Fashion Retail Growth Engines: India’s Consumerism, D2C & Lifestyle Boom 16 Aug 2025

By CapitalKeeper | Retail & Lifestyle Brands Theme | Indian Equities | Market Moves That Matter

🛒 Day 1 – Retail & Lifestyle Brands Theme

Trent & V-Mart: Fashion Retail Growth Engines Driving India’s Consumerism

📌 Introduction: India’s Fashion Retail Growth Story

India’s fashion & lifestyle retail sector is undergoing a massive transformation. From luxury malls in metros to budget-friendly outlets in Tier-3 towns, consumer spending is at an all-time high. Lifestyle aspirations, social media influence, and rising disposable incomes are fueling this growth.

Two clear winners have emerged in this transformation: Trent Ltd (Tata Group’s retail arm) and V-Mart Retail Ltd. Both cater to very different segments – Trent focusing on premium + affordable fashion (Westside, Zudio, Zara JV) and V-Mart leading in Tier-2/3 India with value fashion. Together, they showcase India’s retail dual growth engine.

🏬 Trent Ltd – Premium + Affordable Fashion Mix

Business Model:

- Westside: Mid-premium lifestyle chain, fashion apparel & accessories.

- Zudio: Mass-market fast fashion (₹300–₹700 range), growing aggressively.

- Zara JV: Premium positioning, global fashion partnership.

- Star Bazaar: Grocery & lifestyle mix (still a small part).

Why it Matters:

- Zudio has become a category disruptor, rapidly expanding across India.

- Westside maintains strong brand loyalty in urban millennials.

- Digital-first campaigns + Tata Neu integration = strong omni-channel play.

Financials & Growth:

- Revenue CAGR (3 yrs): 25%

- EBITDA margin: 12–14% (among the best in retail)

- Debt-light structure, backed by Tata Group credibility.

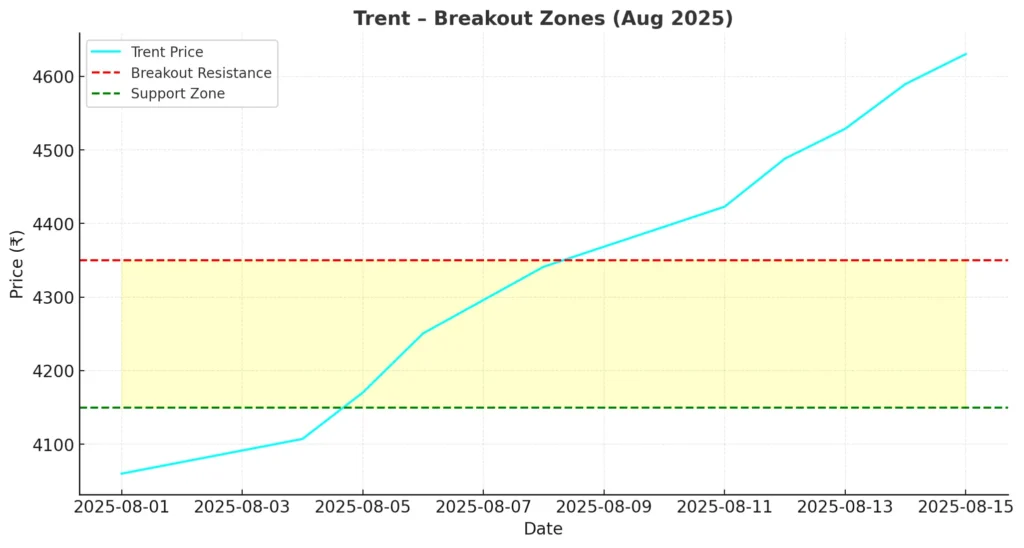

📊 Trent Technical Analysis (Aug 2025)

- CMP: ₹5,370

- 52W Range: ₹4,488 – ₹8,345

- Trend: Strong bullish consolidation.

- Support Zones: ₹5,316 / ₹5,272

- Breakout Level: ₹5,405 (sustained close above = next leg up).

- Upside Targets: ₹5,900 → ₹6,200 medium-term.

- Risk Management: SL at ₹5272.

Chart Insight:

Trent has been consolidating near its lifetime highs, forming a triangle breakout pattern. A breakout above ₹5,250 could trigger strong momentum led by Zudio’s expansion narrative.

🏬 V-Mart Retail – Tier-2 & Tier-3 India’s Fashion Leader

Business Model:

- Operates value fashion stores across small towns.

- Focus on affordable clothing (₹150–₹500 range).

- Expanding into lifestyle accessories + footwear.

Why it Matters:

- Penetration in underserved regions where Reliance & Trent are only beginning.

- Increasing aspirational demand from rural & semi-urban households.

- Expansion strategy targets 50–70 new stores per year.

- Strong link to India’s rural consumption story.

Financials & Growth:

- Revenue CAGR (3 yrs): 18%

- Margins thin (EBITDA 7–8%) due to value pricing.

- Debt under control, steady expansion.

📊 V-Mart Technical Analysis (Aug 2025)

- CMP: ₹741

- 52W Range: ₹676 – ₹1130

- Trend: Recovery after long consolidation.

- Support Zones: ₹714 / ₹732

- Breakout Level: ₹745 (swing breakout).

- Upside Targets: ₹760 → ₹768 short-term.

- Risk Management: SL at ₹714.

Chart Insight:

V-Mart has recently bounced from ₹2,500 support, forming a rounded bottom pattern. Sustained momentum above ₹2,900 could re-rate the stock higher towards ₹3,200 levels.

🔑 Investor Takeaways

| Stock | Theme Focus | Short-Term View | Long-Term View |

|---|---|---|---|

| Trent | Premium + Affordable fashion (Westside + Zudio) | Breakout above ₹5,250 targets ₹5,900 | Strong compounding story with Tata backing |

| V-Mart | Tier-2/3 affordable fashion | Recovery above ₹2,900 targets ₹3,250 | Beneficiary of rural consumption & retail penetration |

👩💼 Investor Fit: Women Users Turned Investors

- Trent (Westside + Zudio): Urban millennial women, college-goers, working professionals who shop frequently.

- V-Mart: Rural & small-town families, value-conscious homemakers, women in Tier-2/3 India.

These consumer-investors understand the brands they wear daily, making them natural candidates to invest.

📌 Conclusion

Day 1 of the Retail & Lifestyle Brands theme shows why Trent & V-Mart are the twin pillars of India’s retail consumption story. While Trent thrives on premium + affordable urban fashion, V-Mart captures the aspirational demand of semi-urban India.

📌 For daily trade setups, technical learning, and smart investing tips, stay tuned to CapitalKeeper.in

📌 For more real-time updates, trade setups, and investment insights — follow us on [Telegram] and [WhatsApp Channel] subscribe to our newsletter!

Subscribe Now , Join Telegram the Crypto Capital Club, Get Free Crypto Updates

📌 Disclaimer

The content provided on CapitalKeeper.in is for informational and educational purposes only and does not constitute investment, trading, or financial advice. While we strive to present accurate and up-to-date market data and analysis, we make no warranties or representations regarding the completeness, reliability, or accuracy of the information.

Stock market investments are subject to market risks, and readers/investors are advised to conduct their own due diligence or consult a SEBI-registered financial advisor before making any investment decisions. CapitalKeeper and its authors are not liable for any loss or damage, direct or indirect, arising from the use of this information.

All views and opinions expressed are personal and do not reflect the official policy or position of any agency or organization. Past performance is not indicative of future results.By using this website, you agree to the terms of this disclaimer.

Ranjit Sahoo

Founder & Chief Editor – CapitalKeeper.in

Ranjit Sahoo is the visionary behind CapitalKeeper.in, a leading platform for real-time market insights, technical analysis, and investment strategies. With a strong focus on Nifty, Bank Nifty, sector trends, and commodities, she delivers in-depth research that helps traders and investors make informed decisions.

Passionate about financial literacy, Ranjit blends technical precision with market storytelling, ensuring even complex concepts are accessible to readers of all levels. Her work covers pre-market analysis, intraday strategies, thematic investing, and long-term portfolio trends.

When he’s not decoding charts, Ranjit enjoys exploring coastal getaways and keeping an eye on emerging business themes.

📌 Follow Ranjit on:

LinkedIn | Twitter/X | Instagram | ✉️ contact@capitalkeeper.in