Indian Stock Market Closing Bell 20 Jan 2026: Nifty Crashes Below 25,300, Risk-Off Sentiment Dominates

Updated: 20 January 2026

Category: Closing Bell | Market Analysis

By CapitalKeeper Research Desk

Indian Stock Market Closing Bell: 20 January 2026

Nifty Cracks 25,300 as Heavy Selling Hits Frontline Indices; Risk-Off Mood Takes Control

Indian stock market Closing Bell for 20 January 2026: Nifty plunges to 25,232, Bank Nifty slips, Fin Nifty weakens sharply, Sensex volatile. Detailed market cues, sector analysis, derivatives view, and global outlook.

Market at a Glance – Closing Summary

| Index | Open | Close | Change |

|---|---|---|---|

| Nifty 50 | 25,580.30 | 25,232.50 | ▼ 347.80 |

| Bank Nifty | 59,851.40 | 59,404.20 | ▼ 447.20 |

| Sensex | 83,207.38 | 82,180.47 | ▼ 1026.91 |

| Fin Nifty | 27,525.55 | 27,200.60 | ▼ 324.95 |

Closing Bell Overview: Panic-Free Sell-Off, But Clear Risk-Off Sentiment

The Indian equity markets witnessed a sharp and decisive sell-off on Tuesday, 20 January 2026, as frontline indices came under sustained selling pressure throughout the session. The Nifty 50 slipped sharply below the 25,300 mark, while Bank Nifty and Fin Nifty registered heavy losses, reflecting a broad-based risk-off environment.

Unlike panic-driven crashes, today’s fall was structured and institutional in nature, suggesting portfolio-level risk reduction rather than emotional retail selling. The market tone clearly shifted from consolidation to distribution, as large players reduced exposure ahead of uncertain global and macro cues.

This session marks one of the most decisive bearish closes of January so far.

Nifty 50 Analysis: Breakdown Below Key Psychological Levels

Nifty opened weak at 25,580.30 and immediately faced aggressive selling pressure. Attempts to stabilize near 25,500 failed, leading to a swift breakdown below 25,400 and 25,300. The index finally closed at 25,232.50, forming a strong bearish candle on the daily chart.

Key Technical Observations:

- Breakdown below 25,400 support

- Heavy selling volume across index heavyweights

- No meaningful intraday recovery

- Close near day’s low signals strong supply dominance

This move confirms that the earlier consolidation zone has now resolved on the downside, shifting the short-term trend into corrective mode.

Important Levels Ahead:

- Immediate Support: 25,200 → 25,100

- Major Support Zone: 25,000 (psychological)

- Resistance: 25,400 → 25,550

Unless Nifty reclaims 25,400, upside attempts may remain short-lived and corrective in nature.

Bank Nifty: Financials Lead the Weakness

Bank Nifty opened at 59,851.40 but failed to hold the 60,000 zone for the second consecutive session. Persistent selling in private banks and profit booking in PSU banks dragged the index down to 59,404.20.

Market Interpretation:

- Institutions reducing financial exposure

- Credit growth optimism priced in earlier now cooling

- Defensive rotation beginning within portfolios

The breakdown below 59,600 weakens the short-term structure. While the long-term trend remains intact, near-term caution is clearly visible.

Key Levels:

- Support: 59,200 → 59,000

- Resistance: 59,900 → 60,200

Sensex: Selective Heavyweight Support Masks Broader Weakness

Interestingly, the Sensex showed relative resilience, closing marginally lower. This was largely due to select heavyweight support, while broader stocks and financials remained weak.

This divergence between Sensex and Nifty indicates:

- Index management by select large-cap stocks

- Broader market sentiment still negative

- Defensive portfolio restructuring underway

Such divergence usually precedes further volatility in coming sessions.

Fin Nifty: Clear Distribution Phase

Fin Nifty witnessed one of the sharpest declines, closing at 27,200.60 after opening at 27,525.55.

Structural Reading:

- Financial stocks witnessing distribution

- Long unwinding visible

- Option writers shifting strikes lower

This move confirms that the financial space is no longer in accumulation, and markets are entering a cooling cycle.

Sectoral Performance: Broad-Based Pressure

Almost all major sectors ended in the red:

- Banking & Financials: Heavy selling

- IT: Global tech weakness spillover

- Metals: Demand concerns

- Capital Goods: Profit booking

- Realty: Risk-off selling

- Pharma: Relatively defensive but not immune

The session clearly reflected a broad-based de-risking environment rather than sector-specific correction.

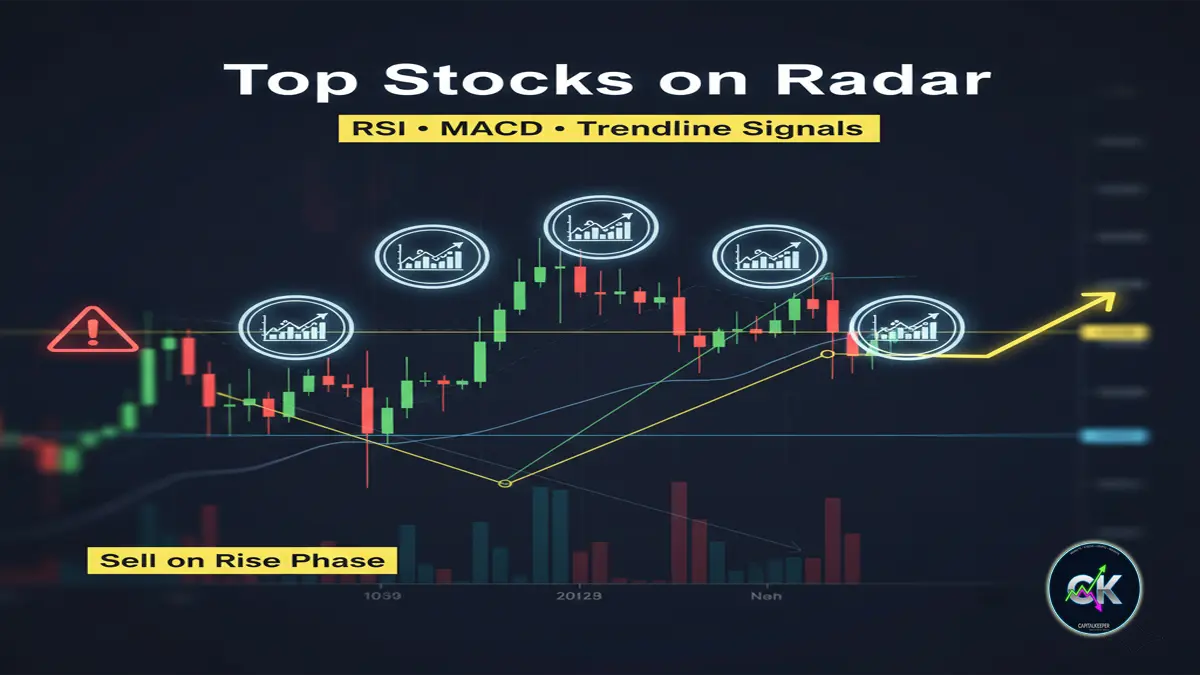

Derivatives & Positioning Insight

Derivatives data reflects aggressive long unwinding:

Key Signals:

- Put unwinding at 25,500 & 25,400

- Fresh put writing shifting to 25,000

- Call writing heavy at 25,400–25,600

- Volatility expanding

This structure confirms that traders are preparing for lower ranges, with the market now pricing in further downside risk.

Global Market Cues: Risk-Off Environment

Global cues played a significant role in today’s fall:

- US Markets: Volatility due to economic data uncertainty

- Bond Yields: Elevated levels pressuring equities

- Dollar Index: Strength impacting emerging markets

- Asian Markets: Broad weakness across major indices

- Commodities: Unstable price action

The global environment currently favors capital preservation over risk-taking, directly impacting emerging markets like India.

Market Psychology: Shift from Greed to Preservation

Today’s session marks a psychological shift in market behavior:

- From accumulation → distribution

- From optimism → caution

- From leverage → capital protection

This does not indicate a bear market, but it does indicate a corrective phase where discipline and risk management will outperform aggression.

Strategy Outlook

For Traders:

- Avoid aggressive longs

- Trade with smaller positions

- Focus on intraday volatility only

- Respect stop-losses strictly

For Investors:

- Do not panic sell

- Accumulate only near major supports

- Focus on fundamentally strong stocks

- Avoid leveraged positions

What to Watch Next

- Nifty 25,000 psychological support

- Bank Nifty 59,000 zone

- Global bond yield movement

- FII flow direction

- Volatility index behavior

Internal Reads on CapitalKeeper.in

- Daily Nifty & Bank Nifty Outlook

- Stock-Specific Momentum Tracker

- Weekly Market Strategy Report

- Options Chain Analysis

- Volatility & Risk Dashboard

Internal Links for CapitalKeeper.in

- Pre-Market Analysis

- Nifty & Bank Nifty Technical Outlook

- Weekly Market Wrap

- Educational Series: RSI & MACD Explained

FAQs – Indian Stock Market Closing Bell

Q1. Why did Nifty fall sharply today?

Due to institutional selling, global risk-off cues, and breakdown below key technical supports.

Q2. Is this the start of a bear market?

No. It is a corrective phase, not a long-term bear trend.

Q3. Which sector is weakest currently?

Financials and banking sectors are currently leading the weakness.

Q4. What should traders do now?

Trade light, reduce leverage, and focus on risk management.

Q5. Is 25,000 a strong support for Nifty?

Yes, it is a major psychological and technical support zone.

Closing Bell Verdict

The Indian stock market ended 20 January 2026 with a strong bearish close, confirming a short-term trend shift into correction mode. The breakdown below key support levels, combined with global risk-off cues and institutional selling, signals that markets are entering a consolidation-to-correction phase.

While this is not a structural bear market, it is a phase where capital protection, patience, and selectivity will define success. Traders must stay disciplined, and investors must stay strategic.

📌 For daily trade setups, technical learning, and smart investing tips, stay tuned to CapitalKeeper.in

📌 For more real-time updates, trade setups, and investment insights — follow us on [Telegram] and [WhatsApp Channel] subscribe to our newsletter!

📌 Disclaimer

The content provided on CapitalKeeper.in is for informational and educational purposes only and does not constitute investment, trading, or financial advice. While we strive to present accurate and up-to-date market data and analysis, we make no warranties or representations regarding the completeness, reliability, or accuracy of the information.

Stock market investments are subject to market risks, and readers/investors are advised to conduct their own due diligence or consult a SEBI-registered financial advisor before making any investment decisions. CapitalKeeper and its authors are not liable for any loss or damage, direct or indirect, arising from the use of this information.

All views and opinions expressed are personal and do not reflect the official policy or position of any agency or organization. Past performance is not indicative of future results. By using this website, you agree to the terms of this disclaimer

Ranjit Sahoo

Founder & Chief Editor – CapitalKeeper.in

Ranjit Sahoo is the visionary behind CapitalKeeper.in, a leading platform for real-time market insights, technical analysis, and investment strategies. With a strong focus on Nifty, Bank Nifty, sector trends, and commodities, she delivers in-depth research that helps traders and investors make informed decisions.

Passionate about financial literacy, Ranjit blends technical precision with market storytelling, ensuring even complex concepts are accessible to readers of all levels. Her work covers pre-market analysis, intraday strategies, thematic investing, and long-term portfolio trends.

When he’s not decoding charts, Ranjit enjoys exploring coastal getaways and keeping an eye on emerging business themes.

📌 Follow Ranjit on:

LinkedIn | Twitter/X | Instagram | ✉️ contact@capitalkeeper.in

Leave a Reply