Stock Market Closing Bell 30 July 2025: Nifty Holds 24,850; Markets Await Midnight Global Event for Direction

By CapitalKeeper | Closing Bell | Indian Equity | Market Moves That Matter

🔔 Flat Close Ahead of Midnight Global Event: Nifty Ends at 24,855 | 30 July 2025

Indian markets closed flat on 30 July 2025 with Nifty at 24,855 and Bank Nifty at 56,150. Investors await key midnight global event (US Fed decision) for next move. Full sectoral analysis and outlook here.

Market Summary – 30 July 2025

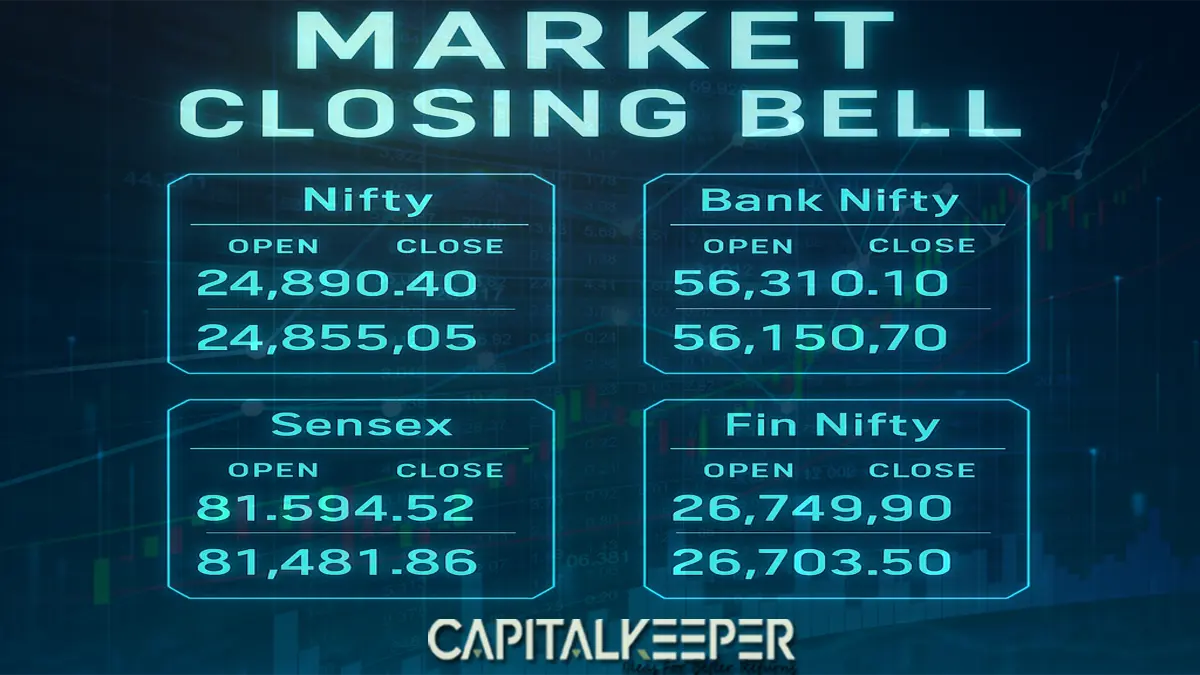

| Index | Open | Close | Change |

|---|---|---|---|

| Nifty 50 | 24,890.40 | 24,855.05 | 🔻 -35.35 pts (-0.14%) |

| Bank Nifty | 56,310.10 | 56,150.70 | 🔻 -159.40 pts (-0.28%) |

| Sensex | 81,594.52 | 81,481.86 | 🔻 -112.66 pts (-0.13%) |

| Fin Nifty | 26,749.90 | 26,703.50 | 🔻 -46.40 pts (-0.17%) |

🧭 Market Recap – Calm Before the Storm

Indian equities ended flat with mild negative bias as traders stayed cautious ahead of the midnight global event – the US Federal Reserve’s policy decision. Nifty oscillated within a narrow range of 120 points, with profit booking in banking and IT offset by buying in FMCG and select autos.

🔍 Key Market Drivers

- US Fed Policy in Focus: Midnight (IST) announcement on interest rates and commentary on inflation outlook.

- FII Activity: Light volumes and reduced positions ahead of global event risk.

- Stock-Specific Action: Jio Finance continued to see momentum; ITC and Britannia supported FMCG pack.

- Earnings Season: Reliance Industries’ results awaited; ICICI Bank results already factored in by markets.

🌍 Global Market Snapshot

- US Futures: Mixed ahead of Fed decision; Nasdaq futures slightly positive.

- European Markets: Flat to negative as investors await Fed signal and Eurozone inflation data.

- Asian Markets: Nikkei lower, Hang Seng mixed, Shanghai mildly positive.

- Commodities: Brent crude steady near $82.20/barrel; gold stable around $2,392/oz.

- Currency: INR closed little changed at 83.72/USD.

📈 Sectoral Performance

Top Gainers:

- FMCG: ITC, HUL supported Nifty with defensive buying.

- Auto: Tata Motors and Bajaj Auto gained on robust sales data.

Top Losers:

- Banking: HDFC Bank, Axis Bank saw profit booking.

- IT: Infosys and TCS remained under pressure ahead of global tech cues.

📌 Notable Stock Highlights

- Jio Finance: Continued positive momentum; crucial driver for Fin Nifty resilience.

- ITC: Defensive play; extended gains amid uncertain global cues.

- HDFC Bank: Weighed on Bank Nifty as traders cut exposure pre-Fed decision.

- Reliance Industries: Mildly higher ahead of results; volatility expected post-announcement.

🔎 Technical Analysis

Nifty 50:

- Support: 24,750 – 24,700

- Resistance: 24,950 – 25,050

- Range-bound with breakout potential post-Fed clarity.

Bank Nifty:

- Support: 56,000 – 55,850

- Resistance: 56,400 – 56,600

- Bias remains sideways until directional global cue emerges.

Fin Nifty:

- Support: 26,600

- Resistance: 26,800

- Consolidating near mid-range.

Midnight Global Event Impact (What to Watch)

- US Federal Reserve Decision: Expected to hold rates but commentary on inflation trajectory and future cuts will be crucial.

- Dollar Index & Bond Yields: Any sharp moves could trigger immediate reaction in rupee and equities at Thursday’s open.

- Global Equities Reaction: Asian market opening cues tomorrow morning will dictate gap-up/gap-down scenario.

CapitalKeeper View

Today’s flat close indicates positioning pause before critical macro event. Expect volatility spike tomorrow at open based on Fed outcome. Short-term traders should maintain tight stop-losses; investors should focus on defensive sectors (FMCG, pharma) until clarity emerges.

📌 For more real-time updates, trade setups, and investment insights — follow us on [Telegram] and [WhatsApp Channel] subscribe to our newsletter!

📌 Disclaimer

The content provided on CapitalKeeper.in is for informational and educational purposes only and does not constitute investment, trading, or financial advice. While we strive to present accurate and up-to-date market data and analysis, we make no warranties or representations regarding the completeness, reliability, or accuracy of the information.

Stock market investments are subject to market risks, and readers/investors are advised to conduct their own due diligence or consult a SEBI-registered financial advisor before making any investment decisions. CapitalKeeper and its authors are not liable for any loss or damage, direct or indirect, arising from the use of this information.

All views and opinions expressed are personal and do not reflect the official policy or position of any agency or organization. Past performance is not indicative of future results.By using this website, you agree to the terms of this disclaimer

Leave a Reply