Indian Stock Market Closing Bell Report – 02 December 2025 : Muted Close as Markets Stay Range-Bound Ahead of Key Global Data; Nifty Ends at 26,032

Updated: 02 Decmber 2025

Category: Closing Bell | Market Analysis

By CapitalKeeper Research Desk

Indian Stock Market Closing Bell 02 Dec 2025: Nifty ends at 26,032, Bank Nifty at 59,273. Global cues mixed, sectors remain range-bound. Full analysis + outlook.

📅Market Summary: A Soft Close Amid Global Uncertainty

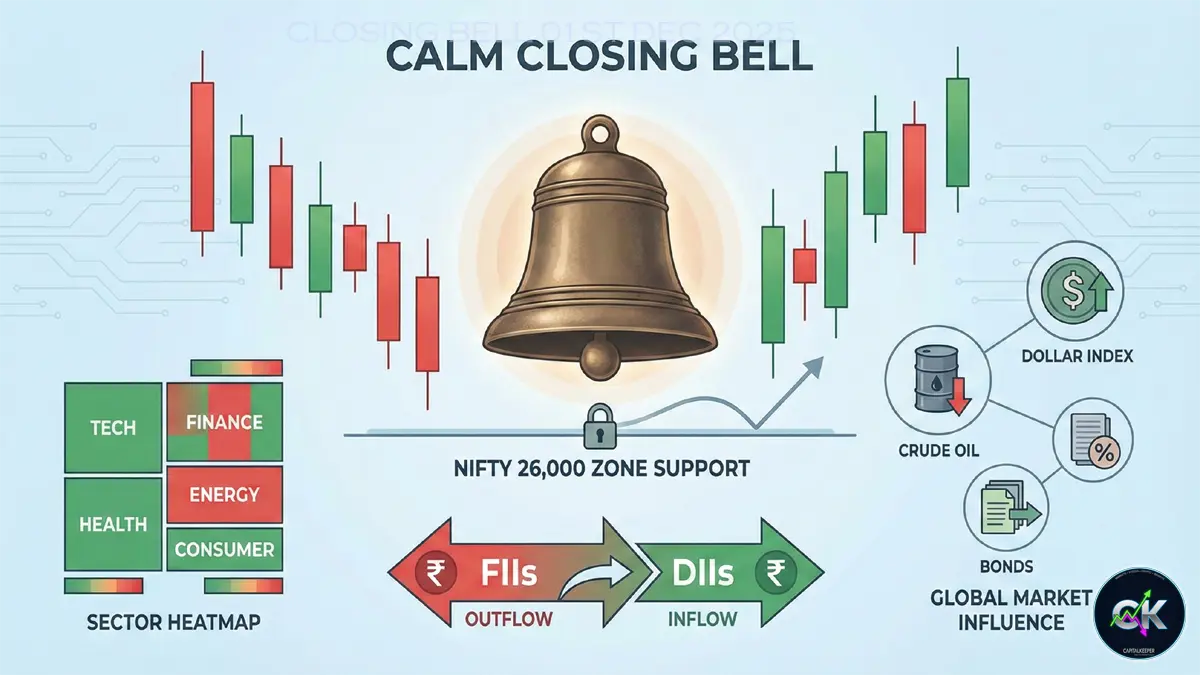

Domestic equities drifted through a narrow band on Tuesday, closing slightly lower as investors stayed cautious ahead of the U.S. jobs data and the European Central Bank’s commentary later this week. Despite firm global commodity cues and a stable INR, benchmark indices failed to extend early optimism.

The day started strong with a mildly positive opening across Nifty, Sensex, Bank Nifty and Fin Nifty. But persistent profit-booking in heavyweight sectors pushed the indices to close marginally lower.

Today’s market action highlighted a clear theme: low conviction trading with FIIs remaining net sellers and DIIs absorbing supply.

Key Index Performance (02 December 2025)

| Index | Open | Close | % Change | Market Mood |

|---|---|---|---|---|

| Nifty 50 | 26,087.95 | 26,032.20 | -0.21% | Cautious & Range-Bound |

| Sensex | 85,325.51 | 85,138.27 | -0.22% | Weakness in Heavyweights |

| Bank Nifty | 59,354.20 | 59,273.80 | -0.13% | Mild Profit Booking |

| Fin Nifty | 27,617.60 | 27,565.25 | -0.19% | Financials Underperformed |

Market Mood: Why Bulls Failed to Hold the Early Gains

Despite a positive setup during the first hour, the market quickly lost momentum. A combination of muted European cues and soft U.S. futures weighed on risk appetite.

Key reasons for today’s sluggish close:

1. FIIs Extending Their Selling Streak

Foreign investors continue to offload positions in frontline stocks due to:

- U.S. 10-year yields stabilizing above 4.25%

- Concern over global corporate earnings

- Dollar strength keeping emerging-market flows subdued

2. Domestic Macro Caution

With India’s services PMI due this week, traders refrained from aggressive long positions.

3. Sectoral Rotation Without Clear Leadership

IT showed resilience, but weakness in banks, autos, and FMCG neutralized gains.

4. Volatility Dropped, Indicating Lack of Direction

India VIX remained below 13, suggesting low fear but also low enthusiasm.

Global Market Cues That Shaped Today’s Session

Asia: Mixed Response to China Data

Asian commentary remained muted as China’s factory output expanded slower than expected.

Nikkei was stable, but Hang Seng faced mild selling in tech.

Europe: Flat Opening Dragged Sentiment

European markets opened lower as traders awaited ECB remarks.

Eurozone inflation print remained above expectations, adding to uncertainty.

U.S. Futures: Cautious Approach

S&P 500 and Nasdaq futures were slightly negative during Indian market hours, keeping global investors defensive.

Sector-Wise Performance Breakdown

1. Banking & Financials – Mildly Negative

Bank Nifty closed at 59,273, losing steam after early gains.

Private lenders like ICICI Bank and Axis Bank saw intraday selling.

Key reasons:

- Higher global yields pressuring BFSI sentiment

- Profit-booking after last week’s rally

- NBFCs saw selective buying but not enough to lift the index

Fin Nifty’s close at 27,565 signals consolidation.

2. IT – One of the Few Gainers Today

Tech stocks outperformed the broader market as:

- U.S. tech futures remained stable

- Weakening rupee improved earnings sentiment

- Large-cap IT such as TCS and Infosys attracted accumulation

The sector remains a preferred defensive bet in the current global setup.

3. Auto – Weak Close After a Strong November Series

Auto companies faced selling pressure due to:

- Concerns over festive season demand moderation

- Commodity cost fluctuations

- Pressure on premium 2-wheeler and EV segments

Stocks like M&M and Bajaj Auto dragged the index.

4. Energy & Metals – Stable

Energy remained supported by crude stability.

Metals were steady due to Chinese infrastructure expectations.

5. FMCG – Soft

Profit booking hit mid-cap consumption names.

Investors await rural demand indicators before raising exposure.

Nifty 50 Technical View: 26,000 Holds Firm

Nifty’s close at 26,032 indicates strong demand near the psychological 26,000 level.

Key Technical Signals

- RSI: Around 52 — neutral zone

- MACD: Slight bearish crossover, hinting at mild downside

- Volume: Lower-than-average, confirming lack of momentum

- Price Structure: Still within a broad consolidation trend

Support Levels:

- 25,950

- 25,820

Resistance Levels:

- 26,180

- 26,250

Unless Nifty closes above 26,180, the index may continue to oscillate in a narrow band.

Bank Nifty Technical Outlook: 59,000 Is Key

Bank Nifty’s close at 59,273 reflects indecision.

Indicators:

- RSI near 48 – mild bearish undertone

- MACD turning flat – consolidation phase

- Volume slightly lower – no aggressive selling pressure

Trading Range for the Week:

- Support: 59,000 → 58,650

- Resistance: 59,650 → 60,200

A break above 60,000 could trigger short-covering.

Sensex: Another Day of Softness

Sensex closing at 85,138 shows weight from heavyweights like Reliance, HDFC Bank, and SBI.

Sentiment remains cautious but stable.

As long as it sustains above 84,800, the short-term structure remains intact.

Fin Nifty: Consolidating Alongside BFSI Space

Fin Nifty’s close at 27,565 shows sectoral consolidation.

Most asset management and exchange-related stocks remained steady.

Watch for a breakout above 27,720 for momentum to resume.

Top Market Drivers Today

1. Crude Oil Stable at Comfortable Levels

Brent remained steady near $78, supporting oil marketing companies.

2. INR Holding Firm

The rupee traded around 83.25, reducing pressure on import-heavy sectors.

3. Global Bond Yields

U.S. yields staying above 4.25% continued to affect FII inflows.

Outlook for the Coming Sessions

Markets are likely to remain data-driven with triggers such as:

- U.S. non-farm payrolls

- India’s services PMI

- Crude oil inventory updates

- FIIs positioning in index futures

Expect narrow-range movement unless big global data shifts sentiment.

Short-term investors should focus on:

- IT

- Energy

- Selective mid-cap momentum stocks

Banks may underperform until clarity emerges on global yield movement.

FAQs – Indian Stock Market Closing Bell: 02 December 2025

1. Why did the market close lower today?

Due to profit booking, FIIs selling, and cautious global cues before key macro data.

2. What sectors were weak?

Banking, Auto, FMCG and select mid-cap consumption names saw pressure.

3. Which sector performed relatively better?

IT remained stable with mild gains.

4. Is Nifty likely to break 26,000?

As long as global cues remain steady, 26,000 is expected to act as strong support.

5. Should traders remain cautious?

Yes. With major global data ahead, volatility may increase.

Internal Links for CapitalKeeper.in

Trading Education Series

Pre-Market Analysis

Daily Nifty & Bank Nifty Levels

Commodity Market Updates

Sectoral Investing Series

📌 For daily trade setups, technical learning, and smart investing tips, stay tuned to CapitalKeeper.in

📌 For more real-time updates, trade setups, and investment insights — follow us on [Telegram] and [WhatsApp Channel] subscribe to our newsletter!

📌 Disclaimer

The content provided on CapitalKeeper.in is for informational and educational purposes only and does not constitute investment, trading, or financial advice. While we strive to present accurate and up-to-date market data and analysis, we make no warranties or representations regarding the completeness, reliability, or accuracy of the information.

Stock market investments are subject to market risks, and readers/investors are advised to conduct their own due diligence or consult a SEBI-registered financial advisor before making any investment decisions. CapitalKeeper and its authors are not liable for any loss or damage, direct or indirect, arising from the use of this information.

All views and opinions expressed are personal and do not reflect the official policy or position of any agency or organization. Past performance is not indicative of future results. By using this website, you agree to the terms of this disclaimer

Ranjit Sahoo

Founder & Chief Editor – CapitalKeeper.in

Ranjit Sahoo is the visionary behind CapitalKeeper.in, a leading platform for real-time market insights, technical analysis, and investment strategies. With a strong focus on Nifty, Bank Nifty, sector trends, and commodities, she delivers in-depth research that helps traders and investors make informed decisions.

Passionate about financial literacy, Ranjit blends technical precision with market storytelling, ensuring even complex concepts are accessible to readers of all levels. Her work covers pre-market analysis, intraday strategies, thematic investing, and long-term portfolio trends.

When he’s not decoding charts, Ranjit enjoys exploring coastal getaways and keeping an eye on emerging business themes.

📌 Follow Ranjit on:

LinkedIn | Twitter/X | Instagram | ✉️ contact@capitalkeeper.in

Leave a Reply