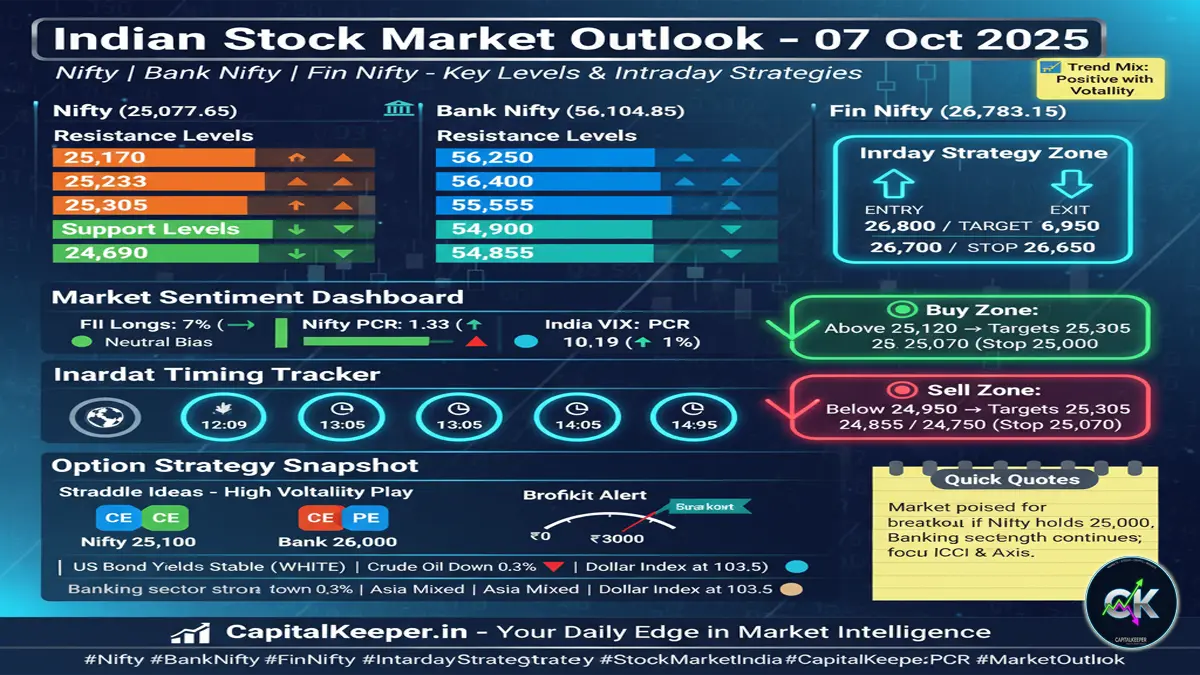

Indian Stock Market Outlook Today (14 Oct 2025): Volatility Persists in Nifty, Bank Nifty; Key Support at 25050–25120

By CapitalKeeper | Nifty & Bank Nifty | Indian Equities | Market Moves That Matter

Stay updated with the 14th October 2025 Indian stock market analysis. Discover Nifty and Bank Nifty’s key support and resistance levels, volatility trends, FII data, PCR ratio shifts, and intraday trading strategies.

Today’s Trend Mix – 14 October 2025: High Volatility Continues Before Expiry

As the Indian stock market opens for trading on 14th October 2025, investors and traders brace for a highly volatile session. The current trend mix shows a crucial battle between bulls and bears, with Nifty attempting to hold above the 25,050–25,120 support zone. The week continues to be part of a high-volatility phase (7th–16th October) that was predicted earlier, making it a critical period to manage positions carefully.

The index movement on Friday and 13th October set the tone for this week’s volatility. Market behavior around these recent highs and lows will determine whether Nifty sustains its upward bias or gives in to profit booking. Let’s analyze today’s setups and sentiment in depth.

🧭 Nifty 50 Overview (24,227.35)

Nifty has seen continuous fluctuations between short-covering rallies and profit booking phases. The price structure suggests the market is attempting to find balance near key zones.

Key Support Levels:

- 24,780

- 24,870

- 25,050

- 25,120

These zones act as accumulation areas, where short-term traders might find dip-buying opportunities. Particularly, the 25,050–25,120 band remains a critical support floor for intraday setups. Sustaining above this level could open up a move toward higher resistances.

Resistance Levels:

- 25,295 / 25,332

- 25,365 / 25,422

- 25,500 / 25,566

Crossing above 25,365–25,500 with volume confirmation may trigger momentum buying. However, traders should watch for potential exhaustion near 25,566 if volatility spikes.

Market Bias:

While broader sentiment remains range-bound to cautiously bullish, the next 48 hours may bring sharp swings. The range between 24,900 and 25,365/25,500 defines the likely volatility band until expiry.

If Nifty sustains above 25,120 during the first half of the session, expect a move toward 25,350–25,400 zones. On the flip side, a breach below 24,870 could trigger intraday weakness.

🏦 Bank Nifty Outlook (56,625)

Bank Nifty continues to show resilience, outperforming Nifty on several recent sessions. However, with volatility peaking and India VIX rising, traders should prepare for sharp intraday reversals.

Key Support Zones:

- 54,000

- 54,455

- 55,400

- 55,500

- 55,800 / 55,950

- 56,100 / 56,300

These levels mark crucial demand zones where market participants may add long positions if panic selling emerges. As long as Bank Nifty remains above 55,500–55,800, the bias stays neutral-to-positive.

Resistance Levels:

- 56,850 / 57,000

- 57,300 / 57,450

Breaking above 57,000 could confirm a bullish continuation toward 57,300–57,450, where profit-booking might emerge.

Technical Bias:

If any panic pressure comes, only then a downside extension toward 54,000–54,455 could unfold. Otherwise, the index appears technically strong, with private and PSU banks contributing selectively.

💹 Market Sentiment & Derivative Data

| Indicator | Current Reading | Change / Observation |

|---|---|---|

| FII Index Longs | 7% | 🔻 Down from 8% (mild profit booking) |

| Nifty PCR | 1.04 | 🔻 Declined from 1.32 – signals balanced sentiment |

| Bank Nifty PCR | 1.12 | 🔻 Slight dip from 1.14 |

| India VIX | 11 | 🔺 Up 9% – volatility on the rise |

Interpretation:

The decline in FII long exposure and PCR ratios points toward profit booking and hedging before the weekly expiry. Rising India VIX confirms that traders expect two highly volatile days (14th–15th October).

The strategy remains to avoid over-leveraging, focus on disciplined setups, and respect intraday stop losses.

🕒 Important Timings to Watch

- 12:10 PM

- 1:05 PM

- 2:14 PM

These are potential volatility clusters based on intraday cycle analysis. Traders can expect movement around these times due to institutional order flows or algorithmic positioning adjustments.

💼 Fin Nifty Analysis (26,865.35)

Fin Nifty, often a leading indicator of overall market tone, remains relatively stable. The index has seen consistent sector rotation among insurance, NBFCs, and banking stocks.

Intraday Strategy:

- Buy Above: 26,880 → Targets: 26,950 / 27,020

- Sell Below: 26,800 → Targets: 26,720 / 26,640

- Stop Loss: 26,850 (for both directions, adjust as per volatility)

Momentum could shift in the second half of the day, so traders should track 12:10–2:15 PM intervals for confirmation.

⚙️ Trading Strategy for 14 October 2025

Nifty Intraday Setup:

- Buy Above: 25,180

- Targets: 25,295 / 25,365 / 25,420

- Stop Loss: 25,050

- Sell Below: 24,950

- Targets: 24,870 / 24,780 / 24,650

- Stop Loss: 25,070

📊 Bias: Stay cautious in volatile swings. Ideal trades near support with tight risk control.

Bank Nifty Intraday Setup:

- Buy Above: 56,150

- Targets: 56,600 / 56,850 / 57,000

- Stop Loss: 55,900

- Sell Below: 55,750

- Targets: 55,400 / 55,000 / 54,800

- Stop Loss: 56,050

⚠️ Note: Avoid chasing breakouts after 2:00 PM unless volumes expand. Focus on banking majors like HDFC Bank, Axis Bank, and SBI for directional moves.

🧩 Market Psychology & Expiry Outlook

Volatility is not the enemy — it’s opportunity disguised in uncertainty. Traders who stay disciplined during high-VIX phases often capitalize when the market finds direction again. As the Nifty weekly expiry approaches, traders should:

- Book profits on long trades into strength.

- Keep SLs tight on all leveraged positions.

- Avoid contrarian trades without confirmation.

- Focus on levels — not emotions.

💬 Expert Take:

“Volatility is expected to persist till mid-week. As long as Nifty holds above 25,050–25,120, dips can be bought into. A move above 25,365 will open gates toward 25,500+. However, breaches below 24,870 can shift the momentum entirely in favor of bears.”

📉 Summary Table

| Index | CMP | Key Supports | Key Resistances | Bias |

|---|---|---|---|---|

| Nifty 50 | 24,227.35 | 24,870 / 25,050 / 25,120 | 25,365 / 25,500 | Neutral–Bullish |

| Bank Nifty | 56,625 | 55,400 / 55,800 / 56,100 | 57,000 / 57,450 | Range–Positive |

| Fin Nifty | 26,865.35 | 26,800 / 26,720 | 26,950 / 27,020 | Stable–Bullish |

🏁 Conclusion

The Indian stock market remains volatile but within a defined structure. The support zone of 25,050–25,120 for Nifty and 55,800–56,100 for Bank Nifty will play a decisive role today.

Traders should remain cautious yet opportunistic — play the range, follow momentum, and exit on strength if the upmove targets are achieved before expiry.

💡 “Volatility is temporary, but discipline is permanent.”

Let’s see where Nifty Weekly Expiry finally settles — whether bulls maintain grip or bears find their short-lived victory.

📌 For more real-time updates, trade setups, and investment insights — follow us on [Telegram] and [WhatsApp Channel] subscribe to our newsletter!

📌 Disclaimer

The content provided on CapitalKeeper.in is for informational and educational purposes only and does not constitute investment, trading, or financial advice. While we strive to present accurate and up-to-date market data and analysis, we make no warranties or representations regarding the completeness, reliability, or accuracy of the information.

Stock market investments are subject to market risks, and readers/investors are advised to conduct their own due diligence or consult a SEBI-registered financial advisor before making any investment decisions. CapitalKeeper and its authors are not liable for any loss or damage, direct or indirect, arising from the use of this information.

All views and opinions expressed are personal and do not reflect the official policy or position of any agency or organization. Past performance is not indicative of future results.

By using this website, you agree to the terms of this disclaimer.

Ranjit Sahoo

Founder & Chief Editor – CapitalKeeper.in

Ranjit Sahoo is the visionary behind CapitalKeeper.in, a leading platform for real-time market insights, technical analysis, and investment strategies. With a strong focus on Nifty, Bank Nifty, sector trends, and commodities, she delivers in-depth research that helps traders and investors make informed decisions.

Passionate about financial literacy, Ranjit blends technical precision with market storytelling, ensuring even complex concepts are accessible to readers of all levels. Her work covers pre-market analysis, intraday strategies, thematic investing, and long-term portfolio trends.

When he’s not decoding charts, Ranjit enjoys exploring coastal getaways and keeping an eye on emerging business themes.

📌 Follow Ranjit on:

LinkedIn | Twitter/X | Instagram | ✉️ contact@capitalkeeper.in

Leave a Reply