Indian Stock Market Closing Bell 28 Jan 2026: Nifty Ends Higher, Sensex Gains, Banks Stay Flat

Updated: 28 January 2026

Category: Closing Bell | Market Analysis

By CapitalKeeper Research Desk

Indian stock market closing bell for 28 January 2026: Nifty closes at 25,342, Sensex outperforms, Bank Nifty remains range-bound amid mixed global cues. Full analysis with outlook.

Indian Stock Market Closing Bell – 28 January 2026

Nifty Edges Higher as Selective Buying Continues; Sensex Outperforms, Banks Remain Range-Bound

Market Snapshot: At a Glance

| Index | Open | High | Low | Close | Change |

|---|---|---|---|---|---|

| Nifty 50 | 25,258.85 | 25,368.40 | 25,201.90 | 25,342.75 | ▲ +83.90 |

| Sensex | 81,892.36 | 82,412.55 | 81,735.44 | 82,344.68 | ▲ +452.32 |

| Bank Nifty | 59,575.65 | 59,780.40 | 59,380.20 | 59,598.80 | ▲ +23.15 |

| Fin Nifty | 27,212.10 | 27,365.45 | 27,130.60 | 27,335.20 | ▲ +123.10 |

Market Overview: A Calm Yet Constructive Session

The Indian equity market ended 28 January 2026 on a mildly positive note, reflecting a measured risk-on sentiment rather than aggressive buying. Benchmark indices managed to hold gains throughout the session, supported by selective accumulation in frontline stocks, while banking and financial heavyweights largely stayed in consolidation mode.

The Nifty 50 closed above the psychological 25,300 mark, suggesting that buyers are still willing to defend key levels, even as global cues remain mixed. The Sensex outperformed, aided by buying interest in capital goods, FMCG, and selective IT counters. Meanwhile, Bank Nifty struggled to build momentum, once again highlighting the lack of fresh triggers in the banking space.

Overall, the session felt like a pause within an ongoing trend, not a reversal—an important distinction for short-term traders and positional investors alike.

How the Trading Session Unfolded

Early Trade: Cautious Start, Flat Bias

Markets opened with a marginally positive bias, tracking mixed cues from Asian peers. Early gains were capped as traders remained cautious ahead of key global macro developments and upcoming central bank signals.

Mid-Session: Sensex Takes the Lead

As the session progressed, Sensex components saw steady inflows, especially in stocks linked to domestic growth themes. Nifty moved into a narrow range, while Bank Nifty oscillated without clear direction.

Closing Hour: Mild Accumulation

The final hour witnessed light accumulation, particularly in large-cap non-banking stocks. There was no panic selling or aggressive short covering, indicating a stable undertone going into the next session.

Index-wise Performance Analysis

🔹 Nifty 50: Holding the Higher Ground

Nifty’s ability to close above 25,300 despite intraday volatility is a constructive sign. The index respected intraday supports and avoided any sharp sell-off, suggesting that dips are still being bought selectively.

- Trend: Sideways to mildly positive

- Immediate Support: 25,200 – 25,150

- Resistance Zone: 25,450 – 25,500

From a technical perspective, Nifty continues to consolidate in a higher range, which often precedes directional movement. However, a decisive breakout will require participation from banks.

🔹 Sensex: Relative Outperformance Continues

Sensex once again outperformed broader indices, gaining over 450 points. This reflects institutional preference for select heavyweights, particularly those aligned with domestic consumption and infrastructure themes.

The broader structure of Sensex remains healthy, with higher lows intact on the daily chart.

🔹 Bank Nifty: Still Searching for Direction

Bank Nifty ended almost flat, reflecting indecision and lack of conviction. Despite intraday swings, the index failed to close convincingly above resistance levels.

- Support: 59,300

- Resistance: 59,900 – 60,100

Unless Bank Nifty sustains above the 60,000 mark, sharp upside in Nifty may remain limited in the near term.

🔹 Fin Nifty: Quiet Strength

Fin Nifty showed relative resilience, closing higher and hinting at selective interest in NBFCs and insurance stocks. The index continues to mirror a gradual accumulation pattern rather than speculative movement.

Sectoral Trends: Mixed but Stable

- Gainers: FMCG, Capital Goods, Select IT stocks

- Underperformers: PSU Banks, Select Metals

- Neutral: Pharma, Realty, Energy

The absence of broad-based selling suggests that the market is digesting recent gains, not distributing aggressively.

Institutional Activity: Silent but Supportive

While there was no aggressive institutional footprint visible intraday, the market’s ability to hold levels indicates that smart money is not in a hurry to exit. FIIs appear cautious but not overtly bearish, while DIIs continue to provide downside support.

Global Market Cues: Mixed Signals Continue

Global markets offered no clear directional lead:

- US Markets: Awaiting clarity on interest rate trajectory and inflation signals

- Asian Markets: Mixed, with selective buying in export-oriented stocks

- Dollar Index: Slightly firm, keeping emerging market flows in check

- Crude Oil: Stable, offering comfort to Indian macros

These cues reinforced a wait-and-watch approach among domestic participants.

Volatility Check: Calm Before the Move?

India VIX remained relatively subdued, reflecting controlled volatility. Such low-volatility phases often precede sharp moves, making risk management crucial at current levels.

What Today’s Closing Bell Tells Investors

- The market is not weak, but it is also not in a hurry to move higher

- Leadership remains narrow; broader participation is still missing

- Banking stocks need to wake up for a sustainable rally

- Domestic-focused sectors continue to attract interest

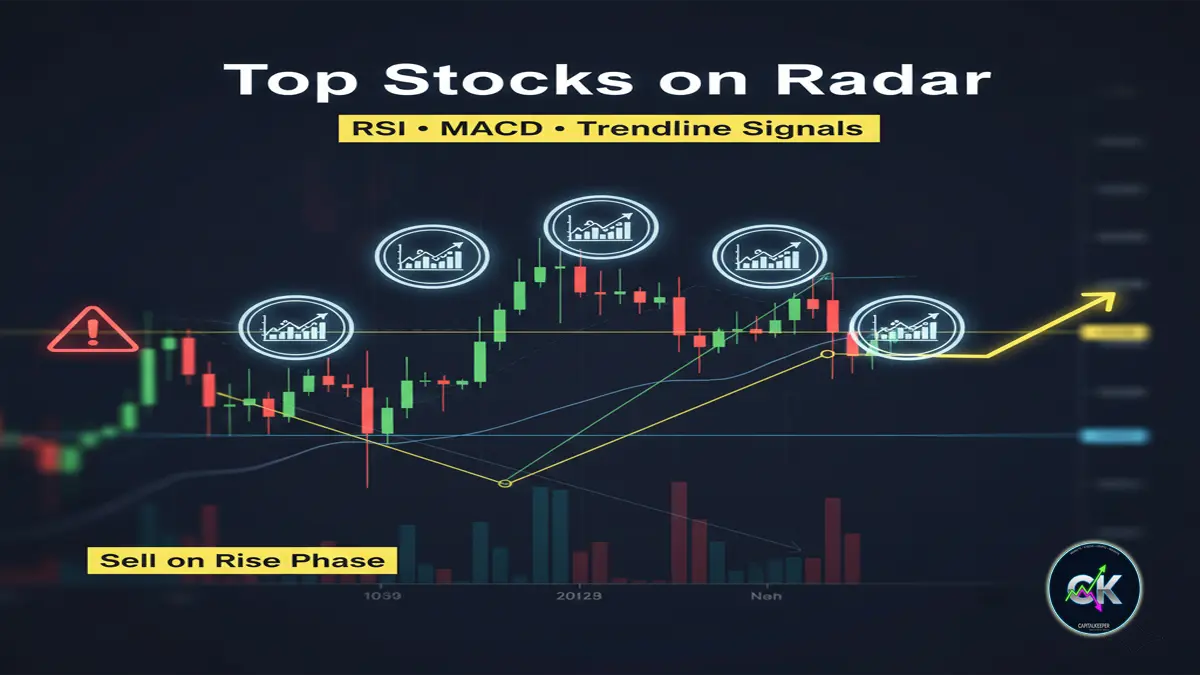

Short-Term Outlook: What to Watch Next

- Nifty above 25,200: Bulls retain control

- Nifty below 25,150: Short-term caution

- Bank Nifty above 60,100: Fresh momentum possible

- Global cues: Key trigger for next directional move

Traders should avoid overleveraging and focus on stock-specific opportunities rather than index chasing.

Key Takeaways – Closing Bell Summary

- Nifty closes higher at 25,342, holding key support

- Sensex outperforms with steady large-cap buying

- Bank Nifty remains range-bound, limiting broader rally

- Market sentiment stable, not euphoric

- Ideal phase for disciplined, selective positioning

Internal Links for CapitalKeeper.in

- Pre-Market Analysis

- Nifty & Bank Nifty Technical Outlook

- Weekly Market Wrap

- Educational Series: RSI & MACD Explained

FAQs – Indian Stock Market Closing Bell (28 Jan 2026)

❓ Why did Nifty close higher today?

Nifty gained due to selective buying in large-cap stocks and strong Sensex components, despite weak momentum in banking stocks.

❓ Is Bank Nifty showing weakness?

Bank Nifty is not weak but stuck in consolidation. A clear breakout above 60,000 is needed for fresh upside.

❓ Should investors be cautious now?

This is a phase of consolidation. Investors should focus on quality stocks and avoid aggressive trades until a clear breakout emerges.

❓ What is the short-term trend for Nifty?

Short-term trend remains sideways to positive as long as Nifty holds above 25,200.

Final Word

The 28 January 2026 Closing Bell reinforces one clear message:

👉 Markets are consolidating with strength, not breaking down.

Patience, discipline, and stock selection—not aggression—remain the winning strategy at this juncture.

📌 For daily trade setups, technical learning, and smart investing tips, stay tuned to CapitalKeeper.in

📌 For more real-time updates, trade setups, and investment insights — follow us on [Telegram] and [WhatsApp Channel] subscribe to our newsletter!

📌 Disclaimer

The content provided on CapitalKeeper.in is for informational and educational purposes only and does not constitute investment, trading, or financial advice. While we strive to present accurate and up-to-date market data and analysis, we make no warranties or representations regarding the completeness, reliability, or accuracy of the information.

Stock market investments are subject to market risks, and readers/investors are advised to conduct their own due diligence or consult a SEBI-registered financial advisor before making any investment decisions. CapitalKeeper and its authors are not liable for any loss or damage, direct or indirect, arising from the use of this information.

All views and opinions expressed are personal and do not reflect the official policy or position of any agency or organization. Past performance is not indicative of future results. By using this website, you agree to the terms of this disclaimer

Ranjit Sahoo

Founder & Chief Editor – CapitalKeeper.in

Ranjit Sahoo is the visionary behind CapitalKeeper.in, a leading platform for real-time market insights, technical analysis, and investment strategies. With a strong focus on Nifty, Bank Nifty, sector trends, and commodities, she delivers in-depth research that helps traders and investors make informed decisions.

Passionate about financial literacy, Ranjit blends technical precision with market storytelling, ensuring even complex concepts are accessible to readers of all levels. Her work covers pre-market analysis, intraday strategies, thematic investing, and long-term portfolio trends.

When he’s not decoding charts, Ranjit enjoys exploring coastal getaways and keeping an eye on emerging business themes.

📌 Follow Ranjit on:

LinkedIn | Twitter/X | Instagram | ✉️ contact@capitalkeeper.in

Leave a Reply