Beverage & Packaged Drinks Expansion: Tata Consumer & Varun Beverages Technical Setups & Market Outlook (August 2025)

By CapitalKeeper | FMCG + Rural Consumption Theme | Indian Equities | Market Moves That Matter

Explore Day 3 of our FMCG theme with a deep dive into Tata Consumer & Varun Beverages. Get August 2025 technical buy/sell setups, key support-resistance levels, and market insights on bottled water, juices, and healthy beverage trends.

FMCG + Rural Consumption Theme – Day 3: Beverage & Packaged Drinks Expansion

Introduction

India’s beverage industry is undergoing a remarkable transformation, powered by both urban lifestyle changes and deep rural market penetration. While soft drinks and bottled water have been FMCG staples for decades, the past few years have seen a significant push into juices, healthy drinks, and functional beverages. This trend is further amplified by seasonal demand spikes, festive consumption, and expanding rural distribution networks.

In today’s Day 3 spotlight, we focus on Varun Beverages (VBL) and Tata Consumer Products (TCPL)—two listed companies spearheading this growth. We’ll also touch on the role of Parle Agro and Bisleri, which remain unlisted but influential players in shaping market trends.

Macro Drivers – Why Beverages Are Booming

Several macroeconomic and demographic factors are fueling the beverage expansion:

1. Seasonal Demand Spikes

- Summer months see over 40% of annual soft drink sales in India.

- Heatwaves in northern and western states are pushing bottled water and soft drink volumes higher.

- Seasonal festivals like Holi, Diwali, and Eid trigger demand for packaged drinks.

2. Rural Penetration

- Rural India accounts for over 50% of total FMCG consumption.

- Companies are introducing smaller pack sizes at ₹10 or ₹20, making them affordable for the rural population.

- Expanded cold-chain logistics and village-level distribution networks are ensuring availability even in remote regions.

3. Shift Towards Healthier Alternatives

- Rising health awareness is boosting demand for juices, flavored water, and low-sugar beverages.

- Functional drinks such as immunity boosters and vitamin-enriched water are slowly gaining ground.

Key Players to Track

1. Varun Beverages (VBL)

- Business Overview: One of PepsiCo’s largest franchise bottlers, covering over 27 states and union territories in India. Products include Pepsi, Mountain Dew, Slice, Tropicana, and Aquafina.

- Rural Strategy: Aggressive push into smaller packs, new warehouses in Tier-3 and rural belts, and tie-ups with kirana stores for cold storage displays.

- Growth Drivers:

- Rising demand for bottled water (Aquafina) in rural markets.

- Tropicana’s expansion in juice category targeting urban + semi-urban consumers.

- Seasonal uptick expected in Q2 and Q3 due to summer heat.

Technical Analysis – Varun Beverages

- CMP: ₹514

- Buying Price: ₹510–₹520 on dips

- Stop-Loss: ₹498

- Target 1: ₹550

- Target 2: ₹575

- Technical Outlook:

VBL recently broke out from a flag pattern on the daily chart with strong volume confirmation. The RSI at 64 indicates bullish momentum without overbought stress. Sustaining above ₹1,520 could trigger the next leg up.

2. Tata Consumer Products (TCPL)

- Business Overview: A diversified FMCG giant with brands like Tata Tea, Tata Coffee, Himalayan Water, Tata Gluco+, and Tetley.

- Rural Strategy: Expanding Tata Gluco+ and Himalayan Water availability in Tier-2/3 towns. Targeting kirana stores with sachet-based energy drinks for rural affordability.

- Growth Drivers:

- Focus on healthy hydration through Himalayan Natural Mineral Water.

- Leveraging Tata’s existing salt & tea distribution network for beverage sales.

- Entry into ready-to-drink cold tea and coffee categories.

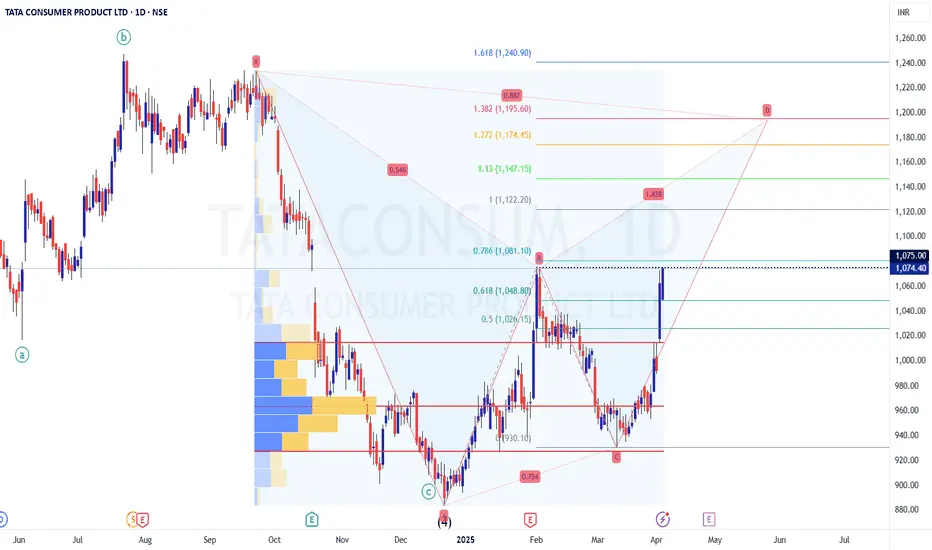

Technical Analysis – Tata Consumer

- CMP: ₹1,049

- Buying Price: ₹1,050–₹1,060 on dips

- Stop-Loss: ₹1,010

- Target 1: ₹1,120

- Target 2: ₹1,225

- Technical Outlook:

The stock is consolidating in a symmetrical triangle on the daily timeframe. Volumes have been picking up, suggesting accumulation. The MACD is showing a positive crossover, indicating a potential breakout.

Unlisted Players Impacting the Market

Parle Agro

- Known for Frooti, Appy, and Bailley Water.

- Has strong penetration in rural markets with low-cost bottle and tetra pack offerings.

- Heavy investment in quick commerce tie-ups for faster urban delivery.

Bisleri

- Market leader in packaged drinking water.

- Expanding into flavored water and energy drink segments.

- Partnership with retail chains for exclusive in-store visibility.

Sector Outlook

The Indian beverage market is projected to grow at a CAGR of 9–10% over the next five years, driven by:

- Increasing disposable incomes in rural India.

- Expansion of cold-chain infrastructure.

- Consumer preference for branded packaged products over loose drinks.

The summer season of 2025 is expected to be warmer than average, which could lead to record beverage sales. FMCG investors can expect Q2 and Q3 earnings to reflect this surge.

Investment Strategy for Day 3 Theme

| Stock | CMP (₹) | Buy Zone (₹) | Stop-Loss (₹) | Target 1 (₹) | Target 2 (₹) | View |

|---|---|---|---|---|---|---|

| Varun Beverages | ₹514 | ₹510–₹52 | ₹498 | ₹550 | ₹575 | Bullish |

| Tata Consumer | ₹1,049 | ₹1,050–₹1,060 | ₹1,010 | ₹1,120 | ₹1,225 | Bullish |

Risk Note: While seasonality works in favor of beverage companies, investors should watch commodity price fluctuations (PET resin, sugar, fruit pulp) and monsoon trends, as these can impact margins.

Conclusion

The beverage and packaged drinks segment is at the cusp of a strong growth cycle, with rural expansion, premiumisation, and health-focused innovations driving momentum. Varun Beverages and Tata Consumer stand out as key beneficiaries from both volume and value growth perspectives. With supportive technical setups, the current dips offer investors an attractive entry point before the seasonal demand wave peaks.

📌 For daily trade setups, technical learning, and smart investing tips, stay tuned to CapitalKeeper.in

📌 For more real-time updates, trade setups, and investment insights — follow us on [Telegram] and [WhatsApp Channel] subscribe to our newsletter!

📌 Disclaimer

The content provided on CapitalKeeper.in is for informational and educational purposes only and does not constitute investment, trading, or financial advice. While we strive to present accurate and up-to-date market data and analysis, we make no warranties or representations regarding the completeness, reliability, or accuracy of the information.

Stock market investments are subject to market risks, and readers/investors are advised to conduct their own due diligence or consult a SEBI-registered financial advisor before making any investment decisions. CapitalKeeper and its authors are not liable for any loss or damage, direct or indirect, arising from the use of this information.

All views and opinions expressed are personal and do not reflect the official policy or position of any agency or organization. Past performance is not indicative of future results.By using this website, you agree to the terms of this disclaimer.

Ranjit Sahoo

Founder & Chief Editor – CapitalKeeper.in

Ranjit Sahoo is the visionary behind CapitalKeeper.in, a leading platform for real-time market insights, technical analysis, and investment strategies. With a strong focus on Nifty, Bank Nifty, sector trends, and commodities, she delivers in-depth research that helps traders and investors make informed decisions.

Passionate about financial literacy, Ranjit blends technical precision with market storytelling, ensuring even complex concepts are accessible to readers of all levels. Her work covers pre-market analysis, intraday strategies, thematic investing, and long-term portfolio trends.

When he’s not decoding charts, Ranjit enjoys exploring coastal getaways and keeping an eye on emerging business themes.

📌 Follow Ranjit on:

LinkedIn | Twitter/X | Instagram | ✉️ contact@capitalkeeper.in

Leave a Reply