Top CDMO & CRAMS Stocks in India: Divi’s Labs, Syngene, Laurus Labs for 2025

By CapitalKeeper | Pharma Theme | Indian Equities | Market Moves That Matter

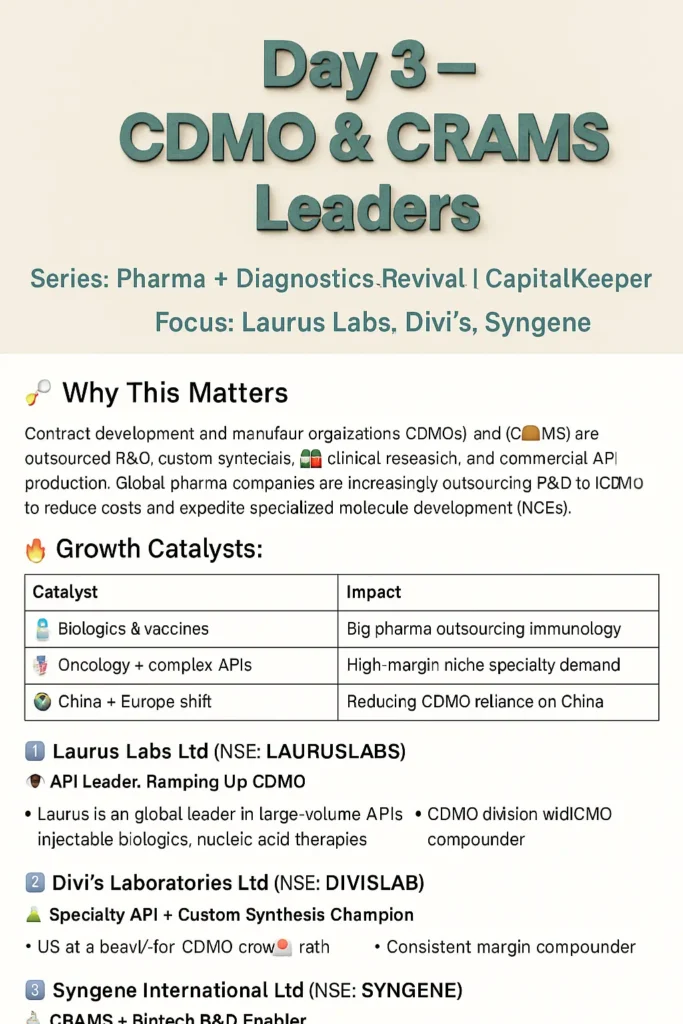

🧪 Day 3 – CDMO & CRAMS Leaders

Series: Pharma + Diagnostics Revival | CapitalKeeper

Explore India’s top CDMO and contract research pharma stocks like Divi’s, Syngene, and Laurus Labs. CapitalKeeper’s Day 3 Pharma Revival series for smart, stable investing.

🔬 Why This Segment Matters

CDMO (Contract Development and Manufacturing Organizations) and CRAMS (Contract Research and Manufacturing Services) are the backbone of global pharma innovation today.

With big pharma companies outsourcing drug development and manufacturing, India is emerging as a low-cost, high-skill hub for custom synthesis, biologics, and specialty molecules.

🚀 Key Growth Drivers:

| Catalyst | Impact |

|---|---|

| 🧫 Biologics + injectables | Rising global demand for outsourcing |

| 🔬 Oncology + specialty APIs | High-value, patented molecule production |

| 🌏 China + Europe shift | Supply chain diversification to India |

| 📈 R&D Outsourcing | Niche Indian players with strong compliance |

🔍 Top Stock Picks

1️⃣ Divi’s Laboratories Ltd (NSE: DIVISLAB)

🔬 Specialty API + Custom Synthesis Champion

Why It Matters:

- Among top global API suppliers to innovators

- High exposure to oncology, nutraceuticals

- Works closely with MNC pharma under long-term contracts

- India’s benchmark CDMO with consistent margins

📊 Technicals:

- CMP: ₹6,361

- Support: ₹6,300

- Resistance: ₹6,750 / ₹46820

- RSI: 58 – Upward Bias

- MACD: Bullish divergence

- Chart Setup: Cup & handle breakout forming

- Trade View: Swing Buy

- Target: ₹6,720

- SL: ₹5,940

2️⃣ Laurus Labs Ltd (NSE: LAURUSLABS)

🧪 API Giant Evolving into CDMO Leader

Why It Matters:

- Strong base in APIs for ARVs & anti-diabetics

- Now scaling up injectable biologics, gene therapy

- Emerging as a bio-CDMO for innovators

- Massive expansion of fermentation capacity

📊 Technicals:

- CMP: ₹849

- Support: ₹809

- Resistance: ₹888 / ₹920

- RSI: 58

- MACD: Bullish trend intact

- Chart Setup: Base accumulation breakout

- Trade View: Positional Buy

- Target: ₹910

- SL: ₹799

3️⃣ Syngene International Ltd (NSE: SYNGENE)

🧬 Biotech R&D + CRAMS Powerhouse

Why It Matters:

- Strong presence in clinical research & molecule development

- Clients include BMS, Amgen, GSK

- Strength in biologics, protein synthesis & integrated R&D

- India’s biotech-driven CDMO export story

📊 Technicals:

- CMP: ₹703

- Support: ₹665

- Resistance: ₹790 / ₹830

- RSI: 61

- MACD: Positive crossover

- Chart Setup: Bollinger band squeeze breakout

- Trade View: Short-Term Momentum Buy

- Target: ₹830

- SL: ₹722

🧠 CapitalKeeper’s Thematic Summary

| Stock | Segment | Edge | Target | SL |

|---|---|---|---|---|

| Divi’s Labs | Custom API + CDMO | High-margin specialty work | ₹6,720 | ₹6,300 |

| Laurus Labs | API + CDMO + Biotech | Scaling injectable CDMO | ₹910 | ₹799 |

| Syngene Intl | CRAMS + R&D | Biotech, big pharma clients | ₹830 | ₹722 |

👩⚕️ Why It Fits Women-Investor Portfolios:

- Ethical: Supports drug development without selling drugs

- Global: USD revenue + R&D exposure

- Compounding: Low debt, high-margin, RoCE winners

- Stability: Defensive non-cyclical healthcare sector

📌 For daily trade setups, technical learning, and smart investing tips, stay tuned to CapitalKeeper.in

📌 For more real-time updates, trade setups, and investment insights — follow us on [Telegram] and [WhatsApp Channel] subscribe to our newsletter!

📌 Disclaimer

The content provided on CapitalKeeper.in is for informational and educational purposes only and does not constitute investment, trading, or financial advice. While we strive to present accurate and up-to-date market data and analysis, we make no warranties or representations regarding the completeness, reliability, or accuracy of the information.

Stock market investments are subject to market risks, and readers/investors are advised to conduct their own due diligence or consult a SEBI-registered financial advisor before making any investment decisions. CapitalKeeper and its authors are not liable for any loss or damage, direct or indirect, arising from the use of this information.

All views and opinions expressed are personal and do not reflect the official policy or position of any agency or organization. Past performance is not indicative of future results.By using this website, you agree to the terms of this disclaimer.

Leave a Reply