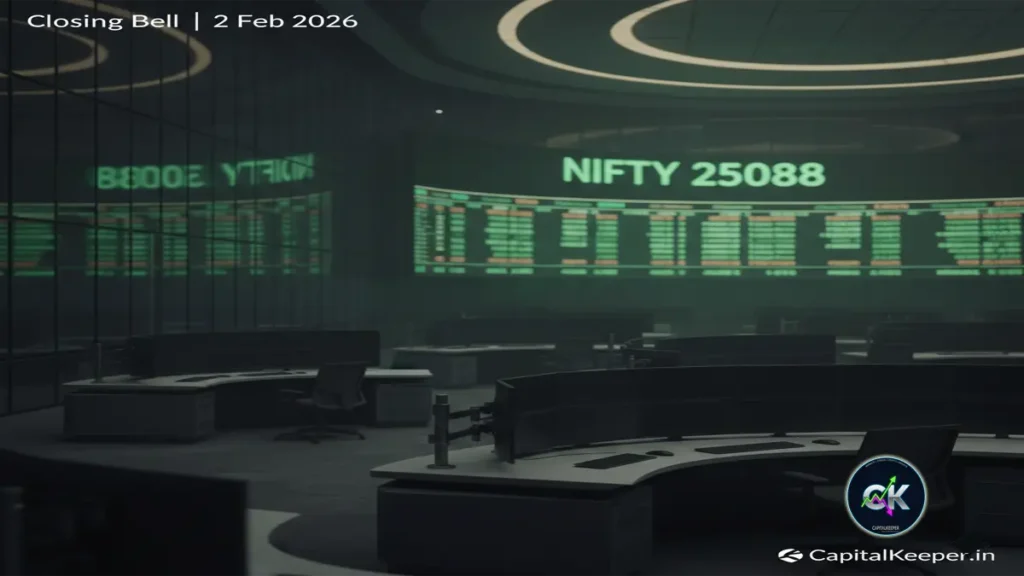

Indian Stock Market Closing Bell 02 February 2026: Post-Budget Relief Rally Lifts Indices as Nifty Reclaims 25,000; Banks Stabilise After Volatility

Updated: 02 February 2026

Category: Closing Bell | Market Analysis

By CapitalKeeper Research Desk

Indian stock market closing bell for 02 February 2026: Nifty rebounds above 25,000, Sensex jumps over 1,100 points, Bank Nifty steadies post-Budget volatility. Detailed market cues, global signals, sector analysis, and outlook.

Market Snapshot: Closing Bell – 02/02/2026

| Index | Open | Close | Change |

|---|---|---|---|

| Nifty 50 | 24,796.50 | 25,088.40 | ▲ 291.90 |

| Bank Nifty | 58,239.30 | 58,619.00 | ▲ 379.70 |

| Sensex | 80,555.68 | 81,666.46 | ▲ 1,110.78 |

| Fin Nifty | 26,612.20 | 26,799.00 | ▲ 186.80 |

Market Overview: Relief Rally After Budget Shock

The Indian equity market staged a strong recovery on Monday, 02 February 2026, shaking off the sharp Budget-day selloff seen on Sunday. After opening with mild uncertainty, buyers stepped in decisively, pushing benchmark indices higher throughout the session.

The Nifty 50 reclaimed the psychologically crucial 25,000 mark, while the Sensex surged over 1,100 points, signaling renewed confidence among institutional participants. Importantly, this rebound came without panic buying, indicating a controlled, confidence-driven move rather than emotional short covering.

Sunday’s Budget Day volatility had exposed thin liquidity and nervous sentiment. Monday’s session, however, reflected post-event clarity, as investors digested fiscal announcements and repositioned portfolios with a medium-term lens.

Intraday Market Behavior: How the Day Unfolded

- Opening Hour:

Markets opened slightly positive but cautious, with traders waiting for confirmation after Sunday’s sharp swings. - Mid-Session:

Gradual accumulation in heavyweights pushed indices higher. Banking stocks stabilized, providing a foundation for the rally. - Closing Hour:

Strong institutional buying emerged in the final hour, lifting benchmarks to near day’s highs and confirming bullish intent.

Market breadth improved steadily, with advancers clearly outnumbering decliners, a healthy sign after recent turbulence.

Sectoral Performance: Banks and Financials Lead Recovery

Banking & Financials

After absorbing the impact of Budget-related concerns, Bank Nifty rebounded smartly, closing above 58,600. PSU banks showed selective strength, while private lenders saw steady accumulation rather than aggressive buying.

The move suggested stability rather than euphoria, an important signal that the sector may now enter a consolidation-to-recovery phase.

IT & Technology

IT stocks traded mixed as global cues remained uncertain. While some buying emerged at lower levels, participants remained cautious ahead of further clarity on global interest rate trajectories.

Capital Goods & Infrastructure

Budget-linked optimism continued to support infra and capital goods stocks. However, gains were selective, indicating investors are focusing more on execution capability than announcements.

Consumption & FMCG

Consumption stocks saw modest buying as investors reassessed fiscal measures aimed at rural and middle-income segments.

Global Market Cues: Stability Supports Indian Equities

Global markets provided a neutral-to-supportive backdrop:

- US Markets:

Wall Street ended largely stable, with investors focusing on upcoming macro data rather than reacting emotionally to policy commentary. - Asian Markets:

Asian equities traded mixed but steady, offering no negative surprise for Indian markets. - Crude Oil:

Crude prices remained range-bound, easing inflation concerns marginally. - Dollar Index:

The dollar showed limited movement, keeping pressure off emerging market currencies, including the rupee.

Overall, the absence of global shocks allowed domestic factors to dominate Monday’s session.

India VIX and Market Sentiment

Volatility indicators cooled slightly after Sunday’s spike. While India VIX remains elevated compared to pre-Budget levels, the decline suggests fear is receding, replaced by cautious optimism.

This environment typically favors stock-specific action over broad-based momentum, a trend already visible in Monday’s trade.

Technical Perspective: Nifty, Bank Nifty & Sensex

Nifty 50

- Reclaimed 25,000 decisively

- Immediate support: 24,850

- Resistance zone: 25,300–25,400

The structure now hints at range expansion rather than breakdown, provided volatility remains controlled.

Bank Nifty

- Closed above short-term moving averages

- Support zone: 58,000

- Resistance: 59,200

Banking stability is crucial for any sustained market recovery.

Sensex

- Strong bullish candle after Budget-day selloff

- Indicates rejection of lower levels near 80,000

Liquidity & Institutional Activity

Monday’s rally was supported by measured institutional participation, not speculative frenzy. Volumes improved compared to Sunday but remained within healthy limits, suggesting genuine accumulation rather than short-term chasing.

This is critical, as sustainable rallies are built on gradual confidence, not impulsive flows.

What This Means for Investors

- Short-Term Traders:

Expect volatility but avoid chasing rallies near resistance levels. - Swing Traders:

Look for pullbacks in strong sectors like banking and infrastructure. - Long-Term Investors:

This phase offers opportunities to accumulate quality stocks gradually as post-Budget narratives stabilize.

Outlook: What to Watch Next

Key triggers ahead include:

- Follow-through buying above Nifty 25,200

- Bank Nifty’s ability to sustain above 58,000

- Global macro data and currency movement

- Continued decline in volatility index

Markets are likely to remain data-driven and selective, rather than trending sharply in one direction.

Conclusion: Confidence Returns, Caution Remains

The 02 February 2026 Closing Bell marked a crucial shift in sentiment. From Budget-day anxiety to post-event clarity, Indian markets demonstrated resilience and maturity.

The rebound was not emotional, not speculative but measured and informed. This sets a constructive tone for the days ahead, provided global stability continues and domestic liquidity improves.

For now, the message from Dalal Street is clear:

Panic has faded, but discipline still rules.

FAQs – Indian Stock Market Closing Bell

Q1. Why did the market rise after Sunday’s Budget volatility?

Post-Budget clarity reduced uncertainty, allowing investors to re-enter at attractive levels.

Q2. Is the Nifty recovery sustainable?

Sustainability depends on holding above 24,850 and improving participation from banking stocks.

Q3. Should investors buy aggressively now?

Aggressive buying is not advised; staggered accumulation is more prudent.

Q4. Which sectors look stable post-Budget?

Banking, infrastructure, and selective consumption stocks appear relatively stable.nt-driven volatility is common around Budget sessions.

Internal Links for CapitalKeeper.in

- Pre-Market Analysis

- Nifty & Bank Nifty Technical Outlook

- Weekly Market Wrap

- Educational Series: RSI & MACD Explained

Frequently Asked Questions (FAQs)

Why did the market remain range-bound today?

Mixed global cues, low volatility, and absence of fresh triggers kept the market confined within a narrow range.

Is Nifty still bullish?

Yes, as long as Nifty holds above the 25,200 support zone, the broader structure remains positive.

Why did Sensex underperform compared to Nifty?

Selective weakness in heavyweight stocks pulled the Sensex lower despite Nifty’s resilience.

Is this a good time for aggressive trading?

No. The current phase favors low-risk, stock-specific, or option decay strategies.

What should investors focus on now?

Quality stocks, strong balance sheets, and disciplined position sizing.

Final Word

The market’s message today was subtle but clear —

discipline over excitement, structure over speculation.

As January closes, the stage is set for a decisive move — but only time, data, and global cues will reveal the direction.

Stay informed. Stay disciplined.

📌 For daily trade setups, technical learning, and smart investing tips, stay tuned to CapitalKeeper.in

📌 For more real-time updates, trade setups, and investment insights — follow us on [Telegram] and [WhatsApp Channel] subscribe to our newsletter!

📌 Disclaimer

The content provided on CapitalKeeper.in is for informational and educational purposes only and does not constitute investment, trading, or financial advice. While we strive to present accurate and up-to-date market data and analysis, we make no warranties or representations regarding the completeness, reliability, or accuracy of the information.

Stock market investments are subject to market risks, and readers/investors are advised to conduct their own due diligence or consult a SEBI-registered financial advisor before making any investment decisions. CapitalKeeper and its authors are not liable for any loss or damage, direct or indirect, arising from the use of this information.

All views and opinions expressed are personal and do not reflect the official policy or position of any agency or organization. Past performance is not indicative of future results. By using this website, you agree to the terms of this disclaimer

Ranjit Sahoo

Founder & Chief Editor – CapitalKeeper.in

Ranjit Sahoo is the visionary behind CapitalKeeper.in, a leading platform for real-time market insights, technical analysis, and investment strategies. With a strong focus on Nifty, Bank Nifty, sector trends, and commodities, she delivers in-depth research that helps traders and investors make informed decisions.

Passionate about financial literacy, Ranjit blends technical precision with market storytelling, ensuring even complex concepts are accessible to readers of all levels. Her work covers pre-market analysis, intraday strategies, thematic investing, and long-term portfolio trends.

When he’s not decoding charts, Ranjit enjoys exploring coastal getaways and keeping an eye on emerging business themes.

📌 Follow Ranjit on:

LinkedIn | Twitter/X | Instagram | ✉️ contact@capitalkeeper.in