Decentralized Identity & Privacy Solutions in Crypto | ZKPs, zk-Rollups & Private Transactions

By CapitalKeeper | Crypto Capital | Crypto Currency | Market Moves That Matter

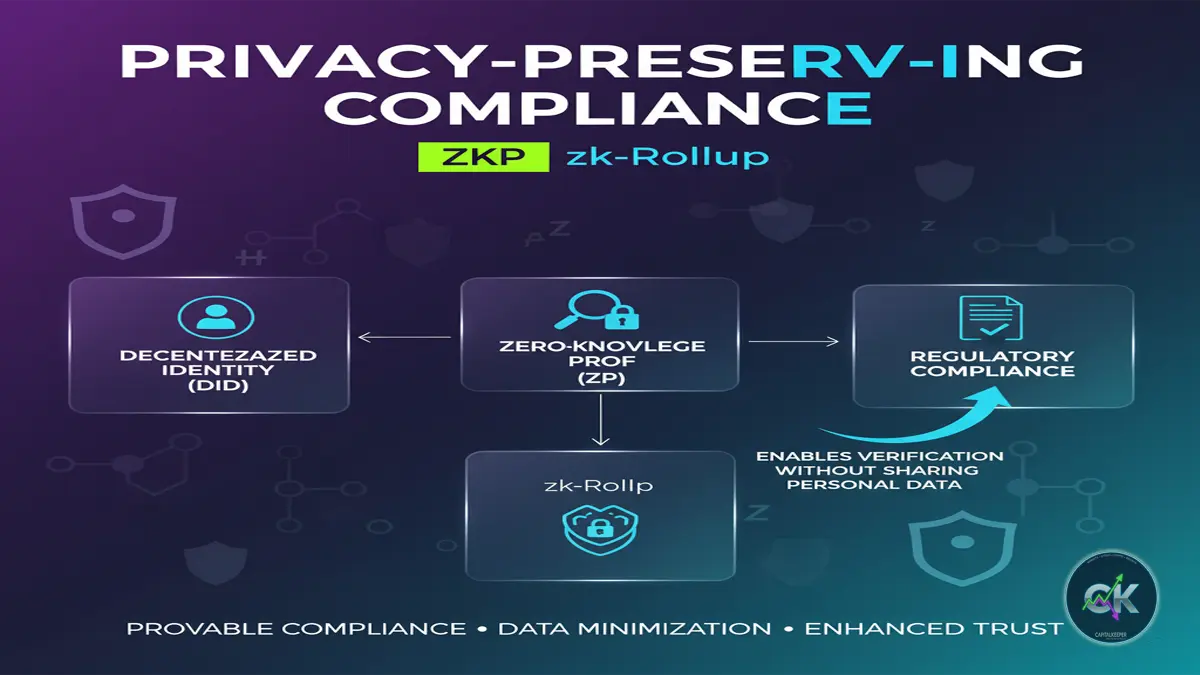

Explore how decentralized identity and privacy solutions like zero-knowledge proofs, zk-rollups, and private transactions are shaping crypto compliance and user privacy in 2025.

Introduction

As the cryptocurrency ecosystem matures, the tension between regulatory compliance and user privacy has intensified. Governments worldwide are introducing stricter Know-Your-Customer (KYC) rules, anti-money laundering (AML) requirements, and other regulatory frameworks. Meanwhile, users increasingly demand privacy and autonomy in their financial interactions.

Decentralized identity (DID) and privacy-focused technologies are emerging as a solution. They promise to verify identity and ensure compliance without compromising user confidentiality.

In this blog, we explore the most prominent tools and trends in this space: zero-knowledge proofs (ZKPs), zk-rollups, and private transaction models.

What Are Decentralized Identities (DIDs)?

Decentralized identities allow users to control their digital identity without relying on a central authority. Unlike traditional KYC processes, which require sharing sensitive personal information with banks or exchanges, DIDs enable selective disclosure.

Key benefits include:

- User Control: Individuals decide which pieces of information to share.

- Reduced Risk: Fewer central points of failure mean less exposure to data breaches.

- Regulatory Compliance: Platforms can verify identities without storing full personal data.

DIDs are already gaining traction on blockchain platforms like Ethereum, Solana, and Polygon, with interoperable standards like W3C DID facilitating adoption.

Zero-Knowledge Proofs (ZKPs): Verifying Without Revealing

Zero-knowledge proofs are cryptographic tools that allow one party to prove knowledge of certain data without revealing the data itself. For crypto users, this means proving compliance without exposing sensitive personal details.

Applications in Crypto:

- Private KYC Verification: Exchanges can verify that users meet regulatory requirements without storing full personal data.

- Confidential Transactions: Protocols like Zcash leverage ZKPs to hide transaction amounts while proving validity.

- Identity Verification on DeFi Platforms: Lending and staking platforms can confirm eligibility for services while maintaining user privacy.

As privacy becomes a priority, ZKPs are expected to underpin most decentralized identity solutions.

zk-Rollups: Scaling Privacy with Efficiency

zk-Rollups are layer-2 scaling solutions that bundle multiple transactions into a single proof, drastically improving blockchain throughput while maintaining privacy.

Why zk-Rollups Matter:

- Privacy: Transactions can be processed off-chain while proving legitimacy on-chain.

- Lower Fees: Batch processing reduces gas costs.

- Regulatory Alignment: zk-Rollups can integrate identity compliance checks without exposing personal data.

Projects like Polygon zkEVM and StarkNet are leading the charge, enabling faster and more confidential transactions on Ethereum-compatible networks.

Private Transaction Models: Beyond ZKPs

While ZKPs and zk-rollups dominate the narrative, other privacy solutions are gaining momentum:

- Ring Signatures: Used by Monero to obfuscate sender identity.

- Stealth Addresses: Ensure recipient addresses remain private.

- Mixers: Services like Tornado Cash anonymize transaction trails.

These tools reinforce the principle that privacy and compliance can coexist in crypto ecosystems, ensuring a user-first experience.

The Road Ahead: Balancing Compliance & Privacy

Regulators are unlikely to relax oversight anytime soon, especially as crypto adoption grows globally. At the same time, users are increasingly aware of the value of data privacy.

The key takeaway: technological innovation in decentralized identity and privacy solutions will define the next generation of crypto platforms. Projects that seamlessly combine compliance, privacy, and user control are poised to dominate the market.

Investors and developers should watch for:

- Protocols integrating DIDs with ZKPs for seamless identity verification.

- Layer-2 solutions like zk-rollups enabling private, scalable transactions.

- Privacy-first DeFi platforms gaining adoption amid tightening regulations.

The future of crypto is private, compliant, and user-centric—and decentralized identity is at its core.

📌 For daily trade setups, technical learning, and smart investing tips, stay tuned to CapitalKeeper.in

📌 For more real-time updates, trade setups, and investment insights — follow us on [Telegram] and [WhatsApp Channel] subscribe to our newsletter!

Subscribe Now , Join Telegram the Crypto Capital Club, Get Free Crypto Updates

📌 Disclaimer

The content provided on CapitalKeeper.in is for informational and educational purposes only and does not constitute investment, trading, or financial advice. While we strive to present accurate and up-to-date market data and analysis, we make no warranties or representations regarding the completeness, reliability, or accuracy of the information.

Stock market investments are subject to market risks, and readers/investors are advised to conduct their own due diligence or consult a SEBI-registered financial advisor before making any investment decisions. CapitalKeeper and its authors are not liable for any loss or damage, direct or indirect, arising from the use of this information.

All views and opinions expressed are personal and do not reflect the official policy or position of any agency or organization. Past performance is not indicative of future results.By using this website, you agree to the terms of this disclaimer.

Ranjit Sahoo

Founder & Chief Editor – CapitalKeeper.in

Ranjit Sahoo is the visionary behind CapitalKeeper.in, a leading platform for real-time market insights, technical analysis, and investment strategies. With a strong focus on Nifty, Bank Nifty, sector trends, and commodities, she delivers in-depth research that helps traders and investors make informed decisions.

Passionate about financial literacy, Ranjit blends technical precision with market storytelling, ensuring even complex concepts are accessible to readers of all levels. Her work covers pre-market analysis, intraday strategies, thematic investing, and long-term portfolio trends.

When he’s not decoding charts, Ranjit enjoys exploring coastal getaways and keeping an eye on emerging business themes.

📌 Follow Ranjit on:

LinkedIn | Twitter/X | Instagram | ✉️ contact@capitalkeeper.in

Leave a Reply