Crypto Market Pulse – 19th October 2025: Bulls Regain Grip as Market Cap Nears $3.7 Trillion

By CapitalKeeper | Crypto Market Pulse | Indian Equities | Market Moves That Matter

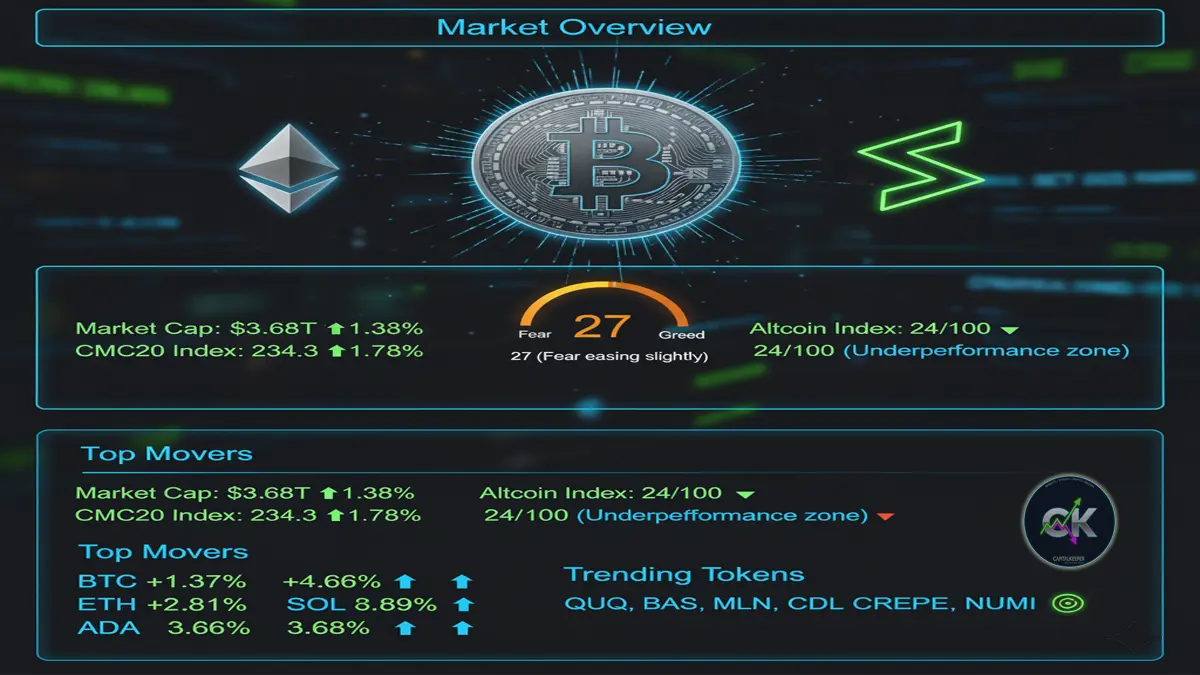

Crypto markets witnessed renewed optimism on October 19, 2025, with Bitcoin holding above $108,000, Ethereum reclaiming $3,980, and the total market cap rising to $3.68 trillion. Here’s the full technical and sentiment-based breakdown in today’s Crypto Market Pulse.

🔹 Overview: Momentum Returns to the Crypto Market

After a cautious start to October’s second half, the crypto market on 19th October 2025 showcased renewed strength, signaling a gradual comeback in investor sentiment.

The global crypto market cap climbed 1.38% to $3.68 trillion, while the CMC20 Index advanced 1.79% to 234.32, indicating broad-based recovery in top-tier assets.

However, the Altcoin Index remained at 24/100, reflecting ongoing weakness in mid-cap and emerging projects. The Fear & Greed Index improved slightly to 27, suggesting that fear still dominates but is beginning to subside — a classic precursor to potential bullish accumulation phases.

🔸 Bitcoin (BTC): Holding Firm Above $108,000

Bitcoin continues to maintain its leadership position, trading at $108,560, up 1.37% in the last 24 hours. Its market capitalization surged to $2.16 trillion, reinforcing its dominant 58% share of the total crypto market.

From a technical perspective, Bitcoin has successfully flipped the $107,000 resistance into short-term support, signaling resilience amid a broader consolidation phase. The next resistance zone lies around $110,500 – $112,000, where traders may witness profit-booking.

Key technical indicators:

- RSI (14-day): 61 — entering bullish territory

- MACD: Positive crossover continuing from October 15th

- 200-day EMA: Acting as strong dynamic support around $103,000

Institutional sentiment remains positive as Bitcoin’s on-chain activity increases — wallet inflows to exchanges have reduced, while whale accumulation wallets continue to rise. The market structure remains bullish, provided BTC sustains above $106,500.

🔸 Ethereum (ETH): Reclaims $3,980 Amid Renewed Confidence

Ethereum mirrored Bitcoin’s strength, climbing 2.81% to $3,981.81, with its market cap now at $468.8 billion. This marks the first time in over a week that ETH has closed consistently above the $3,900 level — a sign of returning investor confidence.

The ETH/BTC ratio remains stable, indicating balanced capital flows between the two largest assets. Layer-2 networks like Arbitrum, Optimism, and Base also recorded increased transaction activity, signaling healthy ecosystem engagement.

Technical snapshot:

- Support: $3,800

- Resistance: $4,050

- Momentum: Bullish continuation likely toward $4,200 if BTC remains stable

On-chain data shows Ethereum staking deposits are at an all-time high, reflecting long-term conviction in the network despite short-term volatility.

🔸 Altcoins: Slow Uptick, but Selective Momentum

While Bitcoin and Ethereum dominated, altcoins remained mixed. The Altcoin Index at 24/100 suggests investors are still risk-averse toward smaller-cap projects.

However, a few altcoins stood out:

- BNB: Up 2.36% to $1,118.99, supported by strong network activity on Binance Smart Chain (BSC).

- Solana (SOL): Climbed 2.89% to $190.71, buoyed by NFT marketplace activity and DeFi liquidity inflows.

- Dogecoin (DOGE): Jumped 4.66% to $0.1962, benefiting from renewed social media buzz and speculation of an integration update.

- Cardano (ADA): Added 3.68% to $0.6559, as investors eye new developments in Hydra scalability solutions.

Smaller tokens like TRON (TRX) also saw mild gains (+1.92%) as its ecosystem continues to attract stablecoin transfers.

🔸 Trending Tokens: Speculators Back Microcaps

The Trending Section on CoinMarketCap indicated rising attention toward smaller projects:

- QUQ ($0.0028) – Up sharply due to influencer-driven hype.

- BAS ($0.027) – Noted for liquidity farming rewards on new DeFi pools.

- MLN ($13.34) – Gaining traction as a governance token for asset management protocols.

- NUMI, CDL, CREPE – Thinly traded microcaps seeing speculative inflows amid lower BTC volatility.

While these assets remain high-risk, their inclusion in the trending list signals early signs of retail re-entry into smaller market segments.

🔸 Sentiment Analysis: Fear Fading, Accumulation Rising

The Crypto Fear & Greed Index rose from 25 to 27, signaling the early phase of sentiment normalization. Although the market is still in the “fear” zone, the upward trajectory indicates improving investor psychology.

Key Sentiment Indicators:

- Exchange Inflows: Declined 5.8% week-over-week — a bullish signal

- Stablecoin Supply Ratio (SSR): Dropping steadily, suggesting stablecoin liquidity re-entering crypto assets

- Funding Rates: Neutral to slightly positive — indicating balanced futures positioning

Collectively, these data points hint that smart money is beginning to reposition in high-conviction assets ahead of potential Q4 rallies.

🔸 Technical Outlook: Momentum Builds Toward Q4

With both BTC and ETH showing renewed strength and total market cap reclaiming momentum, technical structures favor an upward continuation.

The $3.7T total market cap level acts as the next short-term resistance; a breakout above it could lead to a swift rally toward $3.8T–$3.9T in the coming week.

Momentum Summary:

| Indicator | Status | Implication |

|---|---|---|

| Market Cap | $3.68T (+1.38%) | Bullish |

| CMC20 Index | 234.32 (+1.79%) | Stable growth |

| Altcoin Index | 24/100 | Underperforming segment |

| Fear & Greed | 27 | Sentiment improving |

| BTC Dominance | 58.6% | Continued strength |

🔸 Macro & Global Cues: Calm Before the Next Leg

The broader financial environment remains supportive:

- U.S. Dollar Index (DXY) slightly down near 104.5, easing pressure on risk assets.

- Gold & Equity Correlation: Positive — hinting at risk-on sentiment extending to crypto.

- ETF Flows: Bitcoin ETF saw net inflows for the second consecutive week.

Investors continue to watch Federal Reserve statements for hints of further policy easing — any dovish stance could trigger additional inflows into digital assets.

🔹 Conclusion: Quiet Strength, Building Foundations

The Crypto Market Pulse for 19th October 2025 paints a picture of stabilizing confidence and technical consolidation across major assets. While fear persists, its gradual decline — coupled with improving price action in Bitcoin and Ethereum — sets the stage for a potential Q4 recovery rally.

Short-term traders should watch BTC’s $110K level and ETH’s $4,050 resistance, while long-term investors may view current consolidation as an accumulation phase before the next major breakout.

📌 For daily trade setups, technical learning, and smart investing tips, stay tuned to CapitalKeeper.in

📌 For more real-time updates, trade setups, and investment insights — follow us on [Telegram] and [WhatsApp Channel] subscribe to our newsletter!

Subscribe Now , Join Telegram the Crypto Capital Club, Get Free Crypto Updates

📌 Disclaimer

The content provided on CapitalKeeper.in is for informational and educational purposes only and does not constitute investment, trading, or financial advice. While we strive to present accurate and up-to-date market data and analysis, we make no warranties or representations regarding the completeness, reliability, or accuracy of the information.

Stock market investments are subject to market risks, and readers/investors are advised to conduct their own due diligence or consult a SEBI-registered financial advisor before making any investment decisions. CapitalKeeper and its authors are not liable for any loss or damage, direct or indirect, arising from the use of this information.

All views and opinions expressed are personal and do not reflect the official policy or position of any agency or organization. Past performance is not indicative of future results.By using this website, you agree to the terms of this disclaimer.

Ranjit Sahoo

Founder & Chief Editor – CapitalKeeper.in

Ranjit Sahoo is the visionary behind CapitalKeeper.in, a leading platform for real-time market insights, technical analysis, and investment strategies. With a strong focus on Nifty, Bank Nifty, sector trends, and commodities, she delivers in-depth research that helps traders and investors make informed decisions.

Passionate about financial literacy, Ranjit blends technical precision with market storytelling, ensuring even complex concepts are accessible to readers of all levels. Her work covers pre-market analysis, intraday strategies, thematic investing, and long-term portfolio trends.

When he’s not decoding charts, Ranjit enjoys exploring coastal getaways and keeping an eye on emerging business themes.

📌 Follow Ranjit on:

LinkedIn | Twitter/X | Instagram | ✉️ contact@capitalkeeper.in

Leave a Reply