What Are Mutual Funds? Types, NAV & Benefits Explained for Beginners | CapitalKeeper

By CapitalKeeper | Beginner’s Guide | Mutual Funds | Market Moves That Matter

Understand mutual funds, their types, and how NAV works. Learn why mutual funds are ideal for beginner investors seeking diversification and steady returns in 2025.

What Are Mutual Funds? A Beginner’s Guide

Mutual funds are one of the most popular investment vehicles for Indian investors, offering diversification, professional management, and the potential for wealth creation over time. If you’re new to investing, understanding the basics of mutual funds is essential before you start your journey.

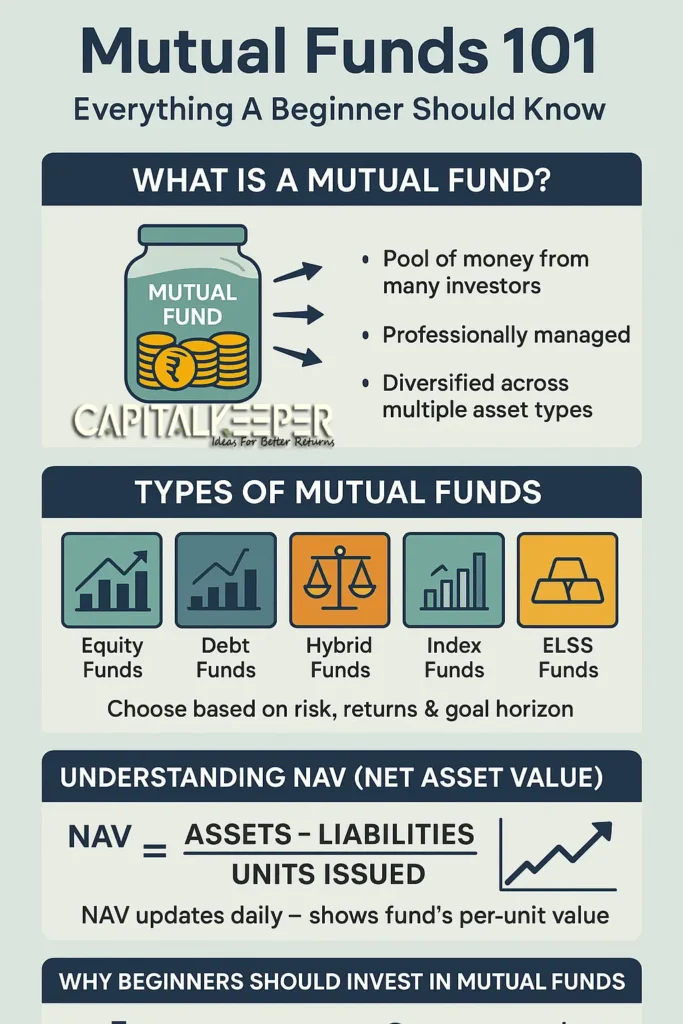

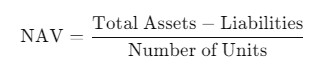

What Is a Mutual Fund?

A mutual fund pools money from multiple investors and invests in assets like stocks, bonds, or gold. The returns are shared proportionately among investors based on their contribution.

Key Features:

- Diversification: Reduces risk by investing in multiple securities.

- Professional Management: Managed by experienced fund managers.

- Liquidity: Can be redeemed at any time (except closed-end funds).

Types of Mutual Funds in India

- Equity Mutual Funds – Invest in stocks; suitable for long-term growth.

- Debt Mutual Funds – Invest in bonds/government securities; lower risk.

- Hybrid Funds – Mix of equity and debt for balanced risk-return.

- Index Funds – Track benchmark indices like Nifty 50 or Sensex.

- ELSS Funds – Equity Linked Savings Schemes offering tax benefits (Section 80C).

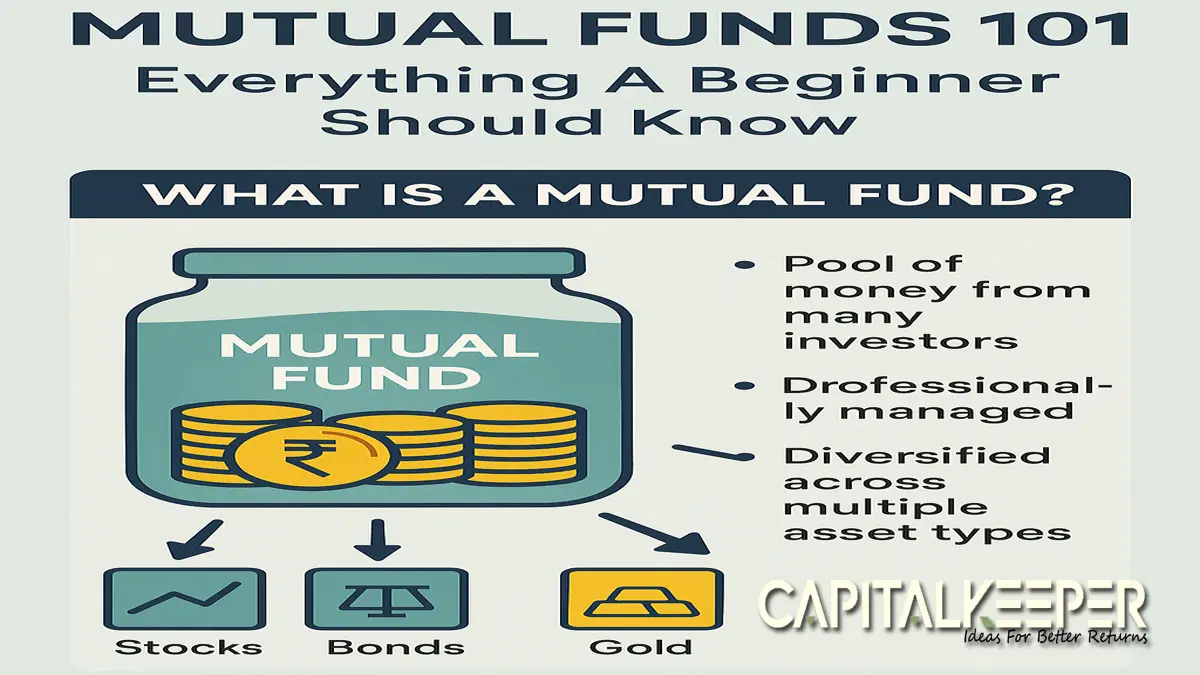

Understanding NAV (Net Asset Value)

NAV represents the per-unit price of a mutual fund.

Formula:

NAV is updated daily and helps investors track fund performance.

Why Should Beginners Invest in Mutual Funds?

- Affordable entry point (SIP starting ₹500/month)

- Professional fund management

- Flexibility (SIP or lumpsum)

- Tax benefits (ELSS)

- Suitable for long-term wealth creation

Pro Tip: Plan Your SIP Before Investing

Use our Free SIP Calculator to estimate returns and set realistic goals before starting your investment.

Stay Updated on Mutual Funds!

Want hand-picked mutual fund insights, SIP recommendations, and market updates delivered to your inbox?

Subscribe to CapitalKeeper Newsletter and plan smarter investments every month.

Try Our Free Tools:

- SIP Calculator – Plan your monthly investments

- Lumpsum Calculator – Estimate one-time investment growth

Next Read:

📌 For daily trade setups, technical learning, and smart investing tips, stay tuned to CapitalKeeper.in

📌 For more real-time updates, trade setups, and investment insights — follow us on [Telegram] and [WhatsApp Channel] subscribe to our newsletter!

📌 Disclaimer

The content provided on CapitalKeeper.in is for informational and educational purposes only and does not constitute investment, trading, or financial advice. While we strive to present accurate and up-to-date market data and analysis, we make no warranties or representations regarding the completeness, reliability, or accuracy of the information.

Stock market investments are subject to market risks, and readers/investors are advised to conduct their own due diligence or consult a SEBI-registered financial advisor before making any investment decisions. CapitalKeeper and its authors are not liable for any loss or damage, direct or indirect, arising from the use of this information.

All views and opinions expressed are personal and do not reflect the official policy or position of any agency or organization. Past performance is not indicative of future results.By using this website, you agree to the terms of this disclaimer.

Leave a Reply