Crypto Market Pulse 12 October 2025: Bitcoin Slips Below $111K, Market Cap Falls to $3.69T

By CapitalKeeper | Crypto Market Pulse | Crypto Capital | Market Moves That Matter

The crypto market sees fresh weakness on 12 October 2025 as Bitcoin drops under $111,000 and global capitalization slides to $3.69T. Read our full breakdown, altcoin trends, and what to watch next.

Crypto Market Pulse – 12 October 2025

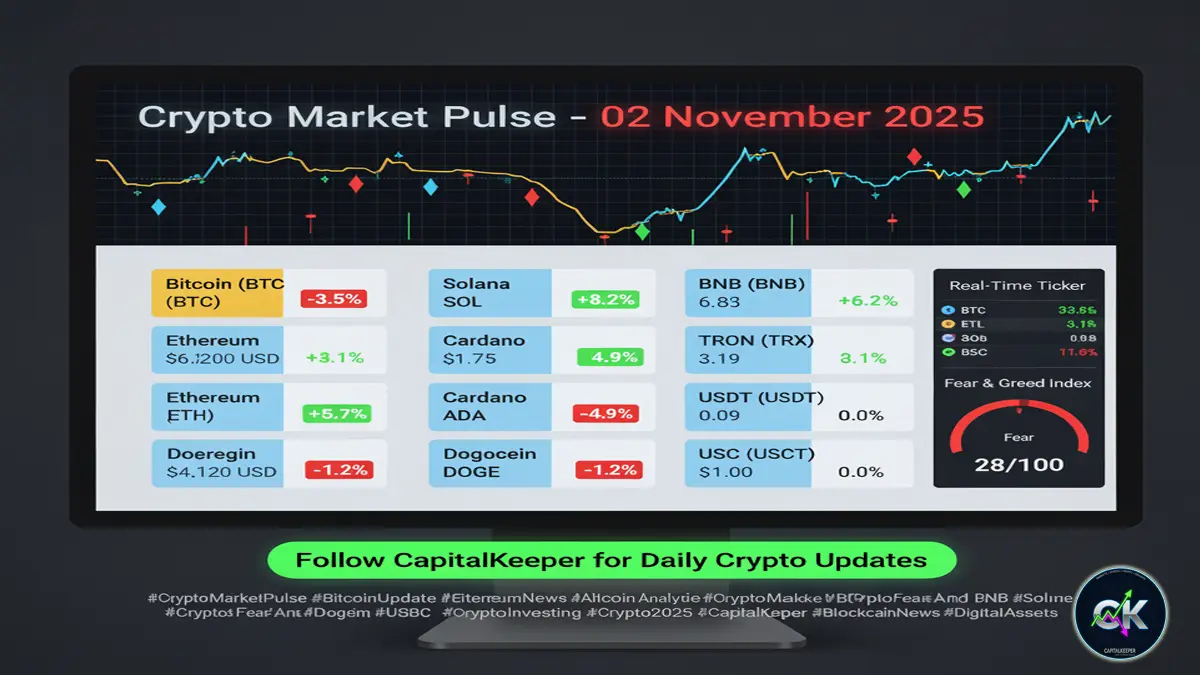

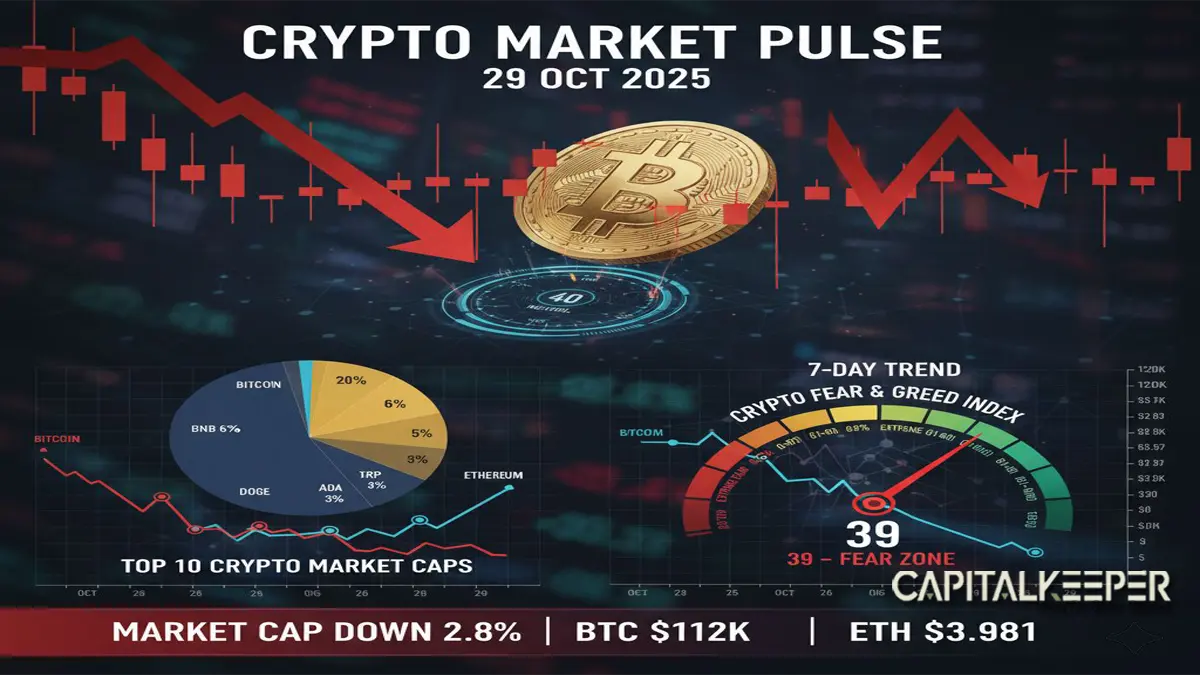

The digital asset markets are feeling the pressure today. On 12 October 2025, the global crypto market cap dipped to $3.69 trillion, marking a ~1.08% decline in the past 24 hours. The CMC20 index, tracking top cryptos, also registered a 1.26% slide, reflecting broad-based weakness. Meanwhile, the Altcoin Index has plunged to 31/100, signaling heavier losses among non-Bitcoin tokens. The Fear & Greed Index stands at 31, entering a “fear” zone as sentiment sours.

These figures show how a broader pullback is underway no longer just a blip, but possibly a transition into a correction phase after a period of exuberance. Below, I break down what’s happening with the major players, underlying dynamics, and what traders and investors should watch going forward.

🟠 Bitcoin (BTC) – Under Pressure

Price: $110,771.02

Change (24h): ▼ 1.47%

Market Cap: ~$2.21 trillion

Bitcoin is taking the lead in today’s downward move, slipping below $111,000. The trigger: intensified macro volatility and geopolitical stress (notably U.S.–China trade rhetoric).

Technical View:

- Support zones to watch: $108,500 → $105,000

- Resistance zones: $113,500 → $115,000

- The drop has pushed BTC below short-term moving averages, showing weakened momentum.

- A break below $108K could open the door to deeper retracement, while reclaiming $113K–$115K would be needed to restore buyer confidence.

On balance, today’s weakness appears partially driven by liquidations: over $16 billion in long positions were cleared across major assets in recent sessions.

🟣 Ethereum (ETH) – Stronger Hold, But Vulnerable

Price: $3,784.16

Change (24h): ▼ 0.36%

Market Cap: ~$457.26 billion

Ethereum’s drop has been milder compared to Bitcoin’s, suggesting some resilience. But after testing near $4,000 earlier in the week, ETH is now clearly under pressure.

Key Observations:

- A critical support band lies between $3,700 and $3,500

- Resistance is back in play near $4,000

- If ETH fails to hold above $3,700, we could see deeper retractions in DeFi and staking sectors

- On-chain metrics show network activity cooling slightly, though core usage remains stable

💡 Altcoins – Divergence and Exaggerated Moves

BNB & Others

Tokens like BNB, SOL, XRP, ADA, and others are suffering bigger downside compared to BTC and ETH. The reason: high beta, thinner liquidity, and reactive sentiment flows.

- Solana (SOL): One of the heavier hit names, with double-digit corrections in some pairs. It’s more sensitive to speculative capital.

- XRP / ADA / Others: These tend to amplify the move weaker tokens suffer greater drawdowns in a risk-off environment.

Stablecoins / Safe Zones

During the slide, stablecoins like USDT and USDC see increased demand. These act as capital parking zones until clarity returns.

📉 Sentiment & Liquidation Stress

The shift in sentiment is evident: the Fear & Greed Index at 31 indicates fear is creeping into market psychology.

Additionally, the $16B+ liquidation event is one of the largest in crypto history. Such sweeping forced exits can exacerbate down moves, create cascades, and test technical supports across assets.

The question now: is this a temporary market shakeout (a “flush”) or the beginning of a deeper correction? Many analysts lean toward a multi-phase bottoming process.

🔍 What’s Driving Today’s Weakness?

- Macro & Trade Tensions

The re-escalation of U.S.–China trade rhetoric (tariff threats) has triggered broad risk-off behavior across equities and crypto. - Profit-Taking & Overbought Conditions

After strong ETF inflows earlier in October and new highs (Bitcoin pushing past $125,000 recently) , many traders booked profits, adding fuel to the downside. - Liquidity & Derivative Excess

The high leverage in derivatives amplified the move forced liquidations add downward pressure. - ETF Inflow Plateau

While early October saw record ETF inflows, momentum may now be pausing or reversing, reducing tailwinds.

🧭 What Should Traders & Investors Watch?

| Focus Area | Key Levels / Signals |

|---|---|

| Bitcoin | $108K – $113K pivot zone |

| Ethereum | $3,700 support, $4,000 resistance |

| Altcoins | Watch for capitulation followed by bounce candidates |

| Liquidity Zones | Stablecoin flows, exchange inflows/outflows |

| Macro Signals | U.S. CPI, Fed commentary, trade policy updates |

| ETF Trends | Direction and strength of institutional flows |

A sustained rebound likely depends on BTC recapturing $113K–$115K range. If that fails, deeper support down to $105K may come into play.

✅ Final Thoughts

The Crypto Market Pulse for 12 October 2025 signals a turning point. The bulls who drove prices higher now face stronger resistance, and forced liquidations have shaken the structure. Bitcoin slipping under $111K and capped ETF momentum add to the uncertainty.

Yet, the fundamentals aren’t broken. The prior record inflows, continued institutional backing, and developer activity remain intact beneath this volatility. This correction could be the cleansing before the next leg up if markets stabilize.

For now: tread carefully, respect trend breaks, and watch for signs of capitulation or bounce setups. The next few sessions will determine whether we resume the uptrend or enter a deeper consolidation phase.

📌 For daily trade setups, technical learning, and smart investing tips, stay tuned to CapitalKeeper.in

📌 For more real-time updates, trade setups, and investment insights — follow us on [Telegram] and [WhatsApp Channel] subscribe to our newsletter!

Subscribe Now , Join Telegram the Crypto Capital Club, Get Free Crypto Updates

📌 Disclaimer

The content provided on CapitalKeeper.in is for informational and educational purposes only and does not constitute investment, trading, or financial advice. While we strive to present accurate and up-to-date market data and analysis, we make no warranties or representations regarding the completeness, reliability, or accuracy of the information.

Stock market investments are subject to market risks, and readers/investors are advised to conduct their own due diligence or consult a SEBI-registered financial advisor before making any investment decisions. CapitalKeeper and its authors are not liable for any loss or damage, direct or indirect, arising from the use of this information.

All views and opinions expressed are personal and do not reflect the official policy or position of any agency or organization. Past performance is not indicative of future results.By using this website, you agree to the terms of this disclaimer.

Ranjit Sahoo

Founder & Chief Editor – CapitalKeeper.in

Ranjit Sahoo is the visionary behind CapitalKeeper.in, a leading platform for real-time market insights, technical analysis, and investment strategies. With a strong focus on Nifty, Bank Nifty, sector trends, and commodities, she delivers in-depth research that helps traders and investors make informed decisions.

Passionate about financial literacy, Ranjit blends technical precision with market storytelling, ensuring even complex concepts are accessible to readers of all levels. Her work covers pre-market analysis, intraday strategies, thematic investing, and long-term portfolio trends.

When he’s not decoding charts, Ranjit enjoys exploring coastal getaways and keeping an eye on emerging business themes.

📌 Follow Ranjit on:

LinkedIn | Twitter/X | Instagram | ✉️ contact@capitalkeeper.in

Leave a Reply