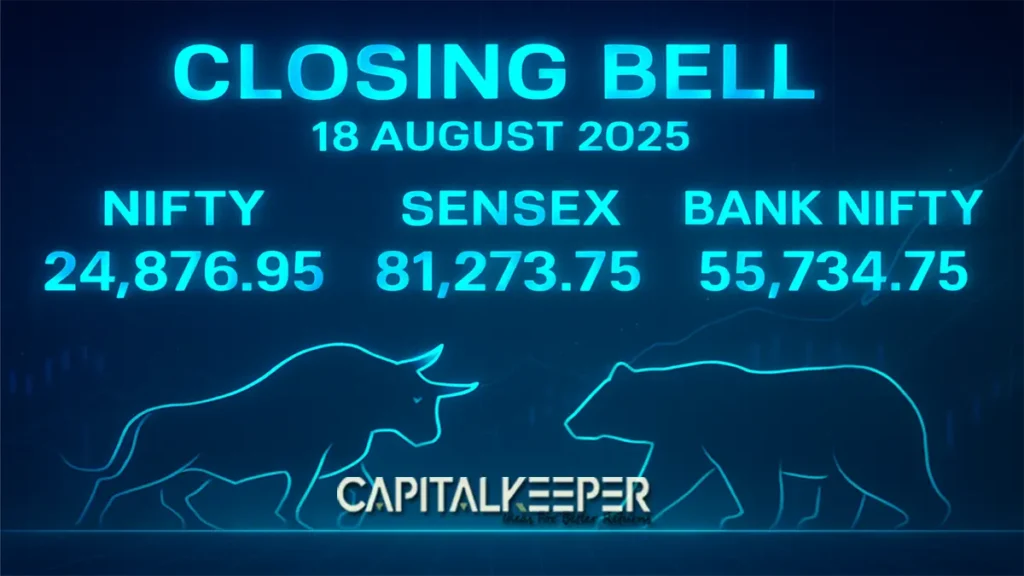

Closing Bell 18 August 2025: Nifty Closes at 24,876, Sensex and Bank Nifty End Weak Despite Global Support

By CapitalKeeper | Closing Bell | Indian Equity | Market Moves That Matter

Indian stock market ended lower on 18th August 2025 as Nifty closed at 24,876.95, Bank Nifty at 55,734.75, and Sensex at 81,273.75. Global cues remained supportive, but profit booking and volatility dragged indices. Read full analysis.

Closing Bell 18th August 2025: Nifty, Sensex, and Bank Nifty Struggle to Hold Gains Despite Positive Global Cues

The Indian stock market witnessed a highly volatile session on Monday, 18th August 2025, as benchmark indices failed to hold on to their early gains despite encouraging global cues.

- Nifty 50 opened higher at 24,938.20 but slipped in the second half, finally closing at 24,876.95, down 61 points from its peak levels.

- Bank Nifty opened at 55,940.60 but faced selling pressure in the afternoon, ending at 55,734.75, a loss of around 200 points from its intraday high.

- Sensex started on a strong note at 81,315.79, but heavyweights dragged it lower, closing at 81,273.75, marginally in the red.

- Fin Nifty followed the same path, opening at 26,670.20 and closing at 26,609.10.

While the overall sentiment remains cautiously optimistic, traders were seen booking profits ahead of key domestic and global events lined up during the week.

Market Highlights

- Nifty’s Struggle Near 25,000:

Nifty once again tested the psychological 25,000 level, but consistent selling pressure and lack of follow-through buying prevented a breakout. Technical charts suggest stiff resistance near 25,050–25,100, while support rests at 24,700–24,650. - Bank Nifty Rangebound but Weak:

Bank Nifty’s intraday recovery attempt fizzled out as PSU and select private banks came under selling pressure. Support is now seen near 55,500, while resistance remains strong at 56,200. - Sensex Heavyweights Under Pressure:

Reliance Industries, HDFC Bank, and IT majors dragged the index lower despite strong openings. Midcaps and small caps also faced selective profit booking. - Fin Nifty Tracks Volatility:

The index mirrored broader cues, unable to sustain above 26,650 levels. Support is seen at 26,450 while resistance lies at 26,800.

Sectoral Performance

- Banking & Financials: Mixed trend with HDFC Bank and Kotak Bank facing selling, while SBI and Axis Bank offered some resilience.

- IT Stocks: Weakness persisted due to currency volatility, as the rupee fluctuated against the dollar. Infosys and Wipro ended in the red.

- Energy & Oil & Gas: Reliance and ONGC were under pressure, offsetting early gains in BPCL and GAIL.

- Pharma & Healthcare: Sun Pharma and Dr. Reddy’s showed positive traction, offering some cushion to indices.

- Metals & Infra: Witnessed mild profit booking after a strong rally last week.

Global Market Cues

Global sentiment remained constructive, but Indian indices diverged due to local profit booking:

- Wall Street: U.S. futures were steady as investors awaited Fed commentary on interest rate trajectory. The Dow Jones and Nasdaq had closed higher in the previous session.

- Europe: Most European indices traded flat with a positive bias, as energy prices cooled down.

- Asia: Nikkei and Hang Seng showed strong performance earlier today, giving a supportive backdrop.

- Crude Oil: Brent crude hovered around $81 per barrel, easing from last week’s highs, offering relief to Indian importers.

- US Dollar & Bond Yields: Dollar index remained firm, while U.S. bond yields stayed rangebound, keeping global risk sentiment in check.

Technical Analysis

- Nifty 50:

Closing at 24,876.95, the index is sandwiched between major resistance at 25,000 and support at 24,650. Momentum indicators like RSI remain neutral around 54, suggesting consolidation. - Bank Nifty:

Closing at 55,734.75, Bank Nifty faces immediate resistance at 56,200 and support at 55,500. A breakdown below 55,500 may invite further selling. - Sensex:

Ending at 81,273.75, the index reflects indecisiveness. While 82,000 acts as a hurdle, 80,800 serves as immediate support. - Fin Nifty:

At 26,609.10, the index shows range-bound action. Key support stands at 26,450 and resistance at 26,850.

Investor Sentiment

Despite positive global markets, the Indian market closed flat-to-negative, highlighting a cautious tone among investors. The upcoming U.S. Federal Reserve minutes, domestic inflation data, and FII flows will be crucial triggers for market direction in the coming sessions.

Foreign Institutional Investors (FIIs) were net sellers, while Domestic Institutional Investors (DIIs) attempted to support the market, preventing deeper losses.

Outlook for 19th August 2025

- Nifty is expected to trade within 24,650–25,100 with heightened volatility.

- Bank Nifty could remain rangebound between 55,500–56,200.

- Global cues remain mildly supportive, but traders must stay alert to sudden volatility due to global central bank commentary.

- Overnight positions may remain risky until clarity emerges from key data releases.

Conclusion

The Closing Bell of 18th August 2025 reflects the market’s inability to capitalize on global positivity due to domestic profit booking and resistance near critical levels. Nifty failed to cross 25,000, Bank Nifty struggled below 56,000, and Sensex remained rangebound.

Going forward, the market will track global liquidity flows, crude oil movement, and RBI-Fed policy signals. Traders should exercise caution and avoid aggressive long positions until a decisive breakout emerges.

📌 For more real-time updates, trade setups, and investment insights — follow us on [Telegram] and [WhatsApp Channel] subscribe to our newsletter!

📌 Disclaimer

The content provided on CapitalKeeper.in is for informational and educational purposes only and does not constitute investment, trading, or financial advice. While we strive to present accurate and up-to-date market data and analysis, we make no warranties or representations regarding the completeness, reliability, or accuracy of the information.

Stock market investments are subject to market risks, and readers/investors are advised to conduct their own due diligence or consult a SEBI-registered financial advisor before making any investment decisions. CapitalKeeper and its authors are not liable for any loss or damage, direct or indirect, arising from the use of this information.

All views and opinions expressed are personal and do not reflect the official policy or position of any agency or organization. Past performance is not indicative of future results.By using this website, you agree to the terms of this disclaimer

Ranjit Sahoo

Founder & Chief Editor – CapitalKeeper.in

Ranjit Sahoo is the visionary behind CapitalKeeper.in, a leading platform for real-time market insights, technical analysis, and investment strategies. With a strong focus on Nifty, Bank Nifty, sector trends, and commodities, she delivers in-depth research that helps traders and investors make informed decisions.

Passionate about financial literacy, Ranjit blends technical precision with market storytelling, ensuring even complex concepts are accessible to readers of all levels. Her work covers pre-market analysis, intraday strategies, thematic investing, and long-term portfolio trends.

When he’s not decoding charts, Ranjit enjoys exploring coastal getaways and keeping an eye on emerging business themes.

📌 Follow Ranjit on:

LinkedIn | Twitter/X | Instagram | ✉️ contact@capitalkeeper.in