Indian Stock Market Closing Bell (03 Oct 2025) | Nifty, Bank Nifty, Sensex & Fin Nifty End Higher

By CapitalKeeper | Closing Bell | Indian Equity | Market Moves That Matter

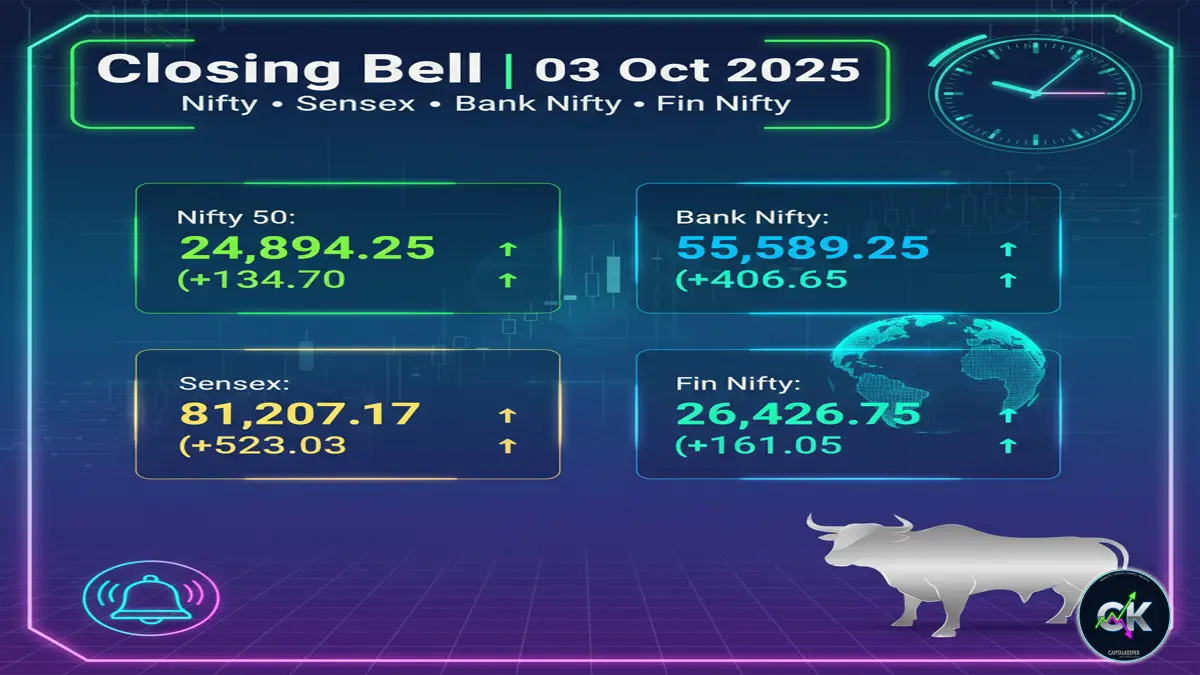

Indian stock market closed higher on 03 Oct 2025 with Nifty at 24,894.25, Sensex at 81,207.17, Bank Nifty at 55,589.25, and Fin Nifty at 26,426.75. Get detailed analysis, global cues, and sector-wise performance insights.

📈 Indian Stock Market Closing Bell Report – 03 October 2025

🔔 Closing Bell Highlights – 03 October 2025

The Indian stock market ended in positive territory on Friday, 03 October 2025, driven by strong buying in banking, financials, and energy stocks. Global sentiment remained supportive as U.S. Treasury yields stabilized, and crude oil prices corrected slightly, giving room for equity markets to breathe.

- Nifty 50: Opened at 24,759.55, closed at 24,894.25 (+134.70 points).

- Bank Nifty: Opened at 55,182.60, closed at 55,589.25 (+406.65 points).

- Sensex: Opened at 80,684.14, closed at 81,207.17 (+523.03 points).

- Fin Nifty: Opened at 26,265.70, closed at 26,426.75 (+161.05 points).

The day was marked by bullish momentum, with strong closing levels ahead of the weekend, reflecting investor confidence in both domestic macros and global stability.

🌍 Global Market Cues

- Wall Street Influence

- U.S. indices closed mixed overnight but Nasdaq remained resilient as tech stocks extended gains.

- Expectations of a Fed rate cut in early 2026 boosted equity inflows in emerging markets.

- Asian Market Trends

- Nikkei 225 and Hang Seng closed higher as Asian investors followed the global risk-on mood.

- China reported better-than-expected PMI data, lifting confidence across Asian equities.

- Commodities Check

- Crude Oil eased slightly to $82 per barrel, offering relief to import-dependent economies like India.

- Gold hovered around $2,340 per ounce, indicating stable safe-haven demand.

📊 Sector-Wise Performance

✅ Top Gainers

- Banking & Financials: Strong rally led by HDFC Bank, ICICI Bank, and Kotak Mahindra Bank, pushing Bank Nifty above 55,500.

- IT Stocks: Infosys, TCS, and Wipro gained as global tech demand outlook improved.

- Energy & Infra: Reliance Industries and Adani Enterprises showed steady buying interest.

❌ Sectoral Laggards

- Pharma: Some profit booking seen in Dr. Reddy’s and Sun Pharma.

- FMCG: Hindustan Unilever and Nestlé India ended marginally lower due to cost pressure concerns.

🔎 Technical Analysis

Nifty 50

- Support Zone: 24,720 – 24,750

- Resistance Zone: 24,950 – 25,050

- Indicators: RSI at 62 suggests bullish momentum; MACD shows a positive crossover.

Bank Nifty

- Support: 55,200

- Resistance: 55,800 – 56,000

- Strong buying seen in PSU banks, keeping the trend positive.

Sensex

- Managed to sustain above 81,000, signaling strong institutional inflows.

- Trend remains bullish with targets towards 81,500+ in the short term.

Fin Nifty

- Closed at 26,426.75, maintaining upward bias.

- Resistance seen at 26,500, support at 26,200.

📌 Key Market Drivers Today

- Domestic Economic Strength

- India’s GST collections for September 2025 showed a 12% YoY rise, indicating strong consumption.

- Manufacturing PMI remained above 55, reflecting expansion.

- Foreign Institutional Investors (FIIs)

- FIIs were net buyers worth ₹2,350 crore, continuing their bullish stance on Indian equities.

- Currency & Bond Markets

- Indian Rupee strengthened to ₹82.85/$, supported by stable crude oil.

- 10-year bond yields eased slightly to 6.97%, providing relief to rate-sensitive sectors.

💡 Expert Outlook

Market analysts believe that Nifty closing above 24,850 is a sign of strength, paving the way for testing 25,000+ levels in the coming sessions. Bank Nifty’s leadership adds confidence, though global volatility and crude oil prices remain key watch factors.

Short-term investors should keep an eye on IT earnings season, while long-term investors may focus on infrastructure and green energy themes.

🏆 Top Stocks in Focus

- Reliance Industries – Gained 1.2% on steady refining margins outlook.

- HDFC Bank – Jumped 2.5% on strong credit growth data.

- Infosys – Rose 1.8% ahead of Q2 earnings.

- Adani Ports – Ended higher as shipping volumes remained robust.

- Sun Pharma – Declined 0.7% amid profit booking.

📅 Market Wrap-Up

The first trading session of October 2025 set a bullish tone, with all major indices closing higher. The strong performance in Bank Nifty and Sensex highlighted robust investor participation. With global sentiment turning favorable and India’s domestic macros stable, the medium-term outlook remains optimistic, though profit booking may occur near resistance levels.

📝 Conclusion

The Indian stock market closed higher on 03 October 2025, led by banking, IT, and energy stocks. Nifty ended at 24,894.25, Sensex at 81,207.17, Bank Nifty at 55,589.25, and Fin Nifty at 26,426.75. The rally was supported by global cues, steady FIIs buying, and strong domestic indicators.

Looking ahead, the market sentiment remains bullish, with 25,000 on Nifty and 56,000 on Bank Nifty in sight, provided global stability continues. a focus on the 25,000 resistance for Nifty and 55,500 for Bank Nifty. As long as support levels hold, traders may expect further strength in the sessions ahead.from global and domestic macro indicators.

📌 For more real-time updates, trade setups, and investment insights — follow us on [Telegram] and [WhatsApp Channel] subscribe to our newsletter!

📌 Disclaimer

The content provided on CapitalKeeper.in is for informational and educational purposes only and does not constitute investment, trading, or financial advice. While we strive to present accurate and up-to-date market data and analysis, we make no warranties or representations regarding the completeness, reliability, or accuracy of the information.

Stock market investments are subject to market risks, and readers/investors are advised to conduct their own due diligence or consult a SEBI-registered financial advisor before making any investment decisions. CapitalKeeper and its authors are not liable for any loss or damage, direct or indirect, arising from the use of this information.

All views and opinions expressed are personal and do not reflect the official policy or position of any agency or organization. Past performance is not indicative of future results. By using this website, you agree to the terms of this disclaimer

Ranjit Sahoo

Founder & Chief Editor – CapitalKeeper.in

Ranjit Sahoo is the visionary behind CapitalKeeper.in, a leading platform for real-time market insights, technical analysis, and investment strategies. With a strong focus on Nifty, Bank Nifty, sector trends, and commodities, she delivers in-depth research that helps traders and investors make informed decisions.

Passionate about financial literacy, Ranjit blends technical precision with market storytelling, ensuring even complex concepts are accessible to readers of all levels. Her work covers pre-market analysis, intraday strategies, thematic investing, and long-term portfolio trends.

When he’s not decoding charts, Ranjit enjoys exploring coastal getaways and keeping an eye on emerging business themes.

📌 Follow Ranjit on:

LinkedIn | Twitter/X | Instagram | ✉️ contact@capitalkeeper.in

Leave a Reply