Indian Stock Market Pre-Market Today 02 Feb 2026: Nifty Sell on Rise, PSU Banks Overbought, Railway Stocks in Focus

Updated: 02 February 2026

Category: Pre Market | Market Analysis

By CapitalKeeper Research Desk

Indian Stock Market Pre-Market Outlook – 02 February 2026

Nifty Faces Distribution Pressure | Sell-on-Rise Strategy Gains Strength | Railway Stocks in Focus

Indian stock market pre-market analysis for 02 February 2026. Nifty, Bank Nifty, Sensex and Fin Nifty technical outlook with RSI, MACD, volume analysis, sector cues, global markets, and key stocks to watch.

Market Snapshot (Previous Close)

| Index | Closing Level | Change | Trend Bias |

|---|---|---|---|

| Nifty 50 | 24,825.45 | 🔻 Sharp fall | Bearish |

| Bank Nifty | 58,417.20 | 🔻 Weak | Bearish |

| Sensex | 80,722.94 | 🔻 Heavy selling | Negative |

| Fin Nifty | 26,699.10 | 🔻 Under pressure | Weak |

Pre-Market Summary: What Changed the Market Mood?

The Indian equity market enters 02 February 2026 with clear signs of distribution, not panic — an important distinction. The previous session witnessed aggressive selling at higher levels, especially in heavyweight financials, PSU banks, and index majors.

Despite intermittent pullbacks, buyers failed to reclaim control, indicating that smart money is gradually reducing exposure rather than chasing rallies.

This phase is best described as:

“Sell on rise, not buy on dip.”

Global Market Cues – Mixed to Negative

US Markets

- Dow Jones and S&P 500 ended mixed with volatility

- US bond yields remain elevated

- Market nervous ahead of macro data and policy commentary

Asian Markets (Early Indicators)

- Nikkei trading weak

- Hang Seng volatile

- Asian indices showing risk-off behaviour

Crude & Dollar

- Crude oil stable but elevated

- Dollar Index firm → negative for emerging markets

👉 Global cues are not supportive for aggressive long positions.

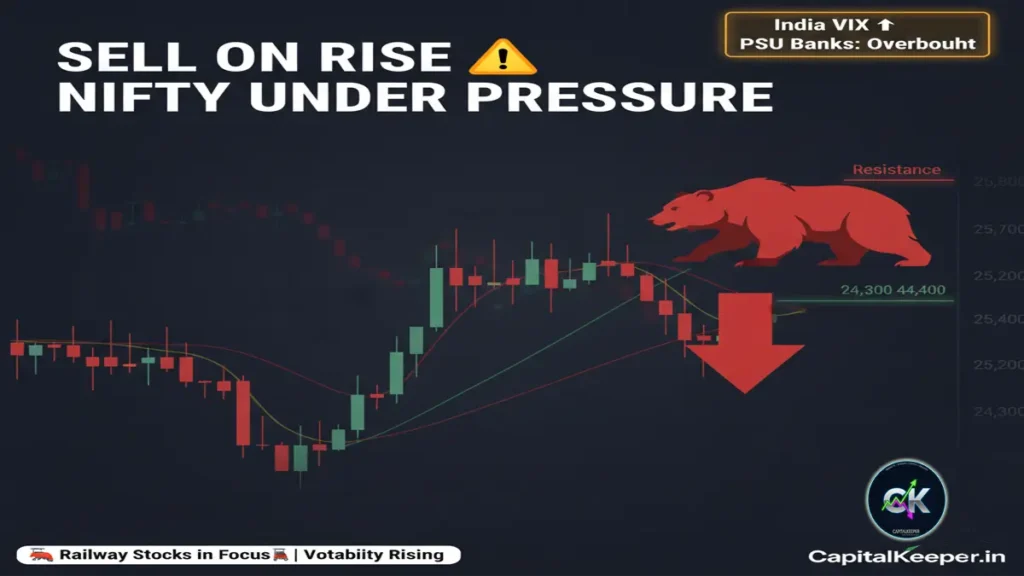

Nifty 50 Technical Outlook – Distribution Phase Clearly Visible

Price Action View

Nifty has decisively slipped below its short-term moving averages. The structure now reflects lower highs and lower closes, a classic early sign of trend fatigue.

Key Levels to Watch

- Immediate Resistance: 25,000 – 25,200

- Major Resistance Zone: 25,200 – 25,300

- Immediate Support: 24,600

- Downside Target Zone: 24,300 – 24,400

Strategy

Sell on every rise near resistance zones.

RSI Analysis (14-Period)

- RSI slipping below 50

- No bullish divergence visible

- Indicates loss of momentum

MACD Analysis

- MACD has crossed below signal line

- Histogram turning negative

- Confirms trend weakening

Volume Analysis

- Selling volume higher than buying volume

- Distribution rather than panic selling

📉 Bias: Bearish to sideways-negative

Bank Nifty Outlook – Danger Zone Approaching

Bank Nifty continues to underperform the broader market, which is a major red flag.

Key Technical Levels

- Immediate Resistance: 58,900 – 59,000

- Major Resistance: 59,500

- Crucial Support: 57,500

⚠️ Important Observation:

If 57,500 breaks decisively, Bank Nifty may witness a 3,000–5,000 point correction in the coming weeks.

RSI & MACD (Bank Nifty)

- RSI in bearish territory

- MACD deeply negative

- No reversal signal yet

👉 Sell on rise remains the safest strategy.

Sectoral View – Where to Avoid, Where to Focus

❌ Avoid PSU Banks (For Now)

- PSU Bank index is in overbought + corrective phase

- RSI already stretched earlier

- Profit booking clearly visible

Avoid fresh longs in PSU banks until base formation appears.

🚆 Railway Stocks – Emerging Strength

Despite broader market weakness, select railway stocks are showing early accumulation signs.

Stocks to Watch:

- IREDA

- RVNL

These stocks are:

- Showing relative strength

- Holding key support zones

- Benefiting from structural themes and government focus

📌 Focus on selective railway names, not aggressive buying.

Fin Nifty Outlook – Weak Participation

Fin Nifty continues to mirror Bank Nifty’s weakness.

- Unable to attract fresh buying

- RSI below neutral zone

- Momentum indicators negative

👉 Avoid aggressive option buying in Fin Nifty.

Market Breadth – Internal Weakness Visible

- Declining stocks > advancing stocks

- Midcap and smallcap recovery attempts failing

- Defensive rotation not strong enough yet

This confirms that the market is not ready for sustained upside.

What Type of Market Is This?

✔ Not a crash

✔ Not panic selling

✔ A controlled distribution phase

Such markets punish:

- Over-leveraged traders

- Blind dip buyers

- Aggressive option buyers

And reward:

- Discipline

- Risk management

- Short-term selling strategies

Trading Strategy for 02 February 2026

Index Strategy

- Nifty: Sell on rise near 25,000–25,200

- Bank Nifty: Sell near 58,900–59,000

- Keep strict stop losses

Positional Traders

- Stay light

- Avoid overexposed sectors

- Hold cash

Options Traders

- Prefer spreads

- Avoid naked buying

- Premium decay likely to dominate

Key Risks to Watch Today

- Global volatility spikes

- Sudden news-based reversal

- False breakdown near support zones

Outlook for the Week Ahead

The coming sessions are expected to remain volatile with negative bias unless:

- Nifty reclaims 25,300 decisively

- Bank Nifty holds above 57,500

Until then, defensive trading is the best approach.

Conclusion – CapitalKeeper View

The Indian stock market is entering a critical short-term correction phase. The smart approach is not prediction but positioning.

- Avoid PSU banks

- Sell on index rallies

- Focus selectively on railway stocks

- Respect support levels strictly

In markets like these, preservation of capital matters more than chasing returns.

FAQs – Indian Stock Market Pre-Market

Q1. Is today good for long positions?

Not recommended. Market structure favours selling on rise.

Q2. Which sector looks relatively strong?

Railway stocks like IREDA and RVNL.

Q3. What is the major risk level for Bank Nifty?

57,500 is the breakdown level.

Q4. Can Nifty fall further from here?

Yes, 24,300–24,400 is possible if selling continues.

📌 For daily trade setups, technical learning, and smart investing tips, stay tuned to CapitalKeeper.in

📌 For more real-time updates, trade setups, and investment insights — follow us on [Telegram] and [WhatsApp Channel] subscribe to our newsletter!

Subscribe Now , Join Telegram the Crypto Capital Club, Get Free Crypto Updates

📌 Disclaimer

The content provided on CapitalKeeper.in is for informational and educational purposes only and does not constitute investment, trading, or financial advice. While we strive to present accurate and up-to-date market data and analysis, we make no warranties or representations regarding the completeness, reliability, or accuracy of the information.

Stock market investments are subject to market risks, and readers/investors are advised to conduct their own due diligence or consult a SEBI-registered financial advisor before making any investment decisions. CapitalKeeper and its authors are not liable for any loss or damage, direct or indirect, arising from the use of this information.

All views and opinions expressed are personal and do not reflect the official policy or position of any agency or organization. Past performance is not indicative of future results.By using this website, you agree to the terms of this disclaimer.

Ranjit Sahoo

Founder & Chief Editor – CapitalKeeper.in

Ranjit Sahoo is the visionary behind CapitalKeeper.in, a leading platform for real-time market insights, technical analysis, and investment strategies. With a strong focus on Nifty, Bank Nifty, sector trends, and commodities, she delivers in-depth research that helps traders and investors make informed decisions.

Passionate about financial literacy, Ranjit blends technical precision with market storytelling, ensuring even complex concepts are accessible to readers of all levels. Her work covers pre-market analysis, intraday strategies, thematic investing, and long-term portfolio trends.

When he’s not decoding charts, Ranjit enjoys exploring coastal getaways and keeping an eye on emerging business themes.

📌 Follow Ranjit on:

LinkedIn | Twitter/X | Instagram | ✉️ contact@capitalkeeper.in