Learn how to identify true breakout stocks and smart confirmation techniques. Avoid false breakouts and trade confidently.

Updated: 23 November 2025

Category: Educational | Market Analysis

By CapitalKeeper Research Desk

Learn how to identify true breakout stocks using RSI, MACD, volume, price action, and smart confirmation techniques. Avoid false breakouts and trade confidently.

Identify true breakout stocks

Breakout trading has always attracted retail and institutional traders alike. When a stock finally moves above a long-standing resistance or slips below a critical support, emotions spike, volumes surge, and traders anticipate a strong directional move. Yet, not every breakout turns into a profitable trend—many reverse sharply and trigger stop-losses.

So, the real question is: How do you differentiate a true breakout from a false one?

This detailed guide breaks down technical confirmation strategies using volume, RSI, MACD, price action, and market structure, helping traders build conviction and reduce uncertainty.

What Is a Breakout in Stock Market Terms?

A breakout occurs when a stock moves beyond a defined support or resistance level, indicating potential continuation of momentum. The breakout must be supported by price strength, volume, and broader market sentiment to qualify as reliable.

Breakouts generally fall into two categories:

- Upside Breakout — Price moves above resistance

- Downside Breakdown — Price falls below support

However, both require confirmation—otherwise, they risk becoming short-lived traps.

Why Most Traders Fail at Breakout Trading

Many traders chase breakouts purely based on candlestick movement—without evaluating volume or technical indicators. Stocks frequently hit resistance, spike briefly, and then pull back, leaving late entrants stuck.

Common mistakes include:

- Entering immediately after price crosses resistance

- Ignoring RSI divergence

- Trading breakouts during low-volume sessions

- Over-relying on intraday price spikes

- Neglecting macro or sector sentiment

Breakout trading is not about reacting—it’s about verifying.

How to Identify a True Breakout — The 5-Step Checklist

✅ 1. Volume Must Confirm the Move

A breakout without strong volume is weak and unreliable. Volume validates trader participation and institutional interest.

Ideal Volume Confirmation Criteria

- 40%–100% higher than 20-day average

- Increasing volume on multiple candles

- Avoid breakouts on declining volume

Rising volume suggests accumulation or distribution—not random price movement.

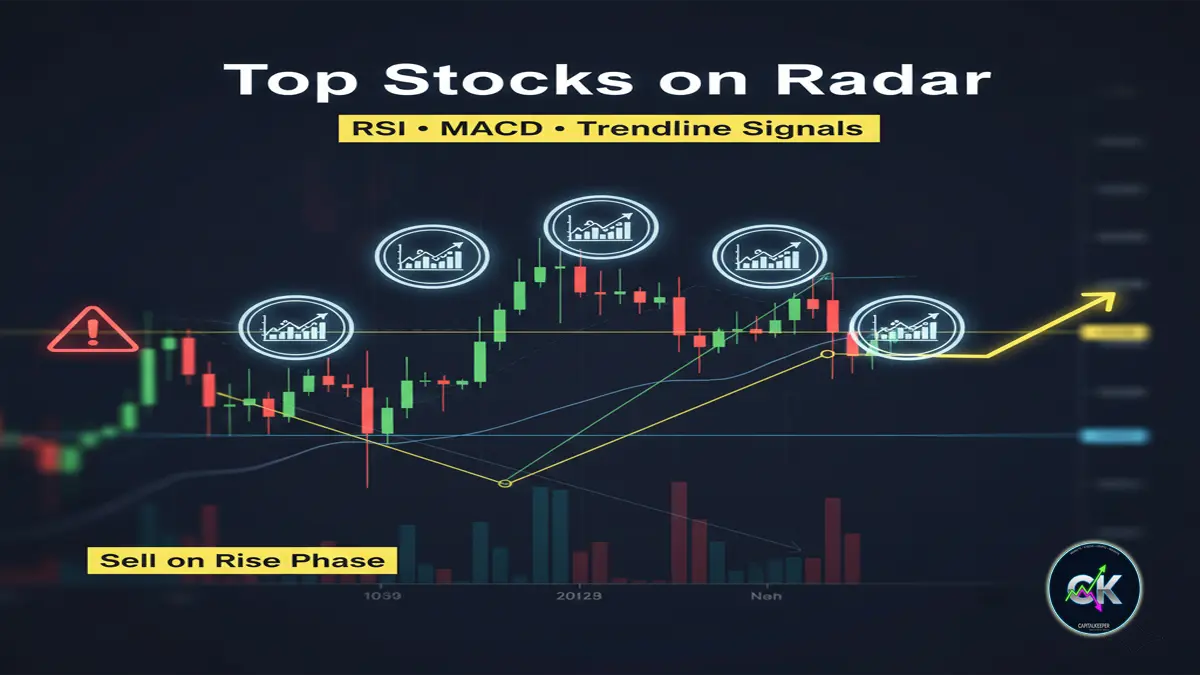

✅ 2. RSI Should Support Momentum

RSI (Relative Strength Index) helps identify whether breakout strength is sustainable.

Bullish Breakout RSI Signals

- RSI above 55 indicates strengthening trend

- RSI between 60–70 signals momentum breakout

- No bearish divergence near resistance

Bearish Breakout RSI Signals

- RSI below 45 confirms weakness

- Breakdown stronger below 40

If price rises but RSI falls, the breakout might be fake—institutions may be exiting quietly.

✅ 3. MACD Must Align With Price Direction

MACD confirms structural trend changes—not just temporary volatility.

For Upside Breakouts

- MACD line crosses above signal line

- Histogram turns positive

- MACD above zero line adds conviction

For Downside Breakdowns

- MACD line crosses below signal

- Histogram turns negative

When breakout, RSI, and MACD align—probability of continuation increases.

✅ 4. Retest of Breakout Zone

A true breakout often retests the old resistance, turning it into fresh support.

This helps shake out weak hands and confirms trend strength.

Retest Benefits

- Provides safer entry zones

- Offers tighter stop-loss placement

- Ensures breakout sustainability

Not all breakouts retest—but when they do, reliability increases.

✅ 5. Breakout Should Occur in Trend Direction

Breakouts against prevailing trends have lower success rates.

- Bullish breakout during a higher-high, higher-low structure → stronger

- Bearish breakdown during lower-high, lower-low structure → valid

Price action + trend confirms market psychology.

Table: True Breakout vs False Breakout Indicators

| Indicator | True Breakout | False Breakout |

|---|---|---|

| Volume | High & rising | Low or declining |

| RSI | Above 55 (bullish) / Below 45 (bearish) | Divergence or flat |

| MACD | Trend-aligned crossover | Opposing crossover |

| Candle Close | Above resistance | Wicks only—no close |

| Retest | Successful support hold | Immediate rejection |

| Trend | Already bullish/bearish | Directionless market |

| Market Sentiment | Sector strength supportive | Broader weakness |

Advanced Price Action Signs of a Genuine Breakout

✅ Multiple resistance tests before breakout

Indicates accumulation and buyer interest.

✅ Wide-range breakout candle

Shows aggressive participation.

✅ Clean chart—no overhead resistance nearby

Gives room for continuation.

✅ Higher time frame confirmation (Daily/Weekly)

Breakouts on weekly charts carry far more reliability than intraday moves.

Common False Breakout Traps and How to Avoid Them

❌ Breakouts during low liquidity sessions

Example: opening minutes and pre-holiday markets.

❌ Breakouts driven by news rumors

Price often retraces after excitement fades.

❌ Penny or operator-driven stocks

These can manipulate price artificially.

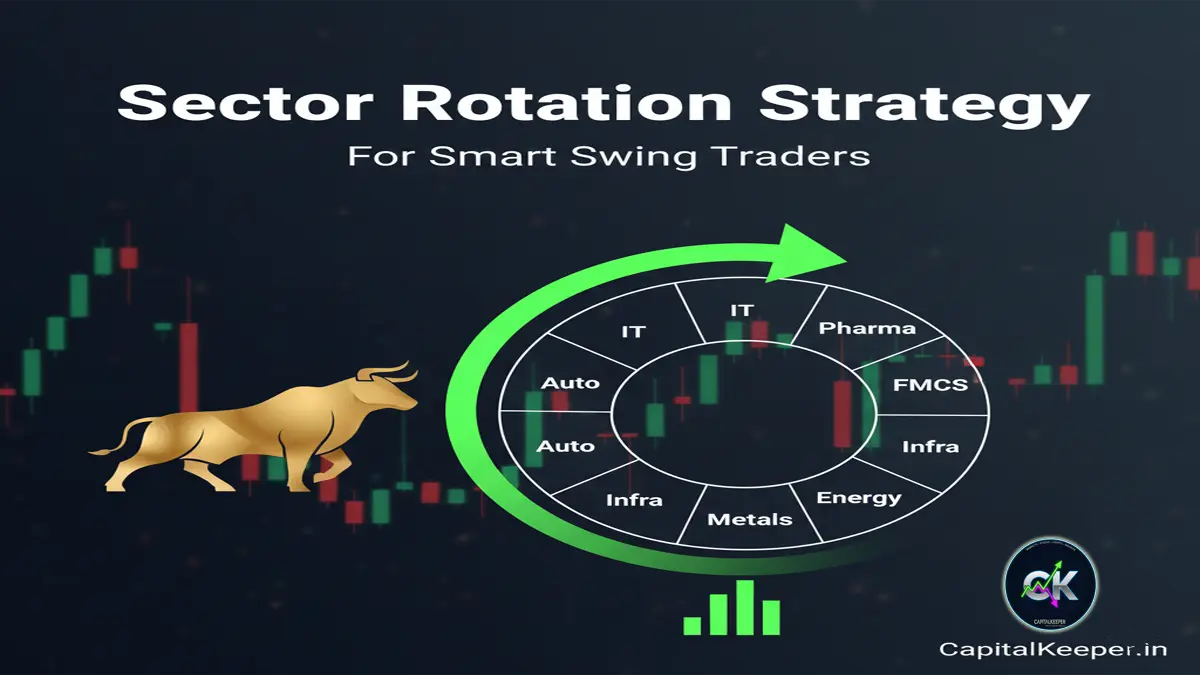

❌ Breakouts without sector or index support

Sector rotation matters—always track peers.

Where to Place Stop-Loss in Breakout Trading

Stop-loss positioning is not random—it should be based on structure.

For Long Trades:

- Just below retested resistance-turned-support

- ATR-based stop to factor volatility

- Below breakout candle low

For Short Trades:

- Slightly above breakdown resistance

A well-placed stop-loss converts uncertainty into strategy.

Ideal Time Frames for Breakout Confirmation

| Trader Type | Time Frame |

|---|---|

| Intraday | 5m, 15m, 30m |

| Swing | 1-hour, Daily |

| Positional | Daily, Weekly |

Higher time frames reduce false signals.

Final Thoughts — Breakouts Reward Patience, Not Speed

A breakout isn’t just a candle crossing a line—it’s a story of demand versus supply shifting in favor of a new trend. Traders who wait for confirmations—volume, RSI, MACD, trend structure, and retest—outperform those who chase price impulsively.

Breakout trading isn’t luck—it’s disciplined execution.

✅ Internal Links for CapitalKeeper.in Publishing

- Read our Nifty 50 Technical Outlook — /nifty-today-analysis

- Learn How RSI Works in Trading — /understanding-rsi-indicator

- Explore Beginner Stock Market Education — /stock-market-education

- View Top Breakout Stocks Weekly List — /breakout-stocks-watchlist

FAQs — Breakout Stock Trading

1. What is the safest breakout confirmation method?

A combination of above-average volume, RSI above 55, and MACD bullish crossover provides high reliability.

2. Are all breakouts tradable?

No—avoid weak volume, penny stocks, rumor-driven spikes, and counter-trend moves.

3. Should I enter on breakout or retest?

Retest entries offer better risk-reward and clearer stop-loss placement.

4. Which time frame is best for identifying breakouts?

Daily and weekly charts provide more trustworthy signals than intraday charts.

5. Can breakouts happen during downtrends?

Yes, but success probability increases when aligned with broader market trend.

📌 For daily trade setups, technical learning, and smart investing tips, stay tuned to CapitalKeeper.in

📌 For more real-time updates, trade setups, and investment insights — follow us on [Telegram] and [WhatsApp Channel] subscribe to our newsletter!

Subscribe Now , Join Telegram the Crypto Capital Club, Get Free Crypto Updates

📌 Disclaimer

The content provided on CapitalKeeper.in is for informational and educational purposes only and does not constitute investment, trading, or financial advice. While we strive to present accurate and up-to-date market data and analysis, we make no warranties or representations regarding the completeness, reliability, or accuracy of the information.

Stock market investments are subject to market risks, and readers/investors are advised to conduct their own due diligence or consult a SEBI-registered financial advisor before making any investment decisions. CapitalKeeper and its authors are not liable for any loss or damage, direct or indirect, arising from the use of this information.

All views and opinions expressed are personal and do not reflect the official policy or position of any agency or organization. Past performance is not indicative of future results.By using this website, you agree to the terms of this disclaimer.

Ranjit Sahoo

Founder & Chief Editor – CapitalKeeper.in

Ranjit Sahoo is the visionary behind CapitalKeeper.in, a leading platform for real-time market insights, technical analysis, and investment strategies. With a strong focus on Nifty, Bank Nifty, sector trends, and commodities, she delivers in-depth research that helps traders and investors make informed decisions.

Passionate about financial literacy, Ranjit blends technical precision with market storytelling, ensuring even complex concepts are accessible to readers of all levels. Her work covers pre-market analysis, intraday strategies, thematic investing, and long-term portfolio trends.

When he’s not decoding charts, Ranjit enjoys exploring coastal getaways and keeping an eye on emerging business themes.

📌 Follow Ranjit on:

LinkedIn | Twitter/X | Instagram | ✉️ contact@capitalkeeper.in

Leave a Reply