Independence Day Special: Next Gen Building India’s Financial Future

By CapitalKeeper | Independence Day Special | Indian Equities | Market Moves That Matter

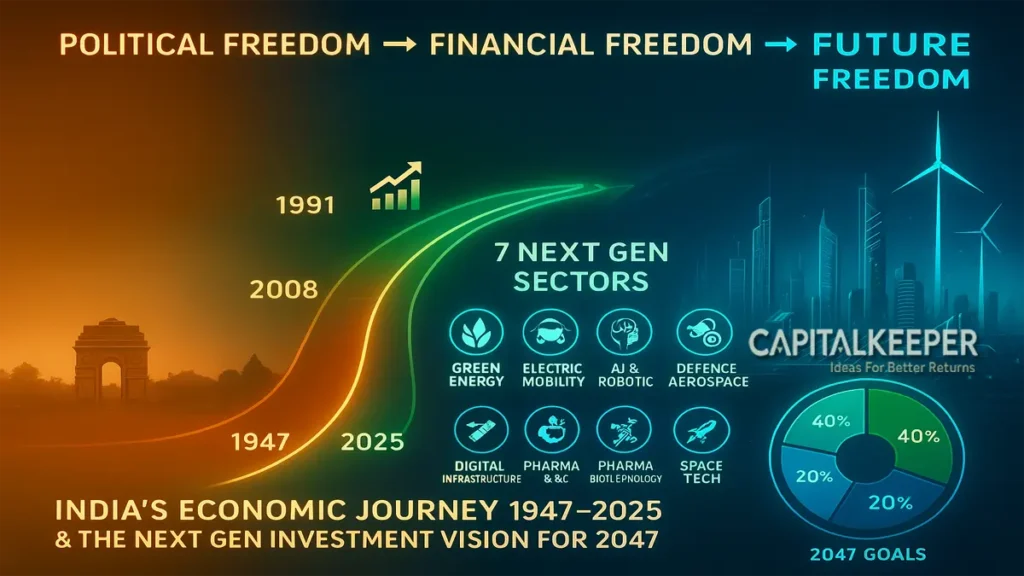

Celebrate India’s Independence Day with a vision for tomorrow. Explore India’s economic journey, the 7 Next Gen growth sectors, and portfolio strategies to build a self-reliant financial future by 2047.

Introduction – From 1947 to 2047: Passing the Torch

When India unfurled its tricolour on August 15, 1947, the nation stood at the cusp of political freedom but economic uncertainty. Seventy-eight years later, in 2025, India is not only the world’s fifth-largest economy but is poised to become a $10 trillion powerhouse by the early 2030s.

But this journey is far from complete. The next generation — the Next Gen of India’s economic leaders, innovators, and investors — will play a defining role in shaping our destiny from now to the centenary of independence in 2047.

This Independence Day, let’s focus on how India’s young demographic, next-gen sectors, and self-reliance drive will create unprecedented opportunities for wealth creation.

1. The Demographic Dividend – Young Minds, Big Impact

- Median Age: 28 years (2025), compared to 38 in China and 47 in Japan.

- Youth Workforce: 65% of India’s population is under 35.

- Digital Penetration: 900+ million internet users by 2030.

This means India’s growth will be driven by digital-first, tech-native citizens who are comfortable investing in equities, crypto, startups, and global markets.

💡 Next Gen Insight: Companies that serve young consumers and empower young professionals will see exponential growth.

2. Key Sectors Leading the Next Gen Revolution

a) Defence & Aerospace – Securing the Future

- Why it matters: National security and export potential.

- Stock Spotlight: Hindustan Aeronautics Ltd (HAL) – A flagship in self-reliance, building fighter jets, helicopters, and defence systems domestically.

- Next Gen Edge: Increased defence budgets, drone tech, and space exploration (ISRO + private sector).

b) Railways & Infrastructure – Connecting a Modern India

- Why it matters: Economic corridors, freight efficiency, and tourism growth.

- Stock Spotlight: RVNL and IRCTC – From high-speed rail to digital ticketing dominance.

- Next Gen Edge: Bullet trains, smart stations, and integrated logistics hubs.

c) Green Energy & EV Revolution – Powering Tomorrow

- Why it matters: Climate commitments and cost efficiency.

- Stock Spotlight: Tata Power, NTPC Green – Solar, wind, and EV charging infrastructure.

- Next Gen Edge: Government incentives, green bonds, and EV adoption growth.

d) Technology & Digital India – From Code to Cloud

- Why it matters: AI, cybersecurity, SaaS, and global IT services demand.

- Stock Spotlight: Infosys, TCS – Stable growth, strong global clients, and R&D leadership.

- Next Gen Edge: AI integration, global expansion, and digital public infrastructure exports.

e) Agriculture & Rural Consumption – Feeding Growth

- Why it matters: 60% of India’s population relies on agriculture for livelihood.

- Stock Spotlight: ITC, Godrej Agrovet – FMCG + agri-business synergy.

- Next Gen Edge: Smart farming, agri-tech startups, and cold-chain logistics.

f) Healthcare & Pharma – Wellness as Wealth

- Why it matters: Healthcare access, medical exports, and biotech innovation.

- Stock Spotlight: Dr. Reddy’s, Sun Pharma – Global generics leadership and specialty pharma growth.

- Next Gen Edge: Telemedicine, biotech, and affordable healthcare models.

g) Banking & Financial Inclusion – The Money Movers

- Why it matters: Access to credit, digital payments, and financial literacy.

- Stock Spotlight: SBI, HDFC Bank – Massive rural penetration and digital transformation.

- Next Gen Edge: UPI dominance, microfinance expansion, and AI-driven lending.

3. Historical Market Reflection – Lessons for the Next Gen

India’s capital markets have transformed from a niche investment avenue for a few elites in the 1950s to a retail-driven powerhouse with over 14 crore demat accounts in 2025.

Market Journey at a Glance:

| Year | Sensex Level | Key Event |

|---|---|---|

| 1947 | 150 (estimated) | Independence |

| 1991 | 450 | Economic reforms |

| 2000 | 5,000 | IT boom |

| 2008 | 21,000 | Pre-global crisis |

| 2020 | 25,000 | COVID crash |

| 2025 | 80,500+ | Record highs |

📊 The takeaway for Next Gen investors: Patience, sector rotation, and staying invested in structural growth stories can generate exponential wealth.

4. Women in the Next Gen Market

Financial independence is the true freedom. Women investors are rising rapidly:

- Participation in 2000: 5%

- Participation in 2025: 25% of direct equity, 30% in mutual funds.

- Drivers: Financial literacy apps, online trading, work-from-home flexibility, and rising incomes.

The next generation of women will not just be investors — they will be fund managers, startup founders, and wealth creators.

5. The Next Gen Portfolio – Building Wealth for 2047

A diversified Independence Day Special: Next Gen Portfolio could include:

| Sector | Stock | Theme |

|---|---|---|

| Defence | HAL | Self-reliance in security |

| Railways | RVNL | Infrastructure transformation |

| Green Energy | Tata Power | Sustainable growth |

| Technology | Infosys | Digital leadership |

| Agriculture | ITC | Rural consumption |

| Healthcare | Dr. Reddy’s | Global healthcare reach |

| Banking | HDFC Bank | Financial inclusion |

💡 Strategy: 60% core blue chips, 25% growth leaders, 15% high-risk/high-reward small/mid caps.

6. Conclusion – The Next 22 Years Are Ours to Build

As we celebrate 78 years of independence, the baton is firmly in the hands of the Next Gen of India — a generation that is tech-savvy, globally connected, and determined to make India self-reliant in every sector.

The path to 2047 will not just be measured in GDP numbers but in:

- The strength of our markets.

- The inclusivity of our growth.

- The empowerment of every citizen through financial literacy and investment.

Freedom is not just about living without chains — it’s about living with choices.

This Independence Day, let’s pledge to build portfolios that reflect our nation’s resilience, ambition, and unstoppable march into the future.

📌 For daily trade setups, technical learning, and smart investing tips, stay tuned to CapitalKeeper.in

📌 For more real-time updates, trade setups, and investment insights — follow us on [Telegram] and [WhatsApp Channel] subscribe to our newsletter!

Subscribe Now , Join Telegram the Crypto Capital Club, Get Free Crypto Updates

📌 Disclaimer

The content provided on CapitalKeeper.in is for informational and educational purposes only and does not constitute investment, trading, or financial advice. While we strive to present accurate and up-to-date market data and analysis, we make no warranties or representations regarding the completeness, reliability, or accuracy of the information.

Stock market investments are subject to market risks, and readers/investors are advised to conduct their own due diligence or consult a SEBI-registered financial advisor before making any investment decisions. CapitalKeeper and its authors are not liable for any loss or damage, direct or indirect, arising from the use of this information.

All views and opinions expressed are personal and do not reflect the official policy or position of any agency or organization. Past performance is not indicative of future results.By using this website, you agree to the terms of this disclaimer.

Ranjit Sahoo

Founder & Chief Editor – CapitalKeeper.in

Ranjit Sahoo is the visionary behind CapitalKeeper.in, a leading platform for real-time market insights, technical analysis, and investment strategies. With a strong focus on Nifty, Bank Nifty, sector trends, and commodities, she delivers in-depth research that helps traders and investors make informed decisions.

Passionate about financial literacy, Ranjit blends technical precision with market storytelling, ensuring even complex concepts are accessible to readers of all levels. Her work covers pre-market analysis, intraday strategies, thematic investing, and long-term portfolio trends.

When he’s not decoding charts, Ranjit enjoys exploring coastal getaways and keeping an eye on emerging business themes.

📌 Follow Ranjit on:

LinkedIn | Twitter/X | Instagram | ✉️ contact@capitalkeeper.in