RBI Reforms & Monetary Policy Outlook 2025: Credit Expansion, NBFC Support, and Market Expectations

By CapitalKeeper | News | Indian Equities | Market Moves That Matter

The RBI has expanded credit access, eased loan norms, and supported NBFCs while markets await key MPC decisions on repo rates. Explore India’s monetary policy outlook, sectorial impact, and investor sentiment for 2025.

Central Bank & Monetary Policy Focus in India: RBI’s Reform Push and Market Expectations

In 2025, India’s financial markets have been riding a wave of strong economic growth, rising investor participation, and policy-driven reforms. At the heart of this transformation lies the Reserve Bank of India (RBI), whose role in shaping credit flow, market liquidity, and financial stability has become more crucial than ever.

Recent moves by the central bank have signaled a proactive approach to reform, with the focus on improving credit access, strengthening non-banking financial companies (NBFCs), and supporting capital markets. At the same time, investors and policymakers alike are closely watching the Monetary Policy Committee (MPC) meetings, where decisions on repo rate, liquidity, and inflation management are shaping the near-term market trajectory.

This blog explores the RBI’s latest reforms, why they matter for businesses and investors, and what the market expects from upcoming policy moves.

📌 RBI’s Recent Reforms: A Closer Look

The RBI has been steadily introducing measures aimed at deepening financial markets and easing credit bottlenecks. Some of the key reforms include:

1. Expanded Credit Access for Companies

- By easing restrictions on lending, RBI is enabling businesses particularly mid-sized and growth-focused firms to secure funding more efficiently.

- This move is expected to benefit sectors like infrastructure, manufacturing, and green energy, which require sustained capital infusion.

- Greater credit availability also supports India’s push for domestic manufacturing and export competitiveness under the “Make in India” initiative.

2. Higher Loan Limits Against Shares

- RBI’s decision to increase the limits on loans against shares strengthens the role of capital markets in financing growth.

- This reform gives corporates and promoters more flexibility to leverage their equity holdings for raising funds.

- For investors, it may translate into higher activity in equity financing, pledging, and structured debt transactions.

3. Reduced Risk Weights for Loans to NBFCs

- NBFCs form a critical backbone of India’s credit system, especially for retail borrowers and MSMEs (Micro, Small & Medium Enterprises).

- By lowering risk weights, RBI has made it easier for banks to lend to NBFCs, enhancing their liquidity and lending capacity.

- This is particularly important given NBFCs’ role in consumer lending, housing finance, and SME support.

Together, these reforms signal a central bank that is not only focused on inflation targeting but also on growth-oriented financial inclusion.

🏦 The Role of RBI’s MPC: What Markets Are Watching

While reforms have boosted sentiment, the real spotlight remains on the Monetary Policy Committee (MPC) meetings, where repo rate and liquidity decisions directly affect markets.

Key Factors Driving MPC Decisions:

- Inflation Management

- Headline inflation has shown signs of moderation, but food prices remain volatile.

- RBI is walking a tightrope between controlling inflation and supporting growth.

- Growth vs. Stability Balance

- India’s GDP growth projections for FY25-26 remain strong, but external risks oil prices, U.S. Fed policy, and geopolitical tensions pose uncertainties.

- The MPC must weigh the need for lower borrowing costs to spur investment against the risk of reigniting inflationary pressures.

- Global Central Bank Trends

- With the U.S. Federal Reserve signaling rate cuts in 2025, emerging markets like India face capital flow dynamics.

- Any RBI decision must account for currency stability and FII flows into Indian equities and bonds.

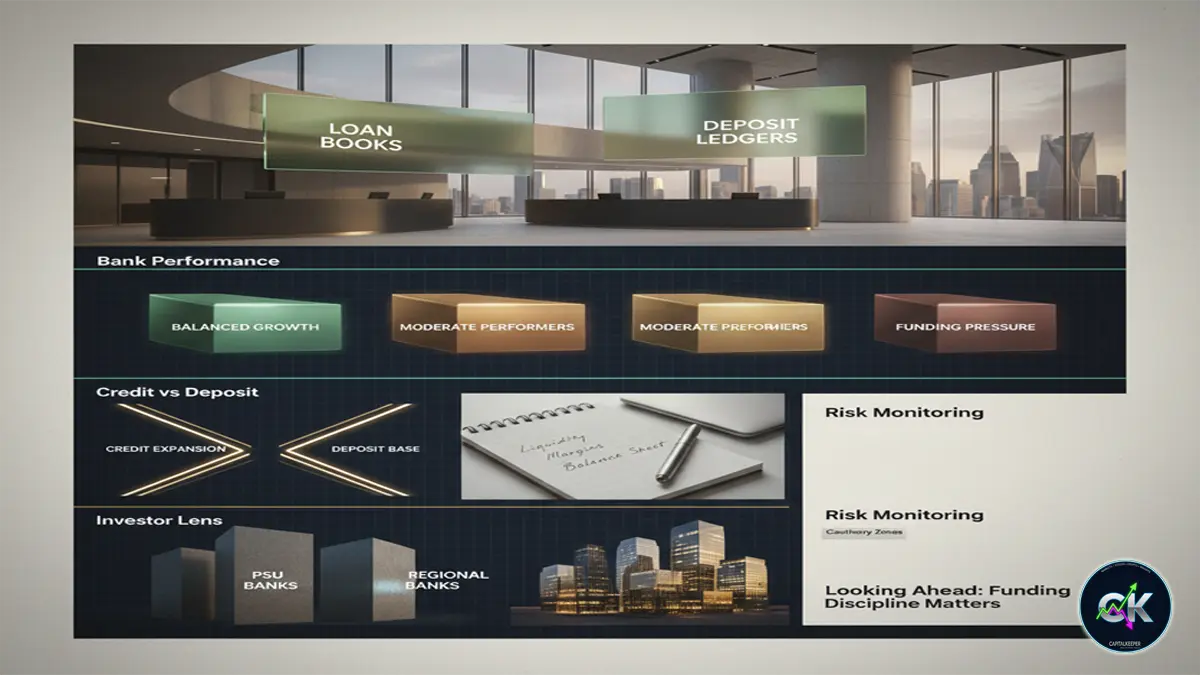

📊 Market Reactions and Investor Sentiment

Markets have responded positively to the RBI’s reform announcements:

- Equity Markets: Banking, NBFC, and infrastructure stocks have shown upward momentum, driven by optimism over easier credit availability.

- Bond Markets: Yields have moderated slightly, reflecting expectations of a stable or accommodative monetary stance.

- Currency Markets: The Indian rupee has held steady against the U.S. dollar, supported by foreign inflows and RBI’s calibrated approach.

Investor sentiment is firmly linked to the upcoming MPC guidance. A status quo on repo rate would be seen as a cautious stance, while even a 25 bps cut could trigger a rally in rate-sensitive sectors like real estate, autos, and banking.

🔍 Sectoral Implications

- Banking & NBFCs

- Lower risk weights and better access to capital will boost lending activity.

- Expect growth in retail loans, housing finance, and SME lending.

- Capital Markets

- Higher loan limits against shares could increase pledged shares transactions, potentially boosting liquidity.

- This reform also strengthens India’s positioning as a more capital-market-driven economy.

- Corporate India

- Expanded credit access supports capex cycles, especially in infrastructure and manufacturing.

- Companies with higher leverage ratios may benefit the most from eased credit conditions.

- Consumers & MSMEs

- With NBFCs better equipped to lend, consumer credit, rural financing, and SME loans are likely to see positive growth.

⚖️ Challenges and Risks Ahead

While reforms and policy flexibility are welcome, challenges remain:

- Credit Quality Concerns: Easier lending norms must not compromise asset quality.

- Inflation Uncertainty: Any surge in food or oil prices could force RBI into a more hawkish stance.

- External Shocks: Global capital flow volatility and geopolitical risks could impact RBI’s maneuvering room.

- NBFC Dependence: Heavy reliance on NBFCs for credit delivery means systemic risks must be monitored.

🔮 Outlook: What to Expect in 2025-26

Looking ahead, RBI’s role in balancing growth and stability will be central. Markets broadly expect:

- MPC to maintain a neutral-to-dovish stance in the near term, with scope for modest rate cuts if inflation remains under control.

- Continued focus on structural reforms to deepen India’s financial markets.

- Further steps to support NBFCs and MSMEs, ensuring that credit access is not just available but affordable.

- Digital finance integration, with RBI expected to expand regulatory support for fintech and digital lending platforms.

✅ Conclusion

The Reserve Bank of India has emerged as a proactive force in shaping the country’s financial system in 2025. With reforms that expand credit access, ease lending against shares, and strengthen NBFC liquidity, the RBI is pushing India toward deeper, more resilient capital markets.

At the same time, the upcoming MPC meetings carry enormous weight, with repo rate decisions poised to influence everything from bond yields to stock market performance.

For investors, the key takeaway is clear: RBI policy is both a driver of near-term market sentiment and a foundation for long-term structural growth. Staying aligned with monetary policy signals will be crucial in navigating opportunities and risks in India’s evolving financial landscape.

📌 For daily trade setups, technical learning, and smart investing tips, stay tuned to CapitalKeeper.in

📌 For more real-time updates, trade setups, and investment insights — follow us on [Telegram] and [WhatsApp Channel] subscribe to our newsletter!

Subscribe Now , Join Telegram the Crypto Capital Club, Get Free Crypto Updates

📌 Disclaimer

The content provided on CapitalKeeper.in is for informational and educational purposes only and does not constitute investment, trading, or financial advice. While we strive to present accurate and up-to-date market data and analysis, we make no warranties or representations regarding the completeness, reliability, or accuracy of the information.

Stock market investments are subject to market risks, and readers/investors are advised to conduct their own due diligence or consult a SEBI-registered financial advisor before making any investment decisions. CapitalKeeper and its authors are not liable for any loss or damage, direct or indirect, arising from the use of this information.

All views and opinions expressed are personal and do not reflect the official policy or position of any agency or organization. Past performance is not indicative of future results.By using this website, you agree to the terms of this disclaimer.

Ranjit Sahoo

Founder & Chief Editor – CapitalKeeper.in

Ranjit Sahoo is the visionary behind CapitalKeeper.in, a leading platform for real-time market insights, technical analysis, and investment strategies. With a strong focus on Nifty, Bank Nifty, sector trends, and commodities, she delivers in-depth research that helps traders and investors make informed decisions.

Passionate about financial literacy, Ranjit blends technical precision with market storytelling, ensuring even complex concepts are accessible to readers of all levels. Her work covers pre-market analysis, intraday strategies, thematic investing, and long-term portfolio trends.

When he’s not decoding charts, Ranjit enjoys exploring coastal getaways and keeping an eye on emerging business themes.

📌 Follow Ranjit on:

LinkedIn | Twitter/X | Instagram | ✉️ contact@capitalkeeper.in

Leave a Reply