GOOD MORNING, INDIA!

Monday, May 20, 2025 | CapitalKeeper.in

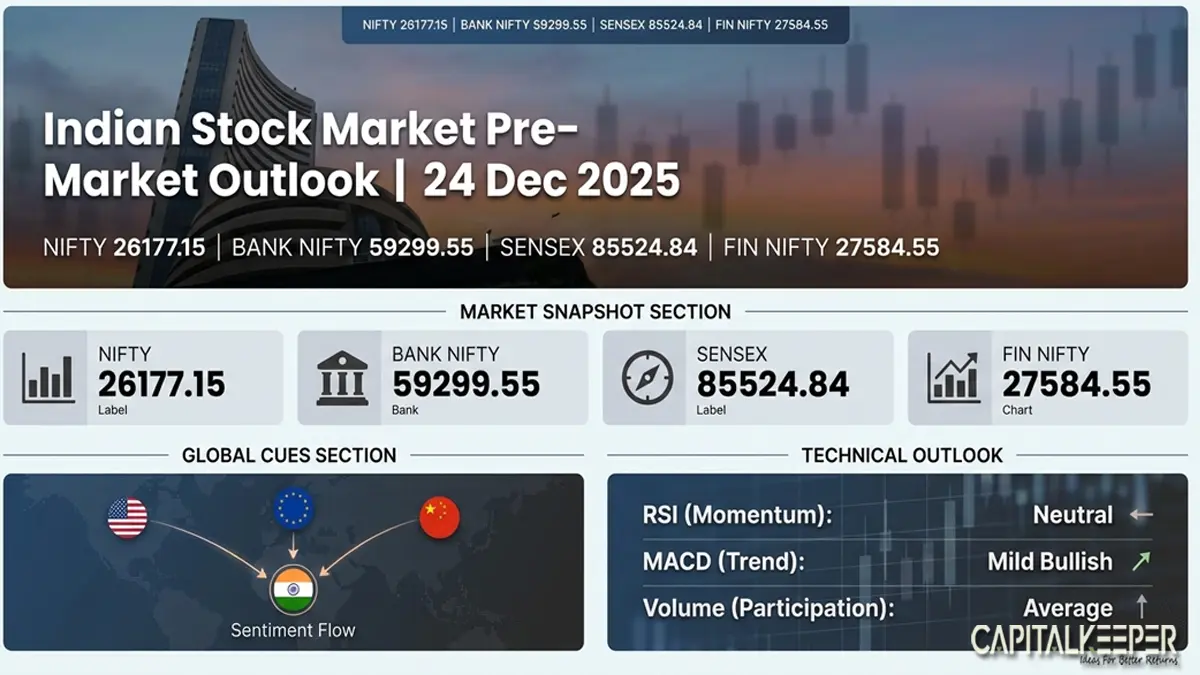

Indices Watch (Nifty/BankNifty)

Nifty 50 Candlestick Analysis

- Current Status: Nifty 50 closed at 24,945.45 on May 19, 2025, forming a spinning top candlestick pattern, indicating market indecision.

- Key Levels:

- Resistance: 25,043 (R1), 25,105 (R2), 25,210 (R3)

- Support: 24,960 (S1), 24,798 (S2), 24,750 (S3)

- Technical Indicators: The Relative Strength Index (RSI) is around 62, suggesting a neutral momentum.

- Outlook: A move above 25,000 could trigger a rally toward the 25,250–25,350 range. Conversely, a break below 24,750 may lead to further downside.

Bank Nifty Candlestick Analysis

- Current Status: Bank Nifty closed at 55,420.70 on May 19, 2025, showing a slight gain of 0.12%.

- Key Levels:

- Resistance: 55,600, 56,000

- Support: 55,300, 54,800 .

- Technical Indicators: The RSI is around 62, indicating a neutral to slightly bullish momentum.

- Outlook: Holding above 55,300 could lead to a test of 55,600–56,000. A break below 54,800 may signal a trend reversal.

Nifty Financial Services (Fin Nifty) Candlestick Analysis

- Current Status: Recent candlestick patterns include a Doji and Long Legged Doji on May 16, 2025, indicating market indecision.

- Key Levels:

- Resistance: Levels to watch are 20,000 and 20,200.

- Support: Key supports are at 19,500 and 19,300.

- Technical Indicators: The presence of Doji patterns suggests a potential reversal or continuation, depending on subsequent price action.

- Outlook: A decisive move above 20,000 could indicate bullish momentum, while a drop below 19,500 may lead to further downside.

Note: These analyses are based on current market data and technical indicators. Investors should consider multiple factors and consult with financial advisors before making investment decisions.

Leave a Reply