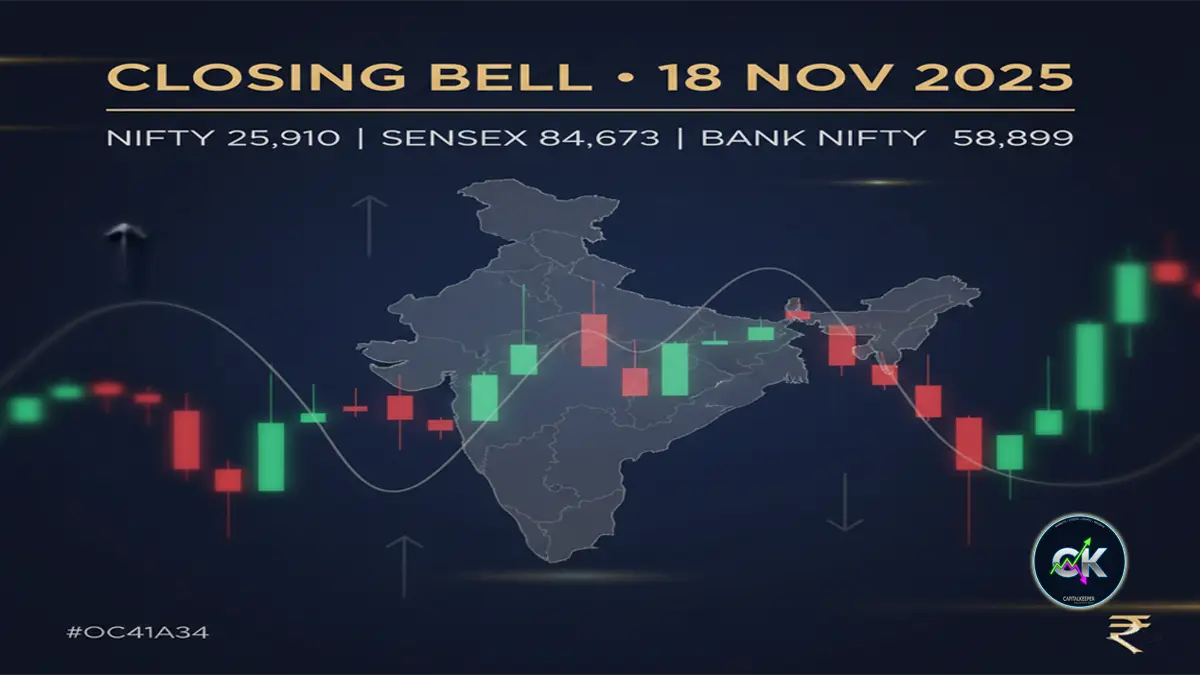

Indian Stock Market Closing Bell 18 November 2025: Nifty slips to 25,910; Bank Nifty holds 58,899 amid global caution

Updated: 18 November 2025

Category: Closing Bell | Market Analysis

By CapitalKeeper Research Desk

Indian Stock Market Closing Bell Report for 18 November 2025: Nifty ends at 25,910 while Sensex slips to 84,673. Detailed coverage of Bank Nifty, Fin Nifty, sector performance, global cues, FII–DII flow trends, technical levels, and outlook for the next trading session.

Indian Stock Indian Stock Market Closing Bell Report — 18 November 2025

The Indian equity market wrapped up Tuesday’s session with mild weakness as profit-booking emerged across largecaps after a volatile intraday move. Despite a positive start driven by strong overnight cues from the U.S., domestic indices failed to hold on to early gains, dragged by pressure in metals, IT, and a part of financials. However, selective buying in autos, telecom, FMCG, and midcaps prevented a deeper correction.

The broader mood remained cautious ahead of key global events this week, including the U.S. Federal Reserve minutes, crude oil inventory data, and inflation prints from Japan and the U.K. Domestically, investors also monitored bond yields and the INR’s slight depreciation against the USD.

📌 Key Market Summary (18 November 2025)

| Index | Open | Close | Movement |

|---|---|---|---|

| Nifty 50 | 26,021.80 | 25,910.05 | ▼ 111.75 |

| Bank Nifty | 58,990.50 | 58,899.25 | ▼ 91.25 |

| Sensex | 85,042.37 | 84,673.02 | ▼ 369.35 |

| Fin Nifty | 27,643.25 | 27,546.75 | ▼ 96.50 |

Nifty and Sensex ended lower for a second straight session, but the consolidation remains healthy after last week’s sharp upward move. Bank Nifty held relatively stable, supported by private banks, while Fin Nifty mirrored the broader trend with mild softness.

📌 GLOBAL MARKET CUES THAT INFLUENCED TODAY’S TRADE

1. U.S. Markets

Overnight, U.S. indices posted mild gains as traders anticipated a rate-cut friendly tone in the upcoming Federal Reserve minutes.

- Dow Jones: Slightly higher

- Nasdaq: Supported by AI and semiconductor names

- S&P 500: Range-bound

This positive momentum initially lifted Indian markets at the open, but domestic factors later overshadowed sentiment.

2. European Markets

European indices were mixed as investors awaited U.K. inflation data.

- FTSE mildly weak

- DAX and CAC trading flat

3. Asian Markets

Asian markets traded cautiously:

- Nikkei under pressure as USD/JPY volatility continued

- Kospi saw selling in tech

- Hang Seng remained steady on bargain buying

The global setup leaned neutral to weak, which translated into intraday indecision for Indian equity benchmarks.

📌 DOMESTIC MARKET DRIVERS

1. Profit-Booking in Index Heavyweights

Reliance Industries, TCS, HDFC Bank, and select IT names weighed on the indices after the recent rally. The selling appeared mild and technical in nature rather than sentiment-driven.

2. Crude Oil Softness Provided Support

Brent crude stayed under control, helping OMCs and broader macros. Cooling crude continues to act as a stabilizing factor for India’s inflation trajectory.

3. INR Movement Against USD

The rupee saw slight weakening, prompting some caution in IT, Pharma, and import-heavy sectors.

4. FII–DII Activity

FIIs continued passive selling in index futures but remained buyers in select cash segments, while DIIs counterbalanced the selling with measured inflows.

📌 SECTOR-WISE MARKET PERFORMANCE

📈 Gainers

Auto, FMCG, Telecom, PSU Banks

Autos witnessed strong traction due to sustained festival-season demand. FMCG remained resilient as investors sought defensive pockets. Telecom continued its steady upward trend, supported by tariff revision expectations.

📉 Losers

IT, Metals, Pharma, Oil & Gas

- IT: Hit by intraday profit booking and margin concerns.

- Metals: Weakness in global metal prices weighed on sentiment.

- Pharma: Some amount of sectoral rotation resulted in selling.

- O&G: Reliance-led weakness pulled the related index down.

Midcaps and smallcaps outperformed again, showing robust market breadth.

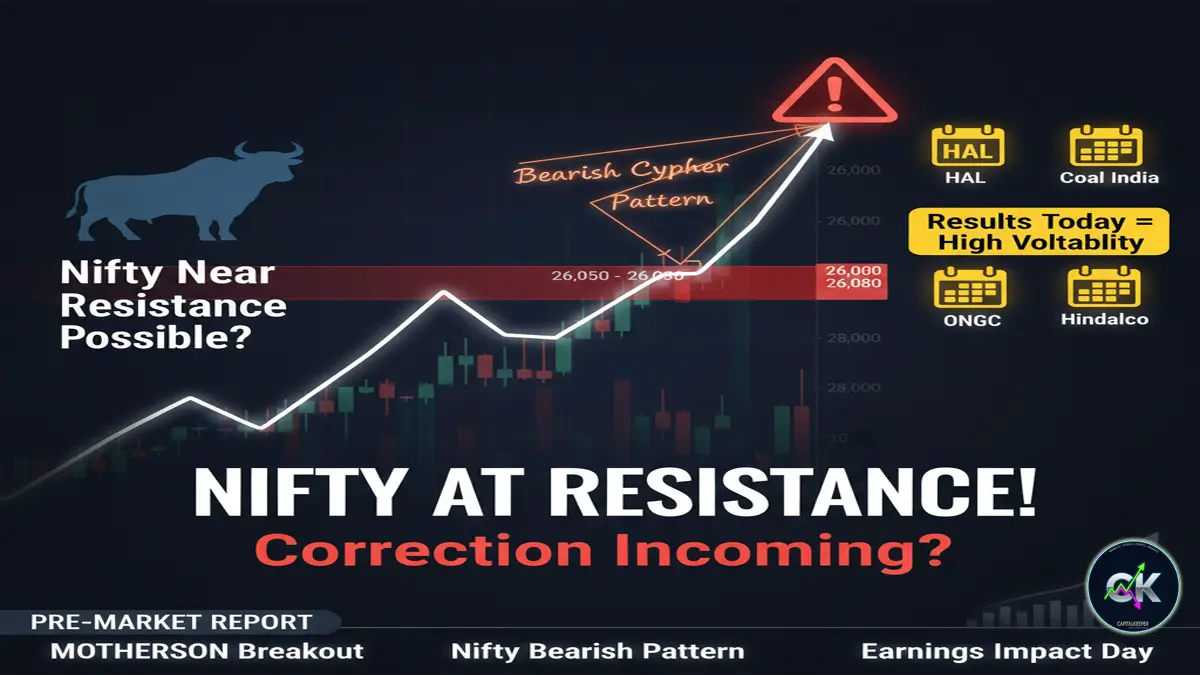

📌 NIFTY TECHNICAL ANALYSIS – 18 NOVEMBER 2025

Nifty closed at 25,910, showing a decline but maintaining its structure above key swing supports.

Support Zones

- 25,820–25,860: First demand zone

- 25,700: Strong positional support

Resistance Zones

- 26,020–26,070: Immediate hurdle

- 26,150: Psychological barrier

The index is currently in a healthy consolidation, forming a base for the next leg of momentum. The long wicks on the daily chart suggest dip-buying interest.

📌 BANK NIFTY TECHNICAL VIEW

Bank Nifty closed at 58,899, showing relative strength compared to Nifty. Private banks supported the index, while PSU banks saw mixed action.

Support

- 58,600

- 58,250 (major support)

Resistance

- 59,200

- 59,450 (breakout zone)

The index is expected to remain sideways to mildly positive unless major global shocks emerge.

📌 FIN NIFTY OVERVIEW

Fin Nifty closed at 27,546, softer but still holding above its breakout region.

- Support: 27,400 → 27,250

- Resistance: 27,680 → 27,820

Financials remain stable overall, supported by NBFC and insurance traction.

📌 SENSEX MARKET WRAP

Sensex closed at 84,673, losing around 370 points as profit booking surfaced in energy and tech stocks. Broader sentiment remains stable as long as the index holds above 84,200.

📌 MARKET BREADTH & VOLUME TRENDS

- Advance–Decline ratio remained positive, indicating broader market strength.

- Midcap index hit intraday highs before cooling-off mildly.

- Smallcap index continued to outperform with strong participation in PSU, defence, and infra themes.

This signals risk-on sentiment despite index-level consolidation.

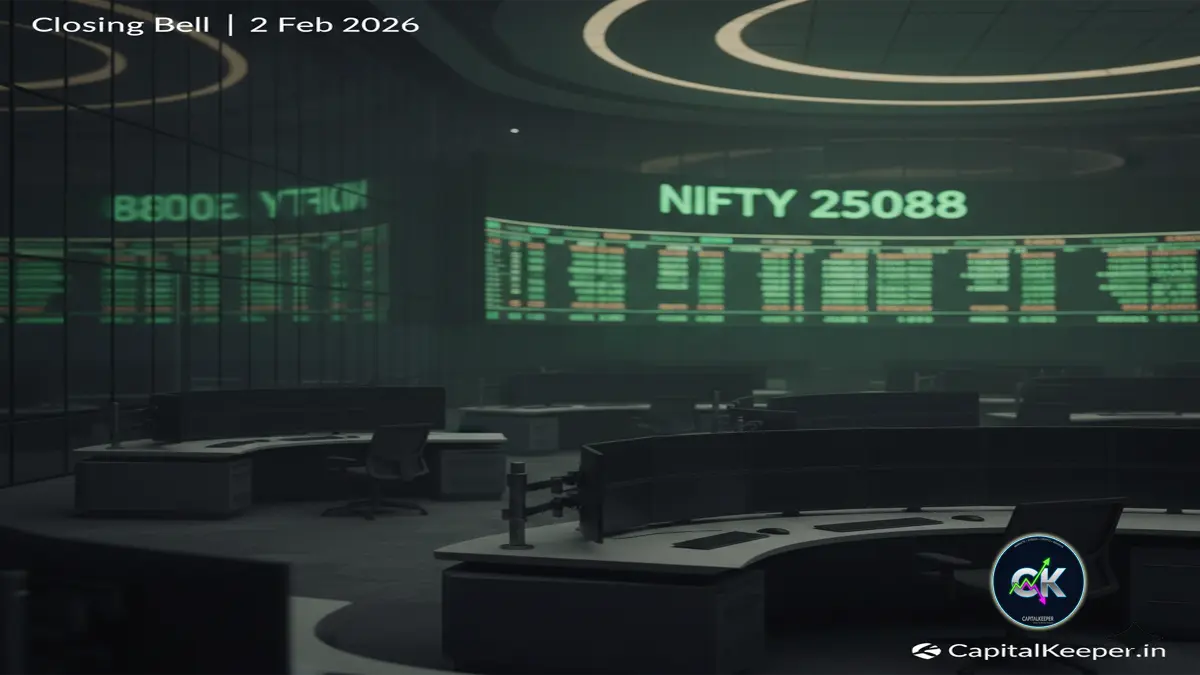

📌 OUTLOOK FOR THE NEXT TRADING SESSION (19 NOV 2025)

The market is expected to open cautiously but remain range-bound with a slight positive bias.

Key triggers to watch tomorrow:

- U.S. Fed minutes

- Crude oil inventory

- INR volatility

- Sector rotation patterns

- FII futures activity

If Nifty sustains above 26,000, a move toward 26,080–26,150 is possible.

On the downside, dips toward 25,820–25,700 may attract buyers.

📌 INTERNAL LINKS FOR CapitalKeeper.in

You may insert these during publication:

- Pre-Market Analysis

- Nifty & Bank Nifty Technical Outlook

- Commodity Market Wrap

- Weekly Market Digest

- Educational Series: Price Action & Indicators

📌 FAQs — Closing Bell India (18 November 2025)

1. Why did Nifty close lower today?

Due to profit booking in index heavyweights and mixed global cues.

2. Which sectors outperformed today?

Autos, FMCG, telecom, and PSU banks.

3. How did global markets affect Indian indices?

Mixed global sentiment kept domestic markets range-bound.

4. Is the trend still positive?

Yes, the overall structure remains bullish as long as Nifty sustains above major supports.

5. What should traders watch tomorrow?

Fed minutes, crude oil trends, and FII–DII flows.

📌 For daily trade setups, technical learning, and smart investing tips, stay tuned to CapitalKeeper.in

📌 For more real-time updates, trade setups, and investment insights — follow us on [Telegram] and [WhatsApp Channel] subscribe to our newsletter!

📌 Disclaimer

The content provided on CapitalKeeper.in is for informational and educational purposes only and does not constitute investment, trading, or financial advice. While we strive to present accurate and up-to-date market data and analysis, we make no warranties or representations regarding the completeness, reliability, or accuracy of the information.

Stock market investments are subject to market risks, and readers/investors are advised to conduct their own due diligence or consult a SEBI-registered financial advisor before making any investment decisions. CapitalKeeper and its authors are not liable for any loss or damage, direct or indirect, arising from the use of this information.

All views and opinions expressed are personal and do not reflect the official policy or position of any agency or organization. Past performance is not indicative of future results. By using this website, you agree to the terms of this disclaimer

Ranjit Sahoo

Founder & Chief Editor – CapitalKeeper.in

Ranjit Sahoo is the visionary behind CapitalKeeper.in, a leading platform for real-time market insights, technical analysis, and investment strategies. With a strong focus on Nifty, Bank Nifty, sector trends, and commodities, she delivers in-depth research that helps traders and investors make informed decisions.

Passionate about financial literacy, Ranjit blends technical precision with market storytelling, ensuring even complex concepts are accessible to readers of all levels. Her work covers pre-market analysis, intraday strategies, thematic investing, and long-term portfolio trends.

When he’s not decoding charts, Ranjit enjoys exploring coastal getaways and keeping an eye on emerging business themes.

📌 Follow Ranjit on:

LinkedIn | Twitter/X | Instagram | ✉️ contact@capitalkeeper.in

Leave a Reply