Mutual Fund Taxation in 2025: LTCG, STCG, and Indexation Explained | CapitalKeeper

By CapitalKeeper | Pre Market Opening | Indian Equities | Market Moves That Matter

Mutual Fund Taxation in 2025: LTCG, STCG & Indexation Rules Explained

Taxation can significantly impact your net mutual fund returns. In 2025, capital gains tax rules for mutual funds remain segmented by fund type (equity vs debt) and holding period. Here’s a comprehensive guide to help you plan and optimize taxes.

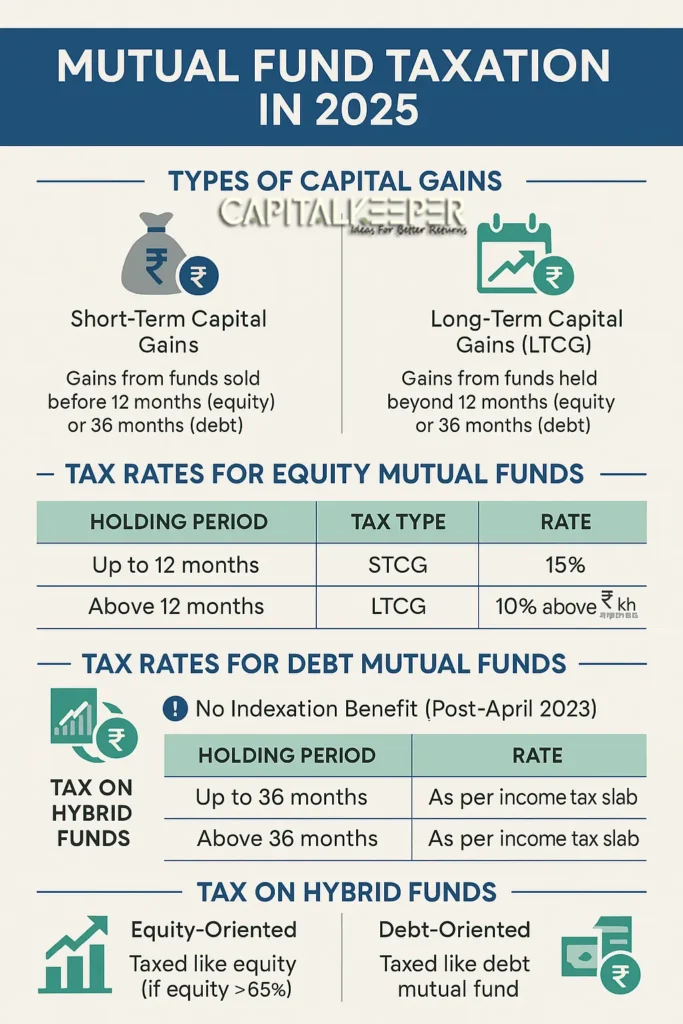

1. Types of Capital Gains

- Short-Term Capital Gains (STCG):

- Gains from funds sold before 12 months (equity) or before 36 months (debt).

- Long-Term Capital Gains (LTCG):

- Gains from funds held beyond 12 months (equity) or beyond 36 months (debt).

2. Tax Rates for Equity Mutual Funds (2025)

| Holding Period | Tax Type | Rate |

|---|---|---|

| Up to 12 months | STCG | 15% flat |

| Above 12 months | LTCG | 10% (above ₹1 lakh exemption) |

3. Tax Rates for Debt Mutual Funds (Post-2023 Rules)

Important: Indexation benefit removed for debt funds in April 2023.

| Holding Period | Tax Type | Rate (2025) |

|---|---|---|

| Up to 36 months | STCG | As per income tax slab |

| Above 36 months | LTCG | As per income tax slab (no indexation) |

4. Tax on Hybrid Funds

- Equity-Oriented Hybrid Funds: Taxed like equity (if equity >65%).

- Debt-Oriented Hybrid Funds: Taxed like debt (as per income slab).

5. Dividend Distribution Tax (DDT)

- Dividends are taxed in the hands of investors as per income slab.

- No separate DDT by AMC; TDS applicable above ₹5,000/year.

6. Pro-Tips to Optimize Tax

- Use SIP mode to stagger exits and utilize ₹1 lakh LTCG exemption annually.

- Prefer equity-oriented hybrids for tax efficiency.

- Align holding periods to benefit from LTCG rates.

7. Tax Filing Tips

- Report capital gains via ITR-2 or ITR-3 (for traders).

- Use broker statements or CAMS/KFintech CAS to compute gains.

Internal Links for Context

- ELSS vs PPF: Tax-Saving Options Explained

- Hybrid Funds: Balance Risk and Safety

- SIP vs Lumpsum: Which is Tax-Efficient?

Plan Your Taxes Smartly in 2025!

Stay updated on changing tax rules and maximize post-tax returns with expert guides.

Subscribe to CapitalKeeper Newsletter for free monthly tax-planning insights.

Free Tools to Help You:

- SIP Calculator – Project SIP growth post-tax

- Lumpsum Calculator – Estimate long-term gains

📌 For daily trade setups, technical learning, and smart investing tips, stay tuned to CapitalKeeper.in

📌 For more real-time updates, trade setups, and investment insights — follow us on [Telegram] and [WhatsApp Channel] subscribe to our newsletter!

📌 Disclaimer

The content provided on CapitalKeeper.in is for informational and educational purposes only and does not constitute investment, trading, or financial advice. While we strive to present accurate and up-to-date market data and analysis, we make no warranties or representations regarding the completeness, reliability, or accuracy of the information.

Stock market investments are subject to market risks, and readers/investors are advised to conduct their own due diligence or consult a SEBI-registered financial advisor before making any investment decisions. CapitalKeeper and its authors are not liable for any loss or damage, direct or indirect, arising from the use of this information.

All views and opinions expressed are personal and do not reflect the official policy or position of any agency or organization. Past performance is not indicative of future results.By using this website, you agree to the terms of this disclaimer.

Leave a Reply