CapitalKeeper Sunday Digest (09–13 Feb 2026): Nifty, Bank Nifty & Sectoral Breakdown with RSI, MACD and Volume Outlook

Updated: 15 February 2026

Category: Sunday Digest | Market Analysis

By CapitalKeeper Research Desk

Detailed weekly wrap-up of the Indian stock market (09–13 Feb 2026) with Nifty, Bank Nifty, sector analysis, RSI–MACD signals, commodity trends, and forecast for the upcoming week. A complete CapitalKeeper Sunday Digest for traders and investors.

CapitalKeeper Sunday Digest (09–13 February 2026)

Weekly Market Wrap, Technical Study & Forecast for the Coming Week

The Indian stock market witnessed a week full of mixed sentiments, sectoral rotation, and technical reactions as traders responded to global cues, institutional positioning, and profit booking at higher levels. The period between 9th February and 13th February 2026 saw volatile price action across benchmark indices, midcaps, commodities, and sectoral indices.

This week was particularly important from a technical perspective, as multiple sectors began showing signs of trend exhaustion, divergence signals, and corrective patterns on daily and weekly charts.

This CapitalKeeper Sunday Digest provides a detailed breakdown of:

- Index performance

- Sectoral strength and weakness

- RSI, MACD, and volume-based interpretation

- Commodities and currency movement

- Forecast for the upcoming week

Weekly Market Overview

The week began with optimism but gradually shifted into consolidation and profit booking, especially at higher resistance levels. The broader market sentiment remained cautious, with selective buying seen in specific pockets.

Nifty Movement

Nifty showed signs of hesitation near resistance zones and struggled to sustain upward momentum. Price action indicated a range-bound market with intermittent selling pressure.

Bank Nifty Trend

Bank Nifty displayed relatively better strength compared to broader markets but also faced resistance near higher zones. PSU banking stocks showed resilience while private banks faced selling pressure.

Market Behaviour Summary

- Volatility increased during the week

- Sectoral rotation remained active

- Traders preferred stock-specific opportunities

- Institutional participation appeared selective

Sectoral Technical Study

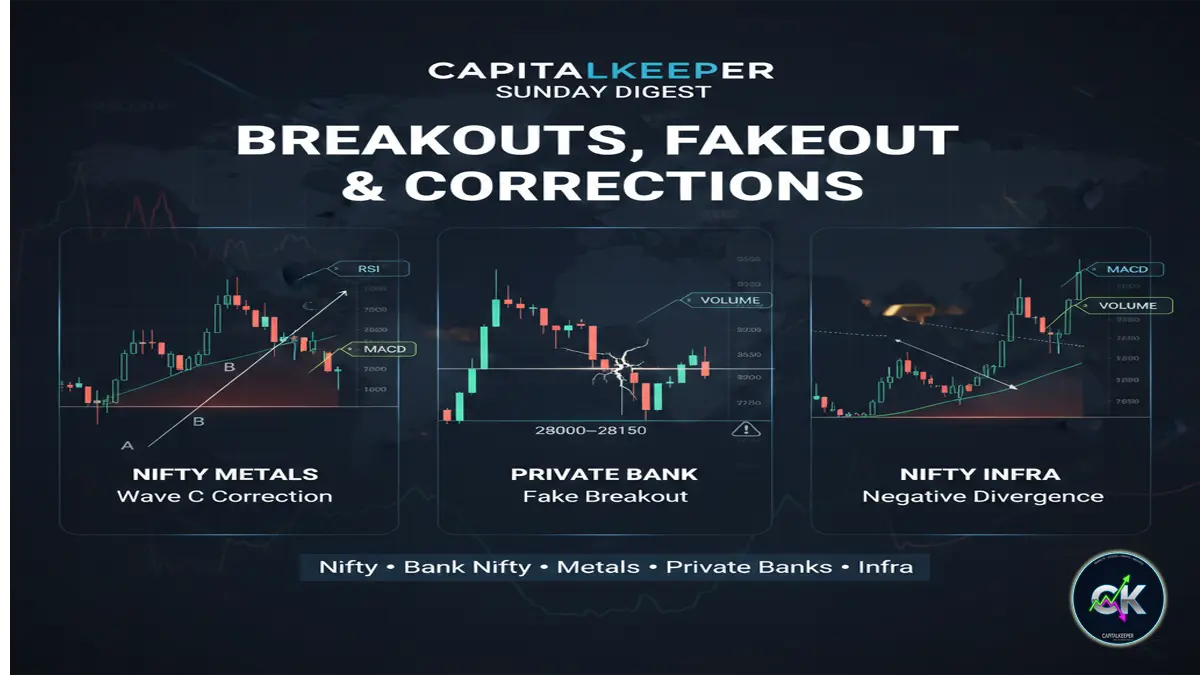

Nifty Metals – Beginning of Wave C Correction

The metals sector showed a faster retracement of the previous rally. Technically, the sector appears to be entering a corrective phase after completing Wave B.

Key Observations

- Corrective rise seen from 11185 to 12326

- Wave B appears to be completed

- Wave C downward move seems to be initiating

Technical Signals

- RSI showing weakening momentum

- MACD turning negative on lower timeframes

- Volume increasing on selling sessions

Outlook

A deeper correction is expected, potentially toward the 10100 zone, which aligns with a crucial EMA support area. This level will be important for medium-term positioning.

Nifty Private Bank – Fake Breakout Trap

Private banking stocks witnessed a gap-up breakout initially after positive global trade cues, but the momentum failed to sustain.

Current Structure

CMP around 28691 indicates a fragile structure.

Technical Interpretation

- Breakout failed to hold

- Selling pressure emerged quickly

- Pattern resembles a fake breakout

Critical Support Zones

- 28000–28150 is a key demand zone

- Breakdown below this region may trigger aggressive selling

Indicators

- RSI showing loss of strength

- MACD flattening near signal line

- Volume increasing during declines

Outlook

If the index decisively breaks below support, it could lead to a sharp downward move in the coming week.

Nifty Infra – Negative Divergence Alert

Infrastructure stocks have been one of the steady performers, but technical signs now indicate caution.

Chart Signals

- Negative divergence on daily timeframe

- Resistance cluster at 9700–9800

- Weak follow-through after rallies

Technical Indicators

- RSI forming lower highs

- MACD losing bullish momentum

- Volume declining on rallies

Important Levels

- Resistance: 9700–9800

- Strong bullish confirmation only above weekly close of 9900–10000

Outlook

Short-term correction likely unless the index decisively crosses resistance levels.

Nifty & Bank Nifty Technical Outlook

Nifty – Consolidation Phase

Nifty appears to be in a distribution phase near resistance zones.

RSI View

RSI is moving sideways, indicating neutral momentum.

MACD Signal

MACD shows mild bearish crossover signals on shorter timeframes.

Volume Study

Volume is declining during upward moves, which suggests lack of strong buying conviction.

Key Zones

- Support: Near recent swing lows

- Resistance: Near recent highs

Expected Behaviour Next Week

- Sideways to slightly bearish bias

- Stock-specific action likely to dominate

Bank Nifty – Relative Strength but Vulnerable

Bank Nifty showed better strength but struggled near resistance.

RSI Analysis

RSI is still in positive territory but showing signs of cooling down.

MACD View

MACD remains positive but flattening.

Volume Insight

Heavy volume seen during intraday reversals.

Outlook

- Outperformance may continue but with volatility

- Sharp moves possible near key support levels

Midcap & Smallcap Market Action

Broader markets continued to show stock-specific opportunities.

Observations

- Selective buying in quality stocks

- Profit booking in overextended names

- Momentum shifting between sectors

Technical Behaviour

- RSI divergence visible in several midcap charts

- MACD crossovers seen in multiple stocks

- Volume accumulation happening quietly

Conclusion

Midcap and smallcap indices may consolidate before next leg of movement.

Commodities & INR Movement

Gold Trend

Gold remained stable as investors maintained cautious positioning amid global uncertainty.

Technical View

- RSI steady

- MACD neutral

- Volume stable

Crude Oil

Crude showed mild volatility due to global supply expectations.

INR Outlook

Rupee movement stayed range-bound, indicating balanced foreign flows.

Table: Weekly Technical Summary

| Segment | Trend | RSI Signal | MACD Signal | Volume Behaviour | Outlook |

|---|---|---|---|---|---|

| Nifty | Sideways | Neutral | Slightly bearish | Mixed | Range-bound |

| Bank Nifty | Stronger | Positive | Flattening | High intraday | Volatile |

| Metals | Bearish | Weakening | Negative | Selling pressure | Correction |

| Private Banks | Weak | Falling | Bearish | High sell volume | Risk zone |

| Infra | Cautious | Divergence | Losing momentum | Weak rallies | Correction |

Forecast for Upcoming Week

Based on RSI, MACD, and volume studies, the market appears to be entering a consolidation-to-correction phase.

What to Expect

- Sector rotation will continue

- Metals may remain under pressure

- Private banks could see sharp volatility

- Infrastructure stocks may correct

- Stock-specific rallies will dominate

Trading Strategy

- Avoid aggressive positions at resistance

- Focus on strong support-based entries

- Track volume for confirmation

Key Technical Signals to Watch

- RSI breakdown below neutral zone in key sectors

- MACD bearish crossover confirmation

- Rising selling volume in sectoral indices

- Support breakdown in private banking stocks

These signals may define the direction for the next week.

FAQs

What is the key takeaway from this week?

Markets showed signs of exhaustion near resistance with sectoral divergences emerging.

Which sector looks weak?

Metals, private banks, and infrastructure are showing early signs of correction.

Is the broader market still strong?

Yes, but stock-specific action is dominating instead of broad-based rallies.

What should traders watch next week?

Support levels, volume confirmation, and RSI breakdown signals.

Final Thoughts

The market is entering a technically sensitive phase. While the broader trend remains intact, momentum indicators suggest caution in the near term. Sectoral divergence is clearly visible, and institutional participation appears selective.

Metals may continue correcting, private banks are at critical support zones, and infrastructure stocks are showing early warning signs. Meanwhile, benchmark indices are consolidating before the next decisive move.

The coming week will be crucial in determining whether the market resumes its upward momentum or enters a deeper corrective phase. Careful observation of RSI, MACD, and volume behaviour will remain the key to navigating this environment successfully.

📌 For daily trade setups, technical learning, and smart investing tips, stay tuned to CapitalKeeper.in

📌 For more real-time updates, trade setups, and investment insights — follow us on [Telegram] and [WhatsApp Channel] subscribe to our newsletter!

Subscribe Now , Join Telegram the Crypto Capital Club, Get Free Crypto Updates

📌 Disclaimer

The content provided on CapitalKeeper.in is for informational and educational purposes only and does not constitute investment, trading, or financial advice. While we strive to present accurate and up-to-date market data and analysis, we make no warranties or representations regarding the completeness, reliability, or accuracy of the information.

Stock market investments are subject to market risks, and readers/investors are advised to conduct their own due diligence or consult a SEBI-registered financial advisor before making any investment decisions. CapitalKeeper and its authors are not liable for any loss or damage, direct or indirect, arising from the use of this information.

All views and opinions expressed are personal and do not reflect the official policy or position of any agency or organization. Past performance is not indicative of future results.By using this website, you agree to the terms of this disclaimer.

Ranjit Sahoo

Founder & Chief Editor – CapitalKeeper.in

Ranjit Sahoo is the visionary behind CapitalKeeper.in, a leading platform for real-time market insights, technical analysis, and investment strategies. With a strong focus on Nifty, Bank Nifty, sector trends, and commodities, she delivers in-depth research that helps traders and investors make informed decisions.

Passionate about financial literacy, Ranjit blends technical precision with market storytelling, ensuring even complex concepts are accessible to readers of all levels. Her work covers pre-market analysis, intraday strategies, thematic investing, and long-term portfolio trends.

When he’s not decoding charts, Ranjit enjoys exploring coastal getaways and keeping an eye on emerging business themes.

📌 Follow Ranjit on:

LinkedIn | Twitter/X | Instagram | ✉️ contact@capitalkeeper.in

Leave a Reply