Indian Stock Market Closing Bell 21 November 2025: Nifty Slips Below 26,100, Bank Nifty Weakens; Global Cues Turn Cautious

Updated: 21 November 2025

Category: Closing Bell | Market Analysis

By CapitalKeeper Research Desk

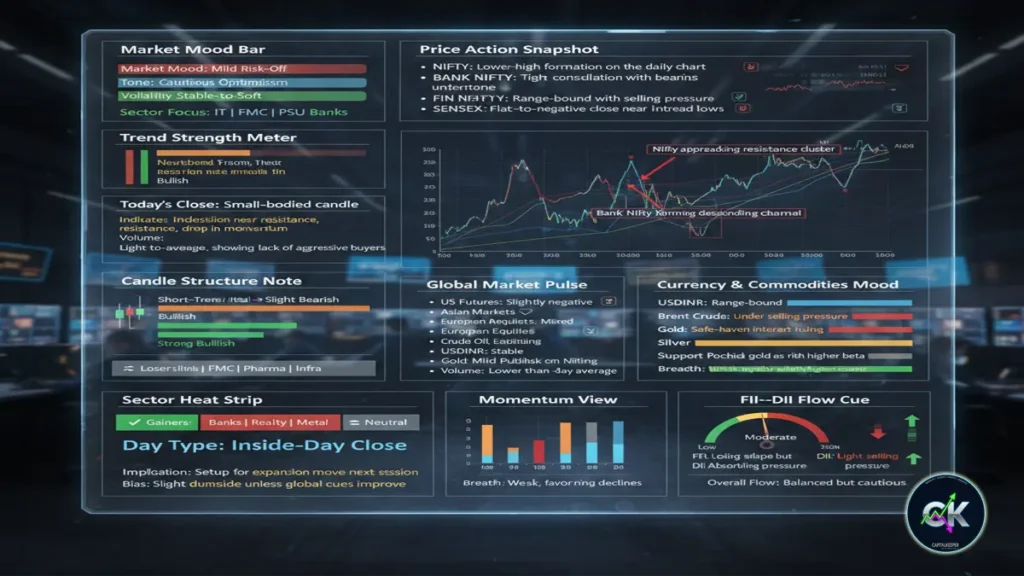

Indian Stock Market Closing Bell 21 November 2025: Nifty closes at 26,068.15 and Bank Nifty at 58,867.70 amid weak global sentiment, cautious FII flows, and mixed sector performance. Full analysis with charts, technical view, global cues, and sector trends.

Indian Stock Market Closing Bell Report – 21 November 2025

Nifty and Bank Nifty end lower as global weakness, bond-yield pressure, and profit booking drag markets off the highs.

The Indian equity markets spent most of the session under pressure on 21 November 2025, slipping into the red after a muted start. Despite opening near the previous close, benchmark indices failed to sustain higher levels as global cues turned soft and profit booking kicked in across heavyweight sectors.

While the selling was not aggressive, the mood remained cautious throughout the day—particularly ahead of upcoming global macro announcements and central bank commentary.

Today’s market action reflected consolidation near record zones, with traders preferring selective stock-based activity rather than broad-market participation.

Key Index Performance – 21 November 2025

| Index | Open | Close | % Change | Trend |

|---|---|---|---|---|

| Nifty 50 | 26,109.55 | 26,068.15 | -0.16% | Mild Weakness |

| Bank Nifty | 59,116.70 | 58,867.70 | -0.42% | Financials Under Pressure |

| Sensex | 85,347.40 | 85,231.92 | -0.14% | Flat to Negative |

| Fin Nifty | 27,742.30 | 27,566.15 | -0.64% | Profit Booking Continues |

Market Mood Summary

- Broader markets remained mixed, with Smallcap slightly outperforming.

- Financials and IT acted as major drags.

- Metals and FMCG attempted to provide support but could not offset selling in index heavyweights.

- Volatility inched higher but stayed below risk zones.

Overall sentiment: Consolidation with a negative undertone.

What Drove Today’s Market? – Detailed Analysis

1. Global Cues Turn Soft

The market followed global sentiment which showed signs of fatigue:

US Markets

- Futures hinted at muted action.

- Profit booking ahead of upcoming Federal Reserve commentary.

- Bond yields edged higher, impacting risk appetite.

Asian Markets

- Nikkei and Hang Seng traded with mild weakness.

- China’s economic data remained mixed, limiting upside.

European Markets

- Opened flat to lower.

- Concerns over inflation trajectory and energy prices added caution.

Impact on Indian markets:

A risk-off setup globally prevented bulls from carrying forward momentum from previous sessions.

2. FII & DII Flows Turn Mixed

Although exact numbers will come later, early trends indicate:

- FII activity remained cautious, leading to intraday selling pressure.

- DII buying supported dips, preventing deeper cuts.

This created a tight, range-bound structure throughout the day.

3. Sector-Wise Performance

Top Performing Sectors

- FMCG: Rotation buying and defensive preference

- Metal: Supported by stable global commodity prices

Weak Sectors

- Banks & Financials: Dragged by profit booking

- IT: Weak global tech sentiment

- Pharma: Mild correction after previous gains

Technical Analysis – Nifty, Bank Nifty, Fin Nifty

🔍 Nifty 50 Technical View

Closing: 26,068.15

Nifty traded in a narrow band but remained below 26,100. Selling pressure emerged near resistance zones.

Key Levels:

- Support 1: 25,980

- Support 2: 25,880

- Resistance 1: 26,150

- Resistance 2: 26,260

Technical Indicators:

- RSI: Hovering near 57, indicating neutral momentum.

- MACD: Showing a mild bearish crossover.

- Volume: Slightly lower than average; suggests consolidation rather than major sell-off.

Overall outlook: Sideways to mildly bearish unless Nifty closes above 26,150.

🔍 Bank Nifty Technical View

Closing: 58,867.70

Profit booking kept Bank Nifty in check. Key private banks contributed most to the day’s fall.

Key Levels:

- Support 1: 58,550

- Support 2: 58,200

- Resistance 1: 59,300

- Resistance 2: 59,700

Indicators:

- RSI: 54 – stable, not oversold.

- MACD: Slight negative divergence.

- Volume: Higher on the downside, hinting institutional trimming.

Trend: Neutral to negative.

🔍 Fin Nifty Technical View

Closing: 27,566.15

Financial stocks saw heavier selling vs. broader indices. NBFCs and insurance showed pressure.

Support Zones:

- 27,450

- 27,200

Resistance Zones:

- 27,850

- 28,050

Trend: Weakness persists unless Fin Nifty moves back above 27,800.

Broader Market Performance

The broader market showed mixed movement:

- Midcaps: Flat

- Smallcaps: Slightly positive

- VIX: Edged up but remained within comfortable range

This divergence indicates stock-specific action rather than broad sentiment panic.

Global Market Snapshot

- DXY (Dollar Index): Stable but elevated

- Crude Oil: Slight decline—supportive for India

- Gold: Safe-haven demand increased due to market caution

No major external shocks, but sentiment leaned defensive.

Stocks That Moved the Market

Gainers

- Selected metal stocks

- FMCG leaders

- PSU stocks on domestic policy-driven optimism

Losers

- Private banks

- Heavyweight IT

- Select auto stocks

Market Outlook for 25 November 2025

The short-term direction will depend on:

- Global market cues

- US treasury yields

- FII behavior near monthly expiry

- Commodity price trends

Expected Trend:

Range-bound with limited downside; upside possible if global cues stabilize.

📌 FAQ Section

1. Why did Nifty fall on 21 November 2025?

Weak global sentiment, higher bond yields, and profit booking across financials caused selling pressure.

2. Which sector performed best today?

FMCG and Metals managed to stay resilient.

3. Is the market correction temporary?

Currently, the structure indicates consolidation—not a deep correction.

4. What is the outlook for Bank Nifty?

It needs to reclaim 59,300 for momentum to return. Support sits near 58,550.

5. Are global cues affecting Indian markets?

Yes. Asian weakness and US yield movement have kept domestic markets range-bound.

📌 For daily trade setups, technical learning, and smart investing tips, stay tuned to CapitalKeeper.in

📌 For more real-time updates, trade setups, and investment insights — follow us on [Telegram] and [WhatsApp Channel] subscribe to our newsletter!

📌 Disclaimer

The content provided on CapitalKeeper.in is for informational and educational purposes only and does not constitute investment, trading, or financial advice. While we strive to present accurate and up-to-date market data and analysis, we make no warranties or representations regarding the completeness, reliability, or accuracy of the information.

Stock market investments are subject to market risks, and readers/investors are advised to conduct their own due diligence or consult a SEBI-registered financial advisor before making any investment decisions. CapitalKeeper and its authors are not liable for any loss or damage, direct or indirect, arising from the use of this information.

All views and opinions expressed are personal and do not reflect the official policy or position of any agency or organization. Past performance is not indicative of future results. By using this website, you agree to the terms of this disclaimer

Ranjit Sahoo

Founder & Chief Editor – CapitalKeeper.in

Ranjit Sahoo is the visionary behind CapitalKeeper.in, a leading platform for real-time market insights, technical analysis, and investment strategies. With a strong focus on Nifty, Bank Nifty, sector trends, and commodities, she delivers in-depth research that helps traders and investors make informed decisions.

Passionate about financial literacy, Ranjit blends technical precision with market storytelling, ensuring even complex concepts are accessible to readers of all levels. Her work covers pre-market analysis, intraday strategies, thematic investing, and long-term portfolio trends.

When he’s not decoding charts, Ranjit enjoys exploring coastal getaways and keeping an eye on emerging business themes.

📌 Follow Ranjit on:

LinkedIn | Twitter/X | Instagram | ✉️ contact@capitalkeeper.in