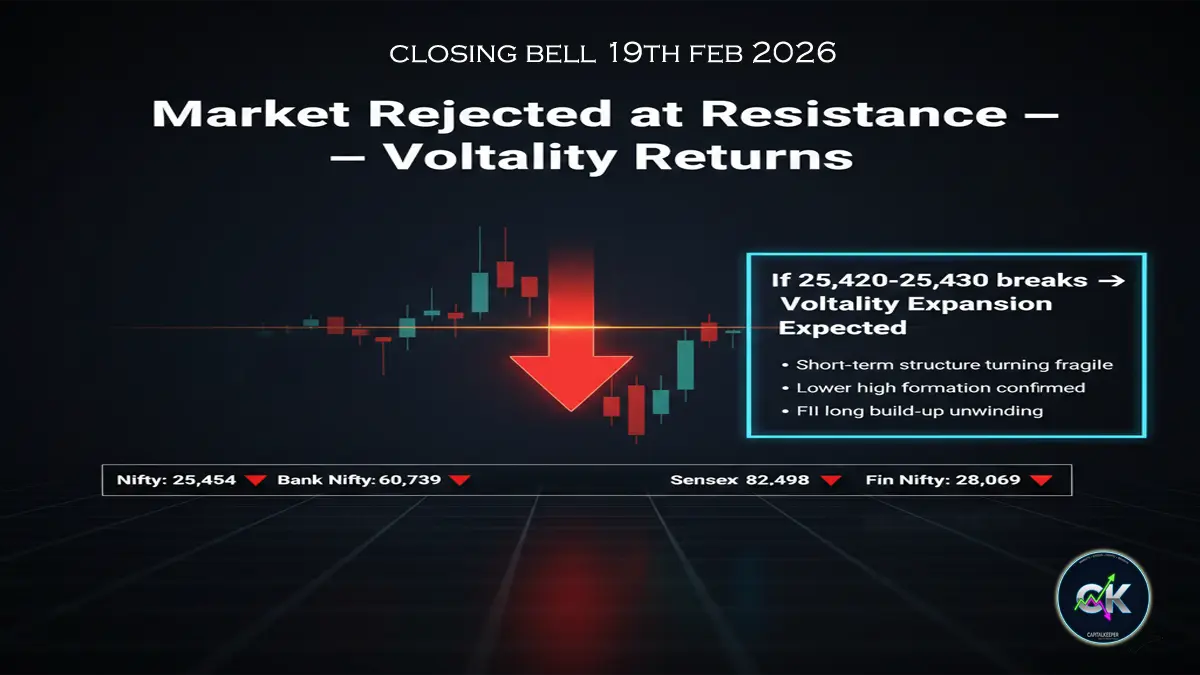

Indian Stock Market Closing Bell 19 February 2026: Sharp Reversal After Resistance Rejection: Is a Bigger Correction Unfolding?

Updated: 19 February 2026

Category: Closing Bell | Market Analysis

By CapitalKeeper Research Desk

Indian stock market closed sharply lower on 19 February 2026 as Nifty slipped to 25454 and Bank Nifty fell below 61,000. Sensex rejected long-term resistance again. Detailed technical analysis, global cues, OI data, support zones and next outlook.

The Indian equity market witnessed a dramatic reversal on 19 February 2026, erasing recent gains and reminding traders why resistance zones matter. After opening on a positive note, benchmark indices failed to sustain higher levels and ended the session deep in the red.

The session was particularly crucial because major indices approached long-term resistance levels before facing aggressive selling pressure.

Let us decode the numbers, technical structure, global triggers and what lies ahead.

📊 Closing Snapshot – 19/02/2026

| Index | Open | Close | Change | Trend |

|---|---|---|---|---|

| Nifty 50 | 25873.35 | 25454.35 | -419 pts | Bearish |

| Bank Nifty | 61660.85 | 60739.55 | -921 pts | Sharp Sell-off |

| Sensex | 83969.82 | 82498.14 | -1471.68 | Reversal |

| Fin Nifty | 28519.80 | 28069.50 | -450 pts | Heavy Pressure |

Market Summary: From Optimism to Panic Selling

The day began with optimism as Nifty opened above 25,850 and Bank Nifty above 61,600. However, selling emerged at higher levels, especially in banking and financial stocks. The intraday structure clearly showed distribution rather than accumulation.

The broader market also felt the heat, with midcaps and smallcaps underperforming during the second half.

The key takeaway: Resistance zones held strong, and profit booking accelerated aggressively.

Sensex at Long-Term Resistance: Historical Pattern Repeating?

The BSE Sensex closed at 82,498 and once again failed to sustain above the major resistance cluster.

Over the past two years, this zone has repeatedly triggered reversals. The critical resistance range remains:

85,500 – 86,000

If this zone is not convincingly crossed in the coming weeks, charts indicate a possible medium-term downside projection toward:

- 79,000

- 69,000

- 65,000

This is not an immediate prediction, but a structural possibility if distribution continues and macro triggers worsen.

Long-term investors should watch this zone closely.

Nifty Technical Breakdown – Warning Signs Confirmed

The Nifty 50 opened strong at 25,873 but closed at 25,454 — nearly a 420-point decline.

Key Observations:

- Strong rejection from upper levels

- Bearish engulfing-type daily candle

- High volume distribution

- No strong dip-buying seen

Immediate Support Zones:

- 25,300

- 25,100

- 24,900

If 25,300 breaks decisively, short-term momentum may accelerate downward.

Bank Nifty: Leadership Turns Weak

The Bank Nifty was the biggest contributor to the fall.

Opening near 61,660, it slipped nearly 1,000 points intraday before settling at 60,739.

Banking heavyweights witnessed:

- Profit booking

- Call writing at higher strikes

- Short build-up in futures

The 61,800–62,000 region now becomes a strong supply zone.

Immediate support: 60,300

Below that: 59,500 possible

Fin Nifty: Financial Pressure Visible

The Nifty Financial Services also declined sharply, closing at 28,069.

Financial stocks are usually trend leaders. Sustained weakness here indicates broader caution in the system.

Open Interest Data – Bears Gaining Control

Options data clearly signaled caution:

- Heavy Call OI addition near 25,900–26,000

- Put unwinding seen at higher levels

- PCR declined intraday

This structure suggests:

✔️ Smart money was selling into strength

✔️ Upside capped unless aggressive short covering emerges

Global Market Cues

Global cues were mixed to weak:

- US bond yields remained elevated

- Asian markets traded cautiously

- Crude oil volatility continued

- Dollar index firmed up

Global risk sentiment remains fragile amid uncertainty regarding rate outlook and geopolitical tensions.

Foreign Institutional Investors showed selective selling, especially in financials and large caps.

Sectoral Performance

Major Losers:

- Banking

- Financial Services

- IT (profit booking)

Defensive Support:

- FMCG (limited damage)

- Pharma (relative outperformance)

Midcaps saw sharper declines compared to frontline indices.

Technical Indicators Analysis

RSI (Daily)

- Slipped below momentum zone

- Showing bearish divergence

MACD

- Early crossover signs visible

- Histogram weakening

Price Action

- Rejection near resistance

- Lower high formation

All signals align with a short-term corrective phase.

What Triggered the Sharp Fall?

Several contributing factors:

- Overbought condition after recent rally

- Resistance rejection in Sensex

- Heavy Call writing

- Weak global undertone

- Profit booking before weekend

Markets often correct sharply when sentiment becomes overly optimistic.

Is This a Healthy Correction or Start of Deeper Fall?

Short-Term View:

Correction within broader uptrend unless 25,000 breaks decisively.

Medium-Term View:

If Sensex fails to cross 85,500–86,000 in upcoming rallies, deeper structural correction cannot be ruled out.

Investors should:

- Avoid aggressive fresh longs

- Trade with stop-loss discipline

- Focus on quality stocks

Trading Strategy for Next Session

For Traders:

- Sell on rise approach

- Watch 25,600 resistance

- Maintain tight risk management

For Investors:

- Accumulate only near strong supports

- Avoid leverage

- Track FII flows

Internal Links for CapitalKeeper.in

- Pre-Market Analysis

- Nifty & Bank Nifty Technical Outlook

- Weekly Market Wrap

- Educational Series: RSI & MACD Explained

Frequently Asked Questions (FAQs)

1. Why did Nifty fall sharply today?

Nifty faced strong resistance near higher levels combined with heavy Call writing and global uncertainty.

2. Is this the start of a major crash?

Not yet confirmed. However, Sensex resistance rejection suggests caution.

3. What is immediate Nifty support?

25,300 is immediate support. Below that, 25,000 becomes critical.

4. Should investors panic?

No panic, but risk management is essential.

Final Verdict

The market has delivered a clear message today: resistance zones matter.

With Sensex again reversing from a historically strong zone and Nifty witnessing aggressive selling from higher levels, caution becomes the dominant theme.

Whether this turns into a deeper correction or remains a short-term shakeout will depend on:

- Global stability

- FII flows

- Support levels holding

For now, discipline over emotion should guide decisions.

Stay tactical. Stay informed.

Stay prepared.

— Team CapitalKeeper

📌 For daily trade setups, technical learning, and smart investing tips, stay tuned to CapitalKeeper.in

📌 For more real-time updates, trade setups, and investment insights — follow us on [Telegram] and [WhatsApp Channel] subscribe to our newsletter!

📌 Disclaimer

The content provided on CapitalKeeper.in is for informational and educational purposes only and does not constitute investment, trading, or financial advice. While we strive to present accurate and up-to-date market data and analysis, we make no warranties or representations regarding the completeness, reliability, or accuracy of the information.

Stock market investments are subject to market risks, and readers/investors are advised to conduct their own due diligence or consult a SEBI-registered financial advisor before making any investment decisions. CapitalKeeper and its authors are not liable for any loss or damage, direct or indirect, arising from the use of this information.

All views and opinions expressed are personal and do not reflect the official policy or position of any agency or organization. Past performance is not indicative of future results. By using this website, you agree to the terms of this disclaimer

Ranjit Sahoo

Founder & Chief Editor – CapitalKeeper.in

Ranjit Sahoo is the visionary behind CapitalKeeper.in, a leading platform for real-time market insights, technical analysis, and investment strategies. With a strong focus on Nifty, Bank Nifty, sector trends, and commodities, she delivers in-depth research that helps traders and investors make informed decisions.

Passionate about financial literacy, Ranjit blends technical precision with market storytelling, ensuring even complex concepts are accessible to readers of all levels. Her work covers pre-market analysis, intraday strategies, thematic investing, and long-term portfolio trends.

When he’s not decoding charts, Ranjit enjoys exploring coastal getaways and keeping an eye on emerging business themes.

📌 Follow Ranjit on:

LinkedIn | Twitter/X | Instagram | ✉️ contact@capitalkeeper.in

Leave a Reply