Top Performing Mutual Funds in 2025: 1-Year & 3-Year Performance Tracker | CapitalKeeper

By CapitalKeeper | Beginner’s Guide | Mutual Funds | Market Moves That Matter

Track the best performing mutual funds in 2025. Analyze 1-year and 3-year returns across equity, midcap, hybrid, and ELSS categories with fund insights.

Top Performing Mutual Funds in 2025: 1-Year & 3-Year Performance Tracker

In a volatile yet opportunity-rich market environment, investors need to stay updated with mutual funds that consistently deliver. This curated performance tracker for 2025 highlights top mutual funds across categories based on their 1-year and 3-year returns, helping you make smarter SIP and lumpsum decisions.

(All returns are approximate and for educational reference only. Past performance is not indicative of future results.)

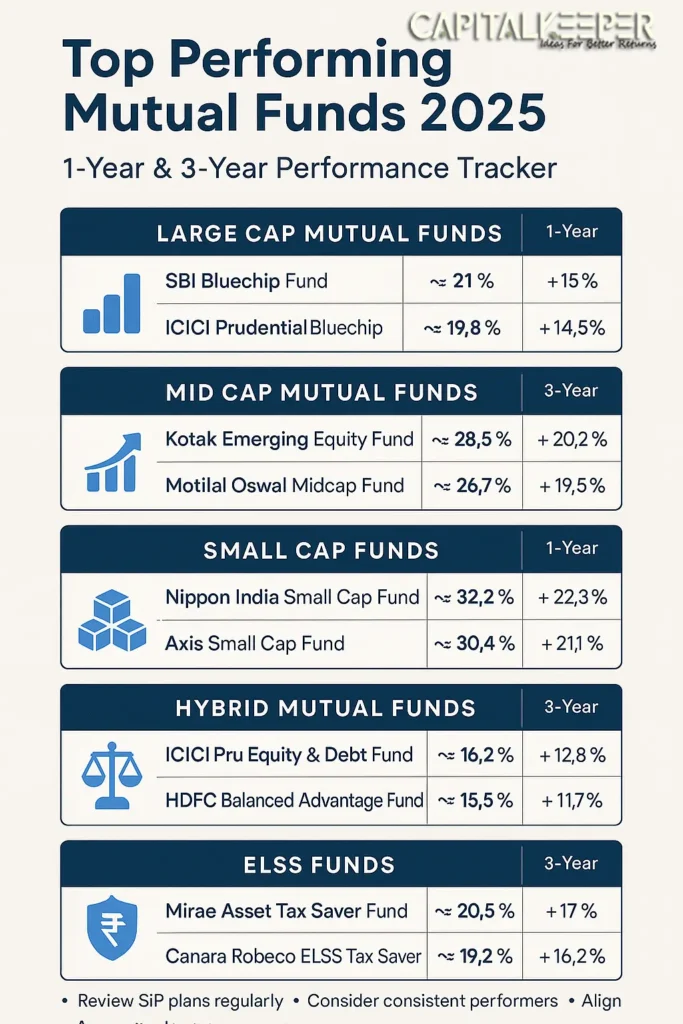

1. Large Cap Mutual Funds (Stable Bluechip Exposure)

| Fund Name | 1-Year Return | 3-Year CAGR |

|---|---|---|

| SBI Bluechip Fund | 21% | 15% |

| ICICI Prudential Bluechip Fund | 19.8% | 14.5% |

📌 Why consider: Suitable for long-term wealth creation with moderate risk.

2. Mid Cap Mutual Funds (Growth-Oriented Exposure)

| Fund Name | 1-Year Return | 3-Year CAGR |

|---|---|---|

| Kotak Emerging Equity Fund | 28.5% | 20.2% |

| Motilal Oswal Midcap Fund | 26.7% | 19.5% |

📌 Why consider: For aggressive investors aiming to beat inflation and index averages.

3. Small Cap Funds (High Growth, High Risk)

| Fund Name | 1-Year Return | 3-Year CAGR |

|---|---|---|

| Nippon India Small Cap Fund | 32.2% | 22.3% |

| Axis Small Cap Fund | 30.4% | 21.1% |

📌 Caution: Ideal for SIPs over 5+ years only. Avoid lumpsum investments in high valuations.

4. Hybrid Mutual Funds (Balanced Risk)

| Fund Name | 1-Year Return | 3-Year CAGR |

|---|---|---|

| ICICI Pru Equity & Debt Fund | 16.2% | 12.8% |

| HDFC Balanced Advantage Fund | 15.5% | 11.7% |

📌 Good For: First-time investors and retirement-focused portfolios.

5. Best Performing ELSS Funds (Tax Saving + Equity Exposure)

| Fund Name | 1-Year Return | 3-Year CAGR |

|---|---|---|

| Mirae Asset Tax Saver Fund | 20.5% | 17% |

| Canara Robeco ELSS Tax Saver | 19.2% | 16.2% |

📌 Reminder: Lock-in period is 3 years; ideal for SIP-based tax-saving strategy.

📊 How to Use This Tracker?

- Revisit every quarter to update your SIP allocations

- Use as a benchmark to compare your existing fund’s performance

- Combine with tools like our SIP Calculator to optimize returns

🧠 Pro Tips:

✅ Never switch funds just based on short-term underperformance

✅ Consider consistency, not just peak returns

✅ Align fund selection with goal horizon (not just returns)

🔁 Internal Links for Deeper Insights

- SIP vs Lumpsum: What Works Better in 2025?

- ELSS vs PPF – Which Tax Saving Option Wins?

- Best Mutual Funds to Invest in August 2025

Stay Updated with CapitalKeeper’s Fund Trackers!

Want monthly performance insights, SIP strategy updates, and fund screeners delivered straight to your inbox?

Subscribe to CapitalKeeper Newsletter and take control of your investments.

Explore Tools:

- SIP Calculator – Compare monthly investment outcomes

- Lumpsum Calculator – Project long-term lump sum returns

Next Read:

📌 For daily trade setups, technical learning, and smart investing tips, stay tuned to CapitalKeeper.in

📌 For more real-time updates, trade setups, and investment insights — follow us on [Telegram] and [WhatsApp Channel] subscribe to our newsletter!

📌 Disclaimer

The content provided on CapitalKeeper.in is for informational and educational purposes only and does not constitute investment, trading, or financial advice. While we strive to present accurate and up-to-date market data and analysis, we make no warranties or representations regarding the completeness, reliability, or accuracy of the information.

Stock market investments are subject to market risks, and readers/investors are advised to conduct their own due diligence or consult a SEBI-registered financial advisor before making any investment decisions. CapitalKeeper and its authors are not liable for any loss or damage, direct or indirect, arising from the use of this information.

All views and opinions expressed are personal and do not reflect the official policy or position of any agency or organization. Past performance is not indicative of future results.By using this website, you agree to the terms of this disclaimer.

Leave a Reply