Nifty, Bank Nifty & Fin Nifty Outlook for 08 January 2026: Positive Bias, Key Levels, RSI–MACD Signals & Intraday Straddle Strategies

Updated: 08 January 2026

Category: Nifty & Bank Nifty | Market Analysis

By CapitalKeeper Research Desk

Indian stock market outlook for 08 January 2026 covering Nifty, Bank Nifty and Fin Nifty. Detailed support–resistance levels, FII data, PCR analysis, India VIX, RSI–MACD–Volume signals, intraday straddle strategies, and key market timings. Read the full analysis on CapitalKeeper.in.

Indian Stock Market Outlook – 08 January 2026

The Indian equity market enters Thursday, 08 January 2026, with a Trend Mix carrying a Positive Bias, supported by stable volatility, controlled option data, and selective institutional participation. While the broader structure remains constructive, intraday traders must stay disciplined, as markets are trading close to important resistance zones.

This outlook covers Nifty 50, Bank Nifty, and Fin Nifty, with a strong focus on price action, derivatives data, RSI–MACD–Volume behavior, and intraday straddle setups suitable for volatile pockets during the session.

Today’s Market Structure at a Glance

| Indicator | Status |

|---|---|

| Trend | Positive Bias |

| India VIX | 9.95 (Low & Stable) |

| FII Index Longs | 10% (down from 13%) |

| Nifty PCR | 0.89 |

| Bank Nifty PCR | 1.05 |

| Volatility Nature | Controlled, range expansion possible |

A low India VIX below 10 generally indicates confidence and smoother price movement, but it also warns traders not to expect runaway trends unless volumes expand meaningfully.

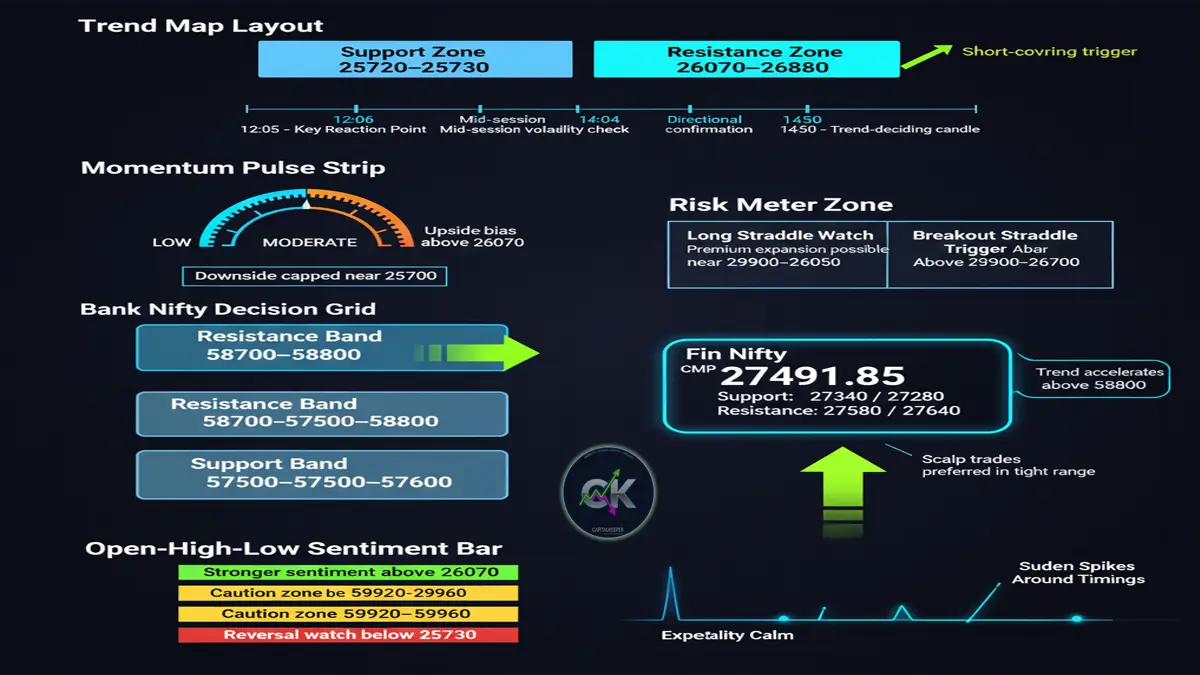

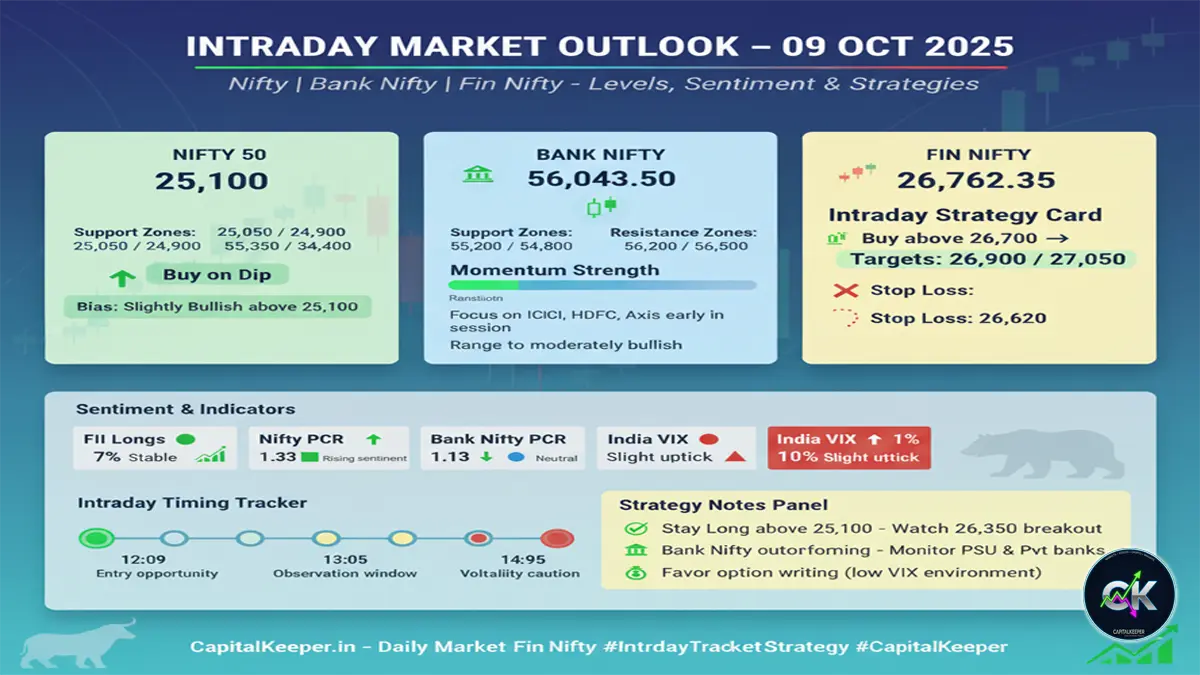

Important Intraday Timings to Watch (Time-Based Trading)

Time-based market reactions remain crucial, especially on derivative-heavy days:

- 12:20 PM – First momentum check

- 13:05 PM – Trend continuation or reversal window

- 14:05 PM – Option activity spike likely

- 14:55 PM – Final-hour directional move / profit booking

These timings often coincide with VWAP shifts, option writers’ activity, and institutional hedging.

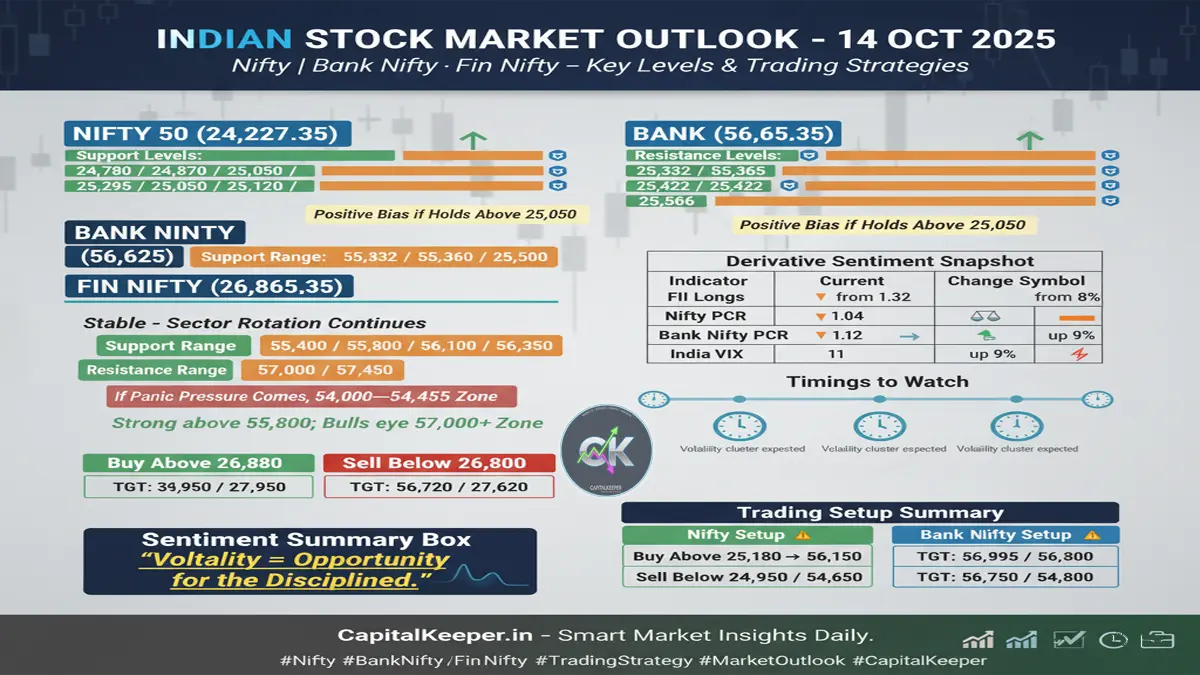

Nifty 50 Outlook – 08 January 2026

Spot Level: 26,030

Nifty Support Levels

- 25,875

- 25,925

- 25,975

- 26,055

Nifty Resistance Levels

- 26,195

- 26,250

- 26,310

- 26,394

Technical Interpretation

Nifty continues to trade within a well-defined range, showing healthy consolidation after the recent upmove. The support cluster between 25,925–25,975 is crucial for maintaining bullish structure.

A sustained hold above 26,055 keeps the bias positive and opens the door toward 26,250–26,310. However, rejection near 26,394 could invite short-term profit booking.

Derivatives & Sentiment

- PCR at 0.89 indicates neither aggressive bullishness nor panic hedging

- Call writers are active near 26,300+, making it a supply zone

- Put writers defending 25,900–26,000

Intraday View:

➡️ Buy-on-dips near support

➡️ Partial profit booking near upper resistance

➡️ Avoid chasing breakouts without volume confirmation

Bank Nifty Outlook – 08 January 2026

Spot Level: 59,925

Bank Nifty Support Levels

- 59,250

- 59,400

- 59,630

- 59,730

Bank Nifty Resistance Levels

- 60,150

- 60,300

- 60,450

- 60,600

- 60,750 / 60,900

Technical Interpretation

Bank Nifty remains structurally stronger than Nifty, supported by heavyweight private banks and selective PSU participation. The index is holding above its short-term VWAP and previous breakout zone.

A clean sustain above 60,150 can trigger momentum toward 60,450–60,600, while failure to hold 59,730 may invite intraday mean reversion.

Options Data Insight

- PCR at 1.05 suggests balanced optimism

- Strong put writing near 59,500–59,700

- Call writers active beyond 60,500

Intraday Bias:

➡️ Range-to-positive

➡️ Strong trend only if volumes expand above 60,150

Fin Nifty Outlook – 08 January 2026

Spot Level: 27,795

Fin Nifty continues to attract attention due to its faster price movement and cleaner option behavior compared to Nifty and Bank Nifty.

RSI Analysis

- RSI hovering in 60–62 zone

- Indicates bullish momentum without overbought conditions

MACD Analysis

- MACD line above signal line

- Histogram positive but flattening → signals consolidation before next move

Volume Analysis

- Volume expanding on up-moves, contracting on dips

- Healthy accumulation behavior

Inference:

Fin Nifty remains positively biased, but traders should prefer range-based or volatility strategies rather than directional overconfidence.

Intraday Straddle (Volatility) Strategies

With India VIX below 10, option premiums are relatively cheap, making intraday straddles attractive near key levels and time windows.

🔹 Nifty Intraday Straddle

- Strike: ATM (26,000 CE + 26,000 PE)

- Entry: Near VWAP between 12:15–12:30

- Target: 25–35% combined premium move

- SL: 20% combined premium

🔹 Bank Nifty Intraday Straddle

- Strike: ATM (60,000 CE + 60,000 PE)

- Entry: Post 13:00 if range compression observed

- Target: 30–40%

- SL: Time-based exit by 14:45 if no expansion

🔹 Fin Nifty Intraday Straddle

- Strike: ATM (27,800 CE + 27,800 PE)

- Best Window: 13:00–14:15

- Target: Quick 20–30%

- SL: Strict time stop if volatility stays muted

⚠️ Risk Note: Always trade straddles with strict stop-loss and time discipline.

Market Risk Factors to Monitor

- Sudden spike in India VIX above 11

- Aggressive FII selling despite positive global cues

- Failure of Nifty to hold 25,925

- Bank Nifty rejection below 59,730 with volume

Short-Term Outlook Summary

| Index | Bias | Strategy |

|---|---|---|

| Nifty | Positive | Buy dips, book near resistance |

| Bank Nifty | Strong | Range breakout above 60,150 |

| Fin Nifty | Bullish | Volatility & momentum plays |

Internal Link Suggestions for CapitalKeeper.in

- Read next: “How to Use PCR, VIX & OI to Predict Market Breakouts”

- Also read: “Sector Rotation Strategy for Swing Traders”

- Education: “Beginner’s Guide to RSI & MACD Trading Signals”

FAQs – Traders & Investors

Q1. Is the market bullish on 08 Jan 2026?

The bias is positive, but markets are near resistance. Disciplined trading is advised.

Q2. Is Bank Nifty stronger than Nifty today?

Yes, Bank Nifty shows relatively stronger structure and option support.

Q3. Are intraday straddles safe today?

Yes, due to low VIX, but strict time-based exits are essential.

Q4. Which index is best for intraday traders today?

Fin Nifty offers cleaner moves and faster premium expansion.

Final Thoughts

The Indian stock market on 08 January 2026 reflects a healthy, controlled bullish environment. With low volatility, balanced PCRs, and stable institutional data, traders should focus on discipline over aggression.

Whether you are trading Nifty, Bank Nifty, or Fin Nifty, remember:

➡️ Respect levels

➡️ Follow time-based discipline

➡️ Protect capital first, profits next

For daily market intelligence, intraday strategies, and sector-wise insights, stay connected with CapitalKeeper.in.

📌 For more real-time updates, trade setups, and investment insights — follow us on [Telegram] and [WhatsApp Channel] subscribe to our newsletter!

📌 Disclaimer

The content provided on CapitalKeeper.in is for informational and educational purposes only and does not constitute investment, trading, or financial advice. While we strive to present accurate and up-to-date market data and analysis, we make no warranties or representations regarding the completeness, reliability, or accuracy of the information.

Stock market investments are subject to market risks, and readers/investors are advised to conduct their own due diligence or consult a SEBI-registered financial advisor before making any investment decisions. CapitalKeeper and its authors are not liable for any loss or damage, direct or indirect, arising from the use of this information.

All views and opinions expressed are personal and do not reflect the official policy or position of any agency or organization. Past performance is not indicative of future results.

By using this website, you agree to the terms of this disclaimer.

Ranjit Sahoo

Founder & Chief Editor – CapitalKeeper.in

Ranjit Sahoo is the visionary behind CapitalKeeper.in, a leading platform for real-time market insights, technical analysis, and investment strategies. With a strong focus on Nifty, Bank Nifty, sector trends, and commodities, she delivers in-depth research that helps traders and investors make informed decisions.

Passionate about financial literacy, Ranjit blends technical precision with market storytelling, ensuring even complex concepts are accessible to readers of all levels. Her work covers pre-market analysis, intraday strategies, thematic investing, and long-term portfolio trends.

When he’s not decoding charts, Ranjit enjoys exploring coastal getaways and keeping an eye on emerging business themes.

📌 Follow Ranjit on:

LinkedIn | Twitter/X | Instagram | ✉️ contact@capitalkeeper.in

Leave a Reply