Ledger Balance in Demat Account: Meaning, Uses & Difference from Available Balance

By CapitalKeeper | Beginner’s Guide | Indian Equities | Market Moves That Matter

What is Ledger Balance in a Demat Account?

Understand what ledger balance means in your Demat account, how it affects trading, and its difference from available margin and funds.

Introduction

When you trade in the stock market, your Demat and trading accounts record every credit and debit transaction you make — from buying shares to receiving dividends or paying brokerage. Among the key terms you’ll encounter is ledger balance. Many new investors confuse it with available balance or margin, leading to miscalculations while placing trades.

In this post, we’ll break down what ledger balance means, why it matters, and how to track it for smooth trading and settlement.

What is Ledger Balance in a Demat Account?

The ledger balance in your Demat account reflects the net amount of money you have after accounting for all credits and debits recorded up to a particular day. It includes:

- Funds added to your trading account

- Proceeds from share sales (credited after T+1 or T+2 settlement)

- Charges like brokerage, GST, DP charges, and penalties deducted

- Payouts from dividends, interest, or buyback offers

In simple terms: Ledger balance = (Total credits – Total debits) in your trading ledger.

How Does Ledger Balance Work?

1. After Buying Shares

- When you purchase shares worth ₹50,000, this amount is immediately debited from your ledger balance.

- Your available margin reduces instantly, even though settlement happens on T+1 or T+2 days.

2. After Selling Shares

- When you sell shares worth ₹30,000, this amount is credited to your ledger after settlement (T+1 for equity).

- Until then, your ledger may show a lower balance than expected.

3. After Adding Funds

- If you transfer ₹10,000 to your trading account, it reflects as a credit in your ledger balance almost immediately (depending on broker).

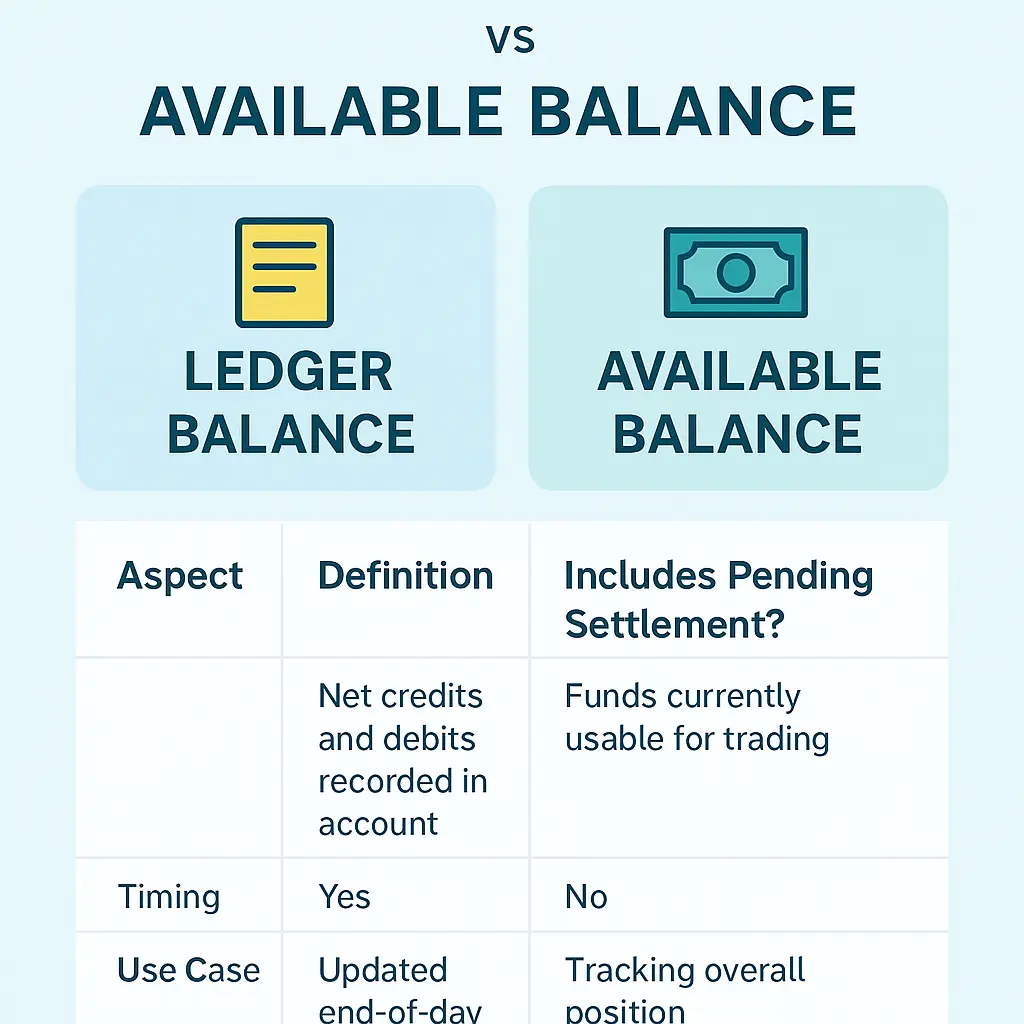

Ledger Balance vs Available Balance: Key Difference

| Aspect | Ledger Balance | Available Balance |

|---|---|---|

| Definition | Net credits and debits recorded in account | Funds currently usable for trading |

| Includes Pending Settlement? | Yes | No |

| Timing | Updated end-of-day | Real-time |

| Use Case | Tracking overall position | Placing trades instantly |

Why is Ledger Balance Important?

- Prevents Overtrading – Knowing your true ledger balance helps avoid placing orders beyond your financial capacity.

- Clears Dues Awareness – If your ledger shows negative, you owe your broker money (interest/penalties may apply).

- Tax & Accounting – Ledger statements help during year-end tax filing and profit-loss calculations.

Where to Check Ledger Balance?

- Broker’s App or Web Portal: Usually under “Funds” or “Ledger” section.

- Contract Notes: Post-trade, the debit/credit details are listed.

- Back-office Reports: Downloadable for detailed reconciliation of all trades and charges.

Final Thoughts

Ledger balance gives you the complete financial snapshot of your Demat account, including settled and pending transactions. By monitoring it regularly, you can plan trades better, manage risk, and avoid surprises in margins or settlements.

Next time you see your ledger balance, remember — it’s not just a number; it’s your true financial standing with the broker.

📌 For daily trade setups, technical learning, and smart investing tips, stay tuned to CapitalKeeper.in

📌 For more real-time updates, trade setups, and investment insights — follow us on [Telegram] and [WhatsApp Channel] subscribe to our newsletter!

📌 Disclaimer

The content provided on CapitalKeeper.in is for informational and educational purposes only and does not constitute investment, trading, or financial advice. While we strive to present accurate and up-to-date market data and analysis, we make no warranties or representations regarding the completeness, reliability, or accuracy of the information.

Stock market investments are subject to market risks, and readers/investors are advised to conduct their own due diligence or consult a SEBI-registered financial advisor before making any investment decisions. CapitalKeeper and its authors are not liable for any loss or damage, direct or indirect, arising from the use of this information.

All views and opinions expressed are personal and do not reflect the official policy or position of any agency or organization. Past performance is not indicative of future results.By using this website, you agree to the terms of this disclaimer.

Ranjit Sahoo

Founder & Chief Editor – CapitalKeeper.in

Ranjit Sahoo is the visionary behind CapitalKeeper.in, a leading platform for real-time market insights, technical analysis, and investment strategies. With a strong focus on Nifty, Bank Nifty, sector trends, and commodities, she delivers in-depth research that helps traders and investors make informed decisions.

Passionate about financial literacy, Ranjit blends technical precision with market storytelling, ensuring even complex concepts are accessible to readers of all levels. Her work covers pre-market analysis, intraday strategies, thematic investing, and long-term portfolio trends.

When he’s not decoding charts, Ranjit enjoys exploring coastal getaways and keeping an eye on emerging business themes.

📌 Follow Ranjit on:

LinkedIn | Twitter/X | Instagram | ✉️ contact@capitalkeeper.in

CapitalKeeper Sunday Digest (08–12 Sept 2025): Market Wrap, Global Cues, and Smallcap Action

Leave a Reply