When Both VIX and Nifty Rise Together | Understanding Market Fear & Volatility in 2025

By CapitalKeeper | Trading Psychology | Indian Equities | Market Moves That Matter

Discover what happens when the India VIX and Nifty 50 rise simultaneously. Learn why this unusual pattern signals hidden market fear, volatility risks, and potential correction ahead.

🧠 Introduction: The Market Paradox That Traders Can’t Ignore

In normal market conditions, the India VIX (Volatility Index) and the Nifty 50 tend to move inversely. When Nifty climbs, VIX usually drops signaling investor confidence and stability. Conversely, when markets fall, VIX spikes as fear and uncertainty grip traders.

However, when both Nifty and VIX rise together, something unusual is happening beneath the surface. It’s like watching a plane ascend while turbulence builds it might keep flying for a while, but the ride is about to get rough.

This paradoxical pattern is a red flag for market participants. It suggests that while prices are climbing, fear is also increasing, indicating that traders are hedging aggressively and preparing for a potential correction.

⚠️ Why the VIX Matters

The India VIX, often called the “Fear Index,” measures expected volatility in the Nifty over the next 30 days, derived from options prices.

- A low VIX (below 12) indicates complacency and calm.

- A moderate VIX (12–18) suggests stable optimism.

- A high VIX (above 20) reflects fear, uncertainty, or anticipation of a big market move.

When the VIX rises alongside Nifty, it indicates that option traders are paying more to hedge, expecting volatility even as prices move higher.

This creates a disconnect between price action and sentiment a dangerous mix that often precedes sudden corrections or short-term reversals.

📊 1. Warning of an Unsustainable Rally

When the Nifty rallies while VIX rises, it’s not pure optimism — it’s nervous buying.

🔍 Implied Weakness Beneath the Surface

A rising VIX signals growing anxiety among institutional traders and hedge funds.

Even though prices are climbing, the cost of protection (put options) is also increasing, showing that smart money is hedging against potential downside.

This implies that the ongoing rally might not be sustainable. The market could be driven by short-covering, momentum, or liquidity, rather than solid fundamental conviction.

In simpler terms:

The crowd is cheering the rally, but the professionals are buying insurance.

😨 2. The “Fear Index” Paradox

The VIX represents expected volatility, not the direction of price. So, when it rises during a bullish market, it indicates fear of future instability not confidence in the uptrend.

This is often referred to as the “Fear Index Paradox.”

Investors are happy with rising prices, but they don’t trust them enough to stay unprotected.

It’s like driving uphill while pressing both the accelerator and the brake. Eventually, one of them has to give way and that’s where volatility strikes.

⚡ 3. Higher Option Premiums — Traders Paying Up for Protection

A rising VIX means option premiums (both calls and puts) become more expensive.

This happens because:

- Traders expect larger price swings in the near term.

- There’s increased demand for put options (protection from downside risk).

- Implied volatility spikes across both monthly and weekly contracts.

For retail traders, this means intraday and positional option trading becomes tricky, as sudden premium decay or spikes can wipe out profits quickly.

📉 4. Risk of a Sharp Correction

Historically, the Nifty tends to top out when the VIX is near its bottom, and vice versa.

When both rise together, it suggests that the market is entering a high-risk zone one where a sharp correction or volatile pullback becomes likely.

Let’s look at past examples:

- January 2018: Nifty was near all-time highs while VIX rose sharply followed by a 10% correction.

- January 2020: Similar setup before the pandemic-induced volatility spike.

When VIX and Nifty move in the same direction, it’s often a pre-warning of turbulence, not the calm before a storm but the storm itself approaching.

⚙️ 5. Strategic Shifts Among Traders and Institutions

When volatility builds, trader behavior changes drastically.

⚠️ Caution for Day Traders

For intraday and short-term traders, this environment is dangerous.

- Sudden reversals are common.

- Stop-losses get triggered quickly.

- False breakouts and whipsaws increase dramatically.

Traders should shift focus from chasing momentum to managing risk and capital preservation.

🧠 Risk Management by Institutions

Professional investors respond differently they increase hedging activities by:

- Buying index puts for protection.

- Reducing gross leverage.

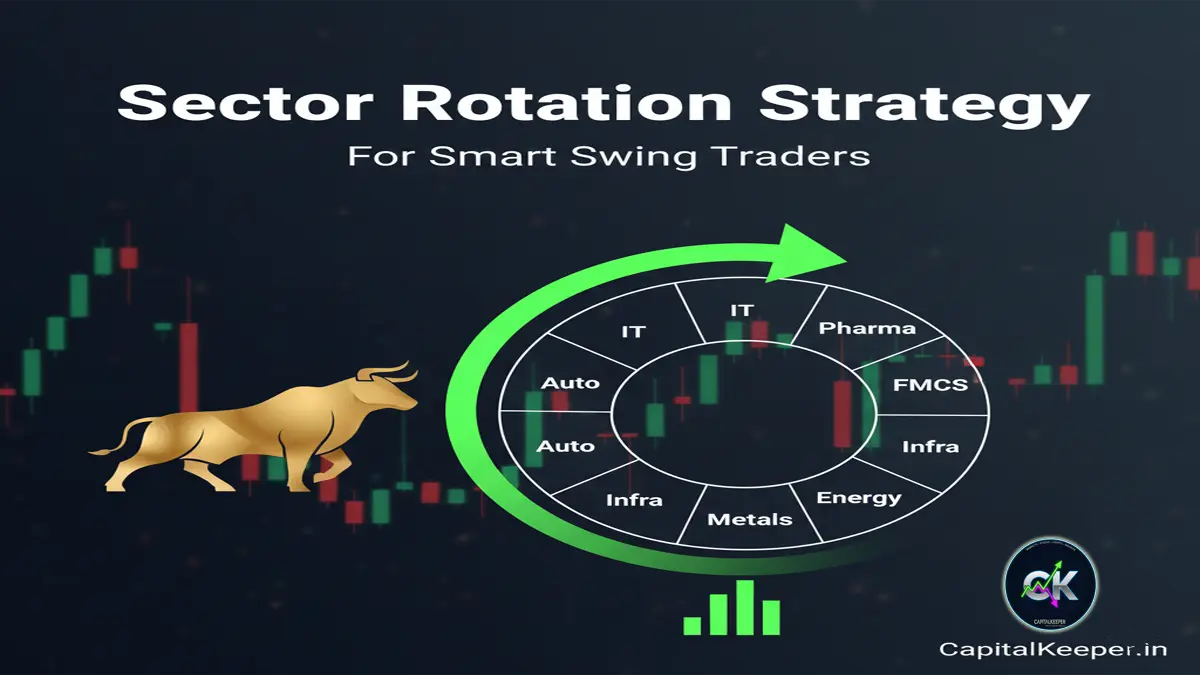

- Switching to defensive sectors like FMCG, IT, and utilities.

When institutions hedge aggressively, it’s a clear sign they expect turbulence ahead even if prices look calm on the surface.

🏦 6. Market Sentiment Becomes Fragile

When the Nifty and VIX both rise, market sentiment turns fragile.

Traders are optimistic but uneasy a combination that fuels volatility.

🌐 Event-Driven Uncertainty

This phenomenon often occurs before high-impact events like:

- Union Budget announcements

- Election results

- Major corporate earnings

- Global geopolitical developments

During these times, markets may rise on positive expectations, but VIX rises because traders are preparing for wild two-way moves once news breaks.

💥 Emotional Market Behavior

Markets become emotion-driven rallies are driven by fear of missing out (FOMO), and sell-offs by panic.

Fundamentals temporarily take a backseat, replaced by sentiment and liquidity.

This emotional tug-of-war often leads to overreactions and short-term volatility spikes.

🧩 7. How Traders Can Navigate a Rising Nifty + Rising VIX Phase

Here are practical strategies to manage such a scenario effectively:

✅ a. Focus on Risk Management

Protect your capital first trade smaller positions and maintain strict stop-losses.

✅ b. Reduce Leverage

When volatility rises, leverage magnifies losses. Scaling down exposure helps reduce whipsaw impact.

✅ c. Avoid Overtrading

High volatility can create false signals trade only when setups are clear.

✅ d. Shift to Defensive Sectors

Move partially into low-beta sectors like FMCG, Pharma, or IT, which tend to hold steady during volatile phases.

✅ e. Monitor Option Data

Rising Put-Call Ratio (PCR) or open interest build-up on both sides can confirm heightened volatility expectations.

✅ f. Watch for a Divergence

When VIX starts falling again while Nifty sustains, it signals stabilization and renewed confidence a healthier uptrend may resume.

🔎 8. Long-Term Investors: Don’t Panic, But Stay Alert

For long-term investors, a simultaneous rise in VIX and Nifty isn’t a reason to sell but it is a reason to stay cautious.

Historically, such phases resolve with:

- Short-term volatility, followed by

- Stronger, healthier market structure once weak hands exit.

Use such corrections to accumulate quality stocks at better valuations especially in sectors with strong fundamentals and earnings visibility.

🧭 Conclusion: Read the Fear Behind the Euphoria

When both VIX and Nifty rise, it’s not business as usual it’s a market on edge.

It reflects a phase where:

- Prices are rising, but confidence is not.

- Traders are excited, but cautious.

- Volatility is increasing, not calming.

This combination has historically been a precursor to heightened volatility or correction, not sustained euphoria.

For investors, the key lies in:

- Staying disciplined.

- Managing exposure smartly.

- Avoiding emotional trades.

In short when fear grows with price, smart money prepares for what comes next.

Suggested Reads on CapitalKeeper.in

- [How to Use RSI and MACD Together for Market Timing (2025 Edition)]

- [Understanding Market Volatility: The Role of India VIX in Stock Analysis]

- [Trading Psychology: How Fear and Greed Move the Markets]

Author: CapitalKeeper Research Desk

Category: Market Sentiment | Volatility Analysis | Trading Psychology

Read Time: 9 Minutes

📌 For daily trade setups, technical learning, and smart investing tips, stay tuned to CapitalKeeper.in

📌 For more real-time updates, trade setups, and investment insights — follow us on [Telegram] and [WhatsApp Channel] subscribe to our newsletter!

Subscribe Now , Join Telegram the Crypto Capital Club, Get Free Crypto Updates

📌 Disclaimer

The content provided on CapitalKeeper.in is for informational and educational purposes only and does not constitute investment, trading, or financial advice. While we strive to present accurate and up-to-date market data and analysis, we make no warranties or representations regarding the completeness, reliability, or accuracy of the information.

Stock market investments are subject to market risks, and readers/investors are advised to conduct their own due diligence or consult a SEBI-registered financial advisor before making any investment decisions. CapitalKeeper and its authors are not liable for any loss or damage, direct or indirect, arising from the use of this information.

All views and opinions expressed are personal and do not reflect the official policy or position of any agency or organization. Past performance is not indicative of future results.By using this website, you agree to the terms of this disclaimer.

Ranjit Sahoo

Founder & Chief Editor – CapitalKeeper.in

Ranjit Sahoo is the visionary behind CapitalKeeper.in, a leading platform for real-time market insights, technical analysis, and investment strategies. With a strong focus on Nifty, Bank Nifty, sector trends, and commodities, she delivers in-depth research that helps traders and investors make informed decisions.

Passionate about financial literacy, Ranjit blends technical precision with market storytelling, ensuring even complex concepts are accessible to readers of all levels. Her work covers pre-market analysis, intraday strategies, thematic investing, and long-term portfolio trends.

When he’s not decoding charts, Ranjit enjoys exploring coastal getaways and keeping an eye on emerging business themes.

📌 Follow Ranjit on:

LinkedIn | Twitter/X | Instagram | ✉️ contact@capitalkeeper.in

Leave a Reply