Closing bell 20 February 2026, Bank Nifty analysis today, Indian stock market closing report, Nifty technical outlook, Sensex today update

Updated: 20 February 2026

Category: Closing Bell | Market Analysis

By CapitalKeeper Research Desk

Nifty Recovers 100 Points but Chart Structure Remains Fragile – Closing Bell Analysis 20 February 2026

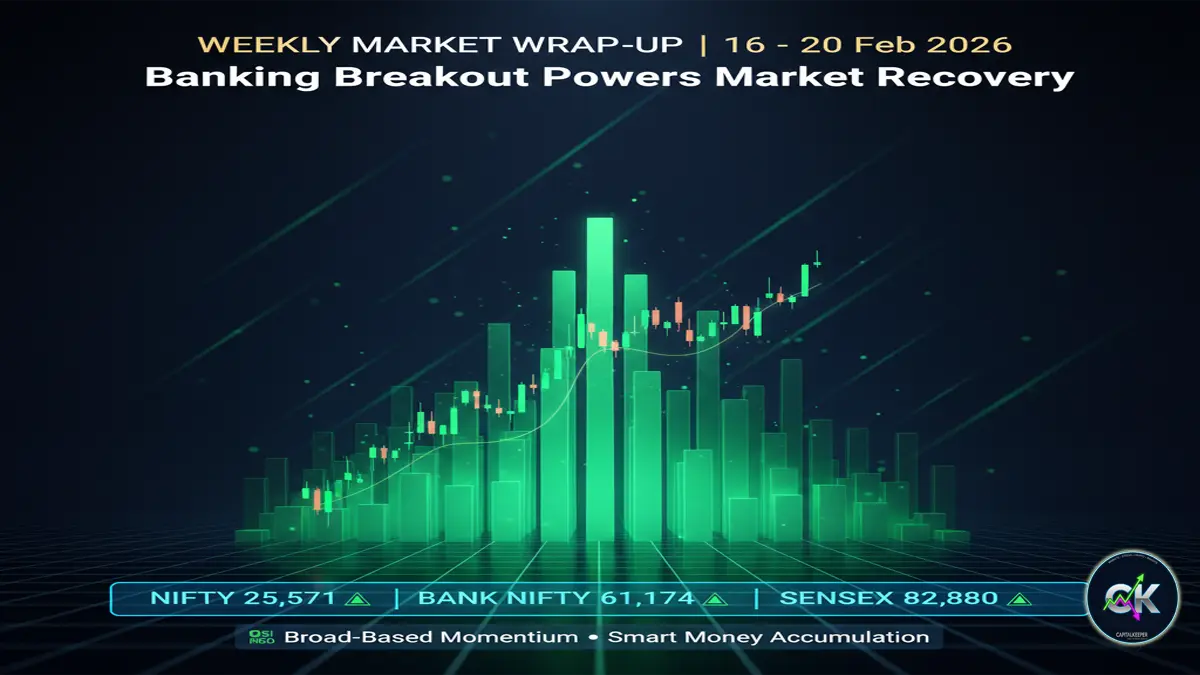

Indian stock market Closing Bell 20 February 2026: Nifty closes at 25,571, Bank Nifty at 61,172, Sensex at 82,814. Despite 100-point recovery, chart structure looks fragile. Detailed technical and global cues analysis.

Market Closing Snapshot – 20/02/2026

| Index | Open | Close | Change | Day Trend |

|---|---|---|---|---|

| Nifty 50 | 25,406.55 | 25,571.25 | +164.70 | Positive |

| Bank Nifty | 60,627.85 | 61,172.00 | +544.15 | Strong |

| Sensex | 82,272.49 | 82,814.71 | +542.22 | Positive |

| Fin Nifty | 28,012.85 | 28,210.60 | +197.75 | Stable |

Market Overview: Recovery or Just a Pause?

The Indian stock market ended Friday’s session in the green, but the bigger picture tells a more cautious story.

After opening flat to mildly weak, indices gradually picked up momentum through the day. Banking stocks led the recovery while select heavyweights supported Nifty near crucial levels. However, even after today’s 100+ point gain, the overall structure of the market still appears vulnerable.

There was buying interest in financials and selective large caps, but the broader market participation remained limited. Midcaps and smallcaps failed to show convincing strength, which keeps risk elevated.

Global Market Cues

Today’s session was influenced by relatively stable global conditions:

- US futures traded mildly positive after recent volatility.

- Asian markets showed mixed signals.

- Crude oil remained steady.

- Dollar index held firm, limiting aggressive FII buying.

While global markets did not create panic, they also did not provide strong bullish triggers. The Indian market largely moved on domestic technical positioning and short covering.

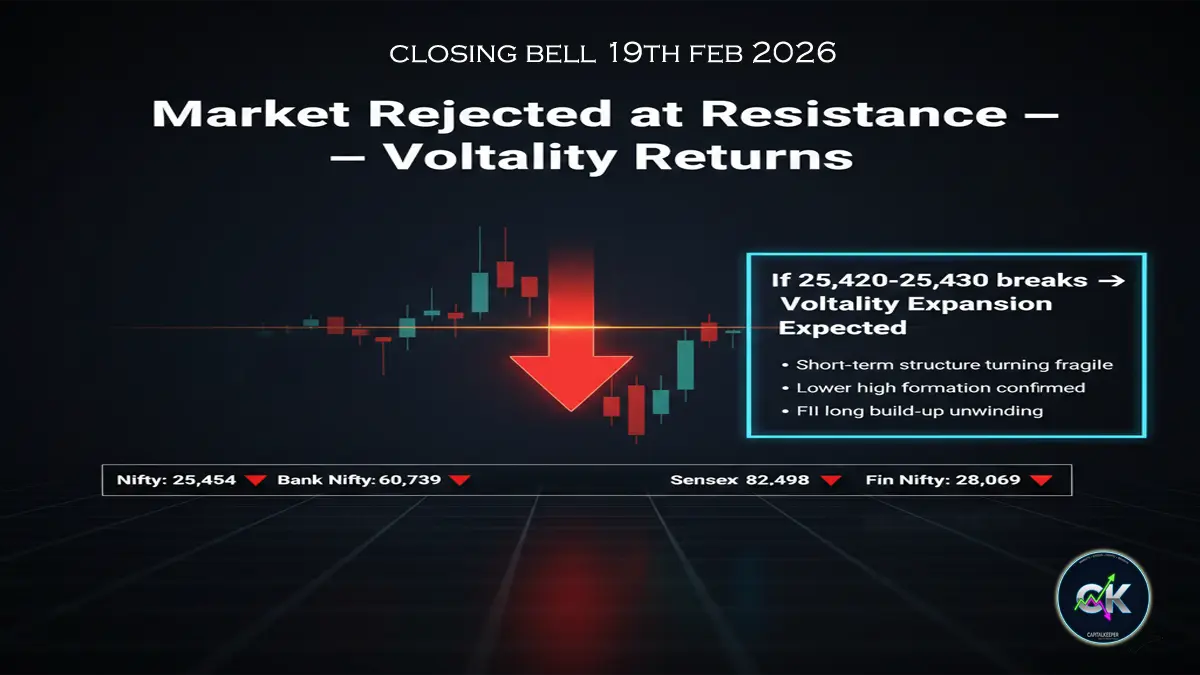

Nifty Technical Analysis – The Chart Still Looks Scary

Let’s address the most important point.

Even after today’s upmove, the Nifty chart structure remains technically fragile.

Why?

- The index is still forming lower highs on the daily timeframe.

- Resistance around 25,750–25,900 remains intact.

- Volume expansion on upmove was not very aggressive.

- Momentum indicators show mixed signals.

Structure Observation

- Immediate resistance: 25,750–25,900

- Immediate support: 25,420

- Breakdown level: 25,300

Unless Nifty convincingly sustains above 25,900, this bounce can be categorized as a relief rally within a weak structure.

The broader pattern resembles a distribution zone rather than accumulation. This is why the chart still appears uncomfortable despite green closing numbers.

Bank Nifty – Stronger Than Nifty?

Bank Nifty clearly outperformed today, gaining over 540 points and closing at 61,172.

Key Observations:

- Support near 60,400 held strongly.

- Short covering was visible in private banking counters.

- PSU banks contributed momentum.

However, Bank Nifty also faces resistance near 61,500–61,800. Sustained movement above 62,000 is required to confirm strength.

Without banking leadership, Nifty cannot sustain higher levels. So next week’s direction heavily depends on Bank Nifty follow-through.

Sensex & Fin Nifty Structure

Sensex closed at 82,814, recovering from intraday lows and reclaiming 82,500 levels. But similar to Nifty, it has not broken above its key resistance cluster.

Fin Nifty showed moderate stability, indicating that financial institutions are currently the only supporting pillar preventing deeper correction.

Still, broader confirmation is missing.

FII & DII Activity

Institutional flows continue to play a crucial role:

- FIIs remain cautious due to firm US bond yields.

- DIIs are providing stability near support zones.

The absence of aggressive foreign buying indicates global risk sentiment remains fragile.

Sectoral Performance

Outperformers:

- Banking

- Select IT counters

- Financial services

Underperformers:

- Midcaps

- Smallcaps

- Realty (profit booking visible)

Sector rotation is visible, but not broad-based expansion.

Options Data & Market Positioning

Options data suggests:

- Heavy Call writing around 25,800–26,000.

- Put support active near 25,400.

- PCR ratio indicates cautious optimism.

This implies that market participants expect consolidation within a range rather than immediate breakout.

Momentum Indicators

RSI (Relative Strength Index)

RSI remains below strong bullish territory. It is trying to recover but has not entered decisive strength zone.

MACD

MACD remains under pressure on daily timeframe. Crossover confirmation is still pending.

Price Action

Recent candles show volatility compression after a strong fall. That typically precedes either sharp recovery or continuation breakdown.

Currently, bias remains neutral to cautious.

What Traders Should Watch Next Week

- Nifty above 25,900 – bullish confirmation.

- Nifty below 25,300 – breakdown risk increases.

- Bank Nifty above 62,000 – leadership strength.

- Global volatility index behavior.

If global markets turn negative, current fragile structure could quickly weaken.

Is This the Start of a Bigger Correction?

The higher timeframe chart still shows:

- Possible lower high formation.

- Distribution near previous highs.

- Weak breadth participation.

Long-term support levels for Sensex remain much lower near 79,000 and below that even 69,000–65,000 zone if macro conditions deteriorate.

At present, panic is not visible, but warning signals are active.

Risk Management Guidance

- Avoid aggressive leveraged positions.

- Keep stop losses tight.

- Focus on strong large-cap leaders.

- Avoid overexposure in weak midcaps.

In uncertain structures, capital preservation matters more than chasing 100-point recoveries.

Closing Thought

Markets often give relief rallies before revealing their true direction. Today’s green closing looks positive on surface, but structure analysis suggests caution.

Traders must respect levels, not emotions.

Internal Links for CapitalKeeper.in

- Pre-Market Analysis

- Nifty & Bank Nifty Technical Outlook

- Weekly Market Wrap

- Educational Series: RSI & MACD Explained

FAQs – Closing Bell 20 February 2026

Q1: Why did Nifty rise today?

Short covering in banking stocks and stability in global markets supported the recovery.

Q2: Is the correction over?

Not yet confirmed. The index must sustain above 25,900 for bullish confirmation.

Q3: Which sector is leading?

Banking and financial services are currently leading the recovery.

Q4: Should investors buy now?

Selective accumulation is possible, but aggressive buying should wait for structure confirmation.

Final Verdict

The market has delivered a clear message today: resistance zones matter.

With Sensex again reversing from a historically strong zone and Nifty witnessing aggressive selling from higher levels, caution becomes the dominant theme.

Whether this turns into a deeper correction or remains a short-term shakeout will depend on:

- Global stability

- FII flows

- Support levels holding

For now, discipline over emotion should guide decisions.

Stay tactical. Stay informed.

Stay prepared.

— Team CapitalKeeper

📌 For daily trade setups, technical learning, and smart investing tips, stay tuned to CapitalKeeper.in

📌 For more real-time updates, trade setups, and investment insights — follow us on [Telegram] and [WhatsApp Channel] subscribe to our newsletter!

📌 Disclaimer

The content provided on CapitalKeeper.in is for informational and educational purposes only and does not constitute investment, trading, or financial advice. While we strive to present accurate and up-to-date market data and analysis, we make no warranties or representations regarding the completeness, reliability, or accuracy of the information.

Stock market investments are subject to market risks, and readers/investors are advised to conduct their own due diligence or consult a SEBI-registered financial advisor before making any investment decisions. CapitalKeeper and its authors are not liable for any loss or damage, direct or indirect, arising from the use of this information.

All views and opinions expressed are personal and do not reflect the official policy or position of any agency or organization. Past performance is not indicative of future results. By using this website, you agree to the terms of this disclaimer

Ranjit Sahoo

Founder & Chief Editor – CapitalKeeper.in

Ranjit Sahoo is the visionary behind CapitalKeeper.in, a leading platform for real-time market insights, technical analysis, and investment strategies. With a strong focus on Nifty, Bank Nifty, sector trends, and commodities, she delivers in-depth research that helps traders and investors make informed decisions.

Passionate about financial literacy, Ranjit blends technical precision with market storytelling, ensuring even complex concepts are accessible to readers of all levels. Her work covers pre-market analysis, intraday strategies, thematic investing, and long-term portfolio trends.

When he’s not decoding charts, Ranjit enjoys exploring coastal getaways and keeping an eye on emerging business themes.

📌 Follow Ranjit on:

LinkedIn | Twitter/X | Instagram | ✉️ contact@capitalkeeper.in

Leave a Reply