CapitalKeeper Sunday Digest 16–20 Feb 2026: Nifty, Bank Nifty React to Global Tariff Shock

Updated: 22 Frebuary 2026

Category: Sunday Digest | Market Analysis

By CapitalKeeper Research Desk

CapitalKeeper Sunday Digest for 16–20 February 2026 covers Nifty, Bank Nifty, INR, commodities, and market reaction to global tariff hikes. Full technical analysis using RSI, MACD, and volume with next week’s forecast.

CapitalKeeper Sunday Digest

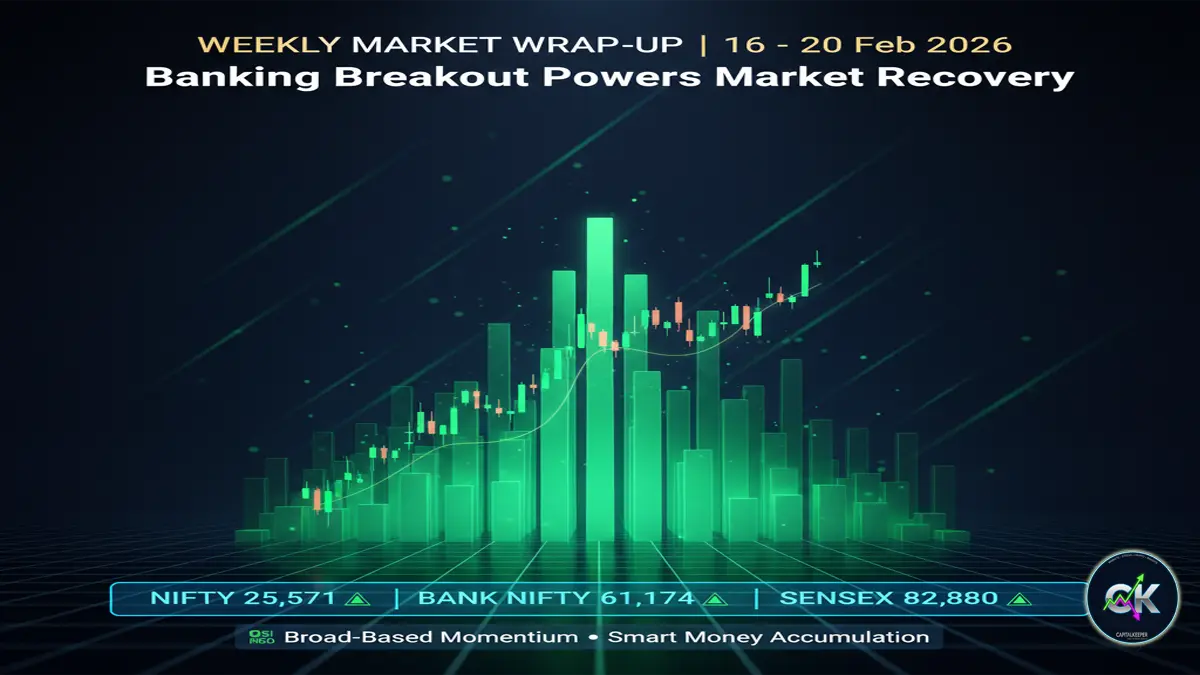

Weekly Market Wrap (16th February – 20th February 2026)

The third week of February 2026 turned unexpectedly volatile after a major global development shook financial markets. Mid-week, former US President Donald Trump announced an increase in global tariffs to 15% from 10%, triggering immediate reactions across equities, commodities, and currencies worldwide.

Indian markets were not immune. While domestic fundamentals remained stable, global risk sentiment shifted rapidly. The result was a week marked by sharp intraday swings, selective sectoral damage, defensive positioning, and strong reactions in metals and export-linked stocks.

In this edition of CapitalKeeper Sunday Digest, we decode:

- How Nifty and Bank Nifty handled the tariff shock

- Sectoral winners and losers

- INR and commodity movement

- RSI, MACD, and volume-based interpretation

- Strategic forecast for the coming week

Weekly Market Snapshot

| Segment | Weekly Behaviour | Technical Tone |

|---|---|---|

| Nifty 50 | Volatile | Consolidation with downside pressure |

| Bank Nifty | Resilient | Relative strength |

| Metals | Sharp reaction | High volatility |

| IT & Exporters | Under pressure | Risk-off bias |

| INR | Mild weakness | Dollar strength impact |

| Gold | Gained | Safe-haven demand |

Market Reaction to Global Tariff Hike

The tariff announcement raised concerns about global trade slowdown, margin pressure for exporters, and inflation risks. Indian markets initially reacted with knee-jerk selling, particularly in sectors with global exposure.

Metals, IT services, and export-heavy companies saw immediate volatility. However, domestic banking and consumption-focused stocks showed resilience, reflecting India’s relatively insulated economic structure.

The key takeaway:

The reaction was sharp but controlled. There was no panic liquidation.

Nifty 50: Volatility Near Key Zones

Nifty experienced strong intraday swings during the week. Initial selling pressure was absorbed near crucial support zones, indicating that institutional money did not exit aggressively.

RSI Analysis

- RSI cooled toward neutral territory

- No extreme oversold reading yet

- Momentum slowdown visible but not breakdown

MACD Interpretation

- MACD histogram shrinking

- Early signs of bearish crossover on lower timeframes

- Weekly timeframe still positive

Volume Study

- Selling sessions saw higher volumes initially

- Follow-up sessions showed declining sell intensity

- Accumulation visible near support

Technical Structure

Nifty is currently consolidating after the tariff-triggered shock. The broader trend remains intact unless critical support breaks decisively.

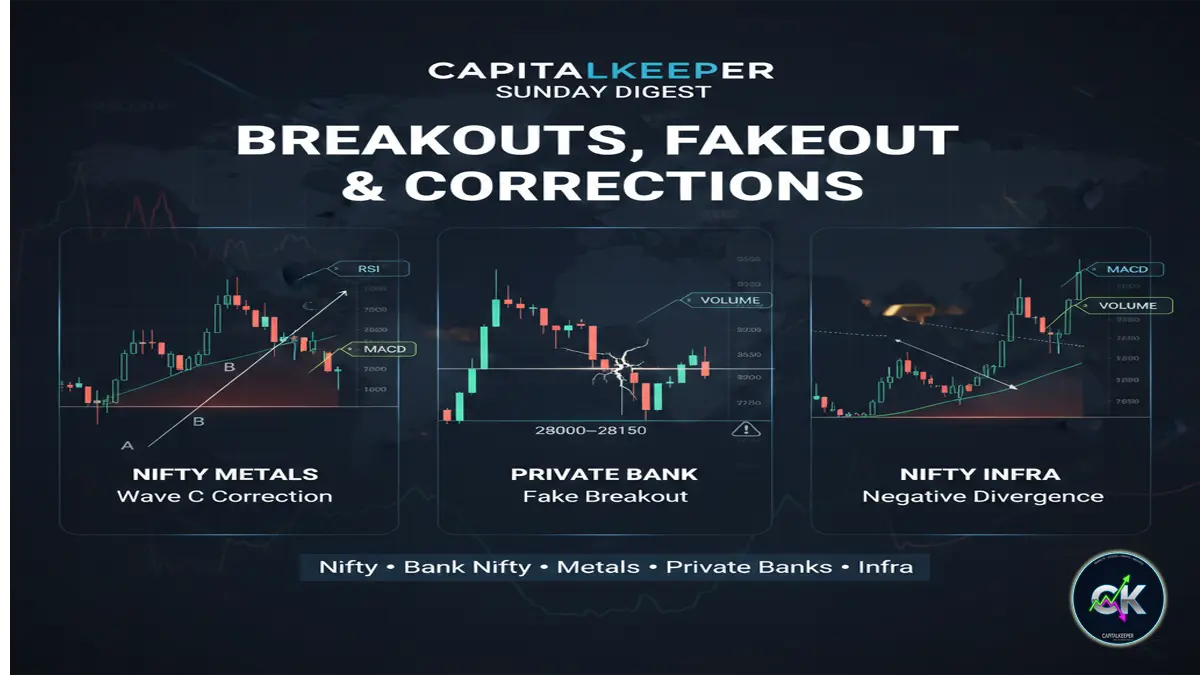

Bank Nifty: Relative Strength Leader

Bank Nifty once again demonstrated leadership. PSU banks and select private banks showed resilience despite global concerns.

RSI View

- RSI holding above midline

- No major bearish divergence

MACD

- Positive crossover still intact

- Momentum slightly slowing

Volume

- Strong participation during rebound sessions

Banking stocks benefited from domestic-focused fundamentals. Asset quality stability and steady credit growth remain supportive factors.

Sectoral Breakdown

Metals: Direct Impact Zone

Metals reacted sharply to tariff fears due to global trade sensitivity.

- Increased volatility

- Short-term selling pressure

- Technical charts show breakdown attempts

However, long-term support levels are still intact.

IT Sector

IT stocks faced pressure due to global exposure and currency volatility. The sector may remain sensitive to further international developments.

FMCG & Domestic Consumption

Defensive sectors showed relative strength as investors rotated toward stability.

INR Movement

The Indian Rupee showed mild weakness against the dollar following the tariff announcement. A stronger dollar globally pressured emerging market currencies.

However, RBI intervention and strong forex reserves helped stabilize the move.

A stable INR remains crucial for controlling imported inflation.

Commodity Market Reaction

Gold

Gold gained traction during the week as global uncertainty increased.

Technical View

- RSI moving upward

- MACD showing bullish momentum

- Volume expanding during rallies

Safe-haven demand returned strongly.

Crude Oil

Crude remained volatile but did not show dramatic breakdown. Markets are watching whether tariff-induced slowdown expectations affect demand.

Technical Indicator Summary

| Indicator | Current Status | Interpretation |

|---|---|---|

| RSI | Cooling | Healthy consolidation |

| MACD | Slowing | Watch for crossover |

| Volume | Spike then stabilize | No panic exit |

| Trend Structure | Higher lows intact | Bullish bias remains |

Broader Market Sentiment

Despite global uncertainty, the Indian market structure remains constructive.

Key observations:

- No broad-based distribution

- Sector rotation visible

- Institutional flows selective

- Defensive positioning increasing

This suggests caution, not collapse.

Forecast for the Upcoming Week

The next week will depend heavily on:

- Global follow-through on tariff developments

- US market reaction

- FII activity

- Domestic institutional flows

Bullish Scenario

If Nifty sustains above support:

- Relief rally possible

- Bank Nifty may lead upside

- Defensive sectors continue strength

Bearish Scenario

If global markets weaken further:

- Export-heavy sectors under pressure

- Metals could see follow-up selling

- Short-term correction may deepen

Most Probable Scenario

Sideways consolidation with a slightly cautious undertone. Market likely to absorb global shock before choosing next direction.

Trading Strategy

For Traders:

- Avoid aggressive leverage

- Watch RSI breakdown below neutral

- Track MACD crossover confirmation

- Use volume as validation

For Investors:

- Focus on domestic themes

- Avoid panic selling

- Accumulate quality stocks on dips

Key Levels to Watch

| Index | Support | Resistance |

|---|---|---|

| Nifty | Recent swing support zone | Near record highs |

| Bank Nifty | Higher low base intact | Immediate weekly high |

Break of support with heavy volume would shift bias decisively.

FAQs

Why did markets react to tariff hike?

Higher tariffs can slow global trade, impact exporters, and increase cost pressures.

Is this the start of a major correction?

Not yet. Technical structure still supports consolidation rather than breakdown.

Which sectors are safer now?

Banking, FMCG, and domestic demand-driven sectors appear relatively stable.

What should traders watch?

RSI breakdown, MACD crossover, and volume expansion on downside.

Final Word

The week of 16–20 February 2026 will be remembered for sudden global policy shockwaves. Yet, Indian markets displayed composure rather than panic. The coming week will determine whether this was merely a volatility spike or the beginning of a broader recalibration.

For now, discipline, risk management, and indicator-based trading remain the smartest approach.

CapitalKeeper continues to track structure over noise.

📌 For daily trade setups, technical learning, and smart investing tips, stay tuned to CapitalKeeper.in

📌 For more real-time updates, trade setups, and investment insights — follow us on [Telegram] and [WhatsApp Channel] subscribe to our newsletter!

Subscribe Now , Join Telegram the Crypto Capital Club, Get Free Crypto Updates

📌 Disclaimer

The content provided on CapitalKeeper.in is for informational and educational purposes only and does not constitute investment, trading, or financial advice. While we strive to present accurate and up-to-date market data and analysis, we make no warranties or representations regarding the completeness, reliability, or accuracy of the information.

Stock market investments are subject to market risks, and readers/investors are advised to conduct their own due diligence or consult a SEBI-registered financial advisor before making any investment decisions. CapitalKeeper and its authors are not liable for any loss or damage, direct or indirect, arising from the use of this information.

All views and opinions expressed are personal and do not reflect the official policy or position of any agency or organization. Past performance is not indicative of future results.By using this website, you agree to the terms of this disclaimer.

Ranjit Sahoo

Founder & Chief Editor – CapitalKeeper.in

Ranjit Sahoo is the visionary behind CapitalKeeper.in, a leading platform for real-time market insights, technical analysis, and investment strategies. With a strong focus on Nifty, Bank Nifty, sector trends, and commodities, she delivers in-depth research that helps traders and investors make informed decisions.

Passionate about financial literacy, Ranjit blends technical precision with market storytelling, ensuring even complex concepts are accessible to readers of all levels. Her work covers pre-market analysis, intraday strategies, thematic investing, and long-term portfolio trends.

When he’s not decoding charts, Ranjit enjoys exploring coastal getaways and keeping an eye on emerging business themes.

📌 Follow Ranjit on:

LinkedIn | Twitter/X | Instagram | ✉️ contact@capitalkeeper.in

Leave a Reply