Top Trades: Tata Motors PE, Rajesh Exports, Havells CE, Tata Power & TCS Option – July 2025 Strategy

By CapitalKeeper | Top Intraday Stock | Smart Trading Starts Here

Explore short-term and positional trading setups in Tata Motors, Rajesh Exports, Havells, Tata Power, and TCS with clear entry, stop-loss, and target levels. High-risk option and cash strategies for active traders.

📈 CapitalKeeper’s Top Trade Setups: Tata Motors PE, Rajesh Exports, Havells CE, Tata Power & TCS

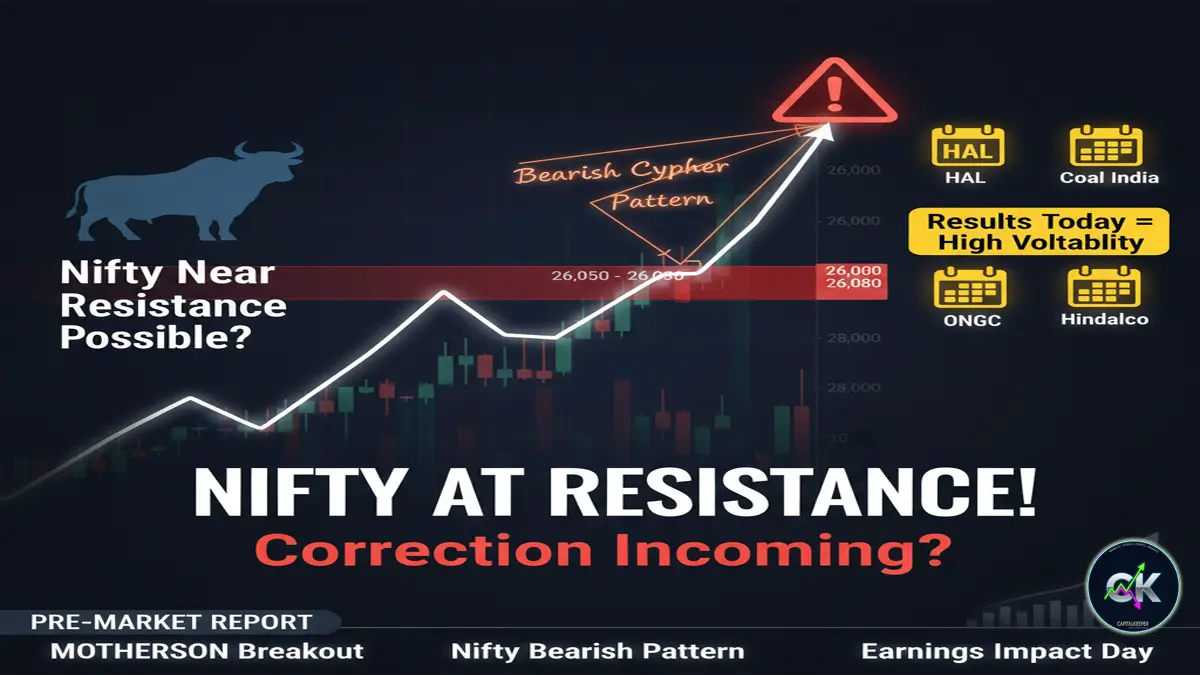

As we progress through the last week of July 2025, market volatility is offering both directional intraday trades and positional opportunities in fundamentally strong counters. Below are handpicked trade setups based on technical and option data, along with key stop-loss and target levels.

🚗 Tata Motors (CMP: ₹690)

⚠️ Very Risky Option Bet:

- Trade: Buy 680 PE (Put Option)

- Entry Price: ₹6

- Stop Loss: ₹3

- Target: ₹8–10

- Expiry: Current month (July/August series)

💡 Analysis:

Tata Motors is hovering near a short-term resistance zone. Traders anticipating a dip can explore this put option trade for quick gains, but with strict risk control, as it’s a high-risk, low-cost setup.

🪙 Rajesh Exports (CMP: ₹199)

🧱 Positional Cash Trade

- Buy Zone: ₹199 and accumulate further near ₹165

- Stop Loss: ₹145

- Targets: ₹230 – ₹273 – ₹300

📊 Technical View:

Rajesh Exports appears to have bottomed out near ₹190 with a potential reversal. Long-term investors can build positions in tranches. Momentum confirmation expected above ₹210.

💡 Havells India (CMP: ₹1551)

📈 Option Trade – Bullish Bias

- Trade: Buy 1600 CE (August Expiry)

- Entry: ₹28

- View: Positional Hold

- Potential Upside: ₹40–50+

- Stop-Loss: Not specified (use ₹18–20 as buffer zone)

💬 Strategy Insight:

Havells is trending strong with momentum picking up in the electricals and appliances segment. Option traders can ride this with the 1600 CE for a potential breakout play.

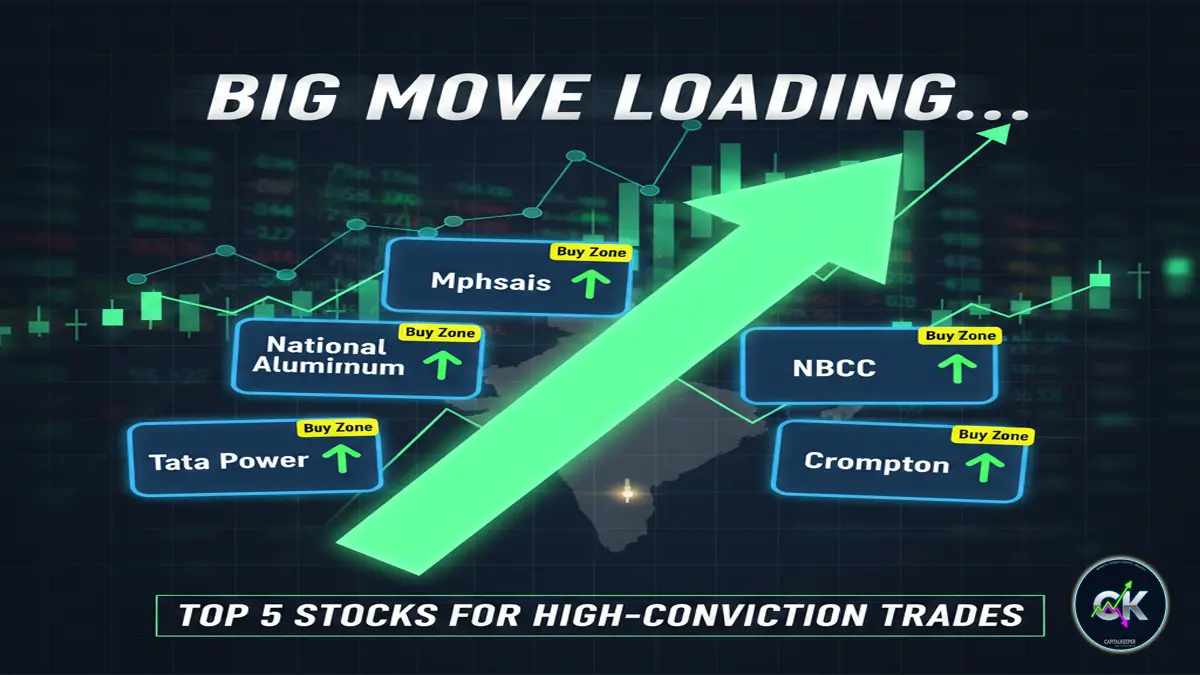

⚡ Tata Power (CMP: ₹403.50)

⚡ Intraday Cash Trade

- Target: ₹411

- Stop Loss: ₹399

- Buy: At current market price

📌 Intraday View:

Tata Power has rebounded from its recent support zone with strong volume. Intraday setup looks promising for a quick 1.5%+ move.

💻 TCS (CMP: ₹3164)

📊 Option Trade – August Expiry

- Trade: Buy 3200 CE (August Expiry)

- CMP: ₹73

- Target: ₹85 – ₹95

- Stop Loss: ₹65

📈 Technical View:

TCS is consolidating just below 3200 resistance. With strong earnings support and momentum in largecap IT, the 3200 CE is ideal for positional traders betting on a breakout.

🔄 Summary Table:

| Stock | Type | Entry/CMP | Stop Loss | Target(s) | Remarks |

|---|---|---|---|---|---|

| Tata Motors | Option (PE) | ₹6 | ₹3 | ₹8 – ₹10 | High Risk – Quick trade |

| Rajesh Exports | Cash (Positional) | ₹199/₹165 | ₹145 | ₹230–273–300 | Tranche-based investment |

| Havells 1600 CE | Option (CE) | ₹28 | – | Hold for ₹40–50+ | Bullish Bias, August Expiry |

| Tata Power | Cash (Intraday) | ₹403.50 | ₹399 | ₹411 | Quick move trade setup |

| TCS 3200 CE | Option (CE) | ₹73 | ₹65 | ₹85–95 | Largecap IT Momentum |

📌 CapitalKeeper’s Trade Discipline:

- Stick to stop-loss levels strictly—especially for options trades

- Do not average in options; follow position sizing

- Positional trades like Rajesh Exports are best entered in tranches to red

📌 For more real-time updates, trade setups, and investment insights — follow us on [Telegram] and [WhatsApp Channel] subscribe to our newsletter!

📌 Disclaimer

The content provided on CapitalKeeper.in is for informational and educational purposes only and does not constitute investment, trading, or financial advice. While we strive to present accurate and up-to-date market data and analysis, we make no warranties or representations regarding the completeness, reliability, or accuracy of the information.

Stock market investments are subject to market risks, and readers/investors are advised to conduct their own due diligence or consult a SEBI-registered financial advisor before making any investment decisions. CapitalKeeper and its authors are not liable for any loss or damage, direct or indirect, arising from the use of this information.

All views and opinions expressed are personal and do not reflect the official policy or position of any agency or organization. Past performance is not indicative of future results.

By using this website, you agree to the terms of this disclaimer.

Leave a Reply