SIP Explained: How to Start a Systematic Investment Plan in 2025 | CapitalKeeper

By CapitalKeeper | Beginner’s Guide| Mutual Funds | Market Moves That Matter

Learn how to start a Systematic Investment Plan (SIP) in 2025. Step-by-step guide to choosing mutual funds, setting goals, and maximizing returns.

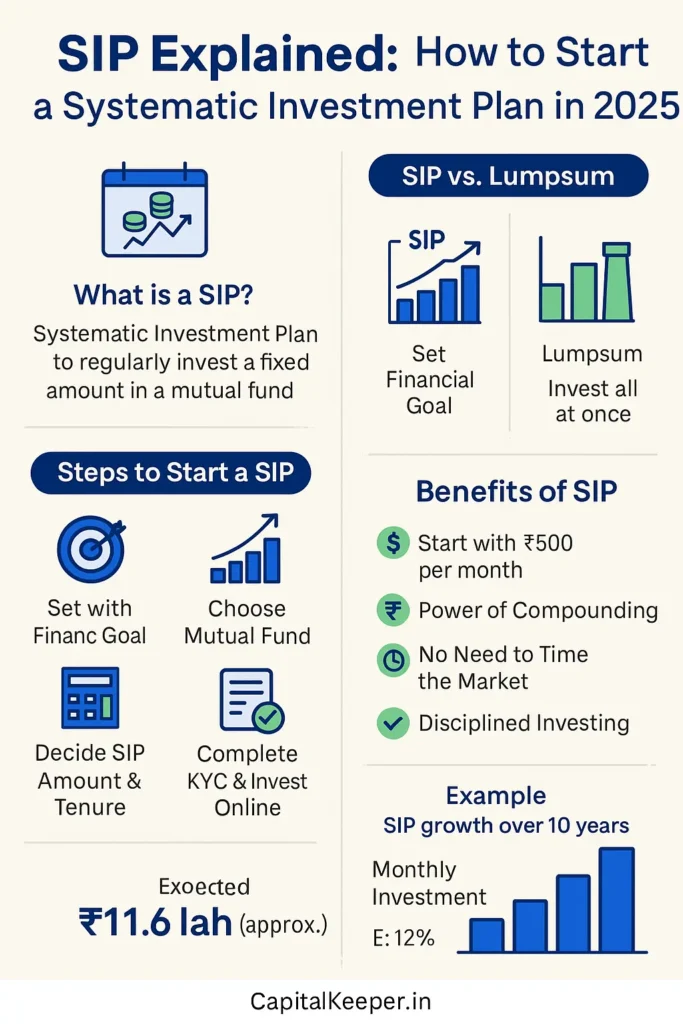

SIP Explained: How to Start a Systematic Investment Plan in 2025

A Systematic Investment Plan (SIP) is one of the easiest and most disciplined ways to invest in mutual funds. It allows you to invest a fixed amount regularly, typically monthly, into a chosen mutual fund scheme. In 2025, with market volatility and rising inflation, SIPs remain a top strategy for retail investors.

What Is a SIP?

- Definition: SIP is a method where you invest a fixed sum at regular intervals (monthly/quarterly) into mutual funds.

- Purpose: Promotes financial discipline and helps average out market volatility through rupee-cost averaging.

- Minimum Amount: Starts as low as ₹500 per month.

Why Choose SIP Over Lumpsum?

- Spreads investment across market cycles

- Reduces impact of volatility

- Builds long-term wealth through compounding

- Easier for salaried individuals to manage

Steps to Start a SIP in 2025

1. Set Your Financial Goal

- Retirement planning, child education, or wealth creation.

- Define amount needed and time horizon.

2. Assess Your Risk Profile

- Conservative → Debt or Hybrid funds

- Moderate → Balanced Advantage or Large Cap funds

- Aggressive → Equity or Thematic funds

3. Choose the Right Mutual Fund

- Compare funds based on past performance, expense ratio, and fund manager track record.

- Use reliable sources like AMFI, Morningstar, or CapitalKeeper’s own fund analysis blogs.

4. Select SIP Amount & Tenure

- Use SIP Calculator to project maturity value.

- Opt for step-up SIPs (increase amount annually) to beat inflation.

5. Complete KYC & Start Online

- Use AMC websites or apps like Groww, Paytm Money, or Zerodha Coin.

- Link your bank account for auto-debit.

Best Practices for SIP in 2025

- Stay invested for 5+ years for equity mutual funds

- Increase SIP amount with salary hikes

- Avoid stopping SIP during market corrections — buy more units at lower prices

- Review fund performance annually

Example: SIP Growth Projection

- Monthly SIP: ₹5,000

- Tenure: 10 years

- Expected Return: 12% annually

Maturity Value = ₹11.6 lakh (approx.)

(Use our SIP Calculator to calculate your exact returns.)

Common Mistakes to Avoid

- Chasing only past high returns

- Not aligning SIP with financial goals

- Ignoring fund expense ratios

- Stopping SIPs during market dips

Stay Updated on Mutual Funds!

Get curated SIP insights and mutual fund strategies directly to your inbox.

Subscribe to CapitalKeeper Newsletter and invest smarter in 2025.

Use Our Free Tools:

- SIP Calculator – Estimate your returns

- Lumpsum Calculator – Plan one-time investments

Next Read:

📌 For daily trade setups, technical learning, and smart investing tips, stay tuned to CapitalKeeper.in

📌 For more real-time updates, trade setups, and investment insights — follow us on [Telegram] and [WhatsApp Channel] subscribe to our newsletter!

📌 Disclaimer

The content provided on CapitalKeeper.in is for informational and educational purposes only and does not constitute investment, trading, or financial advice. While we strive to present accurate and up-to-date market data and analysis, we make no warranties or representations regarding the completeness, reliability, or accuracy of the information.

Stock market investments are subject to market risks, and readers/investors are advised to conduct their own due diligence or consult a SEBI-registered financial advisor before making any investment decisions. CapitalKeeper and its authors are not liable for any loss or damage, direct or indirect, arising from the use of this information.

All views and opinions expressed are personal and do not reflect the official policy or position of any agency or organization. Past performance is not indicative of future results.By using this website, you agree to the terms of this disclaimer.

Leave a Reply