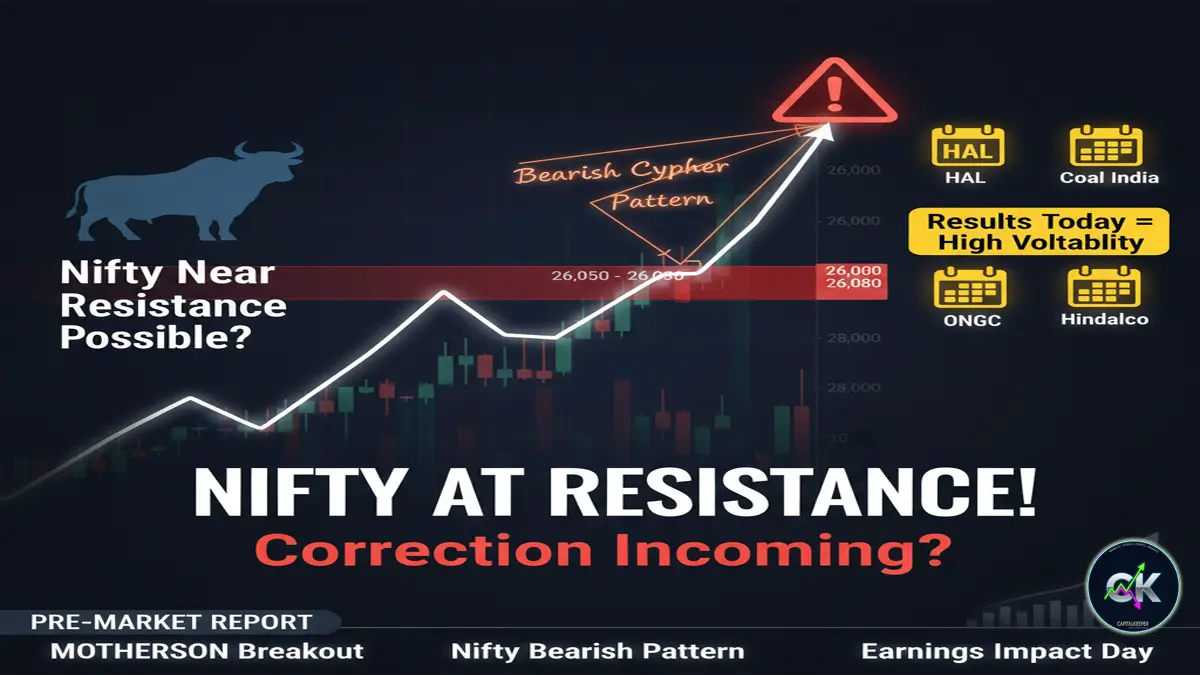

Indian Stock Market Pre-Market Outlook 19 February 2026: Nifty Near 26,000 Zone, Bank Nifty Strong Above 61,500 | Power, Infra & Midcaps in Focus

Updated: 19 January 2026

Category: Pre Market | Market Analysis

By CapitalKeeper Research Desk

Indian stock market pre-market analysis for 19 Feb 2026. Nifty closes at 25,819, Bank Nifty at 61,550. RSI, MACD and volume-based outlook with global cues. Stocks to watch: Tata Power, Eternal, NBCC, Sagility.

The Indian stock market enters 19 February 2026 with firm undertones after benchmark indices ended higher in the previous session. The broader structure remains bullish, led by banking strength and renewed participation in power, infrastructure, and select midcap counters.

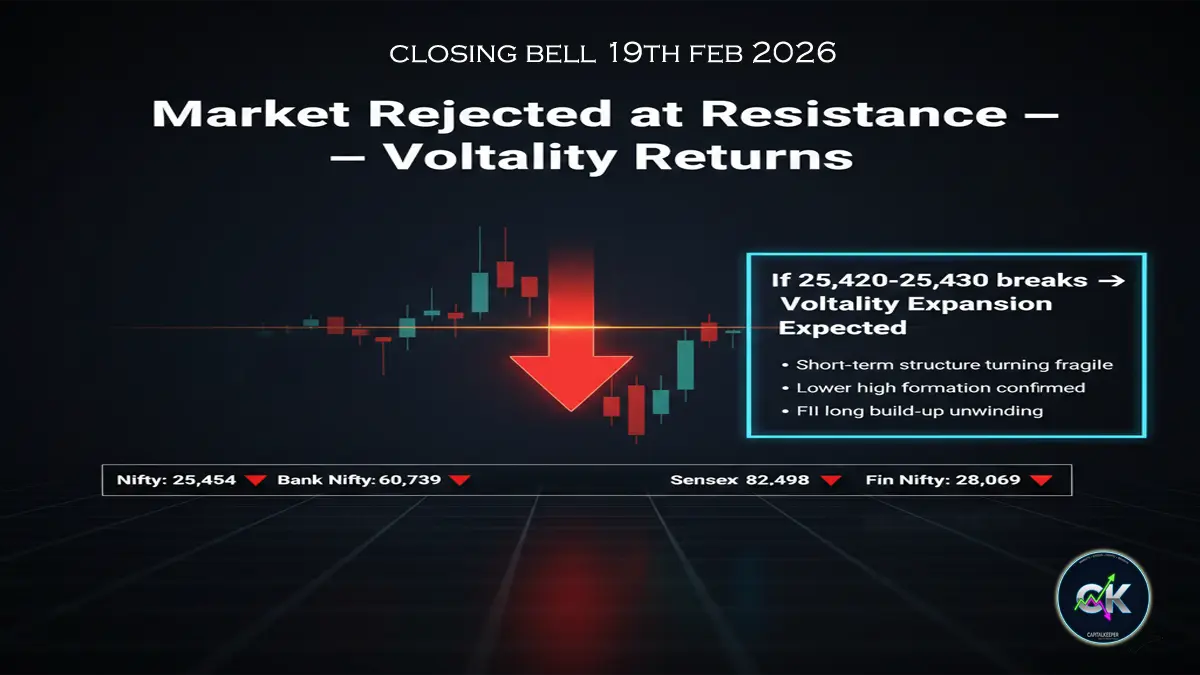

On 18 February, Nifty closed at 25,819.35, inching closer to the psychological 26,000 mark. Bank Nifty settled at 61,550.80, continuing its outperformance trend. Sensex ended at 83,734.25, while Fin Nifty closed at 28,463.25, highlighting sustained momentum in financial services.

The technical structure remains constructive, but with indices approaching resistance zones, traders must balance optimism with discipline.

Market Snapshot – Previous Close

| Index | Closing Level | Trend Structure | Immediate View |

|---|---|---|---|

| Nifty 50 | 25,819.35 | Bullish | Approaching resistance |

| Bank Nifty | 61,550.80 | Strong Bullish | Leadership intact |

| Sensex | 83,734.25 | Positive | Higher highs intact |

| Fin Nifty | 28,463.25 | Stable Bullish | Consolidation breakout |

Global Market Cues

Global cues remain moderately supportive. Asian markets are trading steady, while US markets closed mixed with sectoral rotation. Commodity prices, especially crude oil and base metals, are stable — which supports energy and infrastructure plays in India.

Key global triggers influencing today’s pre-market sentiment:

- Stable US Treasury yields

- Strength in global financial stocks

- Neutral dollar index movement

- Commodity consolidation

The absence of major global shocks keeps domestic markets on track to open steady to mildly positive.

Nifty Technical Analysis – RSI, MACD & Volume

Nifty continues to trade in a rising channel structure. The index has reclaimed key levels above 25,700 and is steadily moving toward 26,000.

Key Support Levels:

- 25,650 – Immediate support

- 25,400 – Strong support

Key Resistance Levels:

- 25,950 – Immediate hurdle

- 26,100 – Major breakout zone

RSI Analysis:

RSI on the daily timeframe is around 63–66. This indicates strong momentum without extreme overbought conditions. The structure suggests buyers remain in control.

MACD Analysis:

MACD remains above the signal line with positive divergence widening. This confirms bullish momentum continuation.

Volume Analysis:

Volume expansion during upward moves suggests institutional participation. There is no visible sign of distribution yet.

Overall, the trend remains bullish unless Nifty closes below 25,600.

Bank Nifty Outlook – Banking Remains the Backbone

Bank Nifty’s close at 61,550 reinforces sector leadership. Private and PSU banks continue to attract buying interest.

Key Levels:

- Support: 60,800 – 60,500

- Resistance: 62,000 – 62,400

RSI on Bank Nifty is near 65, suggesting strength. MACD shows steady bullish momentum. Volume patterns indicate consistent accumulation.

As long as Bank Nifty holds above 60,800, the broader market bias remains upward.

Sector Watch – Emerging Themes

Power & Renewable Energy

Power stocks are showing breakout patterns after consolidation. Improved demand outlook and infrastructure push are driving momentum.

Infrastructure & Construction

Infrastructure counters are witnessing fresh buying, supported by government capex themes.

Midcap Revival

Midcaps are slowly participating, suggesting risk appetite is improving.

Stocks in Focus for 19 February 2026

1️⃣ Tata Power

Buy at: 380

Target: 430

Stop Loss: 350

Tata Power is forming a strong breakout pattern on the daily chart. The stock has cleared key resistance and is trading with strong volume support.

Technical Signals:

- RSI near 68 – strong bullish zone

- MACD positive with strong divergence

- Volume surge near breakout

If sustained above 380, the stock could rally toward 420–430 in the short term.

2️⃣ Eternal Limited

Buy at: 278

Target: 323

Stop Loss: 260

The stock is forming higher highs and higher lows, indicating trend continuation.

Technical View:

- RSI trending upward above 60

- MACD recently turned positive

- Volume rising steadily

The structure suggests positional upside if support at 260 holds.

3️⃣ NBCC (India) Limited

Buy at: 100

Target: 134

Stop Loss: 91

NBCC is showing strong breakout potential from a consolidation base.

Indicators:

- RSI breakout above 65

- MACD bullish crossover

- Strong volume confirmation

If the stock sustains above 100, a momentum-driven rally toward 120–134 is possible.

4️⃣ Sagility India Limited

Buy at: 48

Target: 62

Stop Loss: 43

Sagility is witnessing accumulation near support levels.

Technical Setup:

- RSI recovering from 50 zone

- MACD turning upward

- Gradual volume increase

The risk-reward setup appears favorable for positional traders.

Market Strategy for Today

Short-Term Traders:

- Buy on dips approach

- Avoid chasing near resistance

- Focus on sectoral momentum

Positional Traders:

- Accumulate strong breakout stocks

- Maintain trailing stop losses

Risk Management:

- Keep exposure balanced

- Follow strict stop losses

- Monitor global cues

Key Intraday Triggers

- Movement near 26,000 on Nifty

- Bank Nifty reaction near 62,000

- Power & infra sector continuation

- Volume behavior in midcaps

FAQs

Is Nifty ready for 26,000?

The structure suggests potential, but resistance near 26,000 may cause short-term consolidation.

Which sectors are leading?

Banking, Power, and Infrastructure are showing leadership.

Is this a good time to buy midcaps?

Selective midcaps with strong volume and breakout patterns look attractive.

What is the key risk?

Profit booking near resistance and sudden global volatility.

Final Outlook

The broader trend remains bullish, supported by strong banking performance and sector rotation into power and infrastructure. Nifty approaching 26,000 will be a crucial psychological test.

Momentum indicators favor continuation, but disciplined risk management is essential. Stock-specific opportunities appear stronger than index-wide moves.

Traders should remain focused, avoid emotional decisions, and respect technical levels.

The market structure remains constructive — and selective buying may continue to reward disciplined participants.

📌 For daily trade setups, technical learning, and smart investing tips, stay tuned to CapitalKeeper.in

📌 For more real-time updates, trade setups, and investment insights — follow us on [Telegram] and [WhatsApp Channel] subscribe to our newsletter!

Subscribe Now , Join Telegram the Crypto Capital Club, Get Free Crypto Updates

📌 Disclaimer

The content provided on CapitalKeeper.in is for informational and educational purposes only and does not constitute investment, trading, or financial advice. While we strive to present accurate and up-to-date market data and analysis, we make no warranties or representations regarding the completeness, reliability, or accuracy of the information.

Stock market investments are subject to market risks, and readers/investors are advised to conduct their own due diligence or consult a SEBI-registered financial advisor before making any investment decisions. CapitalKeeper and its authors are not liable for any loss or damage, direct or indirect, arising from the use of this information.

All views and opinions expressed are personal and do not reflect the official policy or position of any agency or organization. Past performance is not indicative of future results.By using this website, you agree to the terms of this disclaimer.

Ranjit Sahoo

Founder & Chief Editor – CapitalKeeper.in

Ranjit Sahoo is the visionary behind CapitalKeeper.in, a leading platform for real-time market insights, technical analysis, and investment strategies. With a strong focus on Nifty, Bank Nifty, sector trends, and commodities, she delivers in-depth research that helps traders and investors make informed decisions.

Passionate about financial literacy, Ranjit blends technical precision with market storytelling, ensuring even complex concepts are accessible to readers of all levels. Her work covers pre-market analysis, intraday strategies, thematic investing, and long-term portfolio trends.

When he’s not decoding charts, Ranjit enjoys exploring coastal getaways and keeping an eye on emerging business themes.

📌 Follow Ranjit on:

LinkedIn | Twitter/X | Instagram | ✉️ contact@capitalkeeper.in

Leave a Reply