Indian Stock Market Closing Bell 28 October 2025 | Nifty Holds Ground, Bank Nifty Leads the Upside

By CapitalKeeper | Closing Bell | Indian Equity | Market Moves That Matter

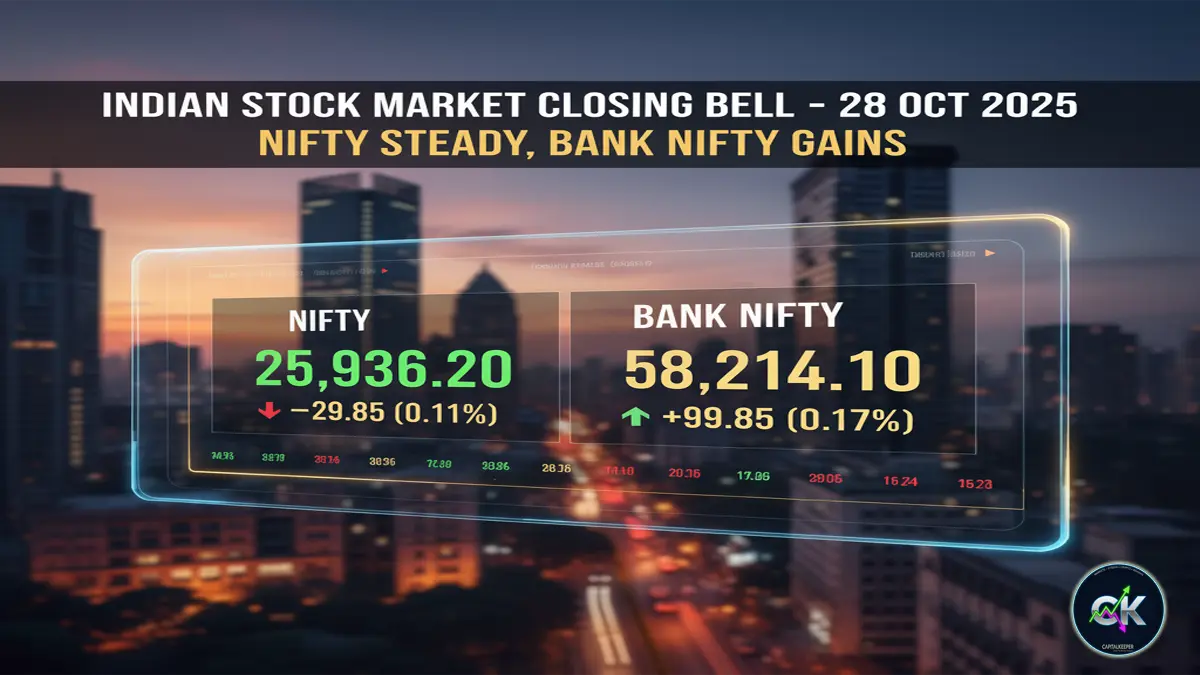

Indian Stock Market ended flat on 28 October 2025 as Nifty closed at 25,936 while Bank Nifty gained modestly to 58,214. Global cues remained mixed with investors awaiting U.S. GDP data. Read detailed analysis on CapitalKeeper.in.

Indian Stock Market Closing Bell – 28 October 2025: Nifty Ends Flat, Bank Nifty Outperforms Amid Mixed Global Cues

As the Indian equity market closed on 28th October 2025, investors witnessed a day marked by consolidation and selective sectoral rotation. After a volatile session, the Nifty 50 index managed to hold near its opening levels, while Bank Nifty showed resilience, closing in positive territory.

The market displayed a tug-of-war between cautious investors booking profits and institutional buying in banking and financial stocks following the previous day’s FDI-related optimism in state-run banks.

📊 Market Summary

| Index | Open | Close | Change | Sentiment |

|---|---|---|---|---|

| Nifty 50 | 25,938.95 | 25,936.20 | 🔻 -0.01% | Consolidation |

| Bank Nifty | 58,006.55 | 58,214.10 | 🔼 +0.36% | Bullish |

| Sensex | 84,625.71 | 84,628.16 | 🔼 +0.00% | Flat |

| Fin Nifty | 27,441.65 | 27,453.95 | 🔼 +0.04% | Range-bound |

The trading day ended with mild divergence across indices, as financials lent support to broader indices while IT, FMCG, and Metals faced mild selling pressure.

🏦 Domestic Market Overview

The Nifty oscillated within a narrow range throughout the session, largely holding above its critical support of 25,900, suggesting underlying strength despite profit booking pressure. Market breadth was slightly positive, indicating a healthy rotation between sectors rather than panic selling.

Bank Nifty, however, continued to outperform, buoyed by follow-up buying in PSU banks after the government’s signal to increase FDI limits to 49% in state-owned banks.

- SBI, PNB, and Bank of Baroda extended gains, adding 1–2% each.

- Private lenders like ICICI Bank and Axis Bank also participated, signaling institutional interest.

On the flip side, IT stocks underperformed due to concerns over global slowdown and cautious U.S. tech earnings guidance. Infosys and TCS saw mild declines, weighing slightly on the Nifty IT index.

🌍 Global Market Cues

Global markets offered a mixed picture as investors across the world awaited key economic data from the United States and Europe.

- Wall Street futures traded sideways ahead of the U.S. Q3 GDP release later this week.

- European markets were subdued as traders digested weak German Ifo business data.

- Asian markets (Nikkei, Hang Seng) ended with minor gains, supported by China’s fiscal stimulus hopes.

Meanwhile, the U.S. Dollar Index remained stable near 104.5, while Brent crude held steady around $83.20 per barrel, providing comfort for import-heavy economies like India.

The global risk appetite remained neutral, offering no major directional push for Indian equities.

💹 Sectoral Highlights

1. Banking and Financials (Positive)

- The top-performing sector for the day, led by PSU banks, continued to attract strong investor attention.

- Institutional buying was visible in SBI, Canara Bank, and Union Bank, reflecting long-term optimism after the FDI policy update.

- The Fin Nifty index mirrored this sentiment, closing slightly higher at 27,453.95.

2. IT Sector (Weak)

- Profit booking emerged after last week’s rally.

- Infosys, HCLTech, and Tech Mahindra lost between 0.5% and 1%, reflecting global tech fatigue.

3. FMCG & Consumer Stocks (Mixed)

- HUL and Dabur witnessed marginal selling due to muted volume growth expectations for Q3.

- ITC, however, stayed firm, supported by defensive buying.

4. Metals and Energy (Stable)

- Tata Steel and JSW Steel traded in a tight band amid global metal price consolidation.

- ONGC and Reliance Industries showed mild upticks as crude oil prices stabilized.

📈 Technical View: Nifty and Bank Nifty

Nifty 50 Analysis:

The Nifty continued to respect its key support zone around 25,900–25,880, holding above it for most of the session. Immediate resistance remains near 26,050, and a breakout above this could trigger fresh momentum towards 26,200 levels.

- Support Zone: 25,850 – 25,900

- Resistance Zone: 26,050 – 26,100

- Momentum Indicator (RSI): Neutral at 53

- MACD: Positive crossover intact

The flat closing suggests accumulation rather than weakness. A close above 26,050 will confirm short-term bullish bias.

Bank Nifty Analysis:

Bank Nifty’s positive close at 58,214 indicates relative strength. The index formed a higher low pattern, hinting at continued institutional buying.

- Support: 57,800

- Resistance: 58,400 – 58,600

- View: Buy on dips remains valid as long as 57,700 holds.

💬 Broader Market Mood

Midcap and smallcap indices remained range-bound, showing mild profit booking after recent rallies. However, rotational buying in select PSU, auto, and infrastructure names indicated continued retail interest.

Top Gainers: INDUSINDBK, JSWSTEEL, TATASTEEL, SBILIFE, EICHERMOT

Top Losers: TRENT, BAJAJFINSV, COALINDIA, ONGC, BAJFINANCE

The India VIX edged slightly lower, reflecting market comfort ahead of the F&O expiry week, with volatility expected to remain moderate.

📊 Institutional Activity

- Foreign Institutional Investors (FIIs): Net buyers in financials, net sellers in IT.

- Domestic Institutional Investors (DIIs): Net buyers across midcap space.

This shows a shift in allocation towards value-oriented sectors like PSU and financials.

🌐 Global Watchlist

- U.S. Q3 GDP and jobless claims data due this week could influence risk sentiment.

- European Central Bank (ECB) commentary on inflation is being closely tracked.

- Oil prices remain range-bound between $82–85/bbl; no fresh inflationary pressure expected.

🔮 Market Outlook for 29 October 2025

Market sentiment remains cautiously optimistic. The Nifty’s consolidation pattern indicates potential strength building for a breakout above 26,000. The Bank Nifty’s leadership is a key positive sign for the broader trend.

If global cues remain stable and institutional flows continue, the index could attempt to retest the 26,100–26,200 zone in the coming sessions. However, traders should maintain a buy-on-dips strategy while protecting positions near key supports.

Short-Term View: Sideways to bullish

Medium-Term View: Positive bias with PSU banks leading

Volatility: Likely to remain contained

🧭 Closing Thoughts

The Indian equity market ended almost unchanged but with encouraging signals beneath the surface. The resilience of banking stocks, coupled with strong domestic liquidity, continues to support the broader uptrend.

While global markets await crucial macroeconomic data, India’s internal policy actions—like increasing FDI in PSU banks have set the tone for renewed investor confidence.

As we move toward the festive season and the October F&O expiry, the focus will remain on sectoral rotation, liquidity flows, and key policy signals that could determine the market’s next leg.

✅ Key Takeaways

Market outlook remains cautiously bullish for the week ahead.oods. The upcoming sessions will determine whether Nifty can decisively conquer the 26,000 mark, setting the tone for November’s market direction.

Nifty holds steady at 25,936 despite volatility.

Bank Nifty leads with 0.36% gain.

PSU banks extend rally post-FDI policy buzz.

IT and FMCG witness mild pressure.

📌 For daily trade setups, technical learning, and smart investing tips, stay tuned to CapitalKeeper.in

📌 For more real-time updates, trade setups, and investment insights — follow us on [Telegram] and [WhatsApp Channel] subscribe to our newsletter!

📌 Disclaimer

The content provided on CapitalKeeper.in is for informational and educational purposes only and does not constitute investment, trading, or financial advice. While we strive to present accurate and up-to-date market data and analysis, we make no warranties or representations regarding the completeness, reliability, or accuracy of the information.

Stock market investments are subject to market risks, and readers/investors are advised to conduct their own due diligence or consult a SEBI-registered financial advisor before making any investment decisions. CapitalKeeper and its authors are not liable for any loss or damage, direct or indirect, arising from the use of this information.

All views and opinions expressed are personal and do not reflect the official policy or position of any agency or organization. Past performance is not indicative of future results. By using this website, you agree to the terms of this disclaimer

Ranjit Sahoo

Founder & Chief Editor – CapitalKeeper.in

Ranjit Sahoo is the visionary behind CapitalKeeper.in, a leading platform for real-time market insights, technical analysis, and investment strategies. With a strong focus on Nifty, Bank Nifty, sector trends, and commodities, she delivers in-depth research that helps traders and investors make informed decisions.

Passionate about financial literacy, Ranjit blends technical precision with market storytelling, ensuring even complex concepts are accessible to readers of all levels. Her work covers pre-market analysis, intraday strategies, thematic investing, and long-term portfolio trends.

When he’s not decoding charts, Ranjit enjoys exploring coastal getaways and keeping an eye on emerging business themes.

📌 Follow Ranjit on:

LinkedIn | Twitter/X | Instagram | ✉️ contact@capitalkeeper.in

Leave a Reply