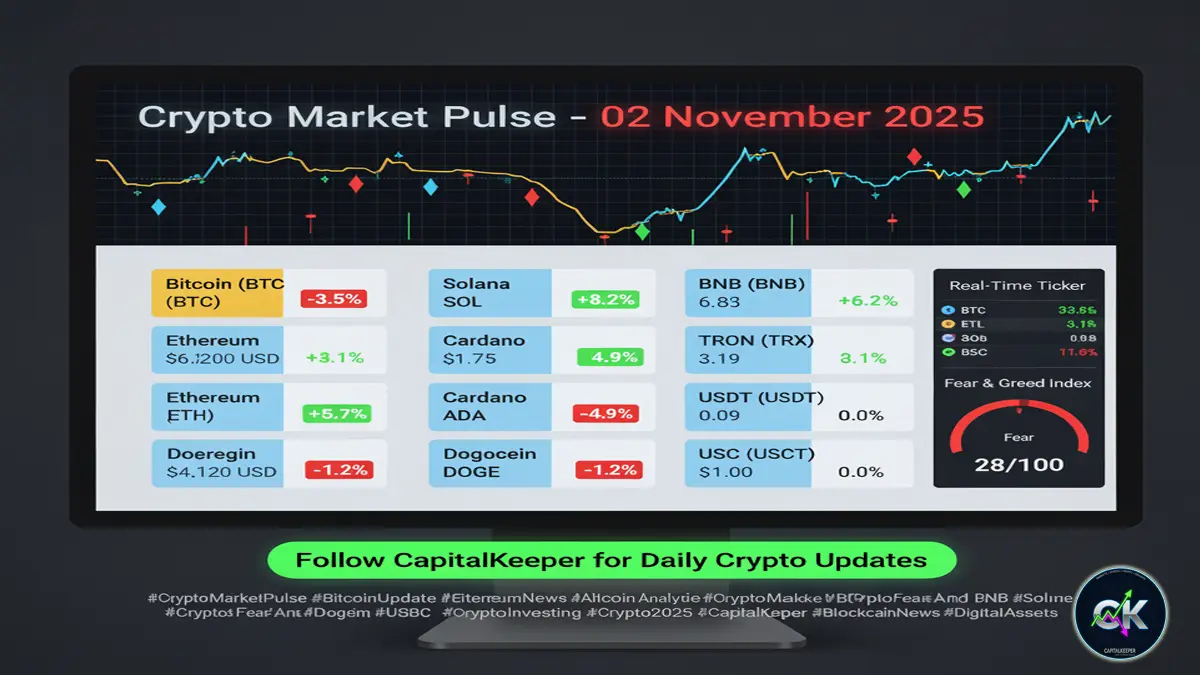

Crypto Market Pulse 14 Aug 2025: Bitcoin at $120,895, ETH Nears $4,720, Altcoins Show Mixed Trends

By CapitalKeeper | Capital Crypto | Crypto Market | Market Moves That Matter

Crypto Market Pulse – 14 August 2025

Bitcoin Holds Above $120K, Ethereum Strengthens, Altcoins Show Mixed Performance

The crypto market is riding a wave of cautious optimism today, with Bitcoin (BTC) holding firm above the $120K mark and Ethereum (ETH) sustaining its bullish momentum. While some altcoins surged in double digits earlier this week, today’s price action reveals a more balanced picture—some tokens cooling off, others pushing higher.

In this Market Pulse, we break down BTC and ETH technical setups, altcoin gainers/losers, market sentiment indicators, and on-chain trends that could hint at the next major move.

1. Bitcoin (BTC) – Stability Above $120K Signals Confidence

- Price: $120,895.19

- 24h Change: +0.21%

- 7d Change: +3.81%

- Market Cap: $2.4T

- 24h Volume: $98.36B

Bitcoin’s ability to maintain support above $120K is significant. The market’s fear and greed index at 68 (Greed) shows traders leaning toward optimism but not yet in “euphoria” territory. The modest 24-hour gain of 0.21% suggests consolidation rather than a reversal.

Short-Term Technicals:

- Support: $119,500

- Resistance: $121,800

- Momentum: RSI remains in neutral-high range, hinting at room for a breakout if volume increases.

Market Outlook:

As long as BTC holds above $120K, bulls remain in control. A push beyond $122K could open the door to $125K in the near term.

2. Ethereum (ETH) – Sustained Strength Above $4,700

- Price: $4,718.74

- 24h Change: +0.59%

- 7d Change: +23.86%

- Market Cap: $569.59B

- 24h Volume: $61.67B

Ethereum has been the standout performer in the top two cryptos, with a weekly gain of nearly 24%. Strong network activity from Layer-2 rollups, DeFi protocols, and NFT platforms has fueled demand.

Short-Term Technicals:

- Support: $4,600

- Resistance: $4,800

- Momentum: High buying pressure from institutions as ETH staking yields remain attractive.

Market Outlook:

If ETH breaks above $4,800, a run toward $5,000 becomes highly probable—especially with upcoming network scalability upgrades in Q4 2025.

3. Altcoin Overview – Mixed Signals Across the Board

Top 3 Altcoin Movers Today

BNB (Binance Coin)

- Price: $862.91 (+1.12% / 24h, +11.07% / 7d)

- Steady growth thanks to continued adoption in Binance’s DeFi ecosystem.

Cardano (ADA)

- Price: $0.9679 (+10.52% / 24h)

- The biggest percentage gainer in the top 10 today, driven by smart contract upgrade hype.

Useless (USELESS)

- Price: $0.2816 (+31.53% / 24h)

- Highly speculative but capturing attention on DexScan trending list.

Notable Declines

XRP: $3.21 (-2.40% / 24h) — Minor correction after a strong weekly run.

MOON: $0.0003815 (-48.39% / 24h) — Sharp sell-off after pump-driven rally.

4. On-Chain Trends – What the Data Shows

Bitcoin On-Chain Signals:

- Exchange inflows remain low → traders prefer holding over selling.

- Whale wallets accumulation trend continues for the fourth consecutive week.

Ethereum On-Chain Signals:

- Staked ETH continues to rise, locking more supply.

- DeFi TVL (total value locked) on Ethereum has grown 9% this week.

Altcoins On-Chain:

- Cardano’s daily active addresses surged 15%, hinting at sustained demand.

- Solana’s network throughput remains one of the highest, supporting rapid DeFi adoption.

5. Market Sentiment – Greed But Not Extreme

With the Fear & Greed Index at 68, the market is leaning bullish but not in overheated conditions. Historically, readings between 65-75 often precede short-term consolidation phases before another leg up.

6. Trader Insights – Potential Entry & Exit Levels

BTC:

- Entry zone: $119,500 – $120,200

- Take-profit zone: $121,800 – $123,000

ETH:

- Entry zone: $4,650 – $4,720

- Take-profit zone: $4,800 – $5,000

ADA:

- Entry zone: $0.90 – $0.94

- Watch for potential $1 breakout.

7. What to Watch Next

- Macro Factors: US inflation data release next week could impact risk asset sentiment.

- Altcoin Season Index: Currently at 41/100 — not yet in full altcoin season, meaning BTC still leads market structure.

- Ethereum Upgrades: Any confirmed testnet results could push ETH past $5K.

Closing Thoughts

Today’s crypto market shows healthy stability in Bitcoin, strong momentum in Ethereum, and mixed but interesting moves in altcoins. For traders, the strategy is to ride the BTC-ETH wave while being selective with altcoin exposure. For long-term investors, current levels still offer opportunities before potential Q4 rallies.

If BTC holds above $120K for the rest of the week and ETH crosses $4,800, we could see renewed bullish acceleration heading into late August.

📌 For daily trade setups, technical learning, and smart investing tips, stay tuned to CapitalKeeper.in

📌 For more real-time updates, trade setups, and investment insights — follow us on [Telegram] and [WhatsApp Channel] subscribe to our newsletter!

Subscribe Now , Join Telegram the Crypto Capital Club, Get Free Crypto Updates

📌 Disclaimer

The content provided on CapitalKeeper.in is for informational and educational purposes only and does not constitute investment, trading, or financial advice. While we strive to present accurate and up-to-date market data and analysis, we make no warranties or representations regarding the completeness, reliability, or accuracy of the information.

Stock market investments are subject to market risks, and readers/investors are advised to conduct their own due diligence or consult a SEBI-registered financial advisor before making any investment decisions. CapitalKeeper and its authors are not liable for any loss or damage, direct or indirect, arising from the use of this information.

All views and opinions expressed are personal and do not reflect the official policy or position of any agency or organization. Past performance is not indicative of future results.By using this website, you agree to the terms of this disclaimer.

Ranjit Sahoo

Founder & Chief Editor – CapitalKeeper.in

Ranjit Sahoo is the visionary behind CapitalKeeper.in, a leading platform for real-time market insights, technical analysis, and investment strategies. With a strong focus on Nifty, Bank Nifty, sector trends, and commodities, she delivers in-depth research that helps traders and investors make informed decisions.

Passionate about financial literacy, Ranjit blends technical precision with market storytelling, ensuring even complex concepts are accessible to readers of all levels. Her work covers pre-market analysis, intraday strategies, thematic investing, and long-term portfolio trends.

When he’s not decoding charts, Ranjit enjoys exploring coastal getaways and keeping an eye on emerging business themes.

📌 Follow Ranjit on:

LinkedIn | Twitter/X | Instagram | ✉️ contact@capitalkeeper.in

Leave a Reply