Top Option Trades & Equity Calls for November 2025 — NMDC, Bajaj Finserv, Manappuram, Motherson, NTPC | CapitalKeeper

By CapitalKeeper | Top Intraday Stock | Smart Trading Starts Here

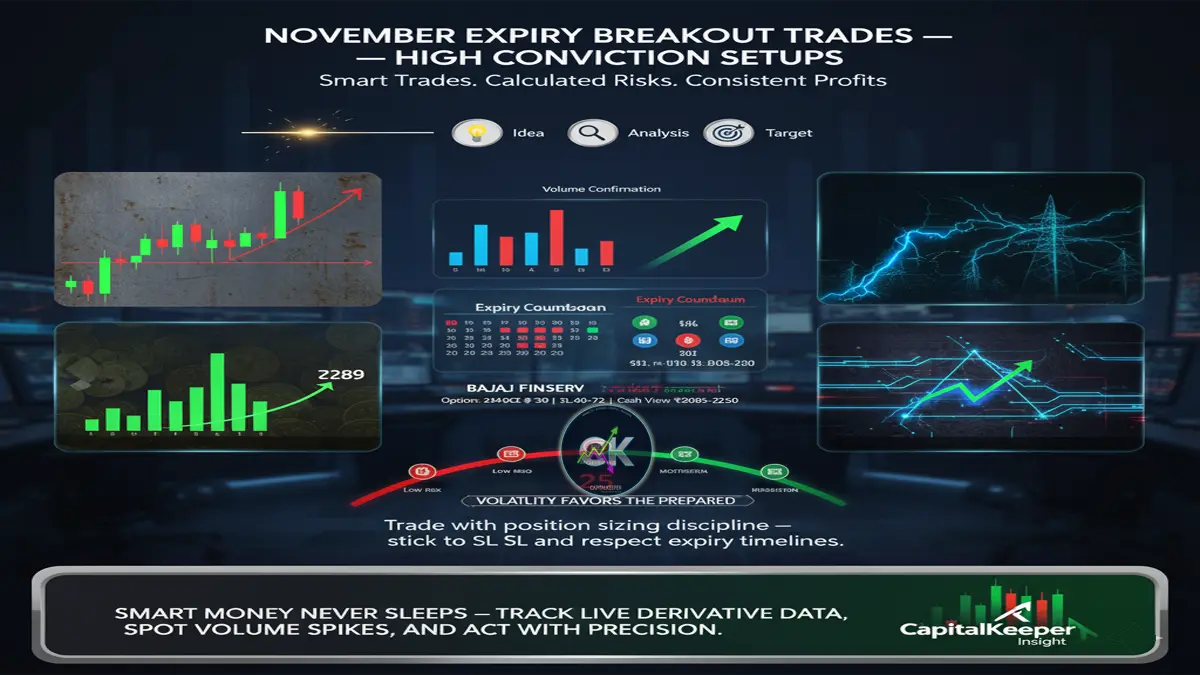

Discover high-probability option and equity trade setups for November 2025 featuring NMDC, Bajaj Finserv, Manappuram Finance, Motherson, and NTPC. Learn entry levels, targets, stop-loss, and expert insights for risk-managed trading.

🚀 Top Option & Equity Trade Setups for November 2025

By CapitalKeeper Research Desk

The Indian stock market has been witnessing strong volatility and renewed momentum in select mid-cap and large-cap names as we head deeper into Q4 FY25. With November expiry around the corner, traders are aligning their portfolios toward sector rotation themes and short-term momentum plays in defensives, infra, and financial names.

Today’s focus list includes five key opportunities—a balanced mix of option trades and cash setups that offer favorable risk–reward ratios. These setups are based on volume breakout zones, derivatives positioning, and technical confirmations from price action.

🧱 1️⃣ NMDC (CMP ₹76.70) – November 85 CE @ ₹0.80

- Setup Type: Option Trade (November Expiry)

- Stop Loss: Below ₹75

- Target: ₹85+

- Lot Size: 13,500

- Risk Disclaimer: Trade according to your capital and risk appetite.

📊 Technical View:

NMDC has been consolidating for the past few sessions near the ₹75–₹78 range, forming a higher base on daily charts. Strong delivery-based buying and consistent volume uptick indicate accumulation at lower levels. A breakout above ₹78.50–₹79.20 could trigger a short-covering rally toward ₹85 and beyond.

The 85 CE premium at ₹0.80 offers an attractive low-risk entry with significant upside potential if momentum picks up. The underlying structure supports a gradual rise toward ₹82–₹85 in the cash segment, making this a well-aligned trade for November expiry positioning.

💼 2️⃣ Bajaj Finserv (CMP ₹2,017) – 2040 CE @ ₹28.50

- Entry Zone: ₹30–₹33

- Stop Loss: ₹24

- Targets: ₹40 → ₹55 → ₹72

- Cash Targets: ₹2,085 → ₹2,125 → ₹2,200–₹2,250

📈 Analysis:

Bajaj Finserv has shown resilient momentum in the NBFC space, with strong support at ₹1,980–₹2,000 levels. The recent breakout above ₹2,020 signals renewed buying interest supported by improving derivatives data.

The 2040 CE is currently trading around ₹28.50, providing an excellent swing setup with a favorable risk-reward ratio of 1:2.5. If the stock sustains above ₹2,040 for more than two sessions, short covering could push it toward ₹2,100+ quickly.

Fundamental Note:

- Positive outlook for NBFCs post RBI’s stable policy stance

- Credit growth and retail lending remain robust

- Finserv’s financial arm continues to deliver consistent profitability

This makes it one of the preferred positional option trades for the month.

💰 3️⃣ Manappuram Finance (CMP ₹286.90) – 300 CE @ ₹2.75

- Stop Loss: Below ₹277

- Target: ₹300 → ₹309

📊 Technical Snapshot:

Manappuram Finance has been one of the stronger midcap NBFCs, consistently forming higher highs since the ₹240 breakout in early September. The stock recently consolidated near ₹280–₹285 levels, forming a flag pattern with potential for a sharp upside breakout.

The 300 CE is trading around ₹2.75, reflecting mild IV buildup. A quick move toward ₹295–₹300 could double the option premium, while the overall cash target remains at ₹309 for positional traders.

Market Tone: NBFCs remain strong, and rotation within the financial space could favor Manappuram in the short term.

🏗️ 4️⃣ Motherson Sumi (CMP ₹103) – 115 CE @ ₹1.30 (November Expiry)

- Stop Loss: Below ₹0.80

- Cash Targets: ₹115 → ₹120 → ₹127

📈 Technical Outlook:

Motherson has shown steady strength across the auto and ancillary space. The stock is now breaking out from a multi-week range between ₹98–₹104, with increasing volume participation.

A move beyond ₹105.50 would confirm a trend continuation pattern, likely to push prices toward ₹115 in the short term. The 115 CE at ₹1.30 gives an early entry into momentum before the implied volatility spikes near expiry.

Supporting Factors:

- EV ecosystem optimism

- Rising auto exports

- Steady improvement in quarterly volumes

This setup aligns well for swing traders seeking option leverage with clear directional bias.

⚡ 5️⃣ NTPC (CMP ₹337 ) – ₹340 CE @ ₹8.60

- Stop Loss: ₹5

- Target: Double or More Potential

- Expiry: November

⚙️ Market Context:

Power stocks have seen consistent strength amid India’s increasing focus on renewable integration and higher power demand. NTPC, a defensive large-cap, continues to deliver both dividend stability and short-term price momentum.

The 340 CE option at ₹8.60 remains a smart positional pick. A move above ₹348–₹350 on the underlying could trigger a new swing toward ₹360+, doubling the option premium.

Technicals:

- Support: ₹334–₹336

- Resistance: ₹350–₹355

- RSI: Holding firmly above 60, indicating sustained bullishness

💡 Sectoral View:

- Power & Infra: Strong structural uptrend continues. NTPC, Power Grid, and Adani group names remain in focus.

- Financials: NBFCs outperforming with steady fund inflows; watch for follow-up buying in Bajaj Finserv & Manappuram.

- Metals: NMDC and SAIL showing early signs of rotation; commodity strength could extend rally.

- Auto & Ancillaries: Motherson, Bosch, and Tata Motors remain buy-on-dips candidates for Q4 plays.

🧭 Trading Psychology & Risk Management

Before executing any trade, follow a disciplined approach:

- Define your stop-loss before entering the trade — never average losing positions.

- Position sizing: Risk no more than 1–2% of your total capital on a single option.

- Trail your stop-loss once the first target is achieved — convert short-term wins into capital protection.

- Avoid overtrading — focus on 2–3 best setups rather than chasing multiple instruments.

- Stay aware of global cues (US yields, crude prices, and USDINR levels) which impact short-term sentiment.

📢 Conclusion:

The upcoming November expiry offers a balanced opportunity window across select large and midcaps. With volatility expected to persist, options traders can gain from directional moves in fundamentally strong counters like Bajaj Finserv, NTPC, and NMDC, while cash-based swing traders may find setups like Motherson and Manappuram more rewarding.

Consistency and discipline remain the core of profitable trading — keep your risk tight, focus on structure, and ride the momentum with patience.cal trade ideas, and sector insights.on play

📌 For more real-time updates, trade setups, and investment insights — follow us on [Telegram] and [WhatsApp Channel] subscribe to our newsletter!

📌 Disclaimer

The content provided on CapitalKeeper.in is for informational and educational purposes only and does not constitute investment, trading, or financial advice. While we strive to present accurate and up-to-date market data and analysis, we make no warranties or representations regarding the completeness, reliability, or accuracy of the information.

Stock market investments are subject to market risks, and readers/investors are advised to conduct their own due diligence or consult a SEBI-registered financial advisor before making any investment decisions. CapitalKeeper and its authors are not liable for any loss or damage, direct or indirect, arising from the use of this information.

All views and opinions expressed are personal and do not reflect the official policy or position of any agency or organization. Past performance is not indicative of future results.

By using this website, you agree to the terms of this disclaimer.

Ranjit Sahoo

Founder & Chief Editor – CapitalKeeper.in

Ranjit Sahoo is the visionary behind CapitalKeeper.in, a leading platform for real-time market insights, technical analysis, and investment strategies. With a strong focus on Nifty, Bank Nifty, sector trends, and commodities, she delivers in-depth research that helps traders and investors make informed decisions.

Passionate about financial literacy, Ranjit blends technical precision with market storytelling, ensuring even complex concepts are accessible to readers of all levels. Her work covers pre-market analysis, intraday strategies, thematic investing, and long-term portfolio trends.

When he’s not decoding charts, Ranjit enjoys exploring coastal getaways and keeping an eye on emerging business themes.

📌 Follow Ranjit on:

LinkedIn | Twitter/X | Instagram | ✉️ contact@capitalkeeper.in

Leave a Reply