Top Option & Cash Trades: IndusInd 840 CE, Bank Nifty 55600 PE, Unominda 1100 CE, SAIL & GMR Airport Analysis

By CapitalKeeper | Top Intraday Stock | Smart Trading Starts Here

Explore actionable setups for IndusInd Bank 840 CE, Bank Nifty 55600 PE, Unominda 1100 CE, SAIL cash levels, and GMR Airport 85 PE hero/zero trade with targets, stop loss, and technical insights.

Top Stock & Option Trades for the Week: IndusInd Bank 840 CE, Bank Nifty 55600 PE, Unominda 1100 CE & More

The Indian stock market continues to exhibit high volatility with rapid sector rotations between banking, PSU, and metal stocks. Traders need to stay nimble and focus on setups with clear technical confirmation and defined risk levels. Here are the top intraday and short-term trade ideas to watch for the coming sessions.

1. IndusInd Bank 840 CE (28 Aug Series)

- Entry Trigger: Above ₹14

- Target: ₹28

- Stop Loss: ₹9

Technical View

IndusInd Bank has been consolidating near ₹820–₹830 levels and is showing signs of bullish momentum on hourly charts. A breakout above ₹840 spot would confirm strength, opening the door for targets around ₹860–₹875 in cash.

The 840 CE option for 28 Aug series is attractive due to relatively low premium and favorable risk-reward. Traders should enter only after a confirmed breakout above ₹14 premium to avoid false triggers.

2. Bank Nifty 28 Aug 55,600 PE

- Entry Trigger: Above ₹650

- Target: ₹800

- Stop Loss: ₹600

Technical View

Bank Nifty has been trading between 54,800–56,000 levels, with multiple rejections seen near 56,000. If the index fails to sustain above this zone, a drop toward 55,000–54,500 is likely.

Buying the 55,600 PE option above ₹650 provides directional exposure to downside moves while maintaining controlled risk. A spike in volatility can quickly push premiums toward ₹800 or more if Bank Nifty corrects sharply.

3. Unominda 1100 CE (28 Aug Series)

- Entry Trigger: Above ₹43

- Target: ₹65

- Stop Loss: ₹35

Technical View

Unominda is approaching a multi-week resistance zone near ₹1,100. A breakout above this level, confirmed by volume, could lead to strong upside momentum toward ₹1,150–₹1,200 in the short term.

The 1100 CE option provides an efficient leveraged play. Wait for a decisive move above ₹43 premium before entry, ensuring alignment with spot breakout.

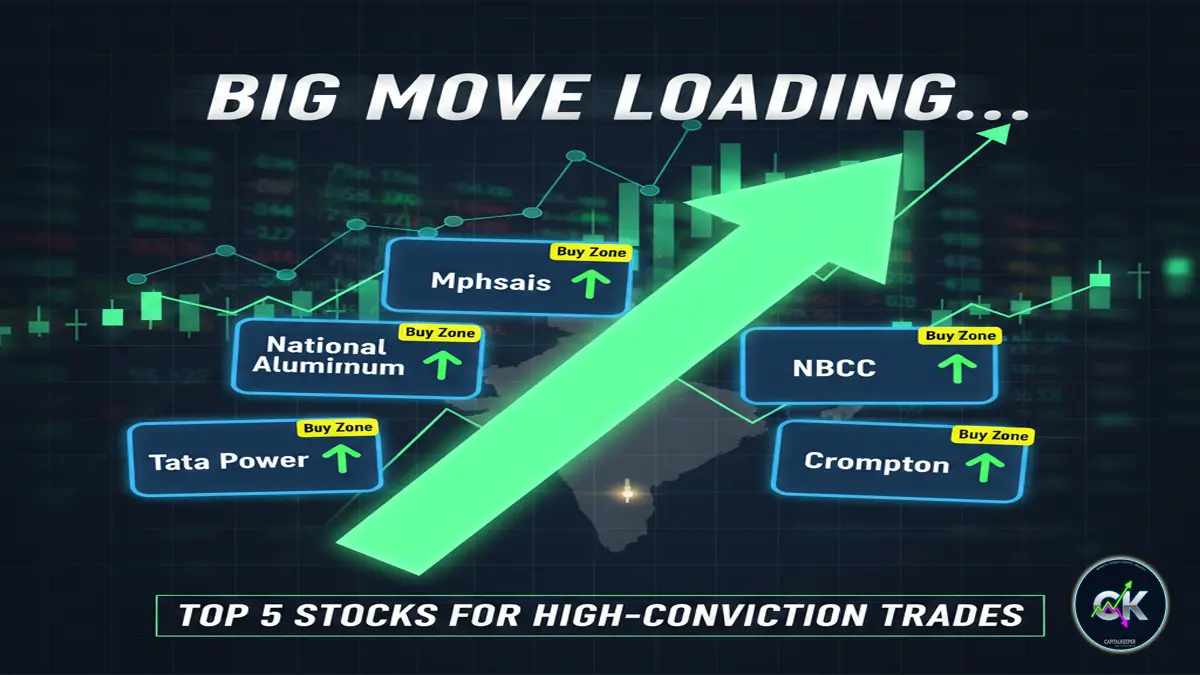

4. SAIL (CMP: ₹125)

- Buy Zone: ₹114 – ₹108

- Stop Loss: ₹100

- Target: ₹130 – ₹148

Technical View

SAIL remains one of the stronger PSU metal counters, holding key support near ₹108. The stock is forming a bullish higher low pattern and is expected to resume upward momentum if global steel prices remain firm.

Positional traders can accumulate on dips toward ₹114–₹108 with medium-term targets of ₹130–148. A strict stop loss below ₹100 should be maintained to manage downside risk.

5. GMR Airports (CMP: ₹91.50)

- Put Option Play: 85 PE @ 0.50

- Target: To be tracked for premium spikes

- View: Hero or Zero trade

Technical View

GMR Airports has been consolidating but faces stiff resistance near ₹95–₹96. The 85 PE trade is classified as hero or zero, meaning extremely low premium but high risk. It is suitable only for aggressive traders willing to risk small capital for potentially high returns, particularly ahead of event-driven volatility or expiry week swings.

Market Context & Outlook

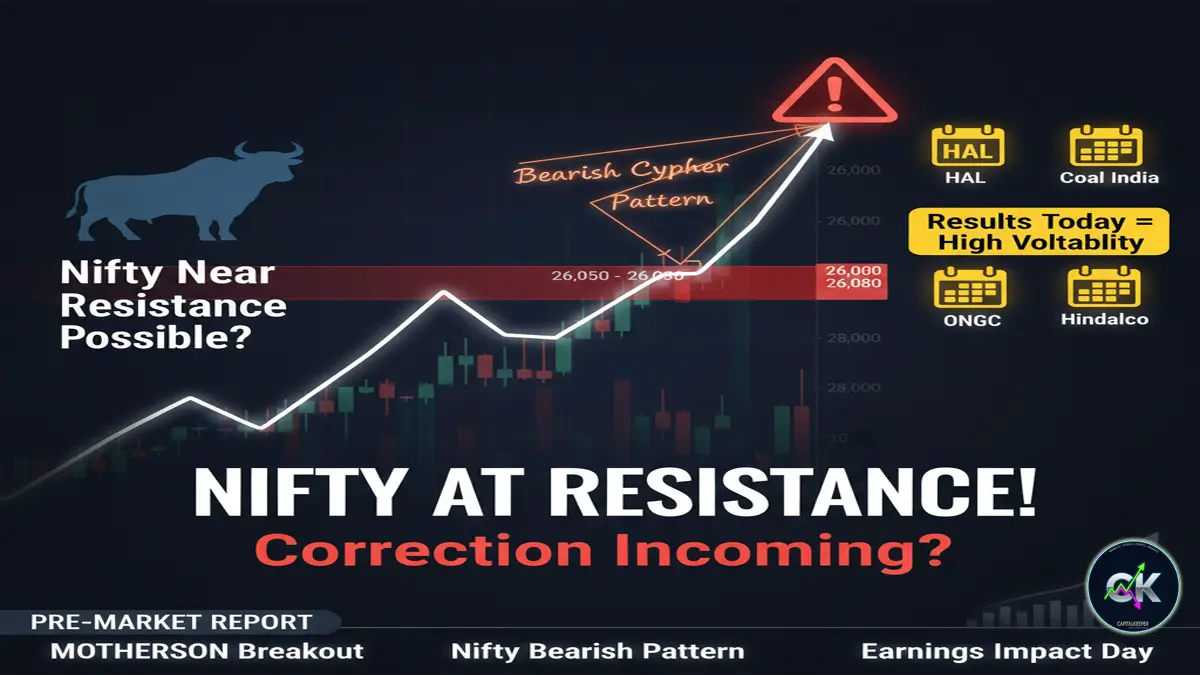

Nifty & Bank Nifty

- Nifty 50: Stuck in a narrow range of 25,300–25,600; expect breakout trades to emerge post key data/events.

- Bank Nifty: Facing supply near 56,000; downside supports lie at 54,400–54,800. A decisive move below 55,500 could open room for 54,500 targets.

Sector Trends

- Metals: Gaining traction (SAIL, JSW Steel leading) due to commodity price upticks.

- Banks: Mixed signals; IndusInd and private banks attempting bounce, PSU banks flat.

- Infra & Airports: GMR in watchlist but needs broader market support for sustained upside.

Risk Management Tips

- Options Trading: Enter only above trigger levels to avoid time decay losses.

- Position Sizing: Keep individual trade exposure limited (2–3% of capital per trade).

- Stop Loss Discipline: Always honor stop loss, especially in leveraged trades.

- Avoid Overlap: Do not take multiple trades on same index direction (e.g., multiple Bank Nifty options) to reduce correlation risk.

Key Support & Resistance Levels

- IndusInd Bank: Support 820; breakout above 840 = momentum to 875.

- Bank Nifty: Resistance 56,000; support 54,800 & 54,400.

- Unominda: Breakout zone 1,100; targets 1,150–1,200.

- SAIL: Buy zone 114–108; targets 130–148.

- GMR Airports: Range 85–95; high-risk trade via 85 PE.

Quick Trade Recap

| Stock / Option | Trigger / Buy Price | Target(s) | Stop Loss | Trade Type |

|---|---|---|---|---|

| IndusInd Bank 840 CE | Above ₹14 | ₹28 | ₹9 | Option Buy |

| Bank Nifty 55,600 PE | Above ₹650 | ₹800 | ₹600 | Option Buy |

| Unominda 1100 CE | Above ₹43 | ₹65 | ₹35 | Option Buy |

| SAIL (Cash) | ₹114 – ₹108 | ₹130 – ₹148 | ₹100 | Positional |

| GMR Airports 85 PE | ₹0.50 | Open target | NA | Hero/Zero Option |

📌 For more real-time updates, trade setups, and investment insights — follow us on [Telegram] and [WhatsApp Channel] subscribe to our newsletter!

📌 Disclaimer

The content provided on CapitalKeeper.in is for informational and educational purposes only and does not constitute investment, trading, or financial advice. While we strive to present accurate and up-to-date market data and analysis, we make no warranties or representations regarding the completeness, reliability, or accuracy of the information.

Stock market investments are subject to market risks, and readers/investors are advised to conduct their own due diligence or consult a SEBI-registered financial advisor before making any investment decisions. CapitalKeeper and its authors are not liable for any loss or damage, direct or indirect, arising from the use of this information.

All views and opinions expressed are personal and do not reflect the official policy or position of any agency or organization. Past performance is not indicative of future results.

By using this website, you agree to the terms of this disclaimer.

Leave a Reply