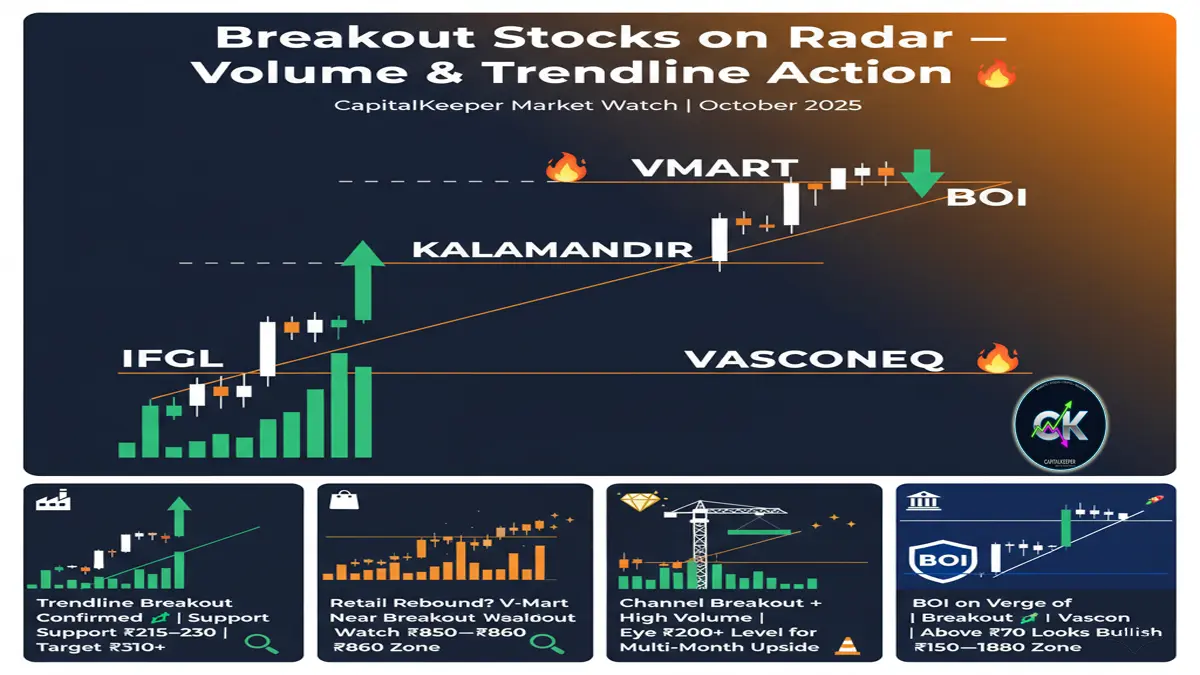

Short-Term Breakout Stocks to Keep on Radar: IFGL Exports, V-Mart, Kalamandir, Vascon Engineers & Bank of India

By CapitalKeeper | Top Intraday Stock | Smart Trading Starts Here

Discover five breakout-ready stocks IFGL Exports, V-Mart, Kalamandir, Vascon Engineers, and Bank of India showing strong technical setups with volume confirmation. Get detailed trendline analysis, support zones, and short-term targets for 2025 market momentum.

🔍 Short-Term Breakout Radar: 5 Stocks Poised for Momentum Moves

The Indian stock market continues to show vibrant sectoral rotation as traders look beyond large caps to identify strong volume-backed breakouts in the mid and small-cap space. The coming sessions could witness momentum in select counters that have just crossed key trendline resistance levels or are on the verge of multi-month breakouts.

Here are five technically strong stocks that traders should keep on radar for the short term IFGL Exports, V-Mart Retail, Kalamandir Jewellers, Vascon Engineers, and Bank of India.

🧱 1️⃣ IFGL Exports (CMP ₹285): Trendline Breakout with Volume Confirmation

Technical Setup:

IFGL Exports has broken above a descending trendline resistance that had capped its price action for several months. The breakout is supported by a noticeable rise in trading volume, confirming strong institutional participation.

Volume & Price Action:

- CMP: ₹285

- Short-term Support: ₹215–₹230 zone

- Resistance Zone: ₹295–₹305

- Breakout Pattern: Trendline + Volume confirmation

- Momentum Indicators: RSI crossing 60; MACD showing fresh bullish crossover.

Analysis:

The stock had consolidated within a broad range of ₹210–₹270 over the past few months. The breakout above ₹275 has triggered a potential short-term trend reversal. If momentum sustains, IFGL Exports could see a quick rally toward ₹310–₹325 in the short term.

Trading View:

- ✅ Buy Zone: ₹275–₹285

- 🎯 Target: ₹310–₹325

- ⛔ Stop Loss: ₹265

This setup fits the profile of a volume-driven breakout, ideal for swing traders seeking short-term positional gains.

🛍️ 2️⃣ V-Mart Retail (CMP ₹842): Near Trendline Breakout with Volume Spurt

Technical Setup:

V-Mart is hovering near a trendline breakout level on the daily chart after forming a higher-low pattern. The volume spurt seen during recent up moves indicates accumulation at lower levels.

Volume & Price Action:

- CMP: ₹842

- Breakout Zone: ₹850–₹860

- Short-Term Support: ₹810

- Resistance after breakout: ₹895–₹910

- Indicators: RSI 58 (rising), MACD positive divergence.

Analysis:

V-Mart had been under pressure for months due to subdued retail demand and weak discretionary spending. However, recent consolidation with strong volume hints at bullish intent returning to the counter. Once it closes above ₹860 with volume confirmation, a strong momentum rally up to ₹900–₹920 could unfold.

Trading View:

- ✅ Buy Zone: ₹840–₹860

- 🎯 Target: ₹900–₹920

- ⛔ Stop Loss: ₹820

With festival demand approaching, retail sector stocks like V-Mart could be among key short-term outperformers.

💎 3️⃣ Kalamandir Jewellers (CMP ₹184): Channel Breakout with Huge Volume

Technical Setup:

Kalamandir Jewellers has shown a multi-month channel breakout backed by heavy volume. The breakout level near ₹196–₹200 has been tested multiple times, making it a critical resistance zone.

Volume & Price Action:

- CMP: ₹184

- Breakout Level: ₹196–₹200

- Support: ₹170–₹175

- Pattern: Parallel Channel Breakout

- Indicators: RSI above 65, signaling strength; MACD histogram expanding.

Analysis:

This stock has been consolidating in a tight channel between ₹160 and ₹190 for months. A sustained close above ₹200 can trigger a multi-month upside move. The breakout is likely to be accompanied by a surge in delivery volumes a classic sign of fresh long accumulation.

Trading View:

- ✅ Buy Zone: ₹185–₹195 (on dips)

- 🎯 Target: ₹220–₹240

- ⛔ Stop Loss: ₹175

Kalamandir looks fundamentally supported too, as the jewelry retail sector benefits from festive and wedding season tailwinds.

🏗️ 4️⃣ Vascon Engineers (CMP ₹71): Trendline Breakout with Volume Expansion

Technical Setup:

Vascon Engineers has broken its long-term descending trendline and closed above it with a surge in volume, marking a significant bullish breakout pattern.

Volume & Price Action:

- CMP: ₹71

- Breakout Confirmation: Above ₹70

- Short-Term Support: ₹64–₹66

- Resistance Zone: ₹75–₹78

- Indicators: RSI 60+, strong volume candle; MACD crossover positive.

Analysis:

The construction and infra theme remains strong across mid-cap counters, and Vascon Engineers stands out with its volume-backed breakout. The momentum could push it toward ₹78–₹82 if it sustains above ₹70 in the coming sessions.

Trading View:

- ✅ Buy Zone: ₹70–₹72

- 🎯 Target: ₹80–₹85

- ⛔ Stop Loss: ₹67

This breakout appears credible given the recent sector rotation toward infrastructure and realty themes.

🏦 5️⃣ Bank of India (CMP ₹125): On the Verge of Major Breakout

Technical Setup:

Bank of India is currently consolidating near its crucial resistance zone of ₹130. A breakout above this level could unlock a fresh leg of rally toward ₹150 initially and potentially ₹180 over the medium term.

Volume & Price Action:

- CMP: ₹125

- Breakout Zone: ₹130+

- Support: ₹120

- Resistance Target: ₹150 → ₹180

- Indicators: RSI 62, MACD positive crossover, ADX showing rising trend strength.

Analysis:

The PSU banking space has been witnessing renewed momentum led by SBI, Canara Bank, and Bank of Baroda. Bank of India’s structure suggests it could be the next candidate for a breakout rally once it clears ₹130 with volume expansion.

Trading View:

- ✅ Buy Zone: ₹124–₹128

- 🎯 Target: ₹150–₹180

- ⛔ Stop Loss: ₹118

Strong fundamentals, improving NIMs, and capital adequacy make this stock suitable for short-to-medium-term holding.

📊 Market View Summary

| Stock | CMP (₹) | Breakout Type | Target (₹) | Support (₹) | Momentum |

|---|---|---|---|---|---|

| IFGL Exports | 285 | Trendline + Volume | 310–325 | 215–230 | Strong |

| V-Mart | 842 | Near Trendline | 900–920 | 810 | Building |

| Kalamandir Jewellers | 184 | Channel + Volume | 220–240 | 175 | Strong |

| Vascon Engineers | 71 | Trendline + Volume | 80–85 | 67 | Rising |

| Bank of India | 125 | Verge of Breakout | 150–180 | 118 | Gaining |

💬 Conclusion: Tactical Breakouts for Active Traders

All five stocks IFGL Exports, V-Mart, Kalamandir, Vascon Engineers, and Bank of India — exhibit technically sound setups supported by volume surges and momentum indicators.

For traders focusing on short-term positional trades, these are radar-worthy candidates for the week ahead.

However, it’s crucial to maintain strict stop-loss discipline and trail profits as the move unfolds. In a volatile environment, only volume-backed breakouts tend to sustain — and these counters fit that bill perfectly. in the coming sessions.

📌 For more real-time updates, trade setups, and investment insights — follow us on [Telegram] and [WhatsApp Channel] subscribe to our newsletter!

📌 Disclaimer

The content provided on CapitalKeeper.in is for informational and educational purposes only and does not constitute investment, trading, or financial advice. While we strive to present accurate and up-to-date market data and analysis, we make no warranties or representations regarding the completeness, reliability, or accuracy of the information.

Stock market investments are subject to market risks, and readers/investors are advised to conduct their own due diligence or consult a SEBI-registered financial advisor before making any investment decisions. CapitalKeeper and its authors are not liable for any loss or damage, direct or indirect, arising from the use of this information.

All views and opinions expressed are personal and do not reflect the official policy or position of any agency or organization. Past performance is not indicative of future results.

By using this website, you agree to the terms of this disclaimer.

Ranjit Sahoo

Founder & Chief Editor – CapitalKeeper.in

Ranjit Sahoo is the visionary behind CapitalKeeper.in, a leading platform for real-time market insights, technical analysis, and investment strategies. With a strong focus on Nifty, Bank Nifty, sector trends, and commodities, she delivers in-depth research that helps traders and investors make informed decisions.

Passionate about financial literacy, Ranjit blends technical precision with market storytelling, ensuring even complex concepts are accessible to readers of all levels. Her work covers pre-market analysis, intraday strategies, thematic investing, and long-term portfolio trends.

When he’s not decoding charts, Ranjit enjoys exploring coastal getaways and keeping an eye on emerging business themes.

📌 Follow Ranjit on:

LinkedIn | Twitter/X | Instagram | ✉️ contact@capitalkeeper.in

Leave a Reply