Indian Stock Market Closing Bell 5 Feb 2026: Nifty Ends at 25,642, Bank Nifty Slips, Global Cues Keep Sentiment Mixed

Updated: 05 February 2026

Category: Closing Bell | Market Analysis

By CapitalKeeper Research Desk

Indian stock market closing bell report for 5 February 2026. Nifty closes at 25,642.80, Sensex at 83,313.93, Bank Nifty weakens. Read full market analysis, global cues, sector trends, outlook, FAQs, and expert insights.

Indian Stock Market Closing Bell – 05 February 2026

Nifty Holds Ground Near 25,600; Banking Stocks Cool Off While Global Cues Keep Traders Cautious

Indian Stock Market Closing Bell – 05 February 2026

The Indian stock market ended Thursday’s session on a cautious note as benchmark indices struggled to maintain early momentum amid mixed global signals and profit booking in heavyweight sectors. After a slightly volatile trading day, Nifty managed to hold above the 25,600 mark, while Bank Nifty witnessed mild pressure. Investors remained selective, balancing global uncertainty with domestic resilience.

Markets opened steady but faced intermittent selling pressure as the day progressed. Despite early optimism, traders turned cautious ahead of global macro developments and institutional positioning. The broader sentiment stayed neutral with stock-specific action dominating the session.

Closing Bell Snapshot – 05 Feb 2026

| Index | Open | Close | Change |

|---|---|---|---|

| Nifty 50 | 25,755.90 | 25,642.80 | Mild decline |

| Bank Nifty | 60,315.35 | 60,063.65 | Weak |

| Sensex | 83,757.54 | 83,313.93 | Lower |

| Fin Nifty | 27,812.60 | 27,689.35 | Slightly negative |

The session reflected consolidation after recent volatility. Markets showed resilience but lacked strong directional conviction.

Market Overview

The day began with a steady opening supported by positive domestic sentiment and stable global markets overnight. However, selling pressure emerged gradually in large-cap stocks, especially in banking and financial services, which dragged indices lower in the second half.

Nifty attempted to sustain near the upper levels but failed to hold early gains. The index closed near 25,642, indicating consolidation near a key support zone.

Sensex also followed a similar pattern. It opened strong but drifted lower as the day progressed, ending the session with a modest decline. Market participants were seen booking profits after recent swings, preferring to stay cautious ahead of global economic cues.

Bank Nifty showed relative weakness compared to frontline indices. Selling in major private banking stocks led to a mild decline, signaling short-term exhaustion after recent strength.

Fin Nifty also remained under pressure as NBFC and financial stocks saw mild intraday selling.

Key Market Drivers

1. Global Market Influence

Global markets played a crucial role in shaping domestic sentiment. Investors kept a close watch on international bond yields, inflation signals, and interest rate expectations. Even small fluctuations in global cues influenced market mood throughout the day.

Asian markets traded mixed, while European futures indicated a cautious opening. This led to a wait-and-watch approach among traders.

2. Institutional Activity

Institutional flows remained a major factor behind intraday volatility. The market moved in narrow ranges as traders tracked foreign investor positioning. Any shift in derivative data continues to impact short-term direction.

3. Sector Rotation

The session saw sector rotation rather than broad-based selling. While banking stocks showed mild weakness, select sectors displayed resilience. IT and FMCG stocks provided partial support to indices, preventing deeper losses.

Sector Performance Analysis

Banking Sector

Banking stocks experienced profit booking after recent strength. The index opened strong but lost momentum during the day. Traders appeared cautious near higher levels, leading to sideways movement.

Despite the decline, the broader trend remains stable, with support seen around key technical zones.

Financial Services

Financial stocks remained under pressure with minor declines in NBFC and insurance stocks. The sector is currently in a consolidation phase after recent volatility.

IT Sector

Technology stocks offered some support to the market. Stability in global tech sentiment helped prevent deeper losses.

FMCG Sector

Defensive stocks attracted buying interest as investors sought safety amid uncertainty. FMCG names helped balance overall market weakness.

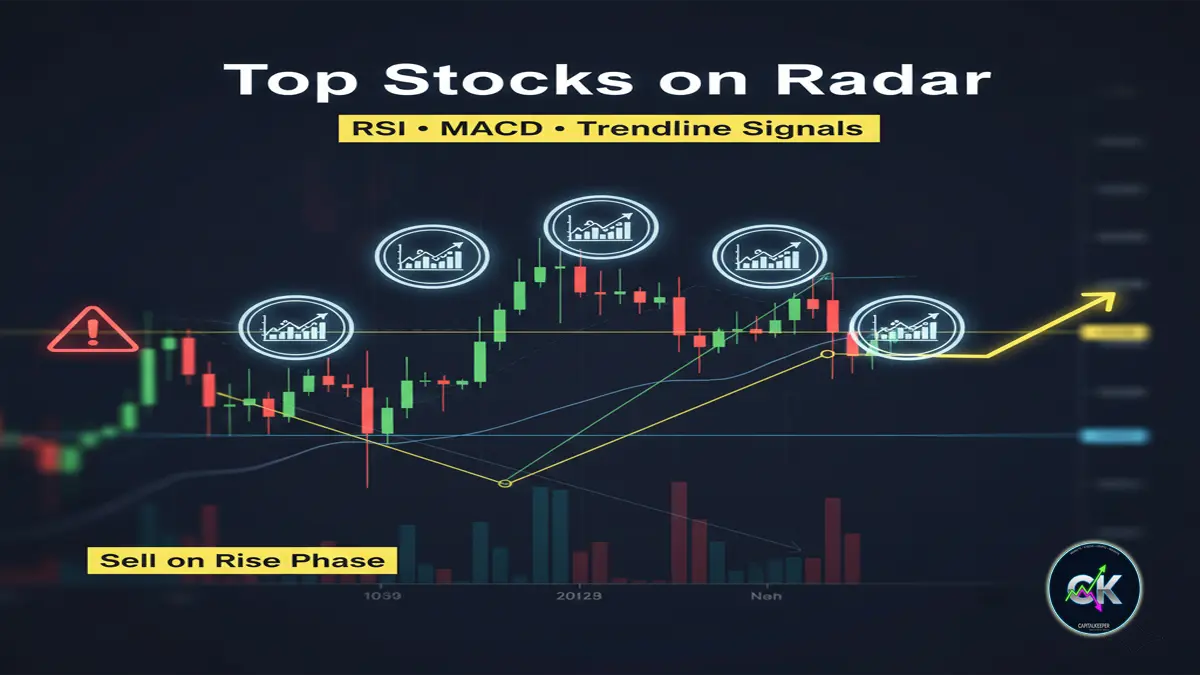

Technical View

Nifty 50 Outlook

Nifty traded within a tight range throughout the session. The index continues to consolidate near crucial levels.

- Immediate Support: 25,500

- Strong Support: 25,200

- Resistance Zone: 26,000 – 26,200

Holding above 25,500 keeps the structure stable. However, failure to break 26,000 may lead to further consolidation.

Bank Nifty Outlook

Bank Nifty showed relative weakness but remains structurally strong.

- Support: 59,500

- Resistance: 60,800 – 61,200

A sustained move above resistance could trigger fresh buying.

Market Sentiment

The overall mood remained neutral to cautious. Traders avoided aggressive positions due to mixed global cues and uncertainty around institutional flows.

Volatility stayed moderate, suggesting consolidation rather than panic selling. Market participants preferred selective trading over broad exposure.

Broader Market & Midcaps

Midcap and smallcap stocks displayed stock-specific action. Some segments saw buying interest while others witnessed mild profit booking. The broader market showed resilience, indicating underlying strength.

Investors continued to focus on fundamentally strong companies rather than chasing momentum.

Global Cues Impacting Markets

Several global factors influenced today’s trading:

- Movements in US bond yields

- Global inflation expectations

- Currency fluctuations

- Oil price trends

Markets reacted sensitively to global risk signals, which kept traders cautious.

What Traders Should Watch Next

Key factors that may guide the next session:

- Global market direction overnight

- Institutional flow trends

- Crude oil price movement

- Interest rate outlook

- Rupee stability

These elements will determine whether markets break out or continue consolidating.

Short-Term Market Outlook

The market currently appears to be in a consolidation phase after recent volatility. The structure remains intact as long as key support levels hold.

A breakout above resistance could lead to renewed bullish momentum. On the downside, any global weakness may trigger short-term corrections.

Investment Strategy

Investors should consider a balanced approach:

- Avoid aggressive buying at higher levels

- Focus on strong sector leaders

- Maintain stop losses in volatile stocks

- Look for opportunities in corrections

Long-term investors can continue accumulating quality stocks gradually.

Internal Links for CapitalKeeper.in

- Pre-Market Analysis

- Nifty & Bank Nifty Technical Outlook

- Weekly Market Wrap

- Educational Series: RSI & MACD Explained

FAQs – Indian Stock Market Closing Bell

1. Why did the market close lower today?

The decline was mainly due to profit booking in banking stocks and cautious global sentiment.

2. Is Nifty still bullish?

Yes, as long as Nifty holds above key support levels, the broader trend remains stable.

3. What is the key level to watch next?

The 26,000 level on Nifty remains a major resistance zone.

4. Which sector showed weakness?

Banking and financial stocks saw mild pressure during the session.

5. What should investors do now?

Focus on quality stocks and avoid overtrading in volatile conditions.

Final Closing Note

Today’s session reflected controlled consolidation rather than panic. Markets continue to show resilience despite global uncertainty. With Nifty holding near 25,600 and banking stocks stabilizing, the broader structure remains intact.

The coming sessions will be crucial as global cues, institutional flows, and technical levels determine the next big move. Traders should stay alert, while investors can use volatility to identify long-term opportunities.

📌 For daily trade setups, technical learning, and smart investing tips, stay tuned to CapitalKeeper.in

📌 For more real-time updates, trade setups, and investment insights — follow us on [Telegram] and [WhatsApp Channel] subscribe to our newsletter!

📌 Disclaimer

The content provided on CapitalKeeper.in is for informational and educational purposes only and does not constitute investment, trading, or financial advice. While we strive to present accurate and up-to-date market data and analysis, we make no warranties or representations regarding the completeness, reliability, or accuracy of the information.

Stock market investments are subject to market risks, and readers/investors are advised to conduct their own due diligence or consult a SEBI-registered financial advisor before making any investment decisions. CapitalKeeper and its authors are not liable for any loss or damage, direct or indirect, arising from the use of this information.

All views and opinions expressed are personal and do not reflect the official policy or position of any agency or organization. Past performance is not indicative of future results. By using this website, you agree to the terms of this disclaimer

Ranjit Sahoo

Founder & Chief Editor – CapitalKeeper.in

Ranjit Sahoo is the visionary behind CapitalKeeper.in, a leading platform for real-time market insights, technical analysis, and investment strategies. With a strong focus on Nifty, Bank Nifty, sector trends, and commodities, she delivers in-depth research that helps traders and investors make informed decisions.

Passionate about financial literacy, Ranjit blends technical precision with market storytelling, ensuring even complex concepts are accessible to readers of all levels. Her work covers pre-market analysis, intraday strategies, thematic investing, and long-term portfolio trends.

When he’s not decoding charts, Ranjit enjoys exploring coastal getaways and keeping an eye on emerging business themes.

📌 Follow Ranjit on:

LinkedIn | Twitter/X | Instagram | ✉️ contact@capitalkeeper.in

Leave a Reply