What Is Percentage Gain in IPO and How Does It Work for Investors?

By CapitalKeeper | Beginner’s Guide | Indian Sock Market | Market Moves That Matter I 23th June 2025

Initial Public Offerings (IPOs) are often seen as exciting investment opportunities — especially when there’s a possibility of strong listing gains. A key metric used by retail and institutional investors to evaluate IPO performance is percentage gain.

This blog explains what percentage gain means in the context of IPOs, how it is calculated, and how you can use it to assess your investment outcomes.

🧾 What Is Percentage Gain?

Percentage gain refers to the increase in value of an asset — like a stock — expressed as a percentage of its original value.

🧮 Formula:

Percentage Gain=(Current Price−Issue PriceIssue Price)×100\text{Percentage Gain} = \left( \frac{\text{Current Price} – \text{Issue Price}}{\text{Issue Price}} \right) \times 100Percentage Gain=(Issue PriceCurrent Price−Issue Price)×100

💡 Understanding Percentage Gain in IPO Context

In IPOs, percentage gain typically refers to the listing day gain — the rise in share price from the issue price to the listing price on the stock exchange.

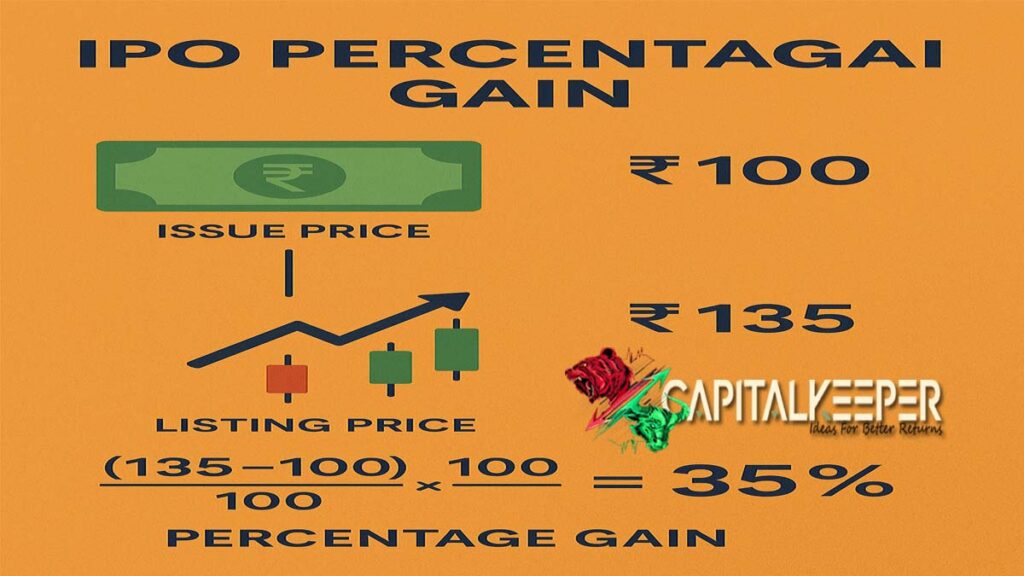

📊 Real-World IPO Example

Let’s say a company launches its IPO with an issue price of ₹100. On the day of listing:

- 📈 Listing Price: ₹135

- 🔢 Percentage Gain:

(135−100100)×100=35%\left( \frac{135 – 100}{100} \right) \times 100 = 35\%(100135−100)×100=35%

🎯 That means investors made a 35% return on listing day.

📦 Why Percentage Gain Matters in IPOs

| Reason | Importance |

|---|---|

| Measures listing day performance | Indicates market demand |

| Helps compare IPOs | Standard metric to evaluate success |

| Assists short-term trading decisions | Traders often aim for quick gains |

| Assesses valuation expectations | Overpricing/underpricing signals |

🔁 What Drives High Percentage Gains in IPOs?

🔸 1. Investor Sentiment

- Oversubscription = More demand = Higher listing price

- Tech, fintech, EV, pharma = Hot sectors = Better gains

🔸 2. Grey Market Premium (GMP)

- A higher GMP pre-listing often signals potential % gain

🔸 3. Company Fundamentals

- Strong revenue, profit, brand trust = Positive listing performance

🔸 4. Market Mood

- Bullish broader indices like Nifty and Sensex = Better listing reactions

⚠️ Risks of Chasing Percentage Gain

Not every IPO gives a positive listing gain. Consider these cases:

| IPO | Issue Price | Listing Price | Percentage Gain/Loss |

|---|---|---|---|

| Zomato | ₹76 | ₹116 | +52.6% |

| LIC | ₹949 | ₹872 | -8.1% |

| Nykaa | ₹1,125 | ₹2,018 | +79.1% |

| Paytm | ₹2,150 | ₹1,950 | -9.3% |

📉 Some investors buy into the hype and face negative listing returns.

📘 How Long-Term Investors Should Interpret % Gain

- Don’t judge IPOs only by Day 1 gains

- Strong businesses often grow post-listing — despite flat debut

- IRCTC listed at ₹320, now trades far above ₹1,000 — true wealth is in holding good companies

🧠 Pro Tip for Traders and Investors

- Use percentage gain only as a short-term measure

- Combine it with business analysis, promoter history, and sector outlook

- Avoid speculative entries purely based on GMP or news hype

📌 Conclusion: More Than Just a Number

Percentage gain in IPOs offers a quick snapshot of how the market values the stock at listing. But true investment success lies in:

- Picking fundamentally strong IPOs

- Knowing your time horizon

- Avoiding herd mentality

🎯 Always combine quantitative metrics (like % gain) with qualitative research.

📌 For more real-time updates, trade setups, and investment insights — follow us on [Telegram] and subscribe to our newsletter!

📌 Disclaimer

The content provided on CapitalKeeper.in is for informational and educational purposes only and does not constitute investment, trading, or financial advice. While we strive to present accurate and up-to-date market data and analysis, we make no warranties or representations regarding the completeness, reliability, or accuracy of the information.

Stock market investments are subject to market risks, and readers/investors are advised to conduct their own due diligence or consult a SEBI-registered financial advisor before making any investment decisions. CapitalKeeper and its authors are not liable for any loss or damage, direct or indirect, arising from the use of this information.

All views and opinions expressed are personal and do not reflect the official policy or position of any agency or organization. Past performance is not indicative of future results.

By using this website, you agree to the terms of this disclaimer.

CapitalKeeper | Turning Market Noise into Marke