🌄 Commodity Morning Outlook – 28 May 2025

By CapitalKeeper | Market Opening | Indian Commodities | Market Moves That Matter

As the commodities market kicks off mid-week trade, global sentiments remain cautiously optimistic. With traders factoring in interest rate expectations, crude inventory data, and geopolitical cues, gold and oil are likely to stay volatile. Let’s look at key indicators that could drive the market today.

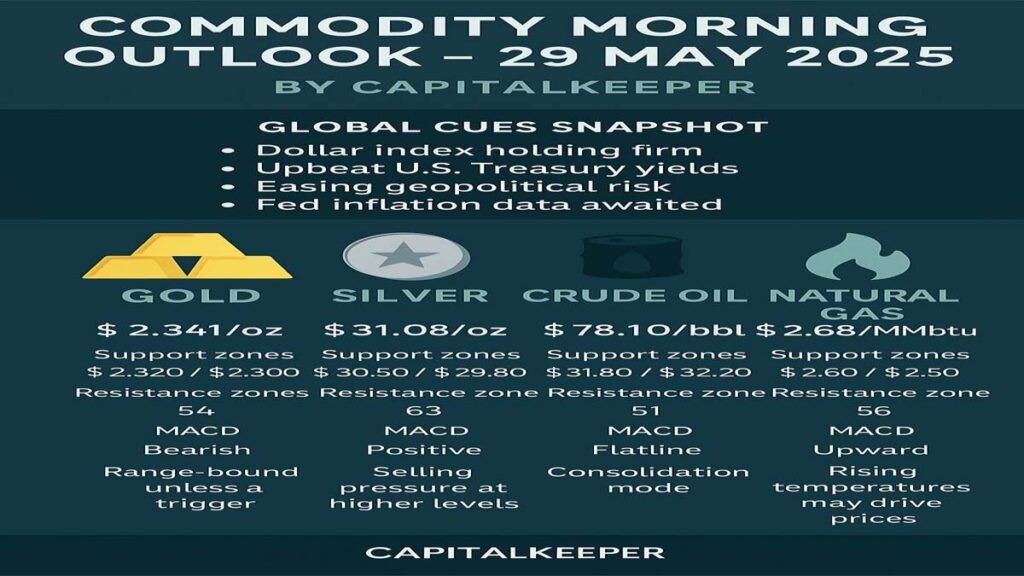

🌍 Global Cues Snapshot

- Dollar Index (DXY): Holding firm near 104.60; pressure remains on bullion.

- US Treasury Yields: Slight uptick to 4.45%; dampens gold sentiment.

- Geopolitical Risk: Easing Middle East tensions leading to mild profit booking in crude oil.

- Fed Outlook: Markets await inflation data next week for policy clarity.

🔥 Today’s Hot Commodity Moves

1. GOLD (MCX June Futures) – Safe-Haven Demand Rises

- Why? Weak global equities & geopolitical tensions boost gold.

- Key Levels:

- Support: ₹72,500/10gm

- Resistance: ₹73,800/10gm

- Trade Idea: Buy on dips towards ₹72,800 with SL below ₹72,300.

- RSI: 54 – Neutral

- MACD: Bearish divergence forming

2. SILVER (MCX July Futures) – Follows Gold’s Shine

- Why? Industrial demand picks up alongside gold’s rally.

- Key Levels:

- Support: ₹92,000/kg

- Resistance: ₹94,500/kg

- Trade Idea: Go long if it sustains above ₹92,500.

3. CRUDE OIL (MCX June Futures) – Under Pressure

- Why? OPEC+ supply fears & weak China demand weigh on prices.

- Key Levels:

- Support: ₹6,200/barrel

- Resistance: ₹6,550/barrel

- Trade Idea: Sell rallies near ₹6,500 with SL above ₹6,600.

4. NATURAL GAS – Volatility Ahead

- Why? Weather forecasts & US inventory data in focus.

- Key Levels:

- Support: ₹240/mmBtu

- Resistance: ₹260/mmBtu

- Trade Idea: Wait for breakout above ₹255 for fresh longs.

5. BASE METALS (Copper, Zinc) – Weakness Continues

- Why? Slow China recovery hurts industrial metals.

- Key Levels (Copper):

- Support: ₹840/kg

- Resistance: ₹870/kg

- Trade Idea: Avoid fresh longs until China stimulus clarity.

🔍 CapitalKeeper Take:

Avoid aggressive longs near resistance. Safer trades possible near the lower band of $2,320 with tight SL.

✅ CapitalKeeper’s Strategic View

- Gold & Silver: Sideways to slightly bearish bias; prefer lower-level buying.

- Crude Oil: Range-bound, wait-and-watch mode ahead of inventory data.

- Natural Gas: Slight bullish bias; good for momentum scalping.

- Dollar Index: As long as DXY stays above 104.50, commodities may face upside resistance.

📋 Tips for Commodity Traders Today

- Gold & Silver: Safe-haven bets – Buy small dips.

- Crude Oil: Bearish bias – Sell on rallies.

- Metals: Avoid aggressive positions till global cues improve.

Follow CapitalKeeper for real-time commodity insights!

- Keep your trades tight and risk-controlled amid consolidation patterns.

- Focus on data release timing — EIA for crude, natural gas storage, and global inflation cues.

- Be cautious of false breakouts; wait for volume confirmation.

📌 Disclaimer

The content provided on CapitalKeeper.in is for informational and educational purposes only and does not constitute investment, trading, or financial advice. While we strive to present accurate and up-to-date market data and analysis, we make no warranties or representations regarding the completeness, reliability, or accuracy of the information.

Stock market investments are subject to market risks, and readers/investors are advised to conduct their own due diligence or consult a SEBI-registered financial advisor before making any investment decisions. CapitalKeeper and its authors are not liable for any loss or damage, direct or indirect, arising from the use of this information.

All views and opinions expressed are personal and do not reflect the official policy or position of any agency or organization. Past performance is not indicative of future results.

By using this website, you agree to the terms of this disclaimer.