Indian Stock Market Pre-Market 20 Feb 2026 | Nifty at 25,454 | Railway & Healthcare Stocks in Focus

Updated: 20 Frebuary 2026

Category: Pre Market | Market Analysis

By CapitalKeeper Research Desk

Indian Stock Market Pre-Market Outlook – 20 February 2026

Nifty Slips Below 25,500; Is This a Healthy Correction or Trend Reversal?

Nifty closes at 25,454 while Bank Nifty ends at 60,739. Technical analysis using RSI, MACD and volume. Global cues, key support levels and trade ideas in RailTel, HFCL, Max Healthcare and Fortis.

The Indian stock market enters the session of 20 February 2026 with a cautious undertone after benchmark indices witnessed profit booking in the previous session. After testing higher levels earlier this week, the indices have pulled back toward critical support zones.

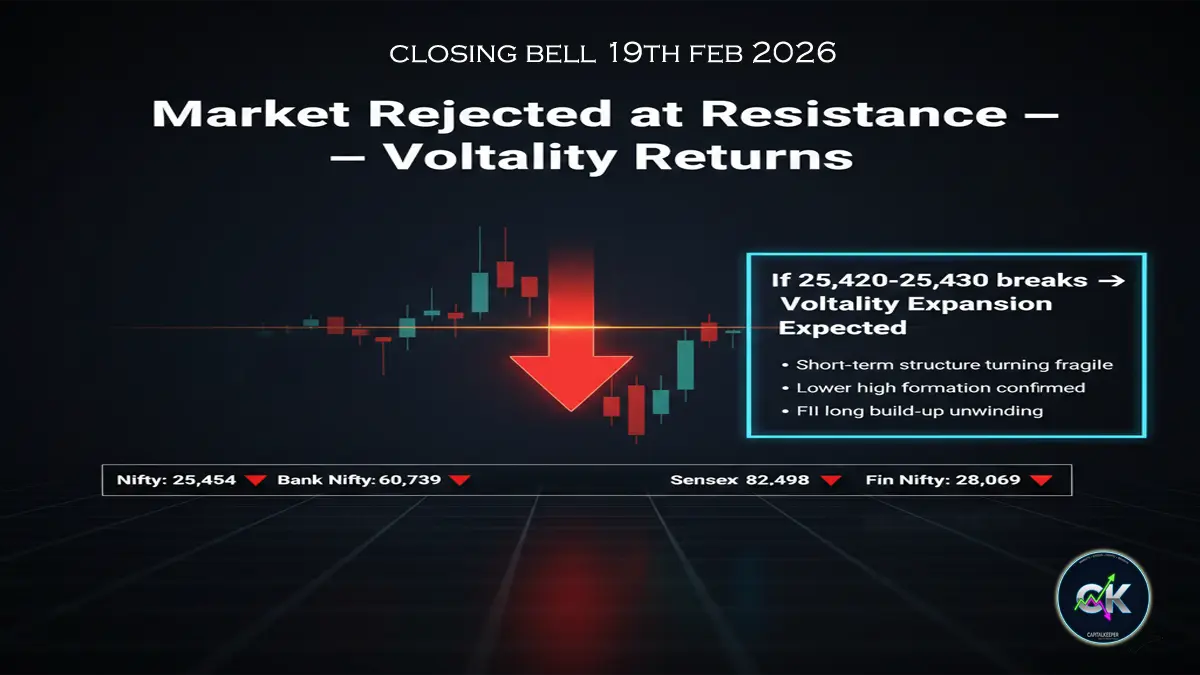

Nifty closed at 25,454.35, slipping below the 25,500 mark. Bank Nifty ended at 60,739.55, while Sensex settled at 82,498.14. Fin Nifty closed at 28,069.50, indicating mild weakness in the broader financial space.

The decline does not yet confirm a trend reversal, but it signals short-term consolidation and the need for disciplined positioning.

Previous Session Market Snapshot

| Index | Closing Level | Immediate Trend | Key Observation |

|---|---|---|---|

| Nifty 50 | 25,454.35 | Short-term Weakness | Testing support |

| Bank Nifty | 60,739.55 | Mild Pullback | Holding 60,500 |

| Sensex | 82,498.14 | Corrective Phase | Profit booking |

| Fin Nifty | 28,069.50 | Neutral | Consolidation |

The structure now suggests a “buy on dips only if support holds” strategy rather than aggressive chasing.

Global Market Cues

Global markets are trading with mixed sentiment. US indices closed slightly lower amid sector rotation and cautious commentary around interest rate outlook. Asian markets opened flat to mildly negative, reflecting global hesitation.

Key global triggers:

- Stable but cautious US bond yields

- Mixed performance in global banking stocks

- Commodity prices consolidating

- Dollar index steady

Crude oil remains stable, which supports domestic energy and infrastructure themes.

Overall, global cues indicate a flat to mildly cautious opening for Indian markets.

Nifty Technical Outlook – RSI, MACD & Volume

Nifty’s close below 25,500 is technically significant. However, the broader uptrend remains intact unless deeper support levels are breached.

Key Support Levels:

- 25,400 – Immediate support

- 25,200 – Strong positional support

- 24,950 – Trend-defining level

Key Resistance Levels:

- 25,650 – Immediate hurdle

- 25,900 – Strong resistance

RSI Analysis

Daily RSI has slipped toward 55, cooling from earlier bullish readings near 65. This suggests momentum has moderated but is not oversold.

MACD Analysis

MACD is flattening and moving closer to signal line convergence. A bearish crossover is possible if weakness continues, but confirmation is awaited.

Volume Analysis

Recent decline has not been accompanied by heavy selling volume. This indicates controlled profit booking rather than panic distribution.

The broader structure still favors consolidation rather than a major breakdown.

Bank Nifty Outlook

Bank Nifty closed at 60,739, holding above the crucial 60,500 support.

Support Zone:

- 60,500 – Immediate

- 60,000 – Strong base

Resistance:

- 61,200

- 61,800

RSI on Bank Nifty remains around 58–60, indicating mild cooling but not weakness. MACD is neutralizing but not fully bearish.

As long as 60,000 holds, the index remains structurally strong.

Sectoral Themes to Watch

Rail & Infrastructure

Railway-linked stocks are seeing renewed buying interest amid strong order flow expectations.

Telecom & Fiber

Optical fiber and telecom infrastructure stocks are building base patterns.

Healthcare & Hospitals

Healthcare stocks are showing accumulation patterns, signaling defensive positioning.

Stocks in Focus – 20 February 2026

🚆 RailTel Corporation of India

Buy Above: 330

Target: 349

Stop Loss: 325

RailTel is forming a breakout pattern above resistance. The stock has shown strong relative strength compared to broader markets.

Technical Signals:

- RSI near 63, turning upward

- MACD showing early bullish crossover

- Volume expansion near breakout level

If sustained above 330, momentum may push it toward 345–349 quickly.

📡 HFCL Limited

Buy Above: 72

Target: 85

Stop Loss: 67

HFCL is consolidating within a rising channel. The breakout above 72 may trigger fresh buying.

Indicators:

- RSI recovering from neutral zone

- MACD bullish divergence forming

- Gradual increase in volume

The setup favors positional upside if momentum sustains.

🏥 Max Healthcare Institute

Buy Above: 1082

Target: 1220

Stop Loss: 1050

Max Healthcare is showing strong accumulation and a potential breakout setup.

Technical View:

- RSI near 65

- MACD firmly positive

- Strong delivery-based volume

Healthcare sector resilience makes this an attractive positional candidate.

🏨 Fortis Healthcare

Buy Above: 910

Target: 1050

Stop Loss: 875

Fortis is forming higher lows, indicating accumulation.

Technical Indicators:

- RSI stable above 60

- MACD positive

- Consistent rising volume

If sustained above 910, a strong momentum move may unfold.

Trading Strategy for Today

Intraday Approach

- Wait for confirmation near support

- Avoid aggressive shorting unless 25,200 breaks

- Focus on stock-specific breakouts

Positional Strategy

- Healthcare & rail stocks look promising

- Follow strict stop losses

Risk Management

- Reduce leverage

- Monitor global volatility

- Trail profits when targets approach

Key Market Triggers

- Nifty behavior near 25,400

- Bank Nifty reaction at 60,500

- Volume participation in healthcare & rail stocks

- Global equity performance during first half

FAQs

Is the market turning bearish?

Not yet. The correction appears controlled unless Nifty breaks below 25,200.

Which sectors are showing strength?

Railway infrastructure and healthcare sectors are relatively strong.

Is this a good buying opportunity?

Selective buying near support zones with strict stop losses is advisable.

What level is crucial today?

25,400 on Nifty and 60,500 on Bank Nifty.

Final Outlook

The market is undergoing a healthy consolidation phase after recent gains. While short-term weakness is visible, structural supports remain intact. Sector rotation toward railways and healthcare suggests smart money is positioning selectively.

Traders should remain disciplined, avoid emotional decisions, and trade only high-probability setups. If support levels hold, this correction could present fresh buying opportunities rather than signal a reversal.

Caution, patience, and precision will define today’s session.

📌 For daily trade setups, technical learning, and smart investing tips, stay tuned to CapitalKeeper.in

📌 For more real-time updates, trade setups, and investment insights — follow us on [Telegram] and [WhatsApp Channel] subscribe to our newsletter!

Subscribe Now , Join Telegram the Crypto Capital Club, Get Free Crypto Updates

📌 Disclaimer

The content provided on CapitalKeeper.in is for informational and educational purposes only and does not constitute investment, trading, or financial advice. While we strive to present accurate and up-to-date market data and analysis, we make no warranties or representations regarding the completeness, reliability, or accuracy of the information.

Stock market investments are subject to market risks, and readers/investors are advised to conduct their own due diligence or consult a SEBI-registered financial advisor before making any investment decisions. CapitalKeeper and its authors are not liable for any loss or damage, direct or indirect, arising from the use of this information.

All views and opinions expressed are personal and do not reflect the official policy or position of any agency or organization. Past performance is not indicative of future results.By using this website, you agree to the terms of this disclaimer.

Ranjit Sahoo

Founder & Chief Editor – CapitalKeeper.in

Ranjit Sahoo is the visionary behind CapitalKeeper.in, a leading platform for real-time market insights, technical analysis, and investment strategies. With a strong focus on Nifty, Bank Nifty, sector trends, and commodities, she delivers in-depth research that helps traders and investors make informed decisions.

Passionate about financial literacy, Ranjit blends technical precision with market storytelling, ensuring even complex concepts are accessible to readers of all levels. Her work covers pre-market analysis, intraday strategies, thematic investing, and long-term portfolio trends.

When he’s not decoding charts, Ranjit enjoys exploring coastal getaways and keeping an eye on emerging business themes.

📌 Follow Ranjit on:

LinkedIn | Twitter/X | Instagram | ✉️ contact@capitalkeeper.in

Leave a Reply