed.

Staying sharp during the MID-DAY MARKET CHECK is essential for all traders.

In conclusion, this MID-DAY MARKET CHECK is just the beginning; further developments will follow.

Trade wisely and remember the insights from this MID-DAY MARKET CHECK.

Leave a Reply