Agri-Linked FMCG & Rural Consumption Multipliers – Stocks, Targets & Technical Insights

By CapitalKeeper | Pre Market Opening | Indian Equities | Market Moves That Matter

Day 5 – Agri-Linked FMCG & Rural Consumption Multipliers

The Power of Agriculture-Driven Demand in FMCG Growth

Introduction

India’s FMCG sector thrives on a unique growth engine—rural consumption, heavily influenced by agriculture. When farm incomes rise—be it from a good monsoon, higher Minimum Support Prices (MSPs), or strong crop yields—the rural demand for packaged food, personal care, and household products rises sharply.

In 2025, this linkage is more prominent than ever. With above-average rainfall and higher MSPs announced for key crops, companies with direct or indirect exposure to rural consumption are poised for growth. The agri-FMCG segment is not just about selling products—it’s about aligning with seasonal income cycles and distribution in Tier-3 & Tier-4 towns.

Why Agriculture Drives FMCG Demand

- Income Effect: A good harvest directly boosts farmers’ disposable income.

- Consumption Upgrades: Rural households move from loose/unbranded to packaged/branded goods.

- Festival & Post-Harvest Splurge: Rural buying peaks during harvest payouts and festive seasons.

- Government Schemes: MSP hikes, PM-Kisan payouts, and rural infrastructure push boost consumption.

Stocks to Track

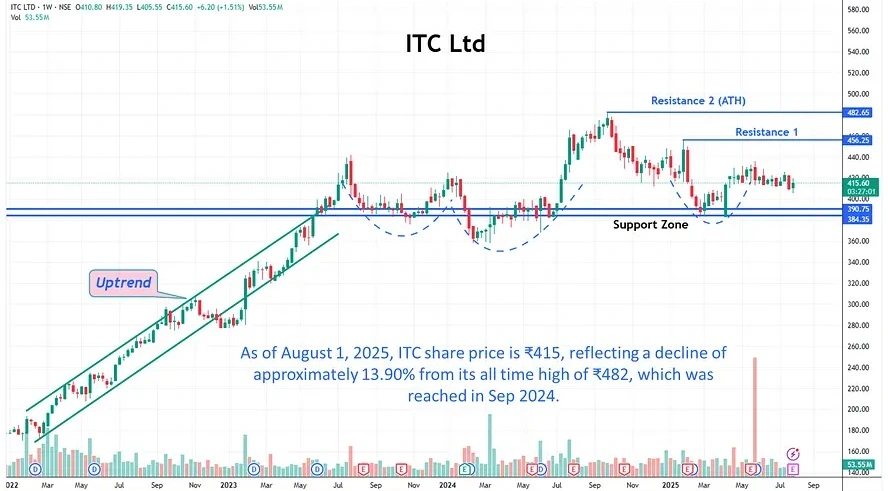

1. ITC Ltd.

- Why It Matters:

- Strong rural distribution network.

- Leader in packaged staples (Aashirvaad), biscuits (Sunfeast), snacks (Bingo).

- Diversified portfolio also includes agri-trading, making it less cyclical.

- Growth Drivers:

- Direct sourcing from farmers through e-Choupal.

- Rising demand for branded atta and biscuits in rural belts.

- Technical Setup (August 2025):

- CMP: ₹411

- Trend: Bullish breakout from ₹480 resistance.

- Buy Zone: ₹410–415

- Target: ₹455

- Stop-Loss: ₹401

- Chart Insight: Price above 20 & 50 EMA; RSI at 64 shows steady momentum.

2. Patanjali Foods

- Why It Matters:

- Strong presence in edible oils, ghee, and packaged food.

- Large rural brand recall due to ayurvedic positioning.

- Growth Drivers:

- Rising edible oil demand during festive cooking season.

- Expansion into value-added packaged food categories.

- Technical Setup:

- CMP: ₹1,764

- Trend: Consolidating near breakout zone of ₹1,770.

- Buy Zone: ₹1,800–1,805

- Target: ₹2,020

- Stop-Loss: ₹1,645

- Chart Insight: Bullish flag pattern forming; volume picking up.

3. KRBL Ltd.

- Why It Matters:

- World’s largest basmati rice exporter.

- Basmati consumption in rural India rising due to income upgrade.

- Growth Drivers:

- Strong export demand to Middle East.

- Premiumisation in domestic rice segment.

- Technical Setup:

- CMP: ₹469

- Trend: Strong uptrend post ₹395 breakout.

- Buy Zone: ₹460–470

- Target: ₹430

- Stop-Loss: ₹540

- Chart Insight: MACD bullish crossover; price in higher-high, higher-low structure.

4. Emami Agrotech (if listed) / Emami Ltd.

- Why It Matters:

- Strong rural presence in edible oils & personal care.

- Aggressive rural ad campaigns.

- Growth Drivers:

- Expanding edible oil capacity.

- Leveraging Emami brand trust in rural markets.

- Technical Setup (Emami Ltd.):

- CMP: ₹582

- Trend: Sideways to bullish, needs ₹605 breakout.

- Buy Zone: ₹582–590

- Target: ₹640

- Stop-Loss: ₹560

- Chart Insight: RSI rebounding from oversold; potential breakout play.

Macro Tailwinds for Agri-Linked FMCG

- Above-Normal Monsoon: Ensures good Kharif output, boosting rural incomes.

- MSP Hikes: Directly add to farmers’ purchasing power.

- Rural Credit Growth: Easier financing for small businesses and households.

- Shift to Packaged Goods: Health, hygiene, and convenience pushing branded product adoption.

Investor Takeaways

- Timing is Key: Buy in pre-harvest season when rural demand build-up starts.

- Diversification: Invest across food, personal care, and staples to balance seasonal risks.

- Export-Linked Bets: KRBL and ITC’s international business provide currency hedge.

📌 For daily trade setups, technical learning, and smart investing tips, stay tuned to CapitalKeeper.in

📌 For more real-time updates, trade setups, and investment insights — follow us on [Telegram] and [WhatsApp Channel] subscribe to our newsletter!

Subscribe Now , Join Telegram the Crypto Capital Club, Get Free Crypto Updates

📌 Disclaimer

The content provided on CapitalKeeper.in is for informational and educational purposes only and does not constitute investment, trading, or financial advice. While we strive to present accurate and up-to-date market data and analysis, we make no warranties or representations regarding the completeness, reliability, or accuracy of the information.

Stock market investments are subject to market risks, and readers/investors are advised to conduct their own due diligence or consult a SEBI-registered financial advisor before making any investment decisions. CapitalKeeper and its authors are not liable for any loss or damage, direct or indirect, arising from the use of this information.

All views and opinions expressed are personal and do not reflect the official policy or position of any agency or organization. Past performance is not indicative of future results.By using this website, you agree to the terms of this disclaimer.

Ranjit Sahoo

Founder & Chief Editor – CapitalKeeper.in

Ranjit Sahoo is the visionary behind CapitalKeeper.in, a leading platform for real-time market insights, technical analysis, and investment strategies. With a strong focus on Nifty, Bank Nifty, sector trends, and commodities, she delivers in-depth research that helps traders and investors make informed decisions.

Passionate about financial literacy, Ranjit blends technical precision with market storytelling, ensuring even complex concepts are accessible to readers of all levels. Her work covers pre-market analysis, intraday strategies, thematic investing, and long-term portfolio trends.

When he’s not decoding charts, Ranjit enjoys exploring coastal getaways and keeping an eye on emerging business themes.

📌 Follow Ranjit on:

LinkedIn | Twitter/X | Instagram | ✉️ contact@capitalkeeper.in