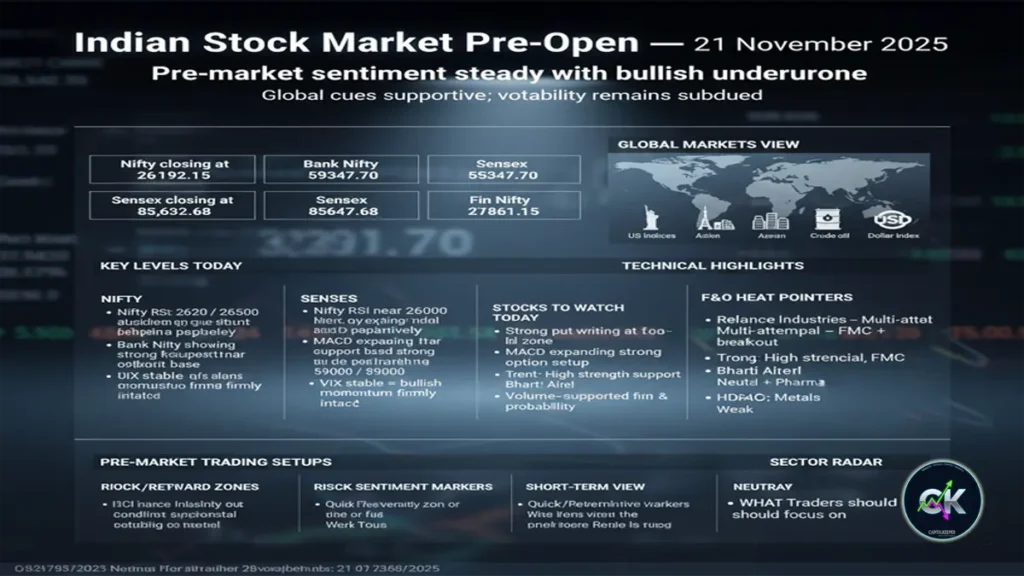

Indian Stock Market Pre-Market Report – 21 November 2025 Nifty 26192.15 | Bank Nifty 59347.70 | Sensex 85632.68 | Fin Nifty 27861.35

Updated: 21 November 2025

Category: Closing Bell | Market Analysis

By CapitalKeeper Research Desk

Indian Stock Market Pre-Market Report for 21 Nov 2025: Nifty, Bank Nifty, Sensex outlook, global cues, derivatives setup, RSI–MACD analysis, and top stocks to watch.

📌 Market Overview: A Crucial Setup for 21 November 2025

The Indian equity market heads into Friday’s pre-market session with a strongly positive undertone. Benchmarks extended gains on November 20, supported by improved risk sentiment, short covering in index futures, and continued sector rotation into financials, consumption, and select midcaps.

Here’s how the key indices closed:

| Index | Close |

|---|---|

| Nifty 50 | 26192.15 |

| Bank Nifty | 59347.70 |

| Sensex | 85632.68 |

| Fin Nifty | 27861.35 |

The market continues to display strength above the 26,000 zone on Nifty, with momentum indicators confirming a continuation move unless global macro triggers disrupt the trend.

🌍 Global Cues: Mixed but Leaning Toward Bullish

US Markets

- Dow, S&P 500, and Nasdaq ended mixed but stable.

- US bond yields dipped slightly, signaling temporary relief for equities.

- FOMC members reiterated a “wait-and-watch” stance on rate adjustments.

Asian Markets

- SGX/Gift Nifty indicated a mildly positive start.

- Nikkei held near multi-month highs.

- Hang Seng showed a recovery in tech, lifting overall sentiment.

Commodities

- Crude oil slipped below comfort levels, supportive for Indian inflation sentiment.

- Gold steadied as the US dollar softened.

- Silver remains volatile after recent rejection at the highs.

Currency

- INR stabilized near the 83.17 zone.

- Dollar index cooled to 103.90, reducing pressure on emerging markets.

Overall global cue summary:

A stable-to-positive global structure supports a constructive Indian market open.

📊 Technical Analysis: Nifty, Bank Nifty & Fin Nifty

Nifty 50 – Close: 26192.15

RSI

Hovering around 64 — still in bullish range, no divergence visible.

MACD

Bullish crossover held firmly, showing continued upward traction.

Volume Structure

Rising delivery-based buying over the last 3 sessions, signaling institutional participation.

Key Levels

- Support: 26020 / 25880

- Major Support: 25740

- Resistance: 26310

- Major Resistance: 26450–26500

Nifty Outlook:

A breakout above 26310 can unlock another wave of short covering towards 26500+. Staying above 26020 remains crucial for bullish continuation.

Bank Nifty – Close: 59347.70

RSI

At 62 — bullish, but room for further upside.

MACD

Positive and widening — sign of trend strengthening.

Volume

Banks saw fresh long additions, especially in large private names.

Key Levels

- Support: 58850 / 58500

- Resistance: 59680 / 60020

- Major Resistance: 60350+

Bank Nifty Outlook:

Expect a breakout attempt toward 60,000+ if global cues stay supportive. PSU banks may remain slightly volatile.

Fin Nifty – Close: 27861.35

- Consistent addition to long positions

- Key constituents displaying strong chart setups

- Momentum likely to continue toward 28,100+

🔥 F&O and Derivatives Setup for 21 November 2025

Nifty OI Build-up

- Massive call writing at 26500

- Strong put support at 26000–25800

- Indicating a tight bullish channel

Bank Nifty Derivatives

- Heavy put writing at 59000

- Small profit booking expected above 59800–60000

Volatility Index

- India VIX remains subdued

- Suggests strength until a sudden macro trigger appears

📌 Stocks to Watch Today (With Technical Analysis)

Below are the high-conviction setups with RSI–MACD–volume confirmation.

1. Reliance Industries (CMP 1549)

Technical View

- After two failed breakout attempts, the stock finally cleared its resistance.

- RSI supports an upward breakout.

- MACD in bullish expansion mode.

Target

- 1800+ positional

Market Structure

This breakout can become a strong multi-week trend driver for Nifty.

2. ICICI Prudential (CMP 616)

December Expiry Setup

- 630 CE @ 13.30

- SL: 6.50

- Cash Target: 630–660

Technical Snapshot

- Price taking support near rising trendline

- RSI bouncing from mid-level zone

- MACD showing early crossover indication

Looks suitable for a short-term target chase.

3. Trent – Positional Trade

- 4300 CE @ 110–115

- SL: 92

- Targets: 128 / 140++

Why it looks strong:

Trent continues to remain one of the strongest retail trend stocks in India. Each dip gets bought with strong volume confirmation.

4. Bharti Airtel – Positional Options Setup

- 2160 CE above 15

- SL: 9

- Targets: 20 / 25 / 30 / 35

RSI & MACD

- RSI near continuation breakout

- MACD improving after a brief lull

- Volume suggests accumulation in cash

5. HDFC AMC – Breakout Watch

- 5450 CE above 37

- SL: 31

- Targets: 43 / 55 / 70++

Technical Strength

- Cup & handle emerging structure

- Rising delivery-based buying

- RSI approaching breakout zone

📌 Sector-Wise Outlook for 21 November 2025

1. Banks

- Leading the bullish momentum

- Private banks outperform

- PSU banks neutral to slightly positive

2. Consumption & FMCG

- Stable INR + softening commodities = favorable

- Stocks like Trent & Nestle still on radar

3. Metals

- Slight weakness due to global cues

- Profit booking possible

4. Pharma

- Range-bound, but select names showing accumulation

5. IT

- Neutral-to-positive with stable US yields

📈 Pre-Market Summary Table

| Component | View |

|---|---|

| Global Cues | Mixed but stable |

| Nifty Trend | Bullish above 26020 |

| Bank Nifty Trend | Breakout possible above 59800 |

| F&O Data | Supports bullish continuation |

| Volatility | Low, favorable |

| Top Sectors | Banks, FMCG, Financials |

| Stocks to Watch | Reliance, Trent, Airtel, HDFC AMC, ICICI Pru |

FAQs (For SEO)

1. What is the Nifty outlook for 21 November 2025?

Nifty looks bullish above 26020, with resistance near 26310 and scope for further gains toward 26500+.

2. Which sectors may outperform today?

Banks, financial services, and FMCG are showing the strongest patterns.

3. Is Reliance Industries bullish?

Yes, Reliance broke a major resistance after two failed attempts and now has potential toward 1800+.

4. What does Bank Nifty’s chart indicate?

A breakout attempt above 59800 can take Bank Nifty toward 60000–60350.

5. How is the global sentiment today?

US markets stable, Asian markets mixed, commodities soft — supporting a positive Indian open.

📌 For daily trade setups, technical learning, and smart investing tips, stay tuned to CapitalKeeper.in

📌 For more real-time updates, trade setups, and investment insights — follow us on [Telegram] and [WhatsApp Channel] subscribe to our newsletter!

Subscribe Now , Join Telegram the Crypto Capital Club, Get Free Crypto Updates

📌 Disclaimer

The content provided on CapitalKeeper.in is for informational and educational purposes only and does not constitute investment, trading, or financial advice. While we strive to present accurate and up-to-date market data and analysis, we make no warranties or representations regarding the completeness, reliability, or accuracy of the information.

Stock market investments are subject to market risks, and readers/investors are advised to conduct their own due diligence or consult a SEBI-registered financial advisor before making any investment decisions. CapitalKeeper and its authors are not liable for any loss or damage, direct or indirect, arising from the use of this information.

All views and opinions expressed are personal and do not reflect the official policy or position of any agency or organization. Past performance is not indicative of future results.By using this website, you agree to the terms of this disclaimer.

Ranjit Sahoo

Founder & Chief Editor – CapitalKeeper.in

Ranjit Sahoo is the visionary behind CapitalKeeper.in, a leading platform for real-time market insights, technical analysis, and investment strategies. With a strong focus on Nifty, Bank Nifty, sector trends, and commodities, she delivers in-depth research that helps traders and investors make informed decisions.

Passionate about financial literacy, Ranjit blends technical precision with market storytelling, ensuring even complex concepts are accessible to readers of all levels. Her work covers pre-market analysis, intraday strategies, thematic investing, and long-term portfolio trends.

When he’s not decoding charts, Ranjit enjoys exploring coastal getaways and keeping an eye on emerging business themes.

📌 Follow Ranjit on:

LinkedIn | Twitter/X | Instagram | ✉️ contact@capitalkeeper.in